This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Gainers and Losers

October 17, 2023

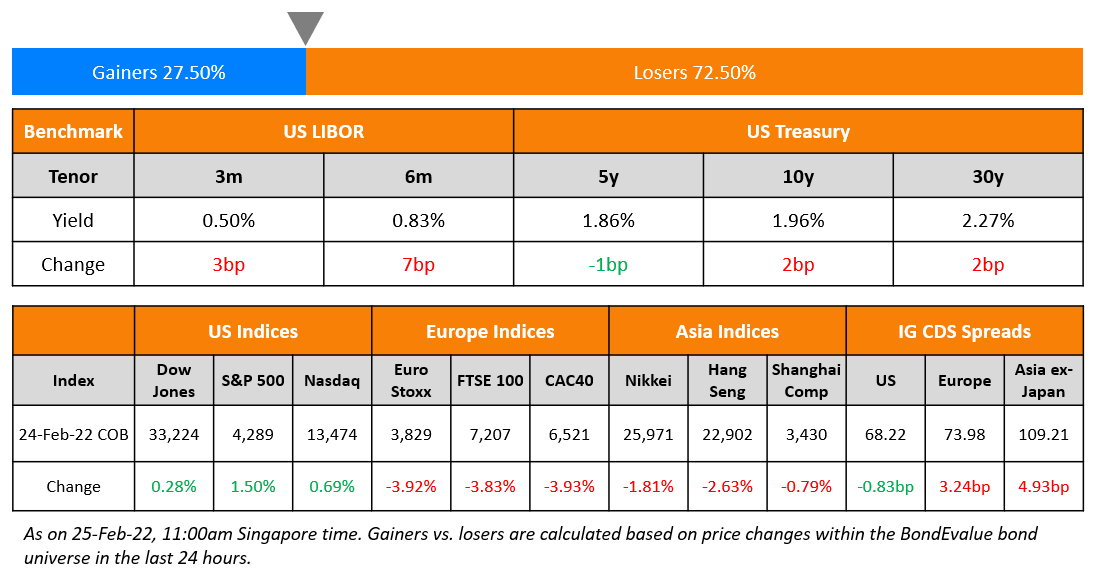

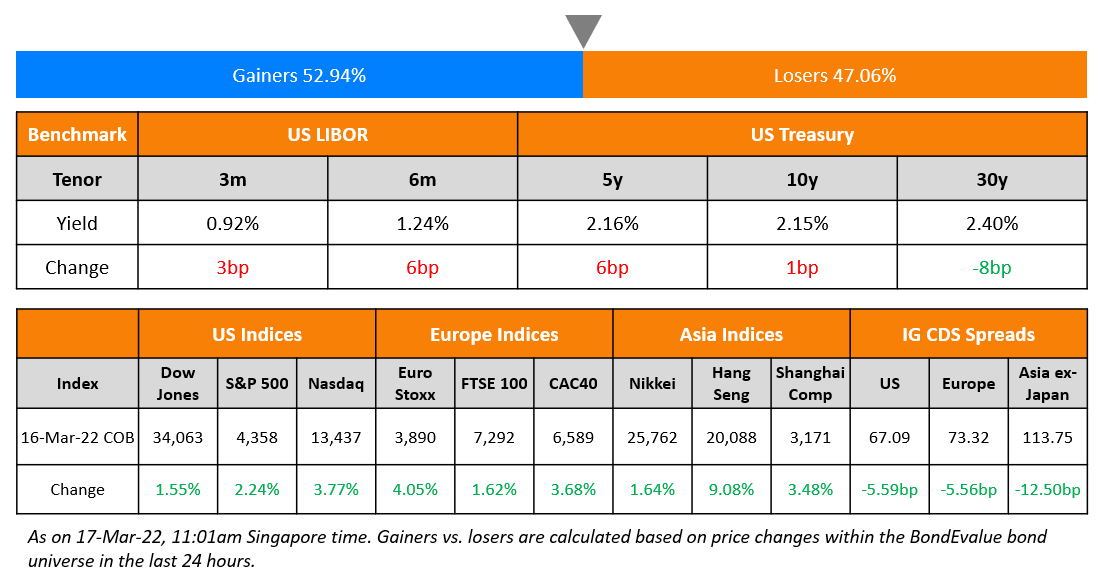

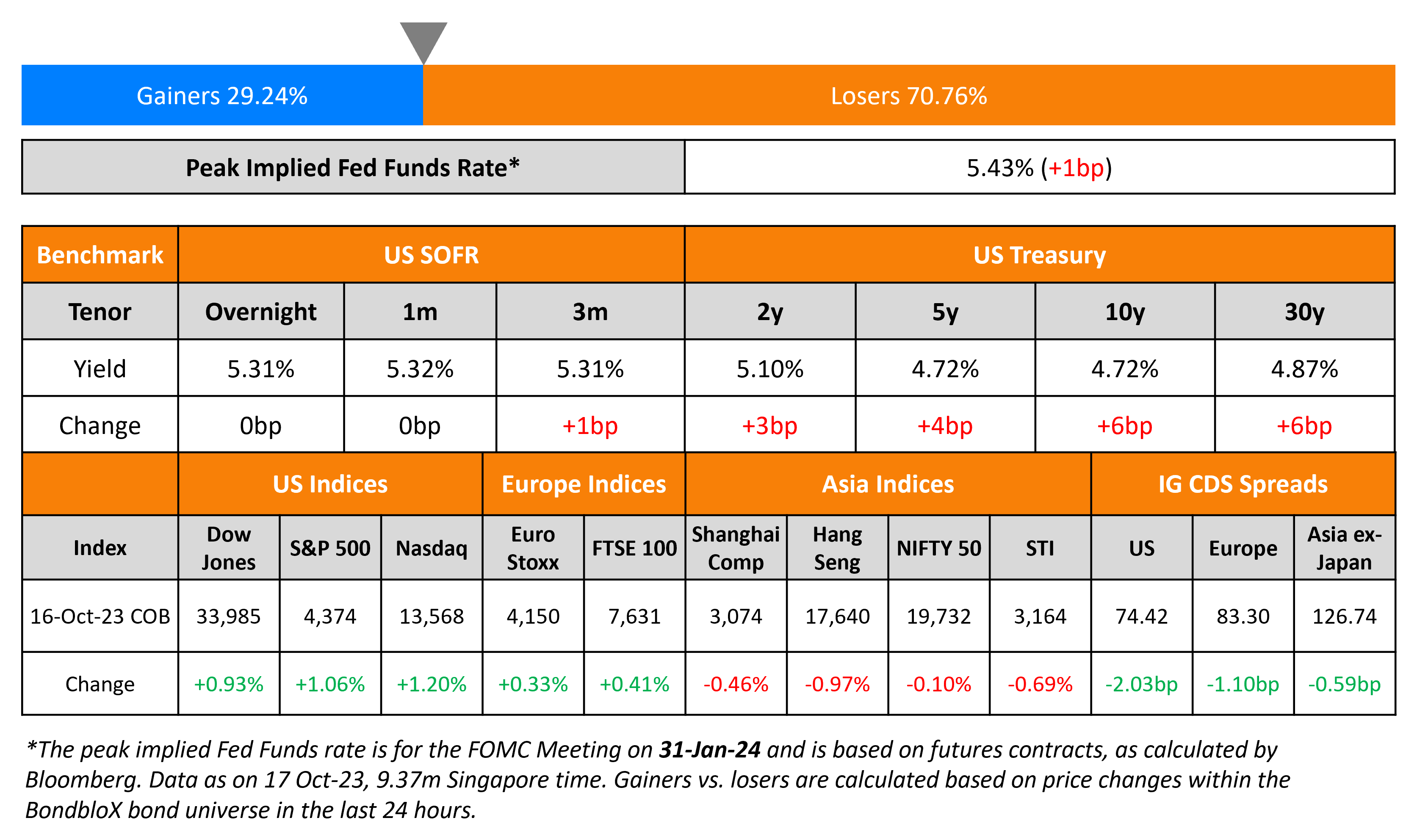

US Treasury yields were higher on Monday, up by 3-6bp across the curve. Philadelphia Fed President Patrick Harker, a voting member, repeated comments he made last week asserting that the Fed can hold rates steady as long as there is no sharp turn in economic data. US credit markets saw IG CDS spreads tighten 2bp and HY spreads tighter by 9bp. US equities moved higher with the S&P and Nasdaq up 1.1-1.2%.

European equity markets were higher too. In credit markets, European main CDS spreads were tighter by 1.1bp and crossover spreads tightened 6bp. Asian equity markets have opened in the green today morning. Asia ex-Japan IG CDS spreads tightened 0.6bp.

New Bond Issues

- KEB Hana $ 5Y Social at T+125bp area

- Commerzbank S$ 10.5NC5.5 Tier 2 at 6.625% area

JP Morgan raised $7bn via a three-tranche deal. It raised

- $2bn via a 4NC3 green bond at a yield of 6.07%, 25bp inside initial guidance of T+145bp area. If uncalled, the coupon will reset at the overnight SOFR plus a spread of 133bps and will be paid quarterly.

- $2.25bn via a 6NC5 bond at a yield of 6.087%, 22.5bp inside initial guidance of T+160bp area. If uncalled, the coupon will reset at the overnight SOFR plus a spread of 157bps and will be paid quarterly. The new bonds are priced 6.3bp tighter to its existing 4.005% 2029s (callable in 2028) that yield 6.15%.

- $3bn via a 11NC10 bond at a yield of 6.254%, 25bp inside initial guidance of T+180bp area. If uncalled, the coupon will reset at the overnight SOFR plus a spread of 181bps and will be paid quarterly. The new bonds offer a new issue premium of 5.4bp over its existing 5.35% 2034s (callable in 2033) that yield 6.2%.

The senior unsecured bonds have expected ratings of A1/A-. Proceeds from the green 4NC3s will be used to fund eligible green projects while proceeds from the other two tranches will be used for general corporate purposes.

Wells Fargo raised $6bn via a two-part deal. It raised

- $2.75bn via a 6NC5 bond at a yield of 6.303%, 25bp inside initial guidance of T+185bp area. If uncalled, the coupon will reset at the overnight SOFR plus a spread of 179bps and will be paid quarterly. The new bonds offer a new issue premium of 3.3bp over its existing 5.574% 2029s (callable in 2028) that yield 6.27%.

- $3.25bn via a 11NC10 bond at a yield of 6.491%, 25bp inside initial guidance of T+205bp area. If uncalled, the coupon will reset at the overnight SOFR plus a spread of 206bps and will be paid quarterly. The new bonds are priced inline with its existing 5.557% 2034s (callable in 2033) that yield 6.49%.

KDB raised $2bn via a four-part deal. More details of the issuance can be found below.

The floating coupon will reset at the overnight SOFR plus a spread of 70bps and will be paid quarterly. The senior unsecured bonds are expected to be rated Aa2/AA/AA- (Moody’s/S&P/Fitch). Proceeds will be used for general corporate purposes. The new 3Y fixed rate note is priced 18.3bps tighter than its existing 0.8% 2026s that yield 5.6%, while the new 5Y issuance offers a new issue premium of 2.7bps over the issuer’s existing 4.375% 2028s that yield 5.44%.

New Bond Pipeline

- PIF hires for $ 5Y/10Y Sukuk

- MUFG hires for $ Perp NC5.25 AT1 bond

- Medco Energi hires for $ 5.5NC2 bond

- Oman Telecom hires for $ 7Y sukuk

Rating Changes

-

Fitch Downgrades GLP to ‘BB’; Outlook Stable

- Rite Aid Corp. Downgraded To ‘D’ From ‘CCC-‘ After Chapter 11 Bankruptcy Announcement

- AIG And Property/Casualty Subsidiaries Outlook Revised To Stable From Negative On Improved Underwriting Performance

-

Fitch Upgrades Indonesia’s Bank Mandiri’s Viability Rating to ‘bbb-‘; Affirms at ‘BBB-‘/’AA+(idn)

Term of the Day

Cross Default

Cross default is a covenant included in bond and loan documents that puts an issuer in default if it has defaulted on another debt instrument. Cross defaults tend to have a domino effect, which puts the issuer under further pressure of making accelerated repayments and reduces its ability to refinance.

Talking Heads

On BlackRock Tweaking Treasuries View After Sell-off

“We turn tactically neutral long-term Treasuries as markets price high-for-longer policy rates but stay underweight strategically. US 10-year yields at 16-year highs show they have adjusted a lot — but we don’t think the process is over”… investors will demand “more compensation for bond risk and stay underweight on a long-run, strategic horizon”… “equal odds that Treasury yields swing in either direction”

On Junk Bonds Yielding Over 10% Hit $325bn, Tempting Investors

Bloomberg Intelligence, Mike Holland

“You look at a slowing economy, rising rates — all of the common indicators of an imminent recession are starting to perk up. A focus on resilience amid a volatile market environment is paramount.

On Big-Money Funds Betting Against Credit As ETF Shorts Build

Peter Palfrey, PM at Loomis Sayles

“We just don’t think you’re being adequately compensated for being in credit … Fed has now tightened by 525bp. That puts a tremendous pressure on all risk markets, but on credit in particular”

John Roe, the head of multi-asset funds at Legal & General

“The market is pricing a very low risk of a significant recession now… limited upside given these spreads, but with the potentially large gain on the short position in an extreme outcome”

On Fed should not be considering more rate increases – Philly Fed President, Patrick Harker

“We should not at this point be thinking about any increases”

Top Gainers & Losers- 17-October-23*

Go back to Latest bond Market News

Related Posts: