This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Gainers and Losers

July 21, 2023

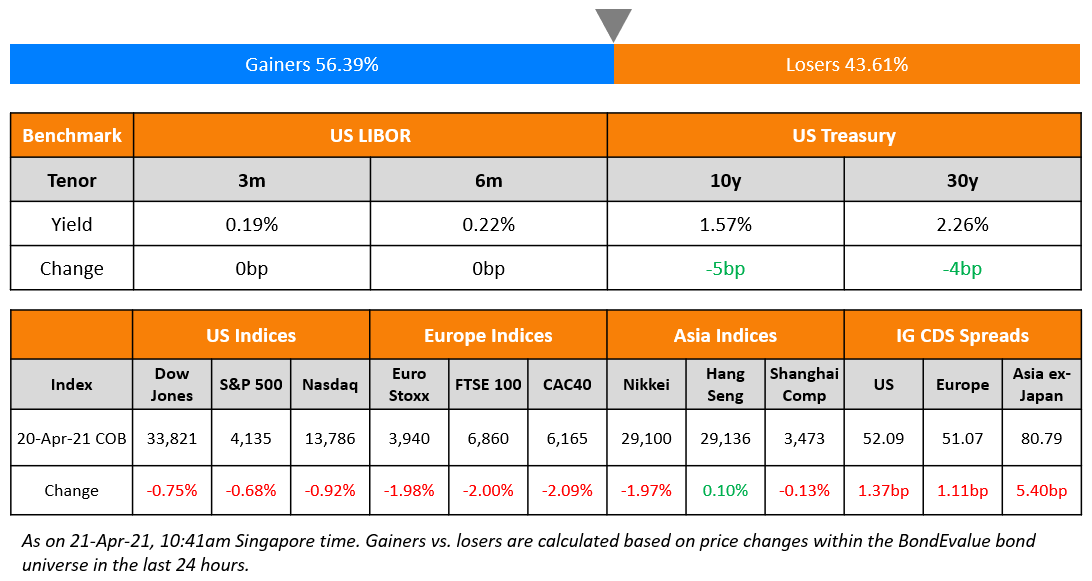

Treasury yields moved higher with the 2s10s curve steepening by 3bp; the 2Y yield was 5bp higher while the 10Y rose 8bp. US initial jobless claims fell by 9k to 228k for the prior week, missing forecasts of 242k. This continues to suggest a relatively resilient labor market. The peak Fed Funds rate was unchanged at 5.40%. Former Fed Chairman Ben Bernanke in a speech said that he expects the Fed to hike by 25bp in July with a possibility that the hike “might be the last one” (scroll lower to Talking Heads for more). US equity indices dropped with the S&P down 0.7% while Nasdaq saw a sharp decline of over 2% after Tesla and Netflix reported disappointing results. Credit spreads widened slightly with US IG and HY CDS spreads wider by 0.1bp and 2.2bp respectively.

European equity indices rose while European main CDS spreads moved 1.1bp wider and Crossover CDS were wider by 4.9bp. Asia ex-Japan CDS spreads widened 0.8bp and Asian equity markets have opened flat. Pakistan reported a rise in its forex reserves to $8.7bn as of July 14, almost twice of what it was the week prior. This was its highest level of reserves in the last 9-months helped by the IMF’s bailout funds coupled with Saudi Arabia and UAE’s financial support.

.png)

New Bond Issues

Guocoland raised S$100mn via a 5Y bond at a yield of 4.4%. The bonds are unrated. Proceeds will be used to finance general working capital and corporate requirements of the group.

South Korean solar cells and modules manufacturer Hanhwa Q Cells raised $400mn via a 5Y Green bond at a yield of 5.168%, 35bp inside initial guidance of T+140bp area. The senior unsecured bonds have expected ratings of Aa2/AA, and are guaranteed by EXIM Korea (rated Aa2/AA/AA–). The deal received orders over $2bn, 5x issue size. Asset and fund managers took 76%, with the remainder taken by other financial institutions like banks and pension funds. APAC took 55%, US 37% and EMEA 8%. Proceeds will be used to finance/refinance eligible green projects in accordance with the Hanwha Solutions green financing framework.

New Bond Pipeline

- KEPCO hires for $ 3Y and/or 5Y Sustainability bond

Rating Actions

- Moody’s downgrades Mallinckrodt’s CFR to Ca following missed interest payments, outlook remains negative

- Fitch Revises Kenya’s Outlook to Negative; Affirms at ‘B’

Term of the Day

Sukuk

A Sukuk is a sharia-compliant fixed income instrument that essentially works similar to bonds. In a Sukuk, key differentiators vs. conventional bonds are:

– Investors share partial ownership of an asset rather than it being a debt obligation by the issuer

– The pricing is based on the underlying value of assets rather than credit worthiness

– The holder receives a share of underlying profits rather than interest payments (considered ‘riba’)

Sharia compliance broadly implies that any profits derived from these funding arrangements must be derived from commercial risk-taking and trading only; that interest income is prohibited on lending activities and; that the assets must be halal. To learn more about sukuk, click here

Talking Heads

On the Fed Interest Rate Decision in July – former Fed Chair Ben Bernanke

“It looks very clear that the Fed will raise another 25 basis points at its next meeting…It’s possible this increase in July might be the last one…We’ll get (inflation) down to three, three plus by early next year and then I think the Fed will take its time trying to get down to its 2% target…What we’ll see is a very modest increase in unemployment and a slowing of the economy…But I’d be very surprised to see a deep recession in the next year.”

On Turkey’s Lower Than Expected Rate Hike

Haluk Bürümcekçi, economist and founder of Bürümcekçi Research & Consulting

“A rate hike by the central bank that was below even the lowest expectations is a negative development for the lira…Policymakers could opt to raise reserve requirements for commercial lenders to reduce lira liquidity in the system.”

Selva Bahar Baziki, economist at Bloomberg

“The size of the central bank’s rate hike is a surprise given the financial system’s recent surge in lira liquidity. In our view, this may prompt the central bank to tighten its reserve requirements — reminiscent of a move previously employed by the central bank. That, if it happens, would cast further doubt over the rates outlook.”

Ercan Erguzel, economist at Barclays

“The authorities might be planning to compensate for less than ideal tightening on the monetary policy side by tighter fiscal policy.”

On a Surge in Argentina’s Dollar-Linked Domestic Bond Issuances

Francisco Schumacher, corporate analyst at BancTrust & Co.

“The difference in US dollar domestic funding versus international funding is at a level I have never seen before…Argentine companies are in a situation where international financing costs are very high (from rate hikes by the Fed) and the risk of currency depreciation is palpable, but there’s a relatively low cost for domestic funding.”

Hugo Eurnekian, CEO of Compania General de Combustibles SA

“The local market is offering very low rates for companies which have been largely kicked out of the official exchange market…This is where the opportunity lies, even if the local market has its own limitations.”

Paula La Greca, corporate analyst at TPCG Valores

“Companies are taking advantage of this boom in the local market…They’re selling debt with coupons close to 0%, and if they have any pesos leftover, they’re going and buying back their more expensive debt.”

On Rebuttals Against Goldman Sachs’ Pessimistic Report on Chinese Banks

Michael Zeng, banking analyst at Daiwa

“The Ministry of Finance has the incentive to keep dividend payout ratios stable…As it’s the controlling shareholder for most state-owned banks, cash dividends are key source of revenue for the government.”

May Yan, head of Greater China financials equity research at UBS

“(Chinese banks are) certainly attractive from a yield perspective…big state-owned banks will try their best to maintain the dividend amount. The worst may have already been priced in.”

Nicholas Zhu, banking analyst at Moody’s

“The average return on assets by banks fell by eight basis points in the first quarter from a year ago, due to a smaller net interest margin…But, with corporate loan yields unlikely to further fall sharply, we expect stable dividend payout ratios of rated banks for 2023, compared with 2022.”

Analysts at Citigroup

“China banks have in the past decade built up significant countercyclical provisions, which could be deployed to help buffer earnings growth and capital generation, without needing to cut dividend payout ratio.”

Top Gainers & Losers – 21-July-23*

Go back to Latest bond Market News

Related Posts: