This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Markets Await NFP; Delta Air Prices $ Bonds; Adidas Upgraded to A

June 6, 2025

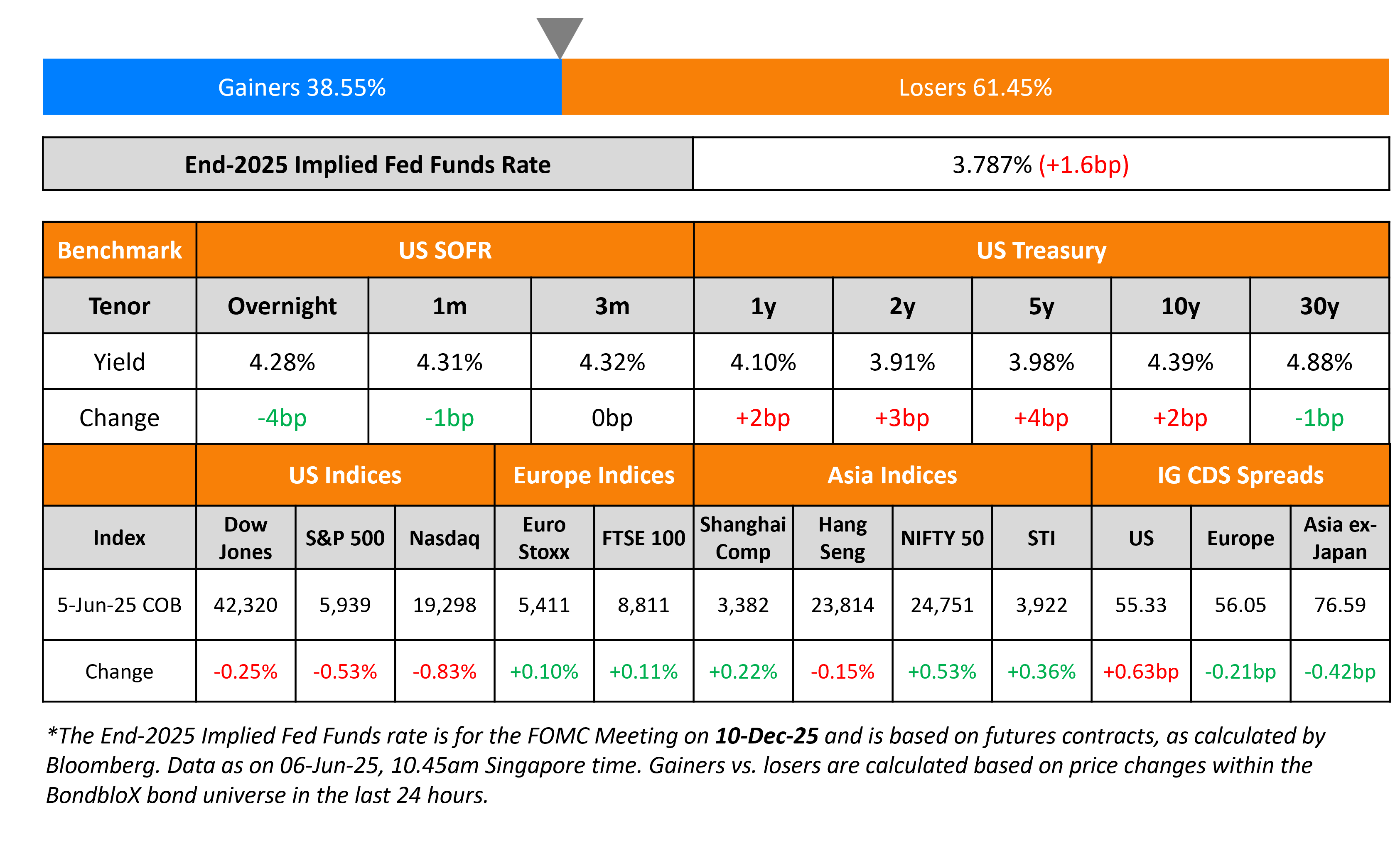

US Treasury yields rose by 2-4bp yesterday. Initial jobless claims for the prior week worsened by 247K, vs. expectations of 235K, marking its worst reading since October 2024. Markets await the NFP report later today, with economists expecting a 126K pickup, and the unemployment rate to hold steady at 4.2%. US President Donald Trump and Chinese President Xi Jinping held a 90-minute phone call and agreed to resume trade negotiations and plan a bilateral meeting. Kansas City Fed President Jeff Schmid warned that new tariffs could reignite inflation, with upward price pressures likely to emerge in the coming months. Federal Reserve Governor Adriana Kugler emphasized that inflation poses a greater risk than weakening employment, citing pressure from Trump’s tariff policies.

Looking at US equity markets, S&P and Nasdaq closed lower by 0.5% and 0.8% respectively. Looking at US credit markets, US IG and HY CDS spreads widened by 0.6bp and 2.7bp respectively. European equity markets closed higher. Looking at credit markets, the iTraxx Main and Crossover CDS spreads tightened by 0.2bp and 1.7bp respectively. Asian markets have opened mixed today. Asia ex-Japan IG CDS spreads tightened by 0.4bp.

New Bond Issues

Delta Airlines raised $2bn via a two-tranche deal. It raised $1bn via a 3Y bond at 4.953%, 30bp inside the initial guidance of T+135bp area. It also raised $1bn via a 5Y bond at 5.295%, 30bp inside the initial guidance of T+160bp area. These senior unsecured notes are rated Baa2/BBB-/BBB-. Proceeds would be used to repay all or portion of approximately $1.65bn of its unsecured Payroll Support Program loan due 19 April 2030. Any remaining proceeds would be used for general corporate purposes. The new 5Y bond is priced at a new issue premium of ~24bp over its existing 3.75% bond due October 2029 that yields 5.05%.

Rating Changes

-

Toll Brothers Inc. Upgraded To ‘BBB’ On Solid Credit Metrics; Outlook Stable

-

Fitch Downgrades New Fortress Energy’s IDR to ‘CCC’; Removes Negative Watch

-

Fitch Downgrades Telefónica Móviles Chile to ‘BB-‘; Outlook Negative

-

Fitch Downgrades PRA Group’s Ratings to ‘BB’; Outlook Stable

-

Fitch Downgrades PizzaExpress to ‘Restricted Default’ on Debt Restructuring; Upgrades to ‘CCC+’

Term of the Day: Tag-along Rights

Tag-along rights are a legal provision in shareholder agreements that protect minority shareholders. They ensure that if a majority shareholder sells their stake to a third party, minority shareholders have the right to “tag along” and sell their shares as well, on the same terms and conditions. This prevents minority shareholders from being left behind with new, potentially less favorable ownership.

Talking Heads

On Debt Surge From Trump Plan Undermining US Power – Larry Summers, Former US Treasury Secretary

“This makes us vulnerable…The world’s greatest debtor accumulating debt faster than any other country ever has in dollar volume is putting at risk its status as the world’s greatest power…I’m with the president on getting rid of the concept of the debt limit as an aspect of the budget process”

On Battles Ahead After ECB Hits Sweet Spot – Christine Lagarde, ECB President

“Inflation is currently at around our 2% medium-term target…we will constantly assess and reassess how we are delivering on this…What’s really important for all governments is firstly to have price stability — and we have that today…At the current level of interest rates, we believe that we are in a good position to navigate the uncertain conditions that will be coming up”

On Paring Risk After Tariff Move & Bracing For More Uncertainty – John Waldron, Goldman Sachs

“We have moderated our risk positioning since April 2nd…We want to continue to do that…The bond market is starting to be heard, and I hope that gets some attention in the halls of Congress…We’re seeing a lot of increase in duration in the rate curves in the United States and Japan and many other countries – and I think that could be a brake on economic growth”

Top Gainers and Losers- 06-Jun-25*

Go back to Latest bond Market News

Related Posts: