This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Markets Await FOMC Decision and Treasury Quarterly Refunding Announcement

November 1, 2023

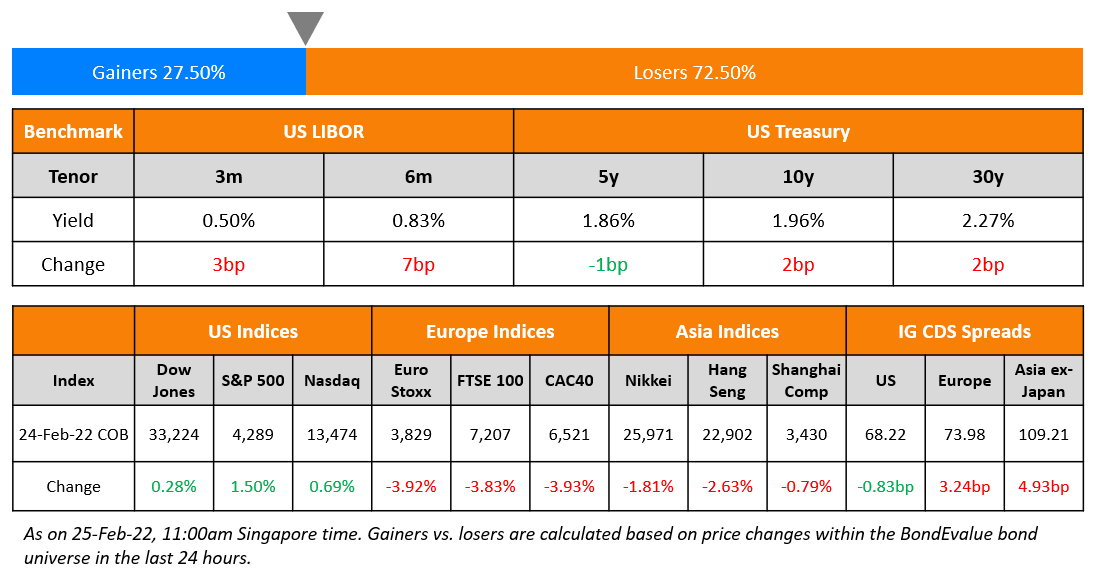

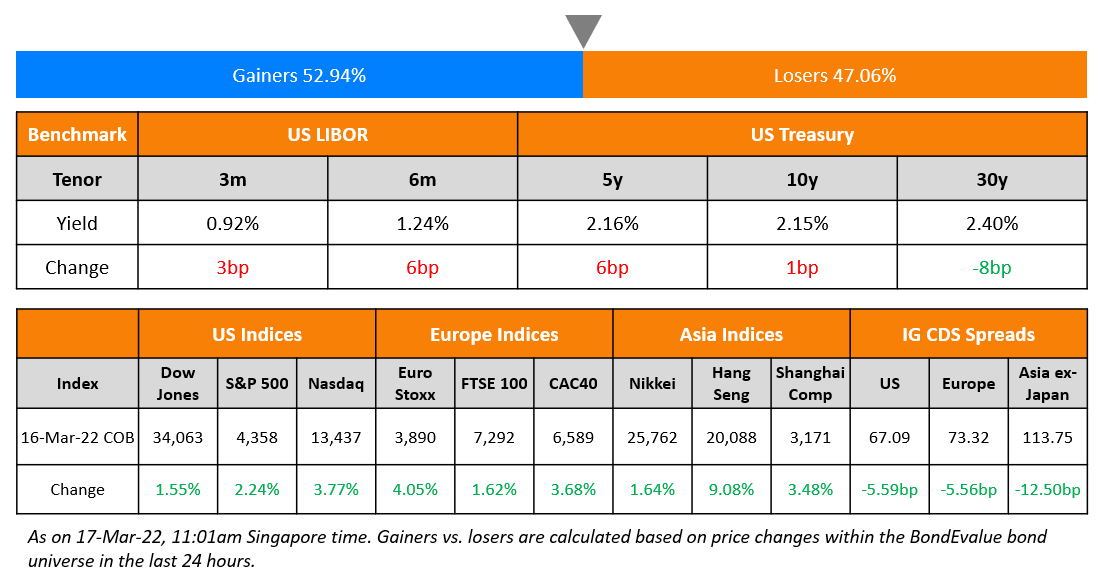

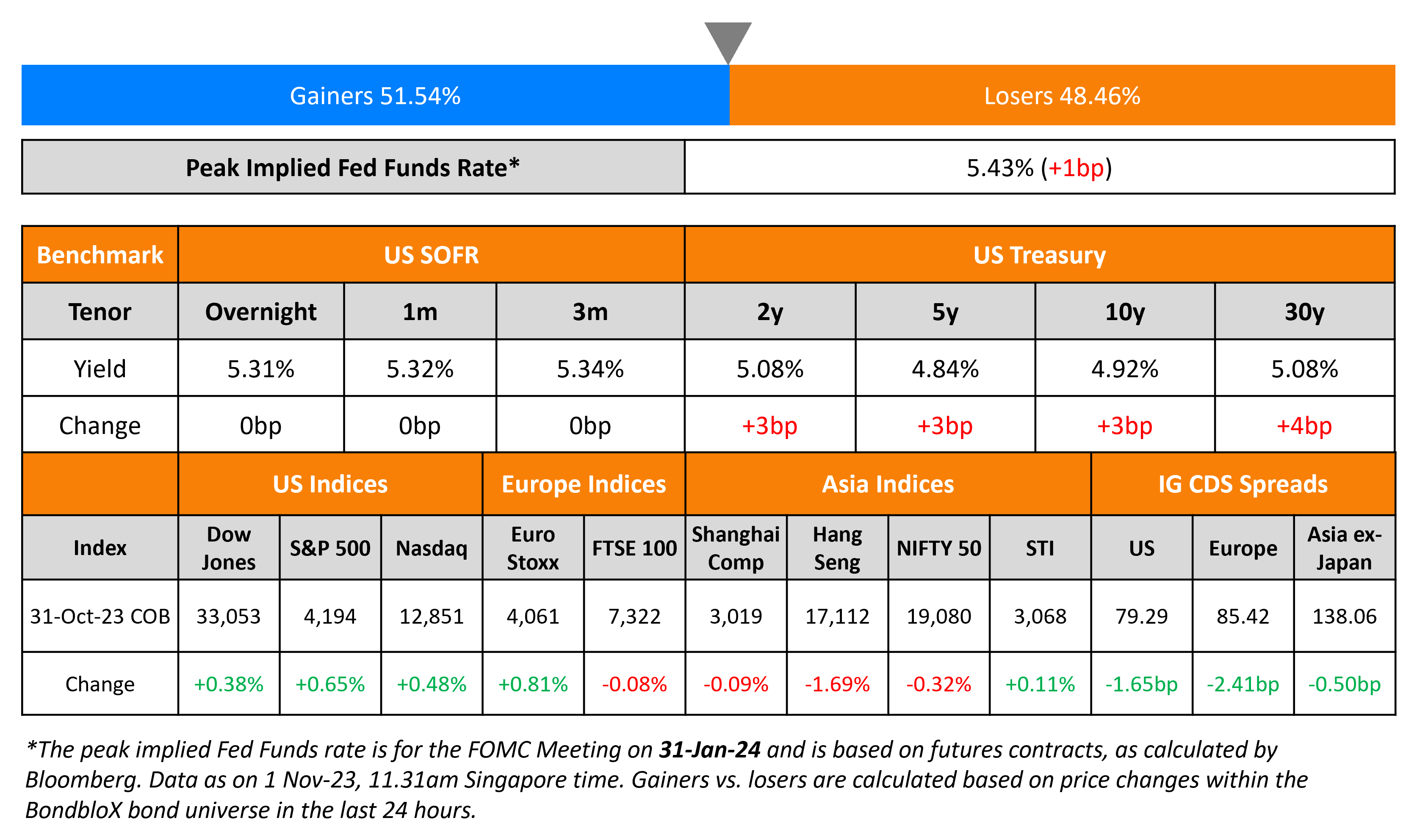

US Treasury yields inched higher by 3-4bp across the curve on Tuesday. Markets await the FOMC meeting later today where the Fed is expected to keep the fed funds rate unchanged. The forward guidance is expected to be looked at for clues regarding its tightening in upcoming meetings. Besides, the US Treasury’s quarterly refunding plans are also due where analysts expect a boost in the size of auctions for bills, notes and bonds in Q4 following a widening budget deficit. US credit markets saw IG CDS spreads tighten 1.7bp and HY spreads tighten by 7bp. US equity markets continued to move higher, with the S&P and the Nasdaq up 0.5-0.7%.

European equity markets closed higher too. In credit markets, European main CDS spreads were tighter by 2.4bp and crossover spreads tightened by 14bp. Eurozone inflation continued to trend lower as the preliminary CPI print came at 2.9% YoY in September vs. estimates of 3.1% and the prior month’s 4.3%. This was the slowest pace of headline inflation since July 2021. Core CPI was in-line with estimates at 4.2%. Asian equity markets have broadly opened higher today. Asia ex-Japan IG CDS spreads tightened 0.5bp.

New Bond Issues

StanChart raised $1.9bn via a three-part deal. It raised

- $750nm via a 4.25NC3.25 bond at a yield of 6.75%, 20bp inside initial guidance of T+205bp. The new bonds are priced 9bp tighter to its existing 2.608% 2028s (callable in 2027) that yield 6.84%.

- $400mn via a 4.25NC3.25 FRN bond at a yield of 7.375%. The coupon will reset at the overnight SOFR plus a spread of 203bps and will be paid quarterly.

- $750mn via a 6.25NC5.25 bond at a yield of 7.018%, 15bp inside initial guidance of T+235bp.

The senior unsecured bonds have expected ratings of A3/BBB+/A. Proceeds will be used for general corporate purposes.

Navient raised $500mn via a 7NC3 bond at a yield of 11.5%. in line with initial price talks at the mid-11% level. The senior unsecured bonds have expected ratings of Ba3/B+. Proceeds will be used for general corporate purposes, including debt repurchases which could include redemptions, open market debt repurchases or tender offers.

CapitaLand Ascott REIT raised S$100mn via a 4.5Y bond at a yield of 4.223%. The senior unsecured bonds have expected ratings of BBB (Fitch) and guaranteed by DBS Trustee Ltd. Proceeds will be used for refinancing the existing borrowings of the issuer and its subsidiaries.

Ziraat Katilim raised $500mn via a 3Y sukuk at a yield of 9.375%, ~31.25bp inside initial guidance of 9.675-9.75% area. The senior unsecured bonds are rated B- by Fitch and received orders of over $2bn, 4x issue size. The issuer is Ziraat Katilim Varlik Kiralama. The bonds have a change of control put.

Xiamen ITG raised $170mn via a 364-day bond at a yield of 6.9%, 10bp inside initial guidance of 7% area. The senior unsecured bonds are unrated and come with a change of control put at 101. Proceeds will be used to replenish offshore working capital and refinance existing offshore debt.

New Bond Pipeline

- Oman Telecom hires for $ 7Y sukuk

- KHFC hires for $ 3Y Fixed/FRN bond

- Korea National Oil Corp hires for $ 3Y Fixed or FRN/5Y bond

Rating Changes

- Moody’s downgrades Panama’s rating to Baa3, changes outlook to stable

- Outlooks On Israeli Banks Revised To Negative On Increased Geopolitical Risk; Ratings Affirmed

Term of the Day

Forbearance

A forbearance or moratorium is a temporary suspension on debt wherein the borrower does not have to make any repayments. It is a waiting period with some protections for the borrower before repayments begin. Typically interest is accumulated until the end of the moratorium period and the accrued interest is then added to the principal amount of the debt.

Talking Heads

On Macro hedge funds turning bearish on equities – Barclays

Global macro funds are likely seeing equities repricing lower as the 10-year Treasury yields has spiked to around 5%… “CTAs have built sizeable shorts in global equities, and have room to add further”

On Evergrande likely to struggle reviving debt restructuring plan

Mat Ng, MD specializing in restructuring at Grant Thornton

“Any process to issue new debt would need to take account of the interests of the other shareholders in those subsidiaries…. Why would those shareholders want to see new debt issued to replace the existing debt issued by Evergrande, what is the benefit for them?”

“Latin America was a pioneer, but it won’t be able to cut as much now. Central bankers will be cautious, as they witness the impacts of monetary policy decisions on their currencies”… Chile serves as a “cautionary tale”… “That’s the biggest lesson learned: to allow themselves to be flexible”

On Credit Strength Surprising Fed Watchers Ahead of Rate Decision

Former Fed Governor, Jeremy Stein

“I really don’t have any good story to explain why things have instead been so resilient”

Conrad DeQuadros, senior economic advisor at Brean Capital

“Corporate spreads are extremely tight and I think they are going to go wider if we are right on the economic outlook in 2024”

Tim Leary, senior portfolio manager at RBC Global Asset Management

“Spreads are contained because defaults are low and balance sheets are healthy”

Dominique Toublan, Credit Strategist, Barclays

“We expect a continuation of the BBB to single-A transition, as inflation and monetary policy tightening has yet to crack the consumer and, therefore, company balance sheets”

Top Gainers & Losers- 01-November-23*

Go back to Latest bond Market News

Related Posts: