This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Macro; Rating Changes; Talking Heads; Top Gainers & Losers

February 10, 2021

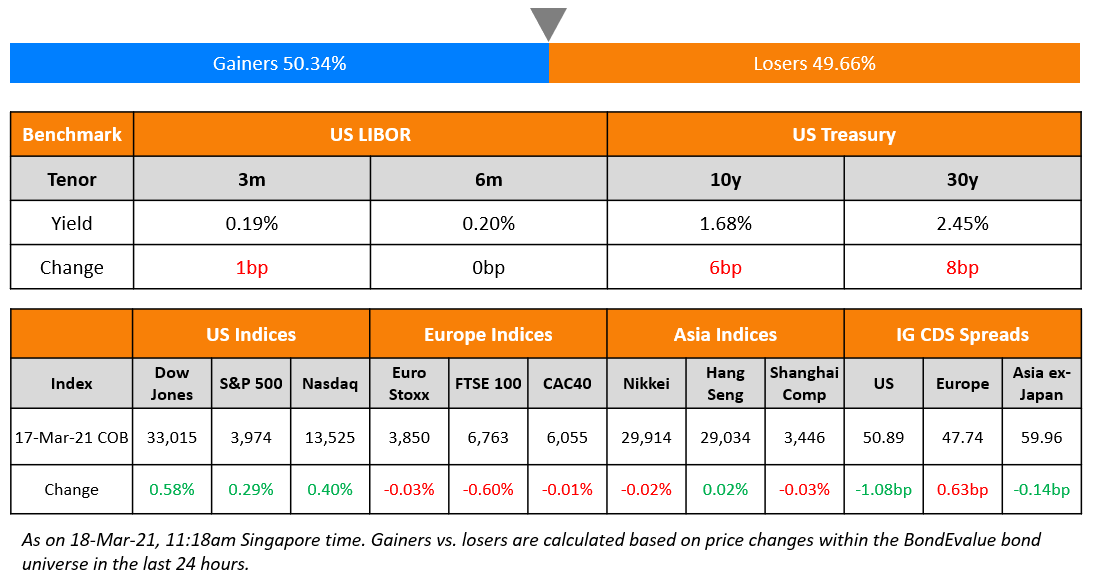

US equities saw the momentum ease a bit as S&P ended 0.1% lower and Nasdaq 0.1% higher. Twitter reported better than expected earnings while warning of slowing user growth. Brent crude is at its highest in more than a year at $61/bbl. US 10Y Treasury yields eased from the day’s high over 1.18% to 1.16%. Similar to the US, European equities were also near flat. US IG CDS spreads were 0.6bp wider and HY was 3.7bp wider. EU main CDS spreads widened 0.5bp while crossover spreads widened 1.9bp. Asia ex-Japan CDS spreads are 0.4bp tighter while Asian equities are mixed to slightly lower today.

Bond Traders’ Masterclass

If your first language is Spanish and you are keen on learning the fundamentals of bonds, do join our masterclass on A Practical Introduction to Bonds, which will be conducted in Spanish on February 17 at 9am Mexico City / 3pm London / 7pm Dubai. The session will be conducted by bond market veterans that have previously worked at premier global institutions such as HSBC and Citibanamex. Click on the image below to register.

New Bond Issues

Details on Deutsche Bank’s €3bn issuance are mentioned in the stories below.

Huafa Industrial Co Ltd Zhuhai raised $200mn via a 364-day note at a yield of 3.6%, 50bp inside initial guidance of 4.1% area. The bonds are unrated and received orders over $1.1bn, 5.5x issue size. Guang Tao Investment is the issuer and Shanghai-listed Huafa Industrial is the guarantor. Proceeds will be used for refinancing offshore debt.

New Bond Pipeline

- JSW Steel $ bond

- First Abu Dhabi Bank € bond

- Liberty Mutual Group

Rating Changes

- Fitch Downgrades Ethiopia to ‘CCC’

- Fitch Places Raizen on Negative Watch; Biosev Placed on Positive Watch

- Methanex Corp. Outlook Revised To Stable From Negative By S&P On Expected Improved Credit Metrics; ‘BB’ Ratings Affirmed

- Jain Irrigation Systems Ltd. ‘D’ Rating Withdrawn By S&P At The Company’s Request

Term of the Day

Carbon Neutrality Bond

Carbon neutral bonds are a category of green bonds where proceeds from the issue will be used for green projects that will reduce carbon emissions – projects covering the photovoltaic, wind power, hydropower and clean transportation industries for example. China’s first carbon neutrality bonds issued yesterday drew tepid demand. Five Chinese power companies and one airport operator are looking to raise a combined CNY 6.4bn ($992mn). Issuers included China Three Gorges, State Power Investment Corp, Huaneng Power International and Yalong River Hydropower Development Co.

Talking Heads

“A meaningful upside surprise in realized inflation may, therefore, turn out to be a double-edged sword,” Tenengauzer wrote. “While a 3% year-over-year CPI inflation overshoot in 2021 would be exactly what the Fed needs to claim ‘mission accomplished’, an ensuing duration selling may trigger a broader market reaction.” “Moreover, before Federal Reserve officials signaled YCC, we think higher bond yields must be painful enough to trigger financial market distress,” Tenengauzer said.

On Spain’s blockbuster debt deal as Italy’s borrowing costs reach historic lows

According to UniCredit

“From a borrower’s perspective . . . subdued European government bond yields, along with generally historically flat curves, have made issuance activity at the extra-long end particularly attractive,” UniCredit said.

Frederik Ducrozet, strategist at Pictet Wealth Management

“It’s fair to say that the Draghi effect has been the dominant factor in the recent peripheral bond rally,” said Ducrozet. “Investors are looking beyond the short-term developments in Italian politics,” said Ducrozet. “In particular, a Draghi-led government implementing pro-European reforms could boost the prospect for a more comprehensive reform of EU fiscal rules, which in turn would support stronger growth in Italy.”

“The recent defaults have highlighted long-standing concerns about high public and private sector leverage against a backdrop of low growth and a very weak real estate market characterized by chronic over-capacity,” said Berry. “In itself, a policy of more limited support is positive for the government’s finances and creditworthiness. However, there is limited transparency on the GREs’ balance sheets and the challenging economic environment has increased the risk that some entities could still require financial support, putting pressure on government finances.”

“It’s easy to find high returns in the high-yield world,” Shor said. “But we have to focus on avoiding headaches.” Some investors are starting to say emerging-market bonds are expensive and are willing to scoopup longer bonds for better returns, Shor said. “That’s a double-edged sword,” Shor said. “I’m staying away.”

“The slow and steady change that has occurred over the past decade will ultimately be seen for the revolution that it brought about,” McPartland wrote. “It’s reached a point where there is broad acceptance that this is a sizable part of the market that isn’t going anywhere,” McPartland said of electronic trading. “We have a handful of big solid incumbents that have particular areas of strength. To some extent, each of them is trying to eat the others’ lunch, which is good and healthy competition to keep everybody on their toes.”

Top Gainers & Losers – 10-Feb-21*

Go back to Latest bond Market News

Related Posts: