This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Gainers and Losers

September 7, 2023

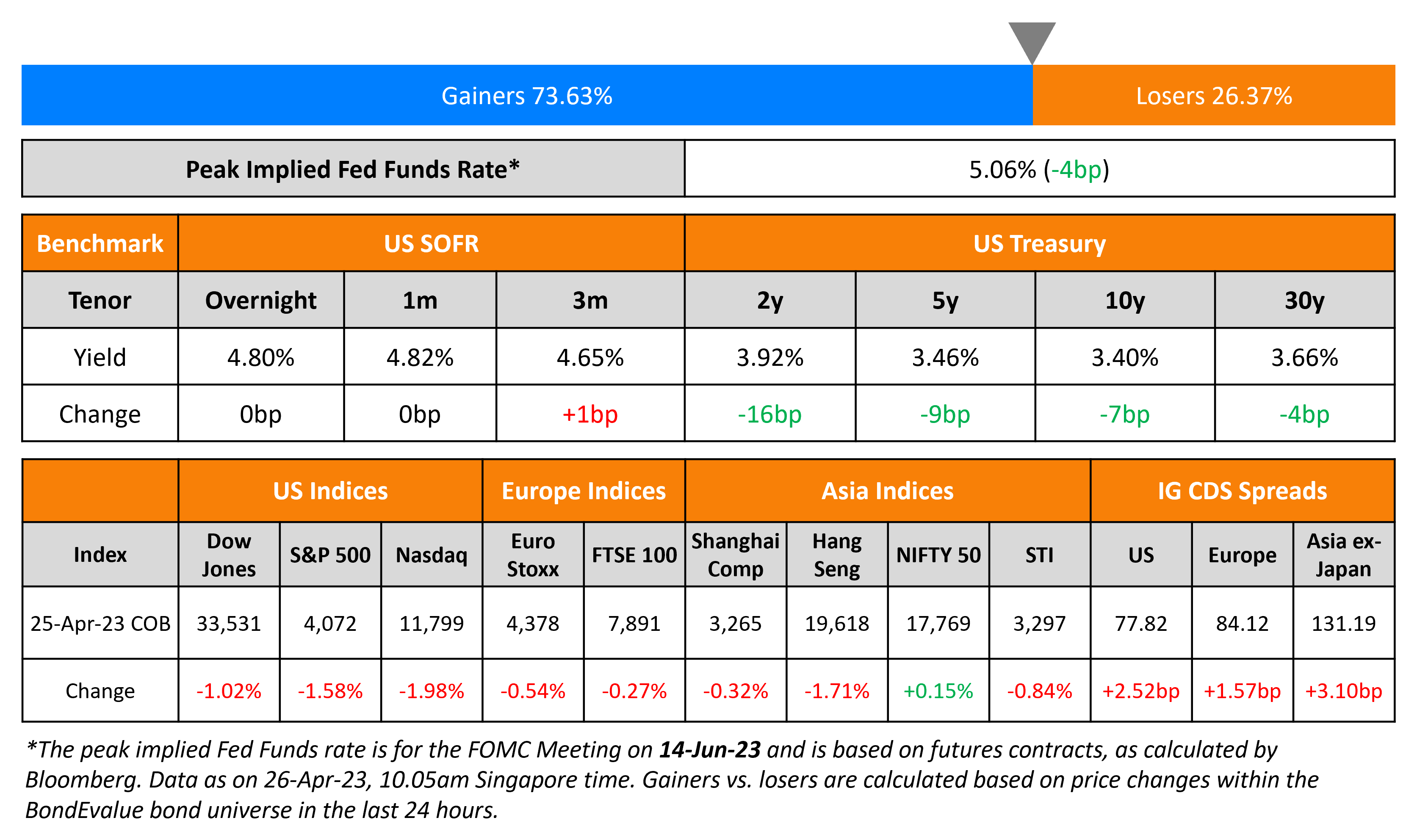

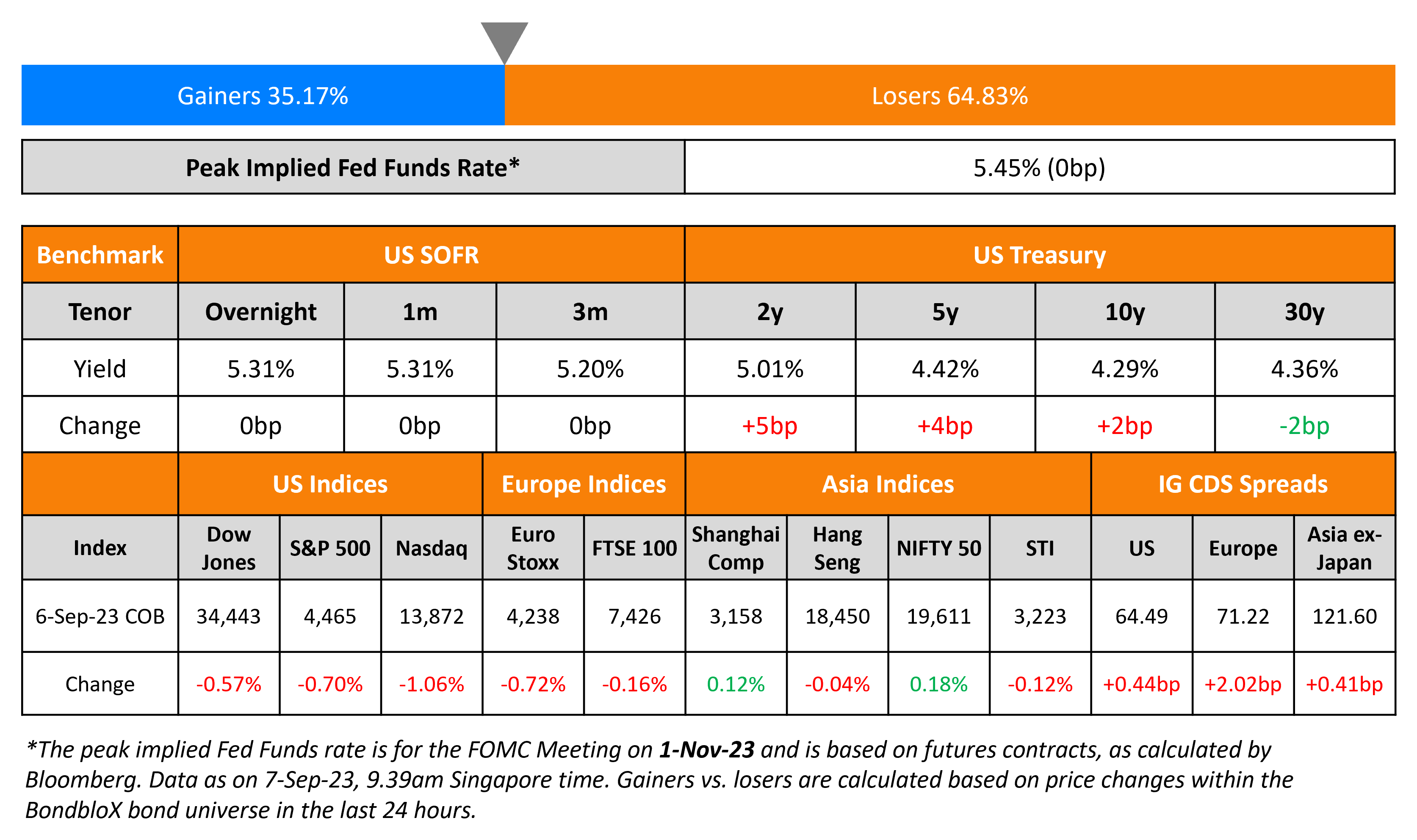

US Treasury yields rose by 2-5bp across the 2-10Y curve on Wednesday. The US ISM Non-Manufacturing Index for August reached 54.4, its highest monthly reading since February, above estimates of 52.5 and last month’s 52.7. US IG CDS spreads were 0.4bp wider and HY spreads widened 3.3bp. Equity markets were slightly weaker with the S&P down 0.7% and the NASDAQ down 1.1%.

European equity markets were also lower yesterday. In credit markets, European main CDS spreads were wider by 2bp with crossover spreads widening 8.4bp. Asian equity markets have opened mixed this morning while Asia ex-Japan CDS spreads widened by 0.4bp yesterday.

New Bond Issues

- BOC London $ 3Y Green FRN at SOFR+105bp area

Barclays raised $4.5bn via a four-tranche deal:

If the 6NC5s and 11NC10s are left uncalled, the coupon will reset at the overnight SOFR plus a spread of 222bp and 262bp respectively. The coupons will be paid quarterly thereafter. The senior unsecured bonds have expected ratings of Baa1/BBB+/A. Proceeds will be used for general corporate purposes and to strengthen further the capital base of the issuer and its subsidiaries. Its new 6NC5s were priced at a new issue premium of 21bp over its existing 4.972% 2029s (callable in 2028) yielding 6.28%, while its new 11NC10s offer a new issue premium of 2.2bp over its existing 6.224% 2034s (callable in 2033) yielding 6.67%.

Turkish lender Yapi Kredi raised $500mn via a 5Y sustainability bond at a yield of 9.375%, 12.5bp inside initial guidance of 9.5% area. The senior unsecured bonds have expected ratings of B3/B- (Moody’s/Fitch). Proceeds will be used to finance/refinance an eligible loan portfolio as defined in its prospectus.

Caixabank raised $2bn via a two-part senior non-preferred deal. It raised $1bn via a 4NC3 bond at a yield of 6.684%, 15bp inside initial guidance of T+210bp area. It also raised $1bn via a 11NC10 bond at a yield of 6.84%, 15bp inside initial guidance of T+270bp area. The bonds have expected ratings of Baa3/BBB/BBB+.

Mongolian Mining raised $180mn via a 3NC2 bond at a yield of 13.754%, in line with its initial guidance. The senior unsecured bonds have expected ratings of B3/B (Moody’s/Fitch). The notes bear covenants that restrict the issuer from incurring additional debt, pay dividends or make other distributions or sell assets, among other conditions. Proceeds will be used to refinance its existing debt.

Rating Changes

- Fitch Upgrades China CITIC Bank’s Long-Term IDR to ‘BBB+’; Outlook Stable

- Fitch Upgrades China Everbright Bank’s IDR to ‘BBB+’; Outlook Stable

- Moody’s downgrades BOCOM International’s rating to Baa1; outlook stable

- Unigel Participacoes S.A. Downgraded To ‘CCC-‘ From ‘CCC+’ On Increased Risks Of Debt Restructuring, Outlook Negative

New Bond Pipeline

- LG Energy hires for $ 3Y and/or 5Y Green bond

Term of the Day

Sustainability Bonds

As per ICMA, an authority in capital markets, “Sustainability bonds are bonds where the proceeds will be exclusively applied to finance or re-finance a combination of both green and social projects.” These can be issued by financial/non-financial companies, governments or municipalities and should follow guidelines by the ICMA. The green and social aspects would be aligned to ICMA’s Green Bond Principles (GBP) and Social Bond Principles (SBP).

Talking Heads

On Expecting More Companies to Default on Debt – Oaktree’s Howard Marks

“When you go through a period when it’s super easy to raise money for any purpose or no purpose, and you go into a period when it’s difficult to raise money, even for a good purpose, clearly many more companies are going to founder… I would like to see the Fed get to a neutral position, which is neither stimulative nor restrictive”

On European Banks Led US IG Bond Spree

Ray Zeek, Head of US regional bank issuance and execution at Barclays

“We’re anticipating a very active financial calendar in September… likely see banks that have taken advantage of cross currency opportunities year to date or have been patiently awaiting regulatory proposals to closely evaluate the USD market this fall”

On Fed’s Collins saying it is now time to be patient, deliberate with policy

“The risk of inflation staying higher for longer must now be weighed against the risk that an overly restrictive stance of monetary policy will lead to a greater slowdown in activity than is needed to restore price stability… calls for a patient and careful, but deliberate, approach to policy, allowing time to assess the effects of policy actions to date, and then acting”

On China’s Credit Wreck Exposing Governance Failings to the World

Dhiraj Bajaj, Head of Asia Credit at Lombard Odier

“There is a clear deterioration in terms of standards, and this will no longer be tolerated by the global investment community… We are becoming less tolerant of many Chinese high-yield companies due to the lack of disclosure standards and direct, straightforward communication.”

Lawrence Lu, senior director of corporate ratings at S&P

“Tapping credit markets is never a one-off deal. Even after distress events emerge or defaults happen, a company should not just run to seed… It’s time for Chinese issuers to change the mindset if they eventually want to get back to the capital market”

Top Gainers & Losers- 07-September-23*

Go back to Latest bond Market News

Related Posts: