This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Markets Pricing in Potential 75bp Fed Rate Cuts by End-2025

April 1, 2025

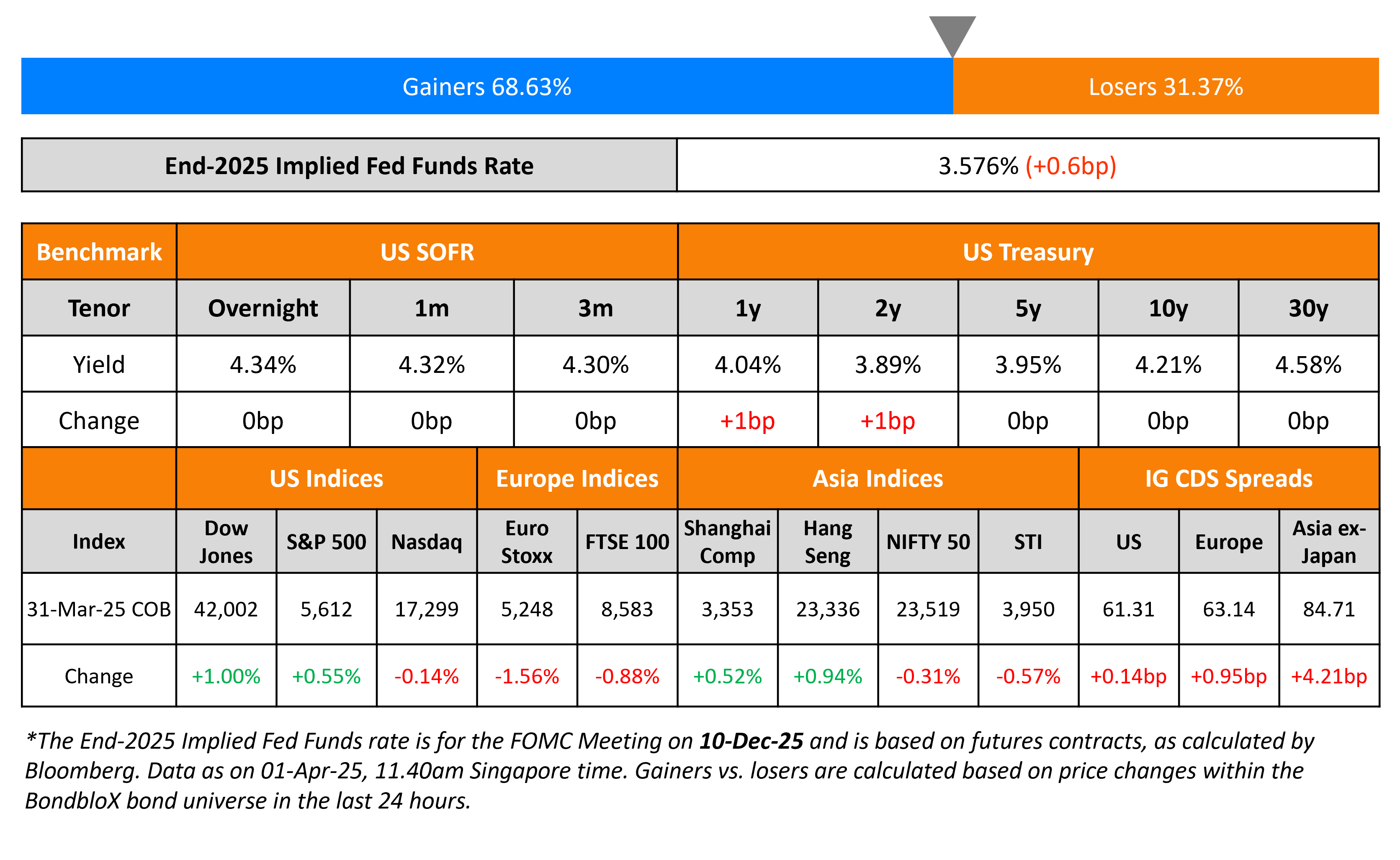

US Treasury yields were lower by over 10bp across the curve since Thursday, as concerns rose over the US economy, driven by weak consumer sentiment and uncertainty on the new administration’s policies. Markets are now pricing-in the possibility of 75bp in Fed rate cuts by end-2025, from the prior expectation of 50bp. However, New York Fed President John Williams said that while there was considerable uncertainty, he expects the Fed to keep interest rates unchanged for “some time”. He added that tariffs could lead to “more prolonged effects” on inflation. Separately, US President Donald Trump’s announcement of reciprocal tariffs is set to come out tomorrow.

US equity markets were mixed, with the S&P up 0.6% and Nasdaq down 0.1% respectively. Looking at credit markets, US IG and HY CDS spreads widened 0.1bp and 1bp respectively. European equity markets ended lower. The iTraxx Main and Crossover CDS spreads widened by 1bp and 5bp respectively. Asian equity markets have opened lower this morning. Asia ex-Japan CDS spreads were wider by 4.2bp.

New Bond Issues

- NRW Bank $ 5Y at MS+49bp area

Rating Changes

-

Fitch Upgrades Howmet to ‘BBB+’; Outlook Stable

-

Moody’s Ratings upgrades Meituan’s ratings to Baa1; outlook stable

-

Moody’s Ratings upgrades Nasdaq to Baa1; outlook stable

-

Moody’s Ratings upgrades Welltower to A3; outlook stable

-

Energo-Pro Downgraded To ‘B+’ On Weaker Financials Despite Announcing Hydro Acquisition; Outlook Stable

-

Fitch Downgrades Bally’s Corporation’s IDR to ‘B-‘; Outlook Negative

-

Moody’s Ratings downgrades Dollar General’s senior unsecured notes ratings to Baa3

-

Fitch Downgrades Comstock Resources’ IDR to ‘B’ and Unsecured Rating to ‘B’/’RR4’; Outlook Stable

-

Fitch Revises Polaris’ Outlook to Negative; Affirms IDR at ‘BBB’

Term of the Day: Will Not Grow (WNG) Bond

Bonds whose size is fixed and cannot be increased are called ‘Will Not Grow (WNG)’ or ‘No Grow’ bonds. Sometimes, issuers increase the final size of a deal to accommodate investor appetite. WNG bonds however have a fixed size and will not be increased. For example, green bonds often fall into this category as per the Climate Bonds Initiative (CBI). The CBI says that issuers need to show that there are enough green projects to match the amount that they intend to raise and for some, the number of suitable projects is limited. This according to them shows why green bonds tend to be smaller than vanilla bonds from the same issuer whereas for others there is more flexibility and the final size of the deal can be increased to accommodate investor appetite.

Talking Heads

On More ECB Officials Ready to Accept an April Rate Pause

“The next meeting will be about how many Council members who have so far gone along with the proposal but have expressed concerns can then decide against a further interest-rate cut”

On Goldman Seeing More Fed Cuts This Year as Tariffs Dent Growth

“The downside risks to the economy from tariffs have increased the likelihood of a package of 2019-style ‘insurance’ cuts, which we now see as the modal outcome under our revised economic forecast”

On recession not on the horizon despite tariff worries – IMF Chief Kristalina Georgieva

“We don’t see recession on the horizon… What we see in the high-frequency indicators is indeed indicating that consumer confidence, investor confidence are weakening somewhat”

Top Gainers and Losers- 01-April-25*

Go back to Latest bond Market News

Related Posts: