This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Macro; Rating Changes; Talking Heads; Gainers and Losers

November 20, 2023

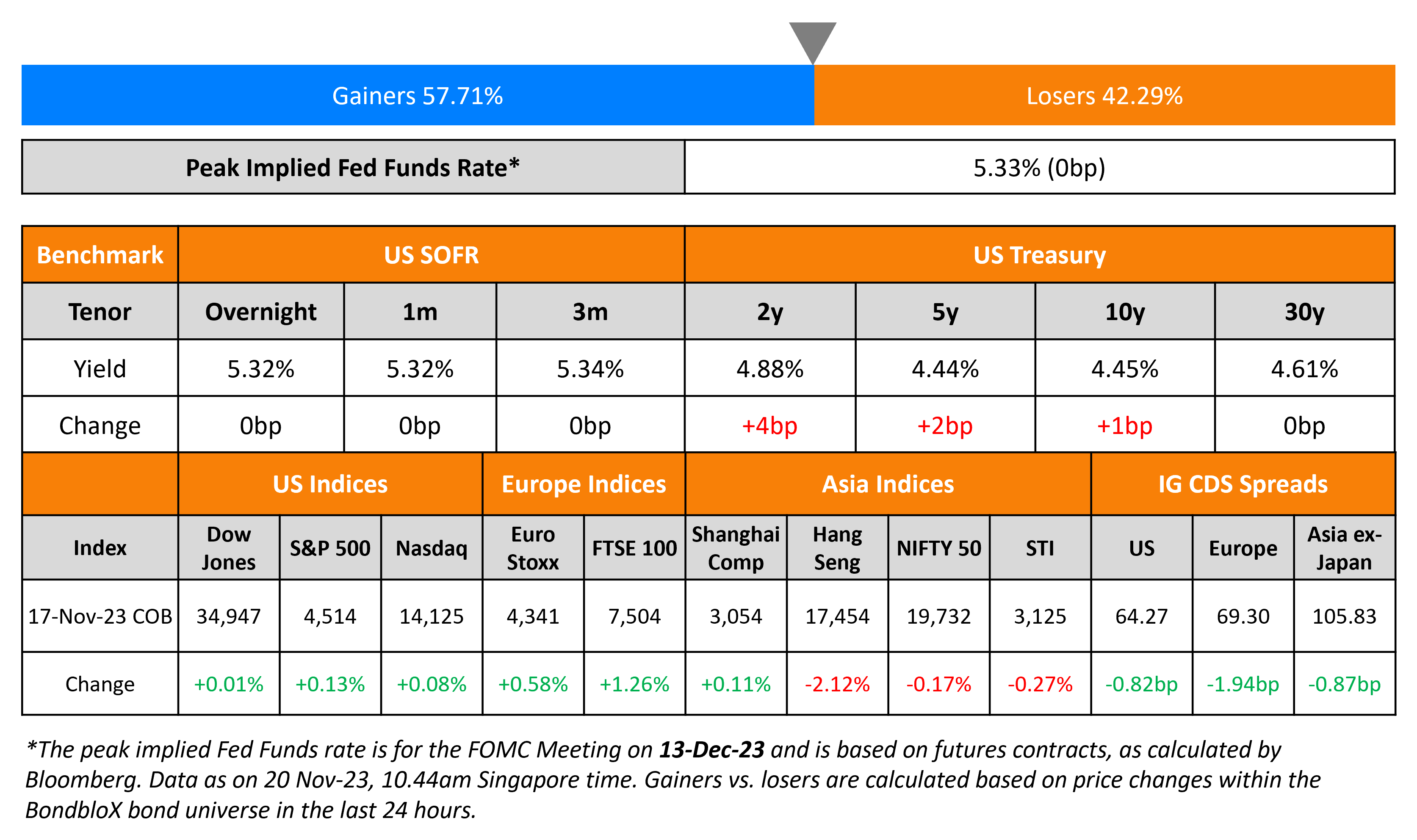

US Treasury yields edged lower yesterday, reversing the pick-up seen a day prior. Yields were down 6-7bp across the curve. The Fed’s Vice Chair for Supervision and voting member, Michael Barr reiterated officials are likely at or near the end of their tightening campaign. On the other hand, San Francisco Fed President Mary Daly (non-voter) said policymakers aren’t certain inflation is on a path to their 2% target. The Peak Fed Funds Rate was unchanged. US credit markets saw IG CDS spreads staying flat while HY spreads tightened by 5.5bp. S&P rose and Nasdaq inched higher by 0.1%.

