This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Markets Await FOMC Meeting; Mexico, Melco, Almarai Price $ Bonds

September 17, 2025

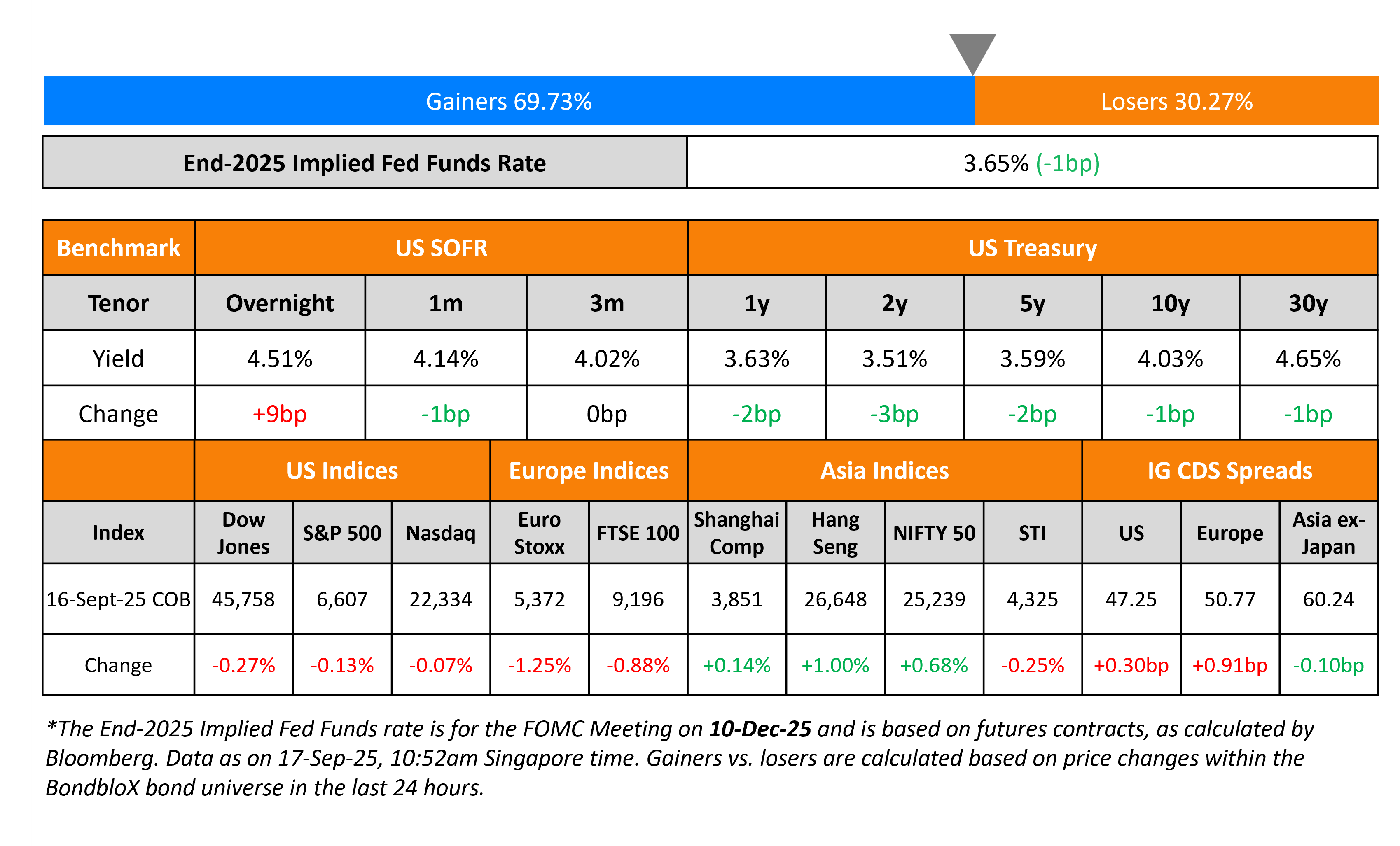

US Treasury yields moved lower by ~2bp across the curve. US Retail Sales for August rose 0.6% MoM, better than expectations of 0.2%. Also, July’s number was revised slightly higher to 0.6%. Core Retail Sales rose 0.7%, again better than expectations of 0.4%. Markets await the FOMC decision and their subsequent guidance later today alongside the SEP report and Dot plots. A 25bp rate cut has already been priced-in.

Looking at US equity markets, the S&P and Nasdaq closed lower by ~0.1% each. US IG and HY CDS spreads were wider by 0.3bp and 1.2bp respectively. European equity markets ended lower too. The iTraxx Main CDS and Crossover spreads were 0.9bp and 0.8bp wider respectively. Asian equity markets have opened in the green today. Asia ex-Japan CDS spreads were 0.1bp tighter. Separately, China is said to be planning new measures to boost consumption – this comes after August factory output and retail sales saw their weakest growth this year. Retail Sales rose 3.4% YoY in August, missing estimates for a 3.9% print. Factory output rose 5.2% YoY, slowing from July’s 5.7% rise.

New Bond Issues

Mexico raised $8bn via a three-trancher:

- $1.5bn via a long 5Y bond at a yield of 4.827%, 27bp inside initial guidance of T+150bp area. The new bond is priced at a new issue premium of 16bp over its existing 6.00% 2030s that currently yield 4.66%.

- $4bn via a long 7Y bond at a yield of 5.435%, 25bp inside initial guidance of T+190bp area. The new bond is priced at a new issue premium of 29bp over its existing 4.75% 2032s that currently yield 5.14%.

- $2.5bn via a 10Y bond at a yield of 5.687%, 30bp inside initial guidance of T+195bp area. The new bond is priced at a new issue premium of 14bp over its existing 6.35% 2035s that currently yield 5.54%.

The senior unsecured bonds are rated Baa2/BBB/BBB-. Proceeds will be used for the general purposes of the government, as well as to make a capital contribution to Pemex. Pemex will in turn use the amount to partially repay, redeem and repurchase certain outstanding securities under its tender offer.

Melco Resorts raised $500mn via an 8NC3 bond at a yield of 6.50%, 12.5bp inside initial guidance of 6.625% area. The senior unsecured note is rated Ba3/BB-. Proceeds will be used for general corporate purposes.

Emirates Islamic Bank raised $500mn via a 5Y sustainability-linked bond at a yield of 4.54%, 30bp inside initial guidance of T+125bp area. The senior unsecured note is rated A+, and received orders of over $1bn, 2x issue size. The issuer is EI Sukuk Company Ltd. Net proceeds will be used for financing a portfolio of general corporate purpose financing instruments in accordance with Emirates Islamic’s SLL Funding Framework.

Almarai raised $500mn via a 5Y sukuk at a yield of 4.45%, 35bp inside initial guidance of T+120bp area. The senior unsecured note is rated Baa3/BBB-. Proceeds will be used to fund the tender offer for the buyback of its 5.25% 2026s.

Transurban raised $550mn via a 10.5Y bond at a yield of 4.924%, 30bp inside initial guidance of T+120bp area. The senior secured note is rated Baa1/A-. Proceeds will be used to refinance existing debt and for general corporate purposes.

Rating Changes

-

Moody’s Ratings downgrades INEOS’ rating to B1; outlook negative

-

Fitch Downgrades INEOS Enterprises to ‘B+’; Outlook Stable; Withdraws Rating

-

Fitch Revises Embraer’s Outlook to Positive; Affirms IDRs at ‘BBB-‘

-

Moody’s Ratings affirms Natura’s Ba2 Ratings; outlook changed to stable

Term of the Day: SEC Registered Bonds

As the name suggests, these are bonds registered with the US Securities and Exchange Commission (SEC). These are not to be confused with 144A bonds, which are privately placed, not SEC registered and have lesser documentation and are traded among Qualified Institutional Buyers (QIBs). Given 144As are restricted securities, they have resale and transfer restrictions that are not applicable for SEC-registered securities. Besides these, they also have a few other differences like being eligible for inclusion in bond indices like Barclays Aggregate Bond Index, no investment restrictions and no private placement restrictions on communications.

Mexico’s latest $8bn three-trancher is an SEC registered bond offering.

Talking Heads

On Trump Pressure on Fed Might Steepen US Yield Curve

Gareth Nicholson, Nomura International Wealth Management

“If politics bends policy, I’d fade rallies in the dollar and stay nimble on duration…Treat dollar and long bonds as the first shock absorbers.”

Stephen Parker, J.P. Morgan Private Bank

“Investors were not being adequately compensated for inflation and fiscal worries, with the long end of the Treasury curve most sensitive to those risks.”

Mike Wilson, Morgan Stanley

“Policymakers will likely seek to repress yields even at the risk of reigniting inflation…That is why people are abandoning sovereign debt and choosing to buy stocks and other assets”

On Fed Rate-Cut Optimism Having Bond Investors Focus On Duration, Steeper Yield Curve

Kathryn Kaminski, AlphaSimplex

“The general trend in the market is a little bit more of a bond-buying view, so pro-bonds in this scenario where rates are likely to go down…They are trying to get ahead of the Fed to be prepared for potential rate cuts.”

Vishal Khanduja, Morgan Stanley

“If the Fed shifts from restrictive to dovish…then you could clearly say that your overall interest rate curve should also be going lower…the higher the duration you have in the fixed income portfolio, you should be mathematically making positive returns”

On PIMCO Recommending Fed Halt Mortgage Unwind to Boost Housing Market

Marc Seidner and Pramol Dhawan

Fed should reinvest the current MBS roll-off, which averages roughly $18 billion each month…that could reduce mortgage rates by 20 to 30 basis points…”It could deliver as much bang for the buck as a 100-bp cut to the federal funds rate, which is what has historically been needed to achieve a similar drop in mortgage rates”

Top Gainers and Losers- 17-Sep-25*

Go back to Latest bond Market News

Related Posts: