This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Macro; New Issues; Rating Changes; Talking Heads; Top Gainers and Losers

July 24, 2023

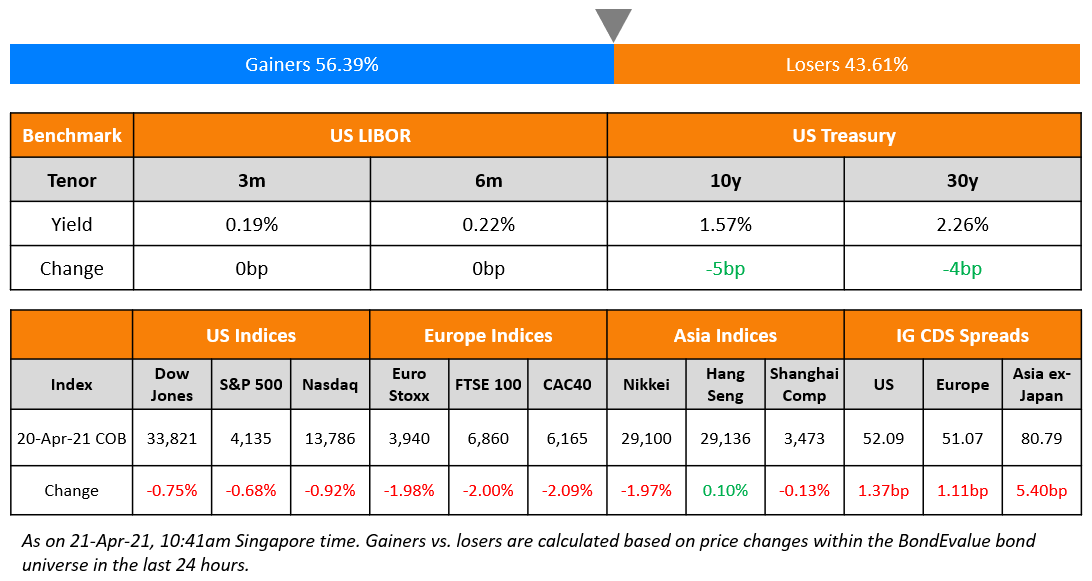

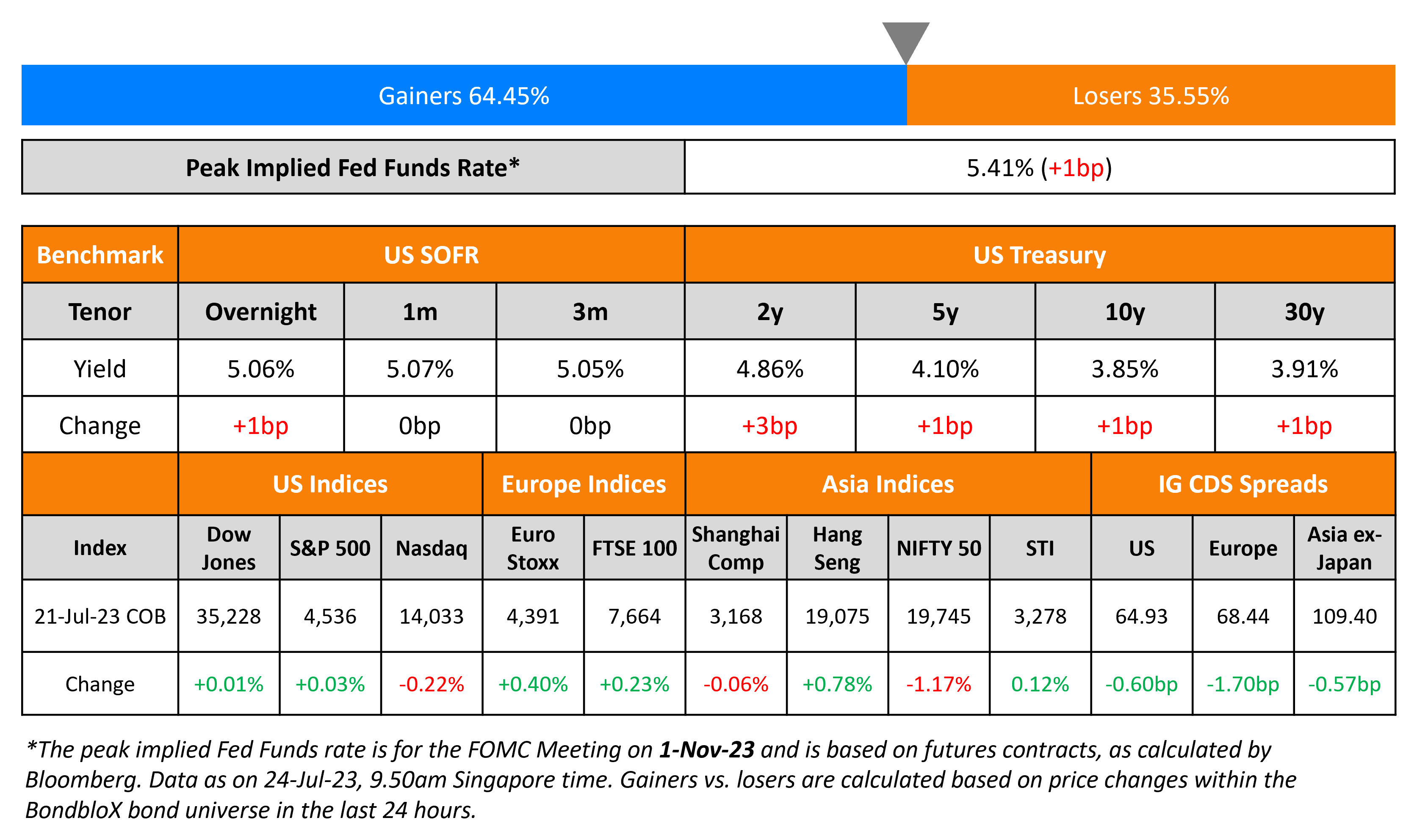

Treasury yields were near flat on Friday with no major data releases. As per CME probabilities, markets expect a status quo in rates for the rest of 2023 after a 25bp hike on Wednesday’s FOMC meeting. The peak Fed Funds rate was 1bp higher at 5.41%. Credit spreads tightened with US IG and HY CDS spreads tighter by 0.6bp and 1.4bp respectively. The S&P and Nasdaq were also near flat, making it a quiet Friday for financial markets.

European equity indices rose while European main CDS spreads moved 1.7bp tighter and Crossover CDS were tighter by 4.3bp. Asia ex-Japan CDS spreads tightened 0.6bp and Asian equity markets have opened mixed this morning.

.png)

New Bond Issues

- KEPCO $ 3Y Sustainability at T+135bp area

Rating Actions

- Fitch Downgrades Wanda Commercial, Wanda HK to ‘C’ After Missed Coupon Payment

- Fitch Downgrades GfK to ‘B+’; Outlook Stable; Withdraws Ratings

- Sri Lanka Local Currency Rating Lowered To ‘CC’ From ‘CCC-‘ On Domestic Debt Restructuring Plan; Outlook Negative

- Moody’s affirms PEMEX’s B1 ratings; outlook changed to negative

Term of the Day

Consent Solicitation

Consent solicitation is an offer by the issuer to change the terms of the security agreement. These are applicable for changes to bonds or shares issued and can range from distribution payment changes and covenant changes in bonds to changes in the board of directors with regard to equities.

Talking Heads

On the Occurrence of a Bond Bull Market – former CIO at Pimco Bill Gross

“…a bull market is not in the cards…Skyrocketing government deficit is adding supply pressure in the bond market at a time when the Fed is offloading its holdings, a combination that is set to keep 10-year yields above 3.5% for a long, long time…the European Central Bank has more work to do than the Fed in its efforts in reining in inflation, exerting a gravitational upward pull for US yields…Ultimately, but not now, as the market awaits a future Fed easing policy, bondholders will experience a continuing bear market, with negative implications for stocks as well.”

“Our longer term view is bullish across credit products including investment grade, but in the near term, we’re more neutral in that we’ve come very far, very fast…as a whole, it does feel like in the near-term sense spreads are fully valued in this current range and we see a little bit more downside risk to spreads over the next couple months versus upside potential…A lot of the higher-quality industrial names are already trading at their year-to-date tights, so if there is any sector-level performance from here, it’s probably within financials, perhaps further down the rating spectrum with some spread compression across BBBs.”

On the Plunge in Country Garden’s Bond Prices

Analysts at ANZ

“New measures, while helpful, are no panacea for the sector’s woes. Other efforts are needed to boost buyers’ sentiment about the long-term trajectory of the property market.”

Analysts at JPMorgan

“(Despite Country Garden’s loan refinancing being marginally credit positive), the onshore operating environment remains challenging for the developers, especially with no indication of relaxation of escrow account supervision.”

Yao Yu, founder of Ratingdog

“Country Garden is in great difficulties…it (has) more than 10 billion yuan of debt due in the next two months.”

On the Uncertainty Over a Rate Hike Beyond July

Gregory Faranello, head of US rates trading and strategy at AmeriVet Securities

“The market senses the Fed is near the end, but if the economic data holds up between July and September, the bond market has to anticipate another hike…For Jay Powell, the end game is still about getting inflation down and looser financial conditions work against that. There’s no reason to believe the Fed’s June stance of two more hikes has changed.”

Jack McIntyre, portfolio manager at Brandywine Global

“It will be interesting to see what is more important for the Fed here. Is it recent data showing some slowing in the economy and inflation, or do they want to retain that hawkish bias…(I suspect that the) Fed goes from a hawkish pause — in June — to a dovish hike.”

George Catrambone, head of fixed income at DWS Americas

“Positioning has been fragile this year, most have been on the wrong side of things…You have to be cautious when the Fed is nearing the end of a hiking cycle. Fed futures will be all over the map between now and September.”

Gurpreet Gill, global fixed income macro strategist at Goldman Sachs

“A resilient labor market limits the extent to how much yields (can decline)…The highly plausible case is that July is the last hike for the cycle, but there is uncertainty.”

On EM Investors Not Pricing in the Effects of El Niño

Eimear Daly, EM strategist at NatWest

“(Investors aren’t yet discussing El Niño’s effects in depth), which makes me nervous that we may be complacent to this risk…Markets are fixated on carry right now and not focused on what seems like increased stagflation risk.”

Julio Callegari, head of Asian fixed income at JPMorgan

“If El Niño proves to be intense — like in 2014 and 2015 — this can indeed change the inflation expectations in emerging markets for 2024 and affect the central banks’ behavior in many countries.. It’s prudent to monitor the risk to long emerging-market positions as details of the severity become known, even if you don’t adjust the portfolio just yet.”

Rajeev De Mello, fund manager at Gama Asset Management

“Higher food prices will hurt large food importers and would throw a wrench into EM central banks of food importers plans to cut interest rates…In view of the risk that El Niño might pose, investors might have been a bit quick to price cuts.”

Top Gainers & Losers – 24-July-23*

Other News

Go back to Latest bond Market News

Related Posts: