This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Markets Await US CPI Today; Pershing Square, Avation Group Price $ Bonds

October 24, 2025

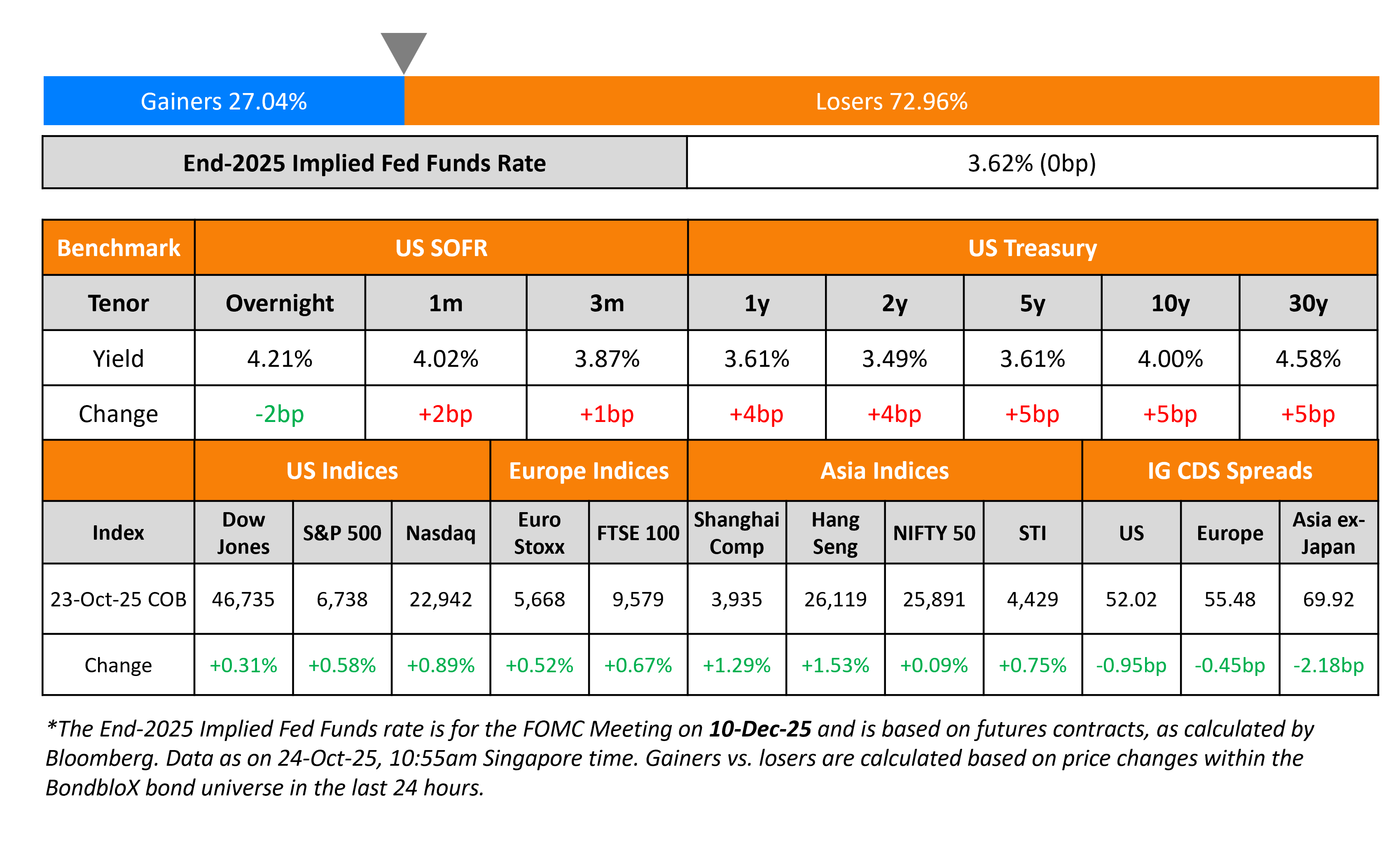

US Treasury yields jumped higher by 4-5bp on Thursday. Markets await the US CPI report which will be published later today, despite the continuing government shutdown. Separately, economists estimated a seasonally adjusted 232k rise on the initial jobless claims print for the prior week, rising from 220k a week before that.

Looking at equity markets, the S&P and Nasdaq closed 0.6% and 0.9% higher. The US IG and HY CDS spreads tightened by 1bp and 5.2bp respectively. European equity indices ended higher too. The iTraxx Main and Crossover CDS spreads were 0.5bp and 1.3bp tighter respectively. Asian equity markets have opened in the green today. Asia ex-Japan CDS spreads were 2.2bp tighter.

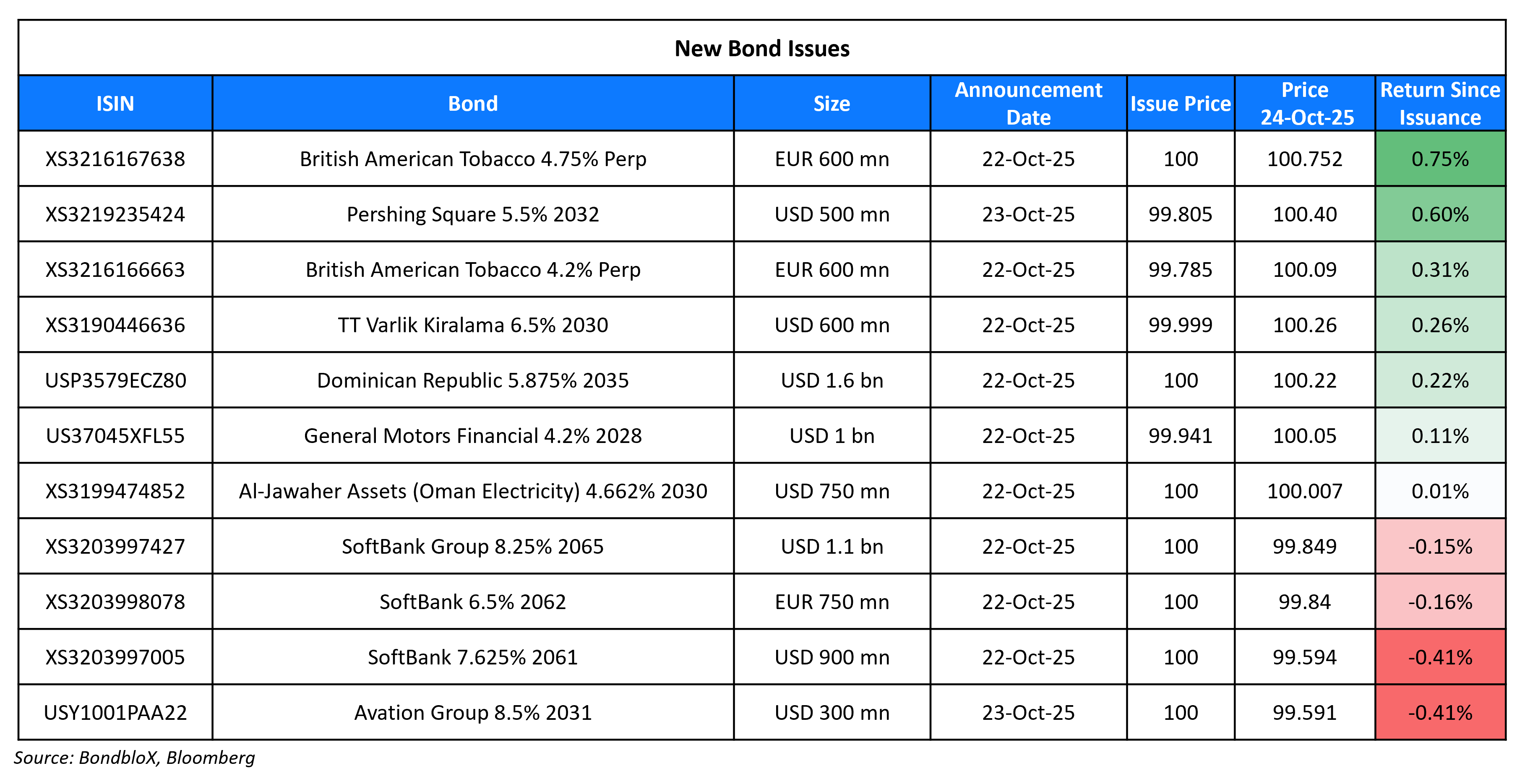

New Bond Issues

Pershing Square Capital raised $500mn via a 7Y bond at a yield of 5.534%, 25bp inside initial guidance of T+200bp area. The senior unsecured note is rated A-/BBB (S&P/Fitch). Proceeds will be used for general corporate purposes, including making investments or holding assets in accordance with the company’s investment policy. This was the company’s first issuance since 2021.

Avation Group raised $300mn via a 5.5NC2 bond at a yield of 8.5%, inline with initial guidance of 8.25-8.5%. The senior unsecured note is rated B2/B/B (Moody’s/S&P/Fitch). Proceeds will be used to refinance its existing 2026s and pay transaction related fees and expenses.

New Bonds Pipeline

-

Hon Hai € 6Y offering

Rating Changes

- Fitch Upgrades Vale IDRs to ‘BBB+’; Outlook Stable

- Moody’s Ratings downgrades Orion’s ratings to Ba3, and places ratings on review for downgrade

- Tata Motors Passenger Vehicles Outlook Revised To Negative On Slow Recovery At Jaguar Land Rover; ‘BBB’ Rating Affirmed

- Jaguar Land Rover Automotive PLC Outlook Revised To Negative As Challenges Mount; ‘BBB-‘ Ratings Affirmed

- Polygon Group AB Outlook Revised To Negative On Weaker Operating Performance And Liquidity Profile; ‘B’ Rating Affirmed

- China Resources Gas Group Ltd. ‘A-‘ Rating Withdrawn At Issuer’s Request

Term of the Day: Quantitative Tightening (QT)

Quantitative Tightening (QT) is a contractionary monetary policy measure used by central banks to decrease the amount of liquidity or money supply in the economy. This is the opposite of quantitative easing (QE) which tries to increase the liqudidity and money supply. This typically takes place via the central bank’s balance sheet normalization policy where it reduces the pace of reinvestment of proceeds from maturing government bonds, ABS and other securities that it bough during the period when it conducted QE. Some analysts expect the Fed to soon halt its balance sheet drawdown.

Talking Heads

On Fed Being Poised to Stop Balance Sheet Runoff

Mark Cabana and Katie Craig, BofA

“Money markets at current or higher levels should signal to the Fed that reserves are no longer abundant”

JPMorgan strategists

Markets have been operating “with much more frictions” as the Fed’s reverse repo facility empties

On a $41bn Debt Binge Turning Mexico Into the Top EM Borrower

Aaron Gifford, T. Rowe Price

“Mexico has been a big borrower, particularly because of the Pemex-related” deals…”expect this kind of issuance to continue in the future, although next year it will probably be a bit less”

Nathalie Marshik, HSBC

“The government is being more proactive… also in an environment where there’s still a lot of liquidity, and so Mexico taking advantage of that is good”

Simon Waever, Morgan Stanley strategist

Mexico went “above and beyond” for Pemex this year

On raising gold outlook on investor interest, central bank buying – JPMorgan

“We believe [gold] has even higher to go as we enter a Fed cutting cycle with overlays of stagflation anxiety, concerns around Fed independence, and broader debasement hedging”

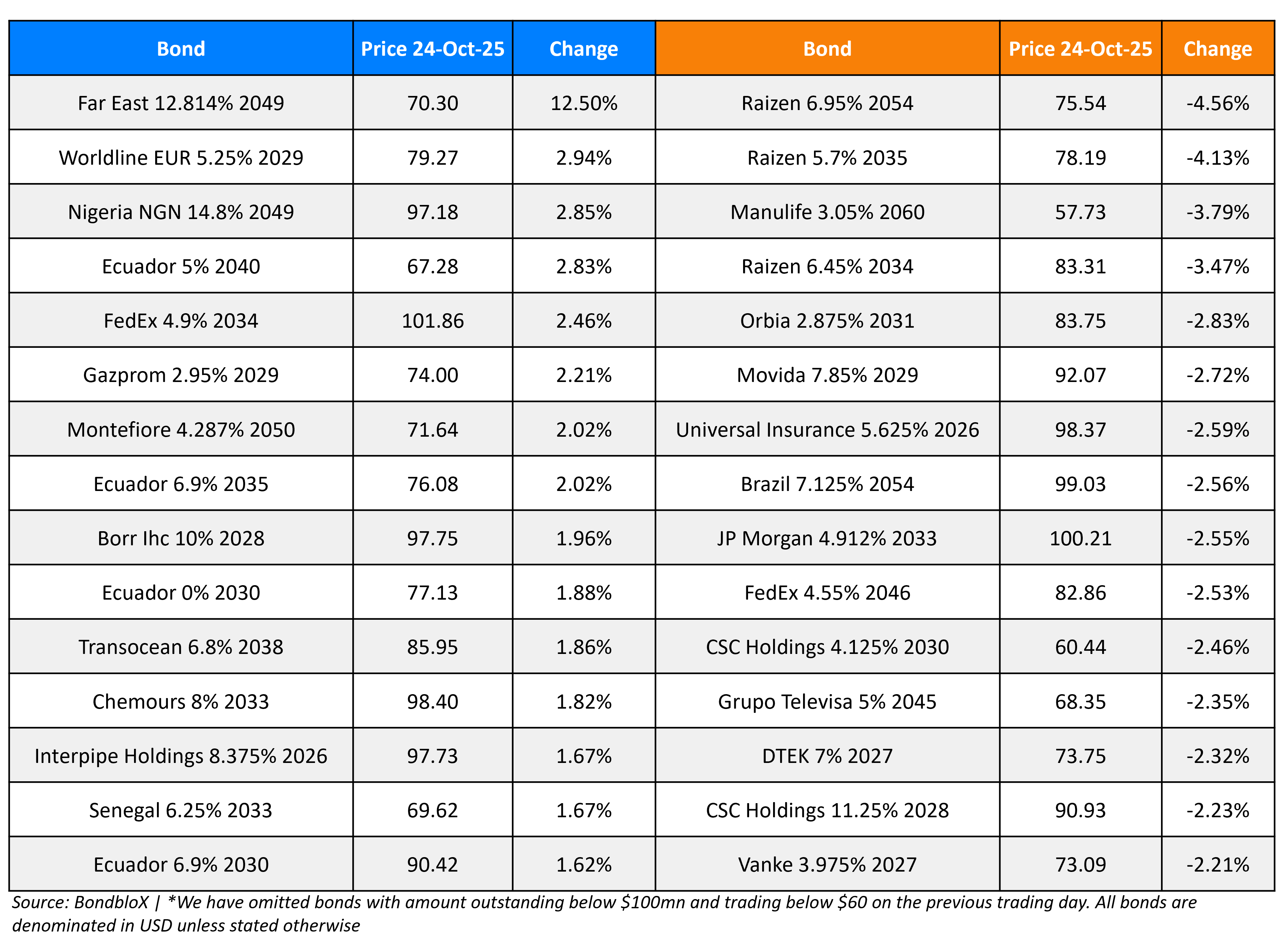

Top Gainers and Losers- 24-Oct-25*

Go back to Latest bond Market News

Related Posts: