This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Mapletree, CapitaLand Price S$ Bonds; Treasury Yields Up on Data Strength

August 16, 2024

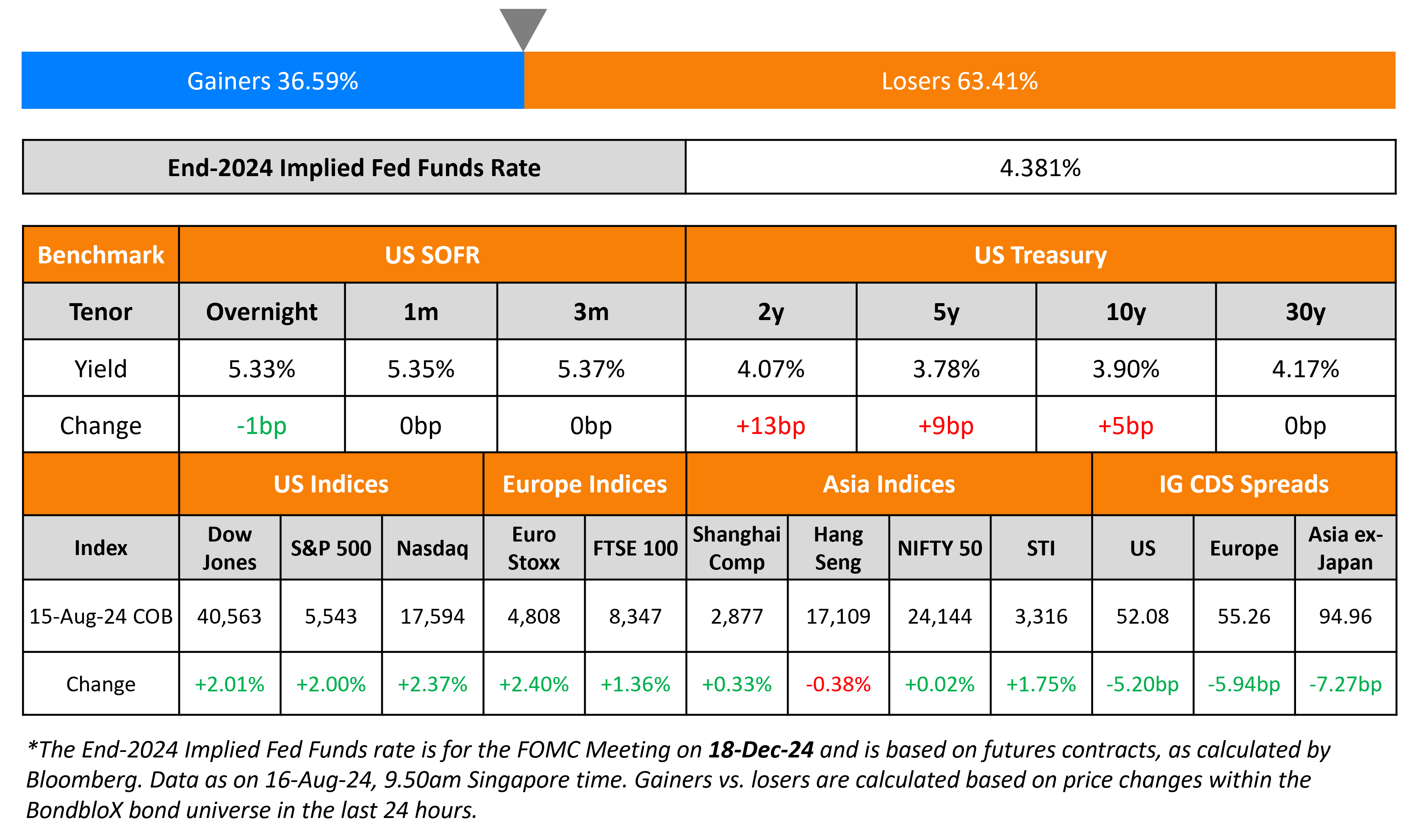

US Treasury yields jumped higher across the curve, led by the front-end. The 2Y yield was up 13bp and the 10Y yield was 5bp higher, after upbeat data. US Retail Sales rose by 1.0% MoM in July, higher than expectations of a 0.4% rise and June’s -0.2% print. Core Retail Sales rose by 0.4%, higher than expectations of a 0.2% rise, but softer than the prior month’s 0.8% reading. Initial jobless claims for the previous week rose by 227k, better than expectations of 235k. Separately, the Empire Manufacturing reading came at -4.7 vs. expectations of -6.0. Following the better-than-expected data, analysts note that recessionary fears have reduced, with markets now pricing-in less than 100bp of rate cuts by end of the year. Looking at US equities, S&P and Nasdaq jumped higher by 2% and 2.4% respectively. US IG CDS spreads tightened by 5.2bp while HY CDS spreads tightened by 15.6bp.

New Bond Issues

CapitaLand Investment raised S$350mn via a 10.5Y bond at a yield of 3.58%, 17bp inside initial guidance of 3.75% area. The senior unsecured bonds are unrated. CLI Treasury Ltd is the issuer and CapitaLand Investment Ltd (Singapore) is the guarantor. Proceeds will be used to refinance existing borrowings, finance investments and for general corporate purposes.

Mapletree Logistics raised S$180mn via a PerpNC5 bond at a yield of 4.3%, 25bp inside initial guidance of 4.55% area. The subordinated notes are rated BBB-. If not called by 22 August 2029, the coupons will reset to the 5Y SORA-OIS plus the initial spread of 187.1bp. The notes have a dividend stopper but do not have a dividend pusher. Proceeds will be used for general corporate purposes and working capital, including refinancing its S$180mn 5.207% Perp callable in September.

NWS Holdings raised $400mn via a 4Y bond at a yield of 6.587%, 20bp inside initial guidance of T+310bp area. The senior unsecured bonds are unrated. The issuer is Celestial Dynasty Ltd and NWS Holdings is the guarantor. Proceeds will be used for general corporate purposes.

Rating Changes

- Fitch Upgrades City of Rio de Janeiro to ‘BB’; Outlook Stable

- Fitch Downgrades 3 Kenyan Banks Following Sovereign Downgrade; Affirms 1

- Moody’s downgrades Avon Products, Inc. to Ca on voluntary filling for Chapter 11, outlook negative

Term of the Day

Minsky Moment

A Minsky Moment refers to a sudden, major crash in asset prices that marks the end of a prolonged period of economic prosperity. This is said to be caused by excessive risk taking by investors where there is a perception of limited market risk, leading to lending significantly more than borrowers can pay up. This theory stems from the works of US economist Hyman Minsky, who specialized in financial instability fueled by excessive borrowing. The term was coined by former PIMCO economist Paul McCulley.

One popular example of a Minsky Moment is the GFC of 2007-08. Bloomberg notes that high debt levels overall have seen renewed interest in understanding the Minsky Moment.

Talking Heads

On More Fed officials line up behind September rate cut

Michael Pearce, Oxford Economics

“The ongoing resilience of consumer spending should ease recession fears … the combination of gradually cooling economic growth and inflation justify a measured pace of easing”

Atlanta Fed President Raphael Bostic

“Now that inflation is coming into range, we have to look at the other side of the mandate, and there, we’ve seen the unemployment rate rise considerably off of its lows”

On JPMorgan Saying Buying Corporate Debt on Dips Pays Off 70% of Time

“Historically speaking it seems relatively clear that most dips in HG are meant to be bought in the short term”

On Carry Trade Attracting Hedge Funds Again

Antony Foster, London

“There has been a notable move back…. The big over-hang short yen position has been wiped out, but this market is extremely fragile”

William Vaughan, Brandywine Global

“People have pretty short memories. There’s so many momentum traders in that sort of space”

Top Gainers & Losers-16-August-24*

Go back to Latest bond Market News

Related Posts: