This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Gainers and Losers

July 5, 2023

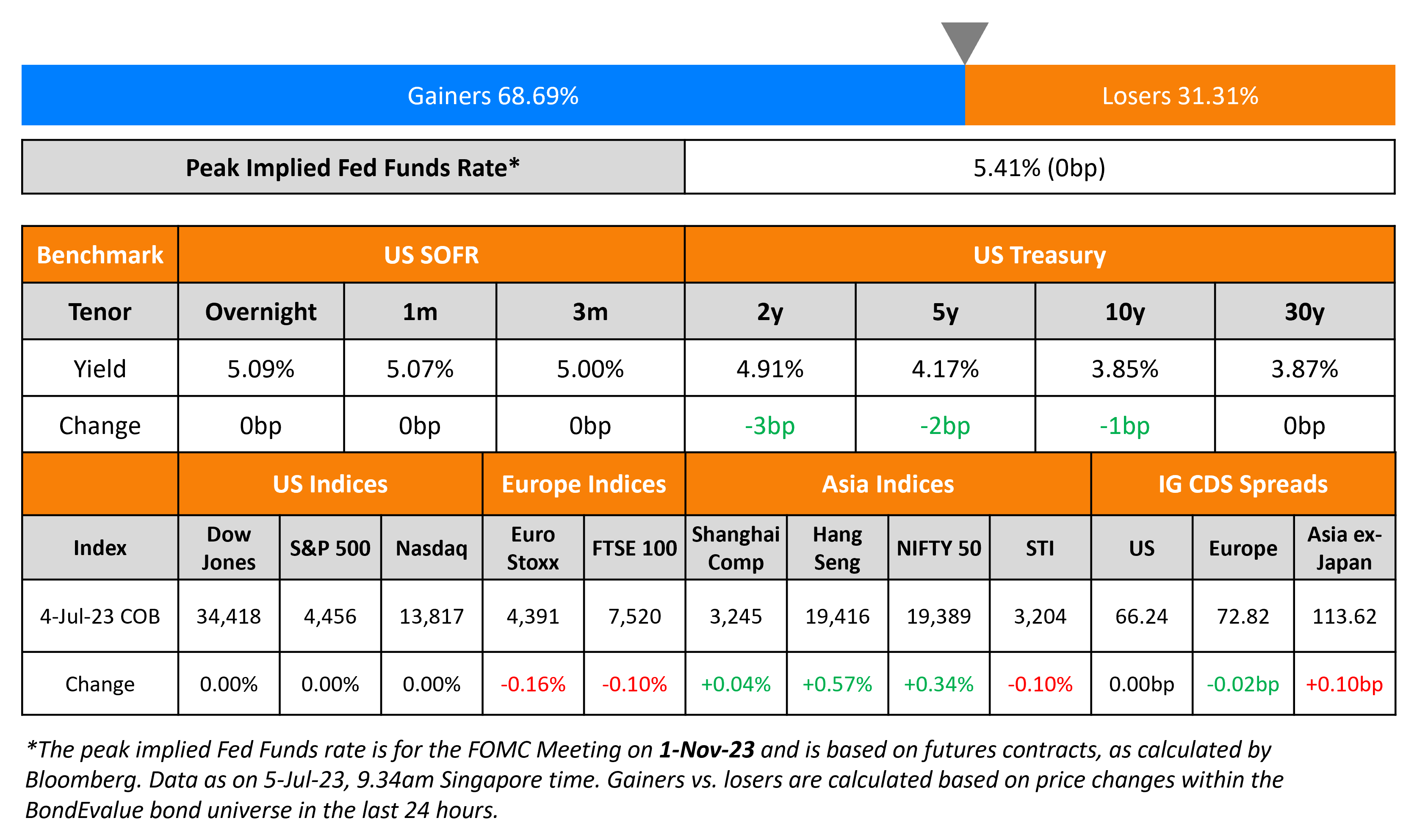

US Treasury yields were marginally lower by 1-3bp across the curve. US markets were shut on account of Independence Day. With a 25bp hike being priced-in at the Fed’s July 26 meeting, markets currently expect rate to be on hold from there on till the end of the year. The peak Fed Funds rate was unchanged at 5.42%.

European equity indices closed marginally lower with European main CDS spreads staying flat while Crossover CDS were wider by 0.7bp. Asia ex-Japan CDS spreads were 0.1bp wider and Asian equity markets have opened lower today.

New Bond Issues

- Korea East-West Power $ 5Y at T+135bp area

- Nomura $ 5Y/10Y at T+215/245bp area

Singapore-based ST Telemedia raised S$300mn via a PerpNC7 bond at a yield of 5.5%, 25bp inside initial guidance of 5.75% area. If the bonds are not called after 7 years, the coupon will reset at the SGD 7Y SORA-OIS plus the initial spread of 324.7bp and a coupon step-up of 100bp. The coupons will reset every 7 years thereafter if the bonds are uncalled. The bonds also have a dividend pusher (Term of the Day, explained below) with a 12 months look back period, and a dividend stopper. The bonds are unrated, and received orders over S$485mn, 1.6x issue size. Private banks and others took the lion’s share at 73%, with fund managers, banks and corporates taking 27% of the new deal. Private banks will receive a 25-cent rebate. Proceeds will be used for financing the general corporate funding requirements or investments of the issuer, its subsidiaries and/or associated companies. ST Telemedia is fully backed by Temasek.

Deutsche Bank raised €500mn via a 2Y senior preferred floating rate note at an expected yield of 4.097%. The floating coupon will be set at the 3m Euribor to be paid quarterly. The bonds are unrated. Proceeds will be used for general corporate purposes.

New Bond Pipeline

-

Shinhan Financial hires for $ 5Y Social bond

Rating Changes

- Credivalores – Crediservicios Ratings Lowered To ‘CCC-‘ And Placed On CreditWatch Negative On Rising Liquidity Pressure

Term of the Day

Dividend Pusher

Dividend pushers are a common covenant seen in perpetual bonds issued by both banks and corporates that require the issuer to make a coupon payment if it has paid a dividend on its shares. These covenants can be found in a bond’s prospectus or offering circular. Dividend pushers are included in a bond’s terms to provide confidence to bond investors that they would be paid coupons if the issuer’s stockholders are paid a dividend. Dividend pushers are sometimes used along with dividend stoppers, which prohibit issuers from paying a dividend on its stock if it has not made a coupon payment on its perpetual bonds.

Talking Heads

On The Time to Buy Bonds After Tech-Fueled Rally – Mackenzie Equity Chief Lesley Marks

“We think that as the data continues to unfold throughout the rest of the year, people will see that the economy is in fact slowing… relative value exists right now in fixed income”… recommend adding investment grade debt and going underweight stocks.

On Double-Digit Gains Suggest Turning Point for Sri Lanka Markets

Dimantha Mathew, chief research and strategy officer, at First Capital Holdings

“The domestic debt optimization plan being limited to the central bank and superannuation funds is very positive for the economy. There may now be interest from foreign investors for rupee bonds.”

Ruchir Desai, fund manager at Asia Frontier Capital

“The equity market in Sri Lanka has more room to run. I am much more optimistic on the outlook compared to the past few years.”

On Chinese Firms Are Issuing the Fewest Dollar Bonds in a Decade

Leonard Law, senior credit analyst with Lucror Analytics

“The market is expecting more rate hikes in the US and more cuts in China. This makes it more expensive to borrow in US dollars than yuan.”

Charles Chang, Greater China country lead at S&P Global

“Many Chinese companies will focus on reducing capital expenditure, and we will see a slowdown of leverage demand amid moderate expectations of the country’s economic recovery”

On High quality government bonds can boost yields for investors – Standard Chartered

“”Bond prices are expected to rise as economic growth slows with returns projected to be less affected by a slightly higher Fed peak rate, given the already elevated current yields”… Upgrade equity to a core allocation, particularly in combination with DM IG government bonds. “This strategy aims to strike a balance between capitalising on strong equity momentum and managing the potential risk of a US recession, which remains a tangible concern although possibly delayed”

Top Gainers & Losers – 05-July-23*

Other News

Go back to Latest bond Market News

Related Posts: