This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Markets Await Inflation Report

December 11, 2024

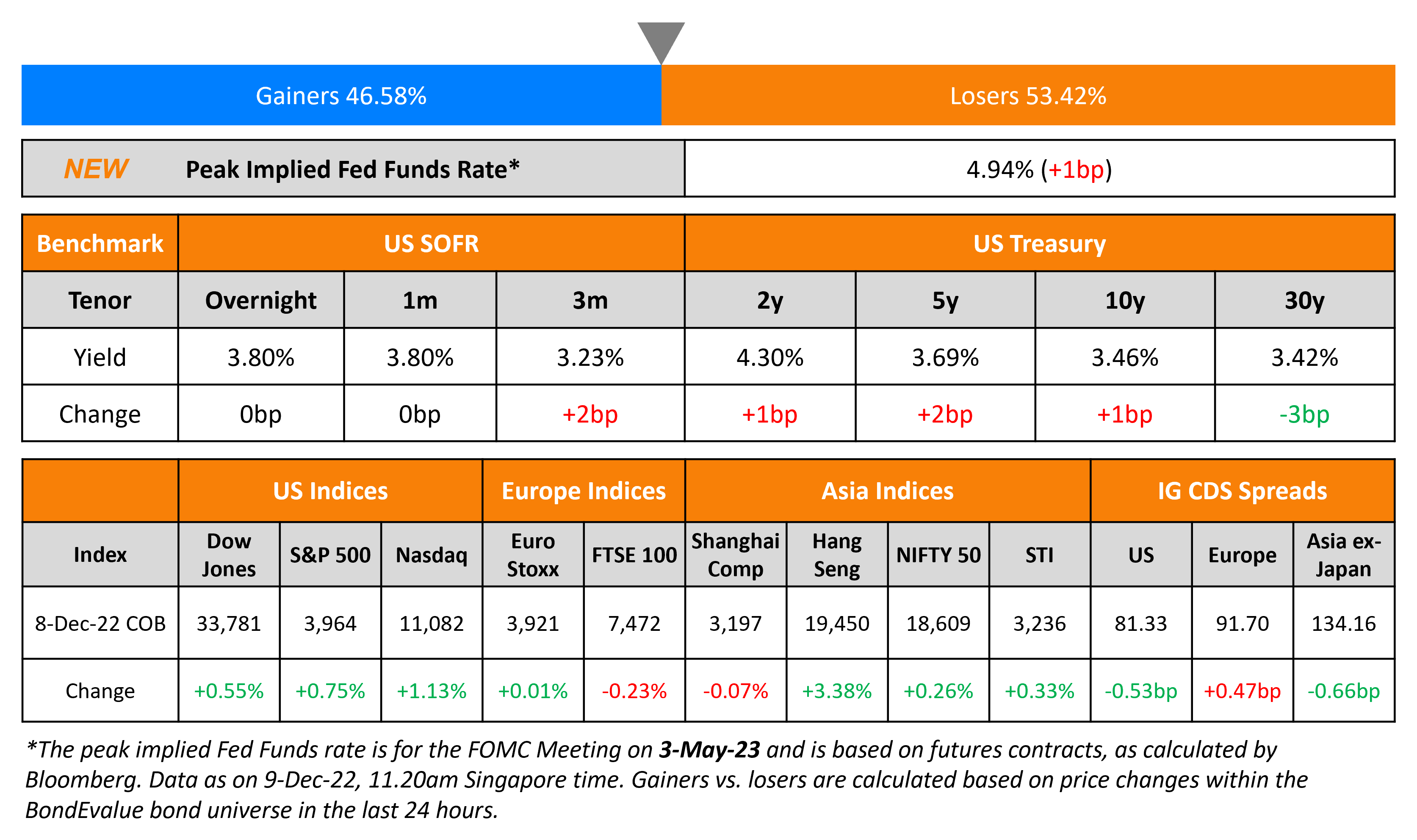

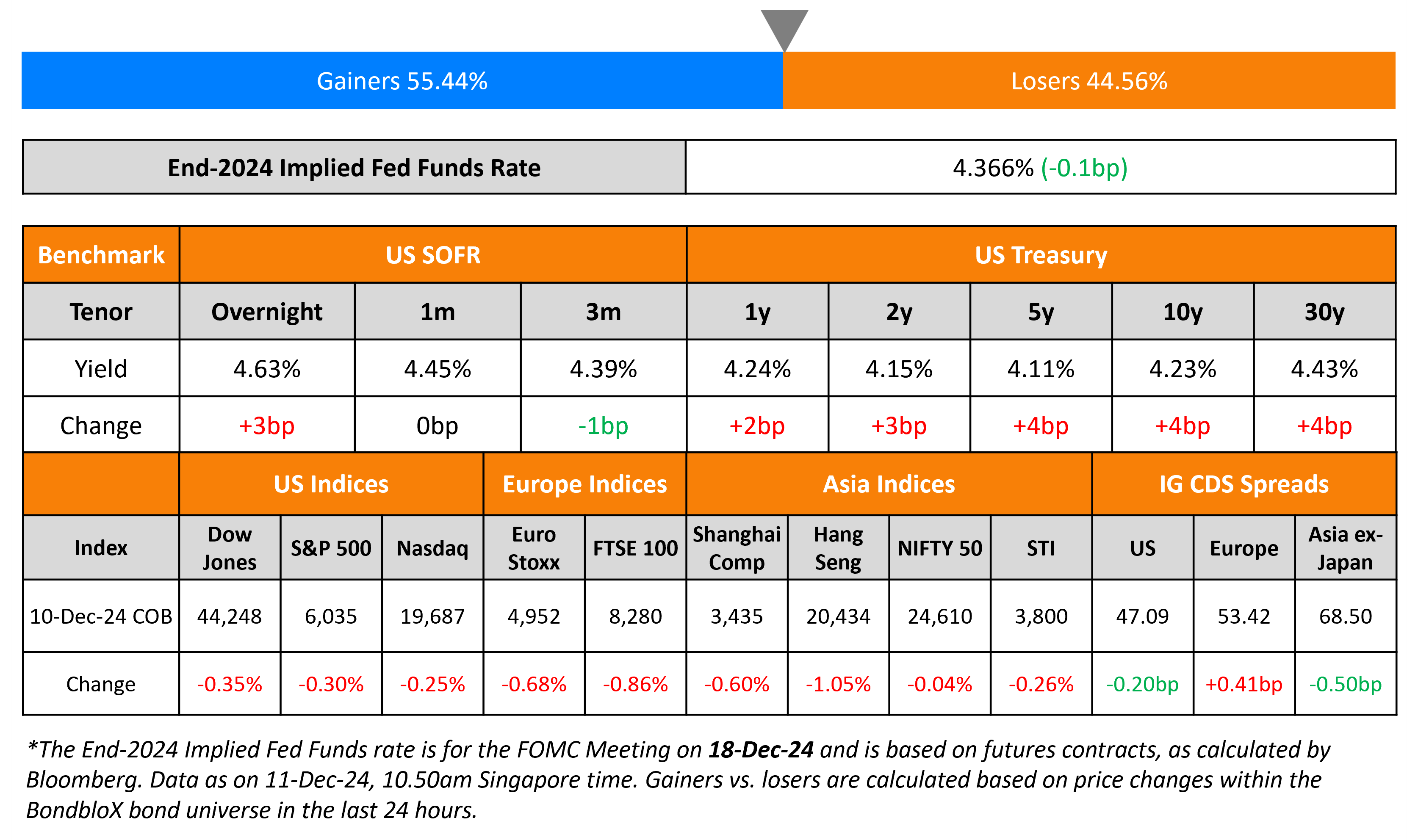

US Treasury yields extended their move higher, by over 3bp on Tuesday. The US inflation report is due later today, with the Headline CPI expected to rise by 2.7% YoY, while the Core CPI reading is set to remain unchanged at 3.3%. Markets continue to price-in an 85% probability of a 25bp rate cut by the Fed next week.

US IG and HY CDS spreads tightened by 0.2bp each. Looking at US equity markets, the S&P and Nasdaq closed 0.3% lower. European equities ended lower as well. In terms of Europe’s CDS spreads, the iTraxx Main and Crossover spreads widened by 0.4bp and 2.2bp respectively. Asian equities have opened mixed this morning. Asia ex-Japan CDS spreads were 0.5bp tighter.

New Bond Issues

Ecuador, via the Amazon Conservation DAC, raised $1bn via an 18Y bond, as part of a debt-for-nature swap at a yield of 6.034%. The notes are rated Aa2/AA (Moody’s/Fitch). The bonds have a weighted average life of ~12.7 years. Interest will be payable in quarterly installments starting on 16 April 2025. Principal amortization and interest payments have an eight year grace period on principal followed by equal quarterly amortizations starting on 16 April 16 2033 and ending in 2042. Proceeds will be used to fund the government’s tender offer which will receive the repackaged debt, with the savings used to support conservation efforts in the Amazon.

Rating Changes

-

Moody’s Ratings upgrades Diebold Nixdorf’s CFR to B2 from B3, outlook stable

-

Intel Corp. Downgraded To ‘BBB’ On Slow Business Recovery And Uncertainty From Management Changes; Outlook Stable

-

Moody’s Ratings downgrades ETESA’s BCA to ba1, affirms ratings at Baa3; outlook remains negative

-

Fitch Revises AngloGold Ashanti’s Outlook to Stable; Affirms IDR at ‘BBB-‘

-

Moody’s Ratings places DLG’s ratings on review for upgrade following announcement of potential acquisition by Aviva

New Bonds Pipeline

- Buenos Aires hires for $ bond

Term of the Day

Recovery Bonds

Recovery bonds are bonds that are typically issued by state utilities trying to recapture losses from natural disasters, such as wildfires or storms. Special fees are levied on customers’ electric bills etc. (to recover losses) and these charges are then combined and sold as notes/ABS. Bloomberg highlights that recovery bonds have seen abundant interest from investors, especially ABS money managers. This is because these bonds offer longer tenors ranging from 10-30 years while typical ABS’s have tenors of just about 5 years. These bonds are also backed by state legislation that allows utilities to impose recovery charges. Analysts say that this makes them a safe haven as compared to other types of ABSs.

Talking Heads

“Important that France sticks with its approach on bringing the budget deficit and public debt credibly on a downward path”

On Government debt glut could rock markets in 2025 – BIS

“Financial markets are beginning to realize they will have to absorb these growing volumes of government debt… takes time for policymakers to adjust policies and if they wait for markets to wake up, it’s going to be too late… Global credit conditions remain “unusually accommodative”.

On BOJ Should Hike Given Risk of Falling Behind

“The BOJ had better move early while it can… they may already be behind the curve… At 0.25%, Japan’s rate is exceptionally low… Unless there is a major shift in the economy, it’s natural to lift the rate. It’s not hawkish.”

Top Gainers and Losers- 11-December-24*

Go back to Latest bond Market News

Related Posts: