This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Macy’s Warns of Weak Consumer Demand for Second Half of 2023; Bonds Slip

August 23, 2023

Macy’s warned of weak consumer demand through the crucial holiday shopping season in the second half of 2023. US retailers are seeing a drop in demand from middle-income customers as they have cutback on discretionary spending amid elevated inflation. This has led to falling credit card revenues and bloated inventories for US retailers. During Q2, Macy’s credit card revenue, about 2% of the total revenue, slumped by 41%. However, Macy’s reaffirmed its sales expectations for 2023 of $22.8-23.2bn and adjusted full-year profit per share between $2.7-3.2. Shares of the retailer closed 14% lower at $12.66, their worst day since June 2020.

Macy’s bonds were under pressure too, with its 5.875% 2029s falling by 1.1 points to 89.875 cents on the dollar, yielding 8.16%.

For more details, click here

Go back to Latest bond Market News

Related Posts:

Macy’s Secured Notes Downgraded to Ba2 by Moody’s

April 6, 2022

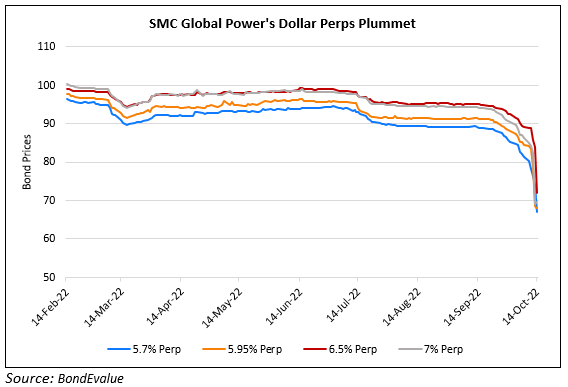

SMC Global’s Dollar Perps Drop Over 10%

October 14, 2022