European equity markets were mixed. In credit markets, European main CDS spreads were wider by 0.7bp and crossover spreads tightened by 7.7bp. Asian equity markets have opened weaker today and Asia ex-Japan IG CDS spreads were wider by 0.6bp

New Bond Issues

American Airlines raised $1bn via a 5.5NC2 senior secured bond at a yield of 8.5%, 25bp inside initial guidance of 8.75% area. The bonds have expected ratings of Ba2/BB. Proceeds, together with the net proceeds from a separate term loan and cash on hand, will be used to redeem $1.5bn of its existing 11.75% 2025s. The bonds also have a special provision where there will be a 200bp increase in the coupon during periods in which the collateral coverage ratio is less than 1.6x (62.5% LTV).

Banco BPM raised €300mn via a PerpNC5.5 AT1 bond at a yield of 9.5%, 50bp inside initial guidance of 10% area. If uncalled on the first call date of November 2028, the coupon will reset on the reset date of May 2029 and every five years thereafter at the 5Y EURIBOR Swap rate plus a spread of 667.3bps. If the CET1 ratio of the group falls below 5.125%, the issuer will cancel any accrued interest and reduce the outstanding principal amount until the CET1 ratio is restored to 5.125%. The bonds have expected ratings of B+ (Fitch), and received orders over €1.15bn, 3.8x issue size. The bonds also have a 75% clean-up call. Proceeds will be used for general corporate purposes, to improve the regulatory capital structure of the group. The new bonds are priced 10bp tighter to its existing 7% Perps (callable in 2027) that yield 9.6%.

Rating Changes

- Moody’s upgrades Portugal’s ratings to A3 and changes outlook to stable

- Telesat Canada Upgraded To ‘CCC+’ From ‘SD’ Following Distressed Debt Repurchase; Outlook Negative

- Fitch Assigns Final ‘BB’/’RR1’ Rating to Hertz’s Secured Term Loan; Downgrades Unsecured Debt

- Deutsche Pfandbriefbank Ratings Lowered To ‘BBB’ On Risk Cost Acceleration In Difficult CRE Markets; Outlook Negative

Term of the Day

Private Placement

A private placement is a sale of securities directly to select private investors, rather than issuing them via a public offering. Investors in privately placed bonds generally comprise large banks, mutual funds, or insurance companies. The advantage of private placements is that they may not be subject to the same strict regulations regarding disclosure and reporting of public offerings. Also, the cost and time savings add to its attractiveness. On the other hand, they may carry a higher rate to entice investors and they limit the number and variety of investors that can take part unlike public offerings. Unlike bonds issued via public offerings, privately placed bonds may not trade on the secondary market.

Israel borrowed $6bn via private placements of dollar and euro bonds to fund the war on Gaza.

Talking Heads

On optimistic in soft landing from inflation – Boston Fed President Susan Collins

“By being very patient right now, to me that helps to support my realistic optimism… there’s been some promising evidence of inflation coming down… I don’t take off the table the possibility rates may need to rise again”

On Dollar Scarcity Pushing More African Countries to Crisis

Benedict Craven, country risk manager at the Economist Intelligence Unit

“Dollar holdings are part of the value proposition. Will investors be able to trade using foreign exchange from official sources? Will they be able to expatriate their dividends abroad? These questions are separating where investment is going”

Lars Krabbe, PM at Coeli Frontier Markets

“The general perception is when a country trades above 10% in USD yields they are not able to issue in the USD market”

David Omojomolo, Africa economist at Capital Economics

“Countries with less punishing dollar-denominated loan amounts and bond repayments, and large stocks of foreign reserves, are most attractive”

On expecting easing shelter inflation to seal path to 2% – Chicago Fed President Austan Goolsbee

“The overwhelmingly important thing of whether we are going to clearly be on path for inflation is what happens to house price inflation. If we hit the targets that we expect to hit, then we would be on path to get to 2%, and that’s what I call the golden path”

On Wall Street Traders Are Placing All-or-Nothing Bets on a Soft Landing

“It’s a pipe dream. Either the economy will reaccelerate and inflation along with it, which will lead to the Fed starting another round of rate hikes “

John Porter, CIO of equities at Newton Investment

“Some of my concern is how quickly investors have re-allocated the flows”

Lindsay Rosner, multi-sector fixed income at Goldman Sachs Asset Management

“The lesson of the past few years is that all good investors must be humble in their economic projections”

Top Gainers & Losers- 20-November-23*

Go back to Latest bond Market News

Related Posts: