This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

October 23, 2023

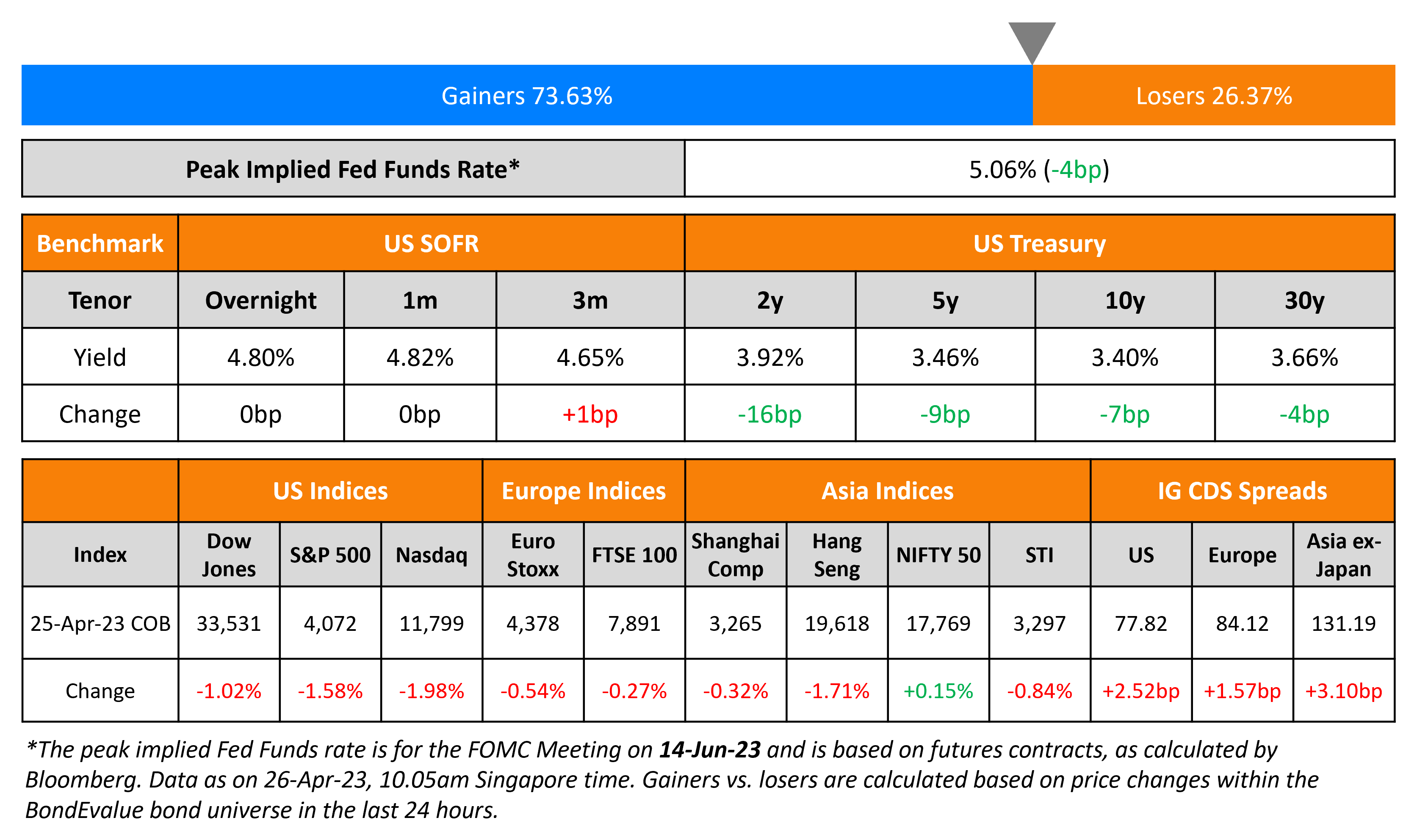

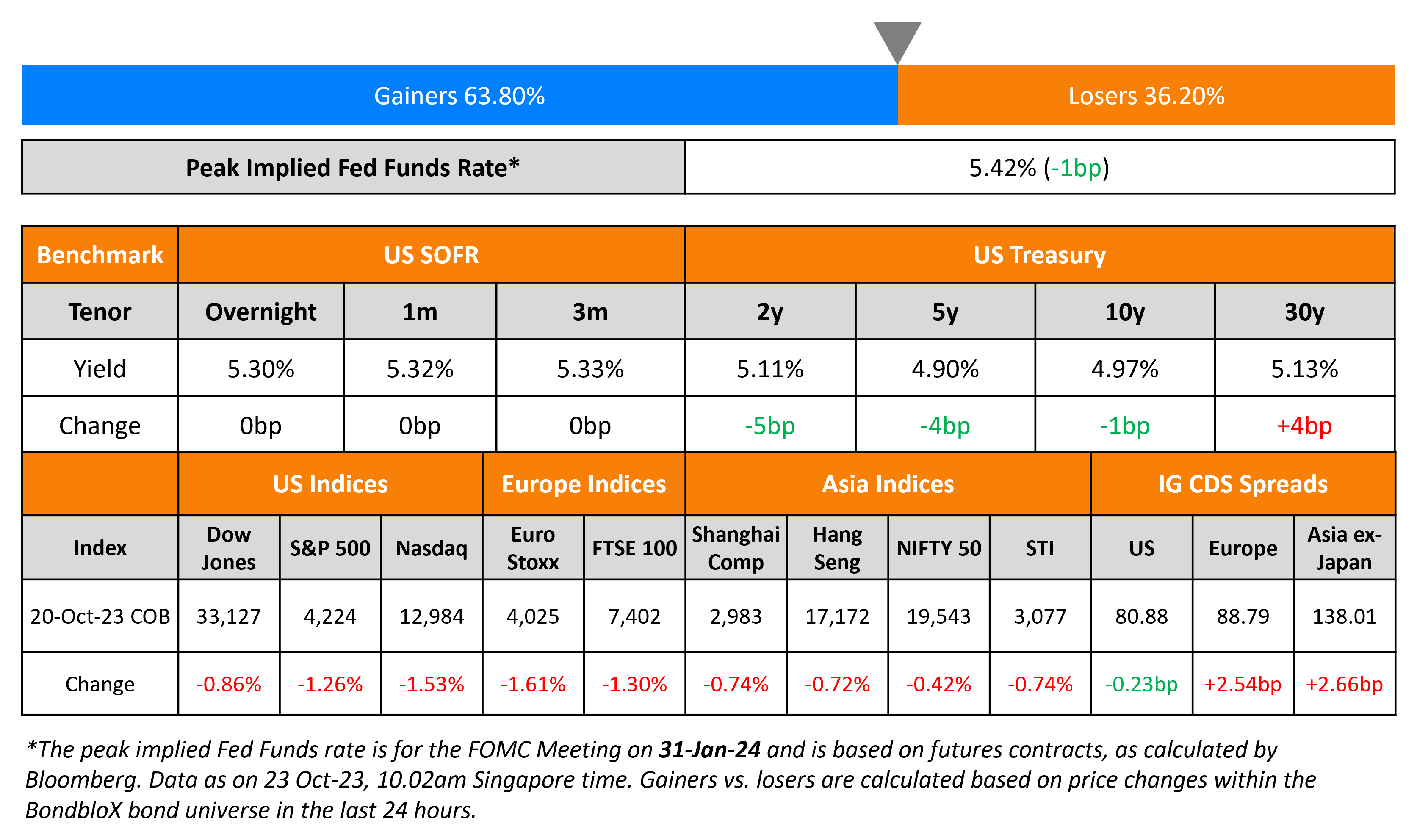

US Treasury yields eased slightly on Friday – the 2Y yield was down 5bp while the 10Y was down 1bp after being just shy of the 5%-mark. Cleveland Fed President Loretta Mester (non-voting member) said that the Fed was “likely near or at a holding point” on the fed funds rate irrespective of their decision in the November meeting. US credit markets saw IG CDS spreads tighten 0.2bp and HY spreads wider by 0.3bp. US equities continued to drop as the S&P and Nasdaq ended lower by 1.3-1.5%.

European equity markets closed lower too. In credit markets, European main CDS spreads were wider by 2.5bp and crossover spreads widened 10.6bp. Asian equity markets have opened in the red again this morning. Asia ex-Japan IG CDS spreads widened 2.7bp.

New Bond Issues

- Tuan Sing S$ 4NC3 at 7.5% area

Jinan Hi-tech raised $280mn via a 3Y green bond at a yield of 7.4%, 30bp inside initial guidance of 7.7% area. The senior unsecured bonds have expected ratings of BBB (Fitch). Proceeds will be used for the repayment of medium- and long-term offshore bonds due within one year, funding construction projects and general working capital in accordance with the green finance framework.

New Bond Pipeline

- Oman Telecom hires for $ 7Y Sukuk

- Fujian Zhanglong hires for $ Blue bond

- Korea Investment & Securities hires for $ 3Y bond

- KHFC hires for $ 3Y Fixed/FRN bond

Rating Changes

- Egypt Downgraded To ‘B-‘ On Mounting Funding Pressures; Outlook Stable

- Fitch Downgrades Hopson Development to ‘B’; Outlook Stablet

- Greece Upgraded To ‘BBB-/A-3’ On An Improved Budgetary Position; Outlook Stable

- Moody’s changes the outlook on the UK to stable from negative, affirms Aa3 ratings

Term of the Day

Yield Curve Control

Yield Curve Control (YCC) is a policy that targets long term interest rates by buying or selling long term bonds to keep the interest rate from rising above it’s target. This is a measure taken to stimulate economic growth. Yield curve controls are also sometimes referred to as Interest Rate Pegs. The Bank of Japan (BOJ) is famous for having a YCC policy in place where they peg the yield on 10-year Japanese Government Bonds (JGB) to fight persistently low inflation.

Talking Heads

On Wild Treasuries Swings Just Starting as Bond Traders ‘Buckle Up’

Mike Schumacher, head of macro strategy at Wells Fargo

“It’s going to be a rough ride, so buckle up… rate volatility should remain quite high, at least through the mid-point of next year, perhaps further as the Middle East sorts itself out”

Mohamed El-Erian, CEA at Allianz

“They need to pivot from excessive data dependence to data dependence that has a greater forward-looking component”

On Junk-Rated Companies Having Most Debt to Refinance Since Global Financial Crisis

Bob Kricheff, PM at Shenkman Capital Management

“It’s kind of like an arm wrestling match. They’re trying to time the market which we all know is difficult saying, ‘I don’t want this to become a current debt. I want to retire it a year before it matures. That’s why you’re seeing people attacking 2024, 2025 and even 2026 maturities with some of these issues”

Winnie Cisar, global head of strategy at CreditSights

It’s going to be tough for B rated issuers. They’re going to have to pay up for sure. Alongside CCC rated issuers, these borrowers will be at the whim of the market when it comes to refinancing maturities as “they probably don’t have similarly strong cash on balance sheets.

On Rates Selloff Seeping Through All Corners of the Credit Market

Benoit Anne, lead strategist at MFS Investment Management

“For a long-term investor the entry level in fixed income is very attractive. The spreads in investment grade are not screaming buy but the yield picture is a once in a lifetime opportunity”

Scott Kimball, MDat Loop Capital Asset Management

“Corporate bonds had very little competition from Treasury or mortgage-backed securities for over a decade, but that dynamic has changed dramatically”

On Europe’s Biggest Money Managers Betting ECB Rates Haven’t Hit a Peak

Christopher Jeffrey, head of rates and inflation strategy at Legal & General

“Europe is of greater vulnerability here than any other developed-market bloc”

Ales Koutny, head of international rates at Vanguard

“The market is underpricing the chance of another hike from the ECB. It was the same with the Fed” until last week

Top Gainers & Losers- 23-October-23*

Go back to Latest bond Market News

Related Posts: