This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

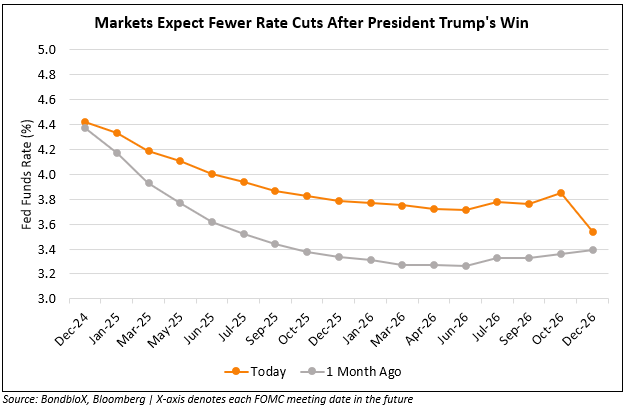

Markets Expect Fewer Fed Rate Cuts Post US Elections

November 11, 2024

The US 2Y Treasury yield rose by 4bp while the 10Y yield fell by 3bp and the curve flattened. Minneapolis Fed President Neel Kashkari spoke on Sunday, remarking that while the economy was strong, inflation continued to remain a challenge. Analysts noted that while the Fed is expected to cut rates at their December meeting, it is likely that the policymakers will reduce rates by less than previously expected in the coming months, following Donald Trump’s election victory. This can also be observed in the market expectations of the Fed Funds rate, based on the pricing of Fed Funds Futures, as seen in the chart above. For instance, the end-2025 Fed Funds Rate expectation is currently at 3.79%, about 45bp higher than the 3.34% seen a month ago. Later in the week, several other Fed Presidents are scheduled to speak at various events, and the CPI data for the month of October will be released this Wednesday. US IG CDS spreads tightened by 0.8bp while HY CDS spreads were flat. Looking at US equity markets, S&P and Nasdaq both closed higher last Friday by 0.4% and 0.1% respectively.

European equities closed lower across the board. In terms of Europe’s CDS spreads, the iTraxx Main tightened by 0.2bp while Crossover spreads widened by 2.3bp. Asian equities opened lower this morning, following a disappointing $1.4tn fiscal plan that was announced by China at a legislative meeting last week. While the package was aimed at aiding local governments with their hidden debt, it stopped short of providing a boost to domestic consumption.

New Bond Issues

- ANZ S$ 10NC5 T2 at 4.1% area

New Bond Pipeline

-

People’s Republic of China Ministry of Finance hires for $ 3Y/5Y bond

- Singapore Medical Group hires for S$ 5Y bond

- Tata Capital hires for $ bond

Rating Changes

-

Moody’s Ratings upgrades Croatia’s ratings to A3, changes outlook to stable from positive

-

Moody’s Ratings downgrades Kongsberg Automotive ASA’s CFR to B2; outlook stable

-

Moody’s Ratings confirms Paramount Global’s Baa3 senior unsecured ratings; outlook revised to negative

-

Fitch Revises Spain’s Outlook to Positive; Affirms IDR at ‘A-‘

-

Fitch Revises Transportadora de gas del Peru’s Outlook to Stable; Affirms ‘BBB+’ Long-Term Ratings

-

Fitch Revises Patrimonio del Trentino S.p.A.’s Outlook to Positive; Affirms IDR at ‘A-‘

Term of the Day: Switch Auction

A switch auction is an auction in which existing bondholders have an opportunity to move their bonds’ maturity out to a number of designated bonds with longer maturities. The rates on these bonds are determined by investors through an open auction mechanism. The objective is to enable the government to consistently issue new bonds in all market conditions, including periods of fiscal balances or surpluses.

Talking Heads

On Bond Market on Risky Path as Traders Regroup From Wild Week

Janet Rilling, Allspring Global

One scenario is “the bond market instills fiscal discipline with an unpleasant rise in rates”

Rick Rieder, BlackRock

“Venturing out to the wild blue yonder of longer-term interest rates,” he added, is “maybe not worth that excitement (or the volatility)”

On Going Into New Trump Era, Risky Emerging Market Bonds Keep Luring Traders

Shamaila Khan, UBS Asset Management

“Fundamentals are improving and countries emerging out of default will continue to perform… If you see weakness in the space, it’s a fantastic opportunity”

Cathy Hepworth, PGIM

“For now, we assume there will be some volatility at the margin” for emerging markets. Higher-yielding spreads, which have idiosyncratic drivers, are likely to continue to outperform”

Eric Fine, VanEck Associates

“It’s a table-pounding yes, no question.

They pay you a higher spread. High-yield corporates are a high-yield trade, and investment grade is a Treasury trade”

On 5% Yields Would Be ‘Difficult’ to Absorb – JPMorgan’s Bob Michele

“5% proved to be a very difficult level for markets to absorb a couple years ago. I’d say that discount rate applied to a lot of asset classes is going to cause a pause, a consolidation, and I don’t think that’s unrealistic… at some point, rates are going to hit a level that better earnings and stock-market valuations won’t be able to absorb”

Top Gainers and Losers – 11 Nov 2024*

Go back to Latest bond Market News

Related Posts: