This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Manulife, ABN Amro Price Bonds

December 3, 2025

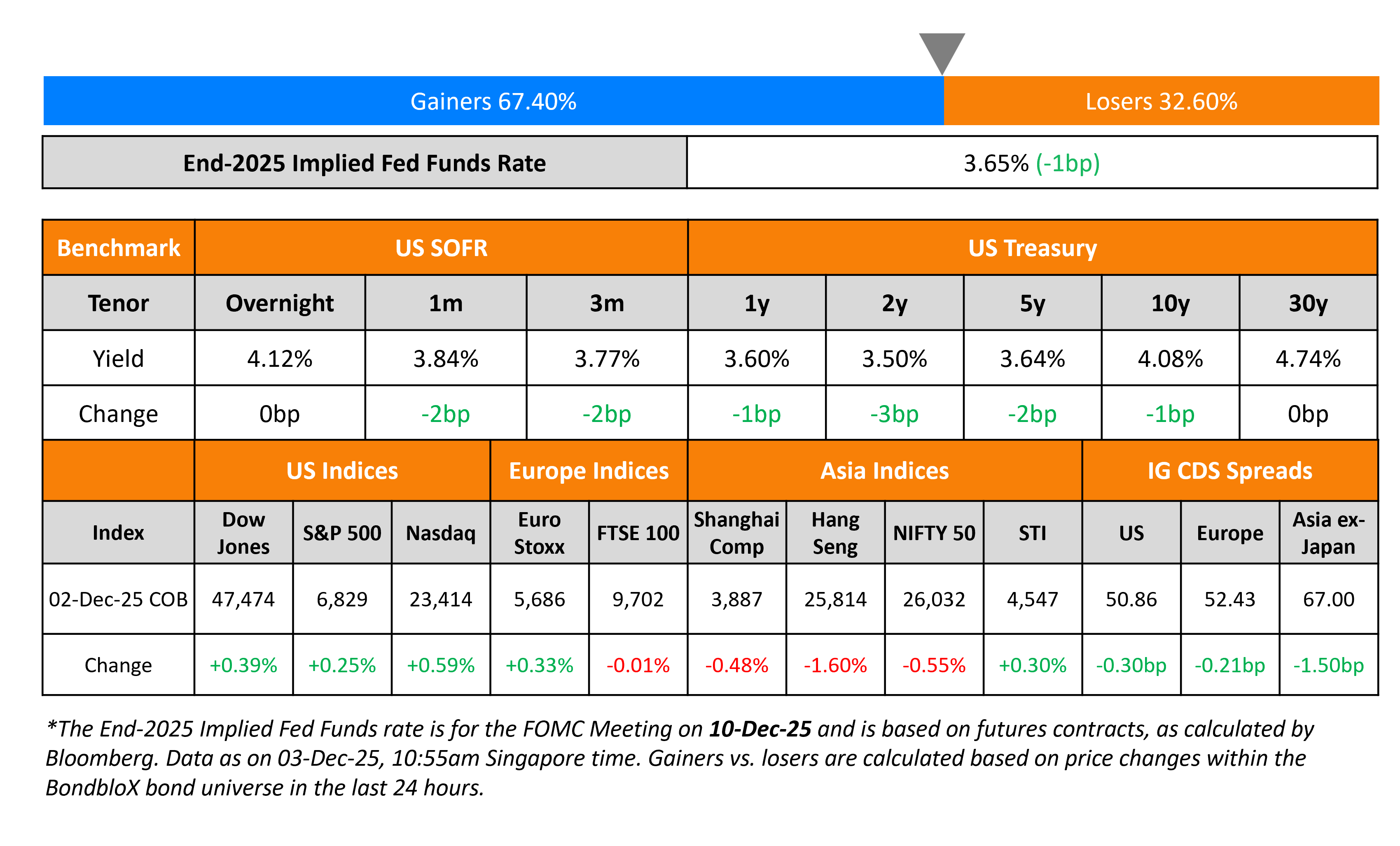

US Treasury yields eased by 1-3bp yesterday. There were no major data points released yesterday and markets are currently pricing in an 89% probability of a 25bp rate cut at the FOMC meeting next week. While Treasuries are set for their best year since 2020 with the Bloomberg US Treasury Index up 6.23% YTD, JPM strategists are not hopeful of the strong performance continuing into 2026. “If the Fed doesn’t deliver as many cuts, there’s some normalization” in Treasury yields, said Jay Barry, JPMorgan’s head of global rates strategy.

Looking at US equity markets, the S&P and Nasdaq closed higher by 0.3% and 0.6% respectively. US IG and HY CDS spreads tightened by 0.3bp and 1.6bp respectively. European equity indices ended mixed. The iTraxx Main CDS spreads tightened 0.2bp while the Crossover CDS spreads were 1bp tighter. Asian equity markets have opened broadly lower this morning. Asia ex-Japan CDS spreads were 1.5bp tighter.

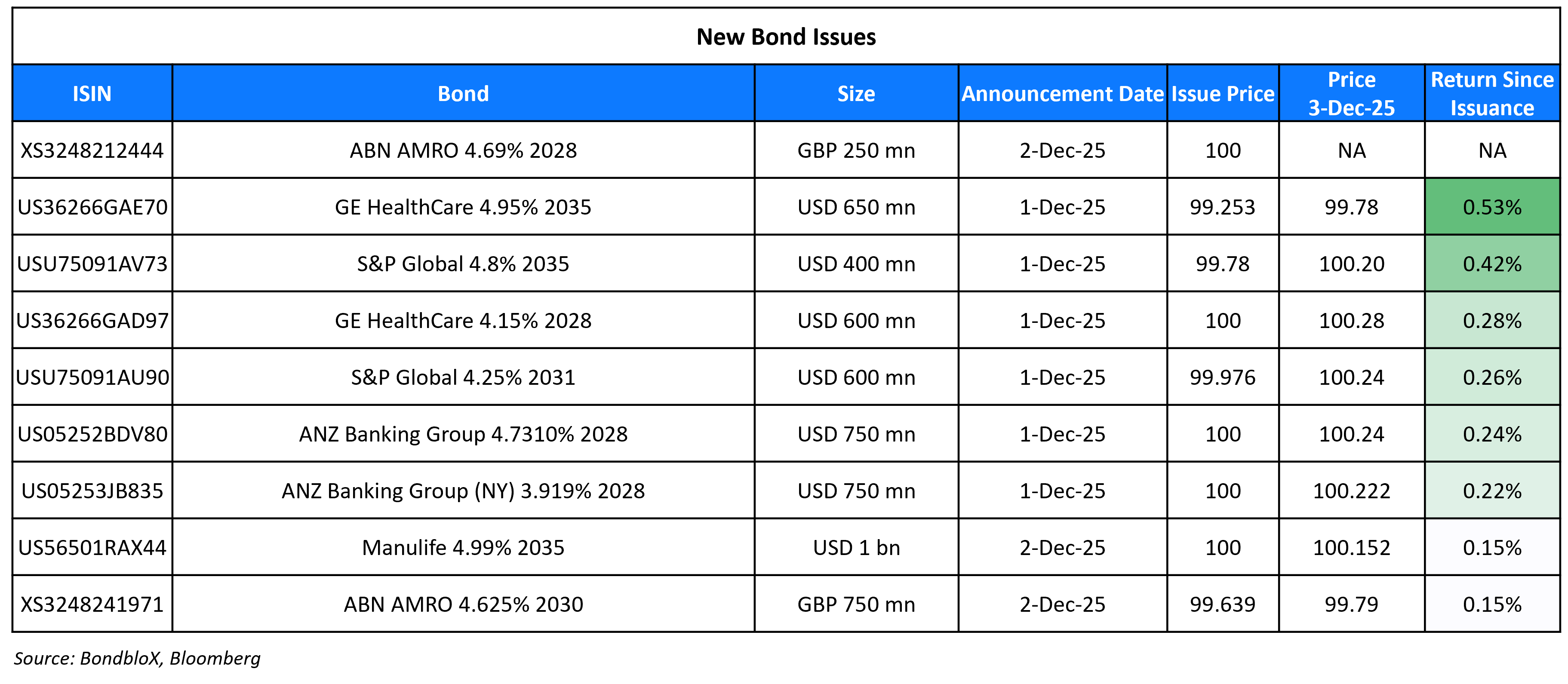

New Bond Issues

Manulife Financial raised $1bn via a 10Y bond at a yield of 4.986%, 30bp inside initial guidance of T+120bp area. The senior unsecured note is rated A/A (S&P/Fitch). Proceeds will be used for general corporate purposes.

ABN Amro raised £1bn ($1.3bn) via a two trancher. It raised £750mn via a 5Y green bond at a yield of 4.709%, 17.5bp inside initial guidance of UKT+105-110bp area. The senior non-preferred note is rated Baa1/BBB/A. It also raised £250mn ($330mn) via a 3Y FRN at SONIA+70bp. The senior preferred note is rated Aa3/A/A+. Proceeds will be used to finance and refinance, in whole or in part, green bond eligible assets as defined in the Issuer’s green bond factsheet in accordance with EU Green Bond Regulation.

New Bonds Pipeline

- China Minmetals $ Guaranteed Subordinated Perp

- Dexus Finance A$ 30NC5.25 And/or 30NC8.25 Subordinated Notes

Rating Changes

- Moody’s Ratings upgrades Precision Drilling’s CFR to Ba2; outlook stable

- Vistra Corp. Upgraded To ‘BBB-‘ From ‘BB+’ On Improved Business Risk Profile; Outlook Stable

- Denmark-Based Oil And Gas Services Provider Welltec International Upgraded To ‘BB-‘ On Lower Leverage; Outlook Stable

- Fitch Places China Vanke, Vanke HK on Rating Watch Negative; Downgrades Subsidiary’s Notes to ‘CC’

- Fitch Revises Outlook on Beijing Capital Development Holding to Stable; Affirms at ‘BBB-‘

- Tyson Foods Inc. Outlook Revised To Positive On Improving Credit Measures; ‘BBB’ Ratings Affirmed

Term of the Day

GDP-Linked Bonds

GDP-Linked bonds are fixed income securities whose payouts are linked to the GDP of a country. These bonds are typically issued by governments and pay more to investors if their economy is growing and vice versa. The idea of GDP-linked bonds was first proposed by Nobel laureate Robert Shiller in the 1990s. The structure of these bonds are designed in a way that support the borrower in times of poor economic activity, and hence are typically used by countries facing a crisis. Countries that have issued such securities in the past include Ukraine, Costa Rica, Bulgaria, Bosnia and Herzegovina, Argentina and Greece.

Talking Heads

On Money Markets Assets Assets Surging to $8tn

Gennadiy Goldberg, TD Securities

“Money market funds continue to draw inflows as yields remain highly attractive amid gradual Fed rate cuts.”

Teresa Ho, JPMorgan Chase & Co

“Retail investors are not overly allocated to money market funds that it would prompt them to allocate out. So if anything, I think we’re going to pass $8 trillion and it’s just going to go higher and higher next year.”

On Extension of Australian Bond Sell-Off

Kenneth Crompton, National Australia Bank

“There’s a lot of momentum building behind the rate-hike story. The 10-year yield could reach 4.75% by year-end as the market fully prices one or 1.5 hikes for next year from the roughly 60% chance factored in currently.”

On Continuing Surge in Hong Kong Dollar Bonds

Oliver Greer, Standard Chartered

“The Hong Kong dollar bond market will continue to grow over the long term, supported by structural shifts. The Hong Kong dollar has offered more competitive all-in costs, particularly for borrowers with natural Hong Kong dollar needs or balance-sheet alignment.”

On Fed Being Divided Over Long Term Interest Rate Plan

Stephen Stanley, Santander

“We have people all over the place. There’s always a degree of disagreement on that, but the current range is wider. The estimates starts to become potentially a binding constraint for some of the more hawkish Fed members. It definitely means that each successive cut becomes harder and harder.”

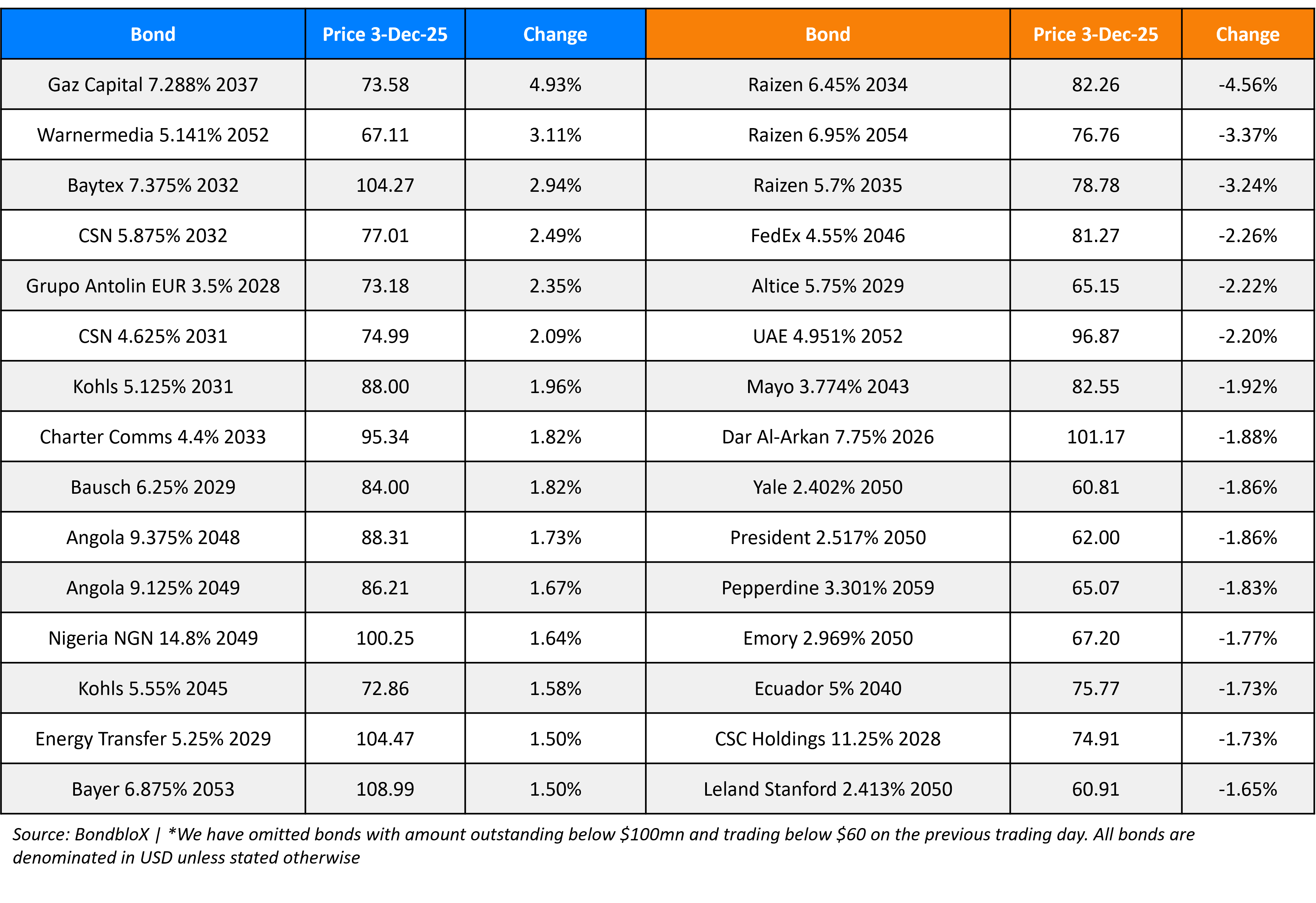

Top Gainers and Losers- 03-Dec-25*

Go back to Latest bond Market News

Related Posts: