This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Markets Await NFP Expected at 240k

May 3, 2024

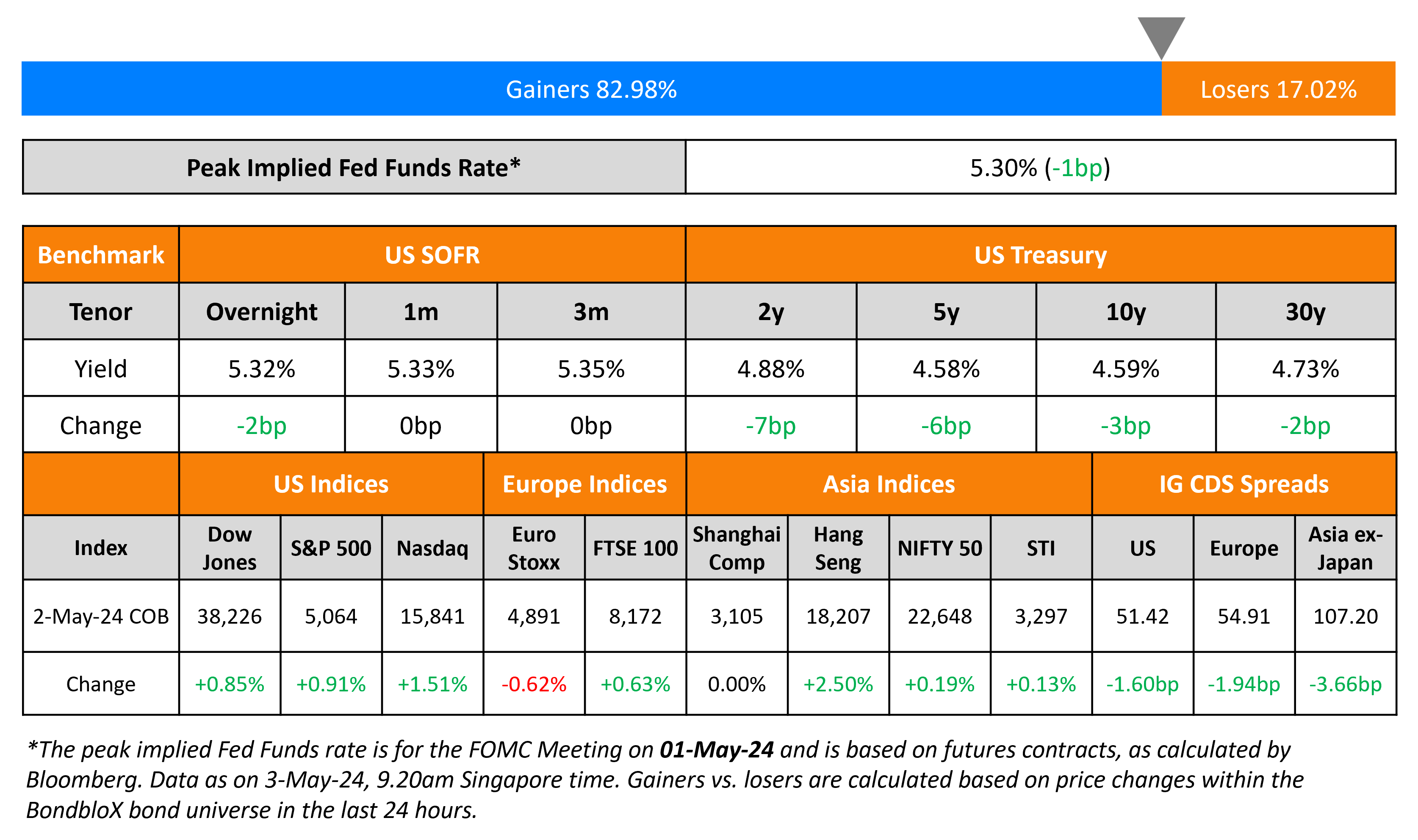

US Treasury yields continued to ease further, by 6-8bp across the curve. On the data front, the final print for US Durable Good Orders in March remained unchanged at 2.6%. Initial jobless claims for the prior week rose by 208k, better than expectations of 211k. Markets await the Non-Farm Payrolls (NFP) print later today with economists expecting jobs to grow by 240k. S&P and Nasdaq ended higher by 0.9-1.5% each. US IG CDS spreads tightened 1.6bp and HY spreads were 8bp tighter.

European equity markets were mixed. The iTraxx main CDS spreads tightened 1.9bp and the crossover CDS spreads tightened 1.9bp. Asian equity indices have opened weaker this morning, while the Hang Seng Index (HSI) continues to march upwards. The HSI is up over 5% this week and 20% from the lows seen in January. Asia ex-Japan CDS spreads tightened 3.7bp.

New Bond Issues

New Bonds Pipeline

- Korea Expressway hires for $ 3Y/5Y bond

Rating Changes

- Moody’s Ratings upgrades Bombardier’s CFR to B1; outlook stable

- Moody’s Ratings upgrades Danske Bank’s long-term deposit ratings and senior unsecured debt ratings to A1; outlook on long-term deposit and senior unsecured ratings changed to stable

- Fitch Upgrades Mizuho Bank and Mizuho Trust & Banking to ‘A’, Affirms Group IDR at ‘A-‘

Term of the Day

Neutral Rate of Interest

The neutral rate aka natural rate or “R*” is the theoretical federal funds rate at which point the US Federal Reserve monetary policy is neither accommodative nor restrictive. In other words it is the short-term real interest rate that is consistent with the economy maintaining full employment and price stability. This rate is inferred and calculated via models and varies based on economic and financial market factors.

Talking Heads

On Bonds offer opportunity to tap historically high yields – Navin Saigal, BlackRock

“The opportunity is set for unique and incredible return for fixed-income investment without taking on volatility. Bond investors are looking at yields of between 6-7% on a diversified portfolio of high quality bonds. This is an opportunity that has not existed for some 16 years”

On Powell’s soothing tone may not be enough for inflation-spooked markets

Steve Hooker, PM at Newfleet Asset Management

“If the Fed is going to be as data-dependent as they claim to be, every data point will be scrutinized by the market to see whether it means higher for longer or the possibility that rate hikes are back on the table”

Paul Mielczarski, head of global macro strategy at Brandywine Global

“Market expectations have swung from one extreme to another. Naturally the market is a little bit cautious … and is waiting for the data to confirm the Fed’s underlying view that inflation can come down to 2%”

On Weak US productivity could threaten Fed’s ‘soft landing’ hopes

Jerome Powell, Fed Chairman

“It would have to be a meaningful thing and get our attention and lead us to think the labor market was really significantly weakening”… inflation can be returned to the Fed’s target “without significant dislocations in the labor market or elsewhere.”

Top Gainers & Losers- 03-May-24*

Go back to Latest bond Market News

Related Posts: