This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Macquarie, StanChart, UBS Price Bonds

August 6, 2025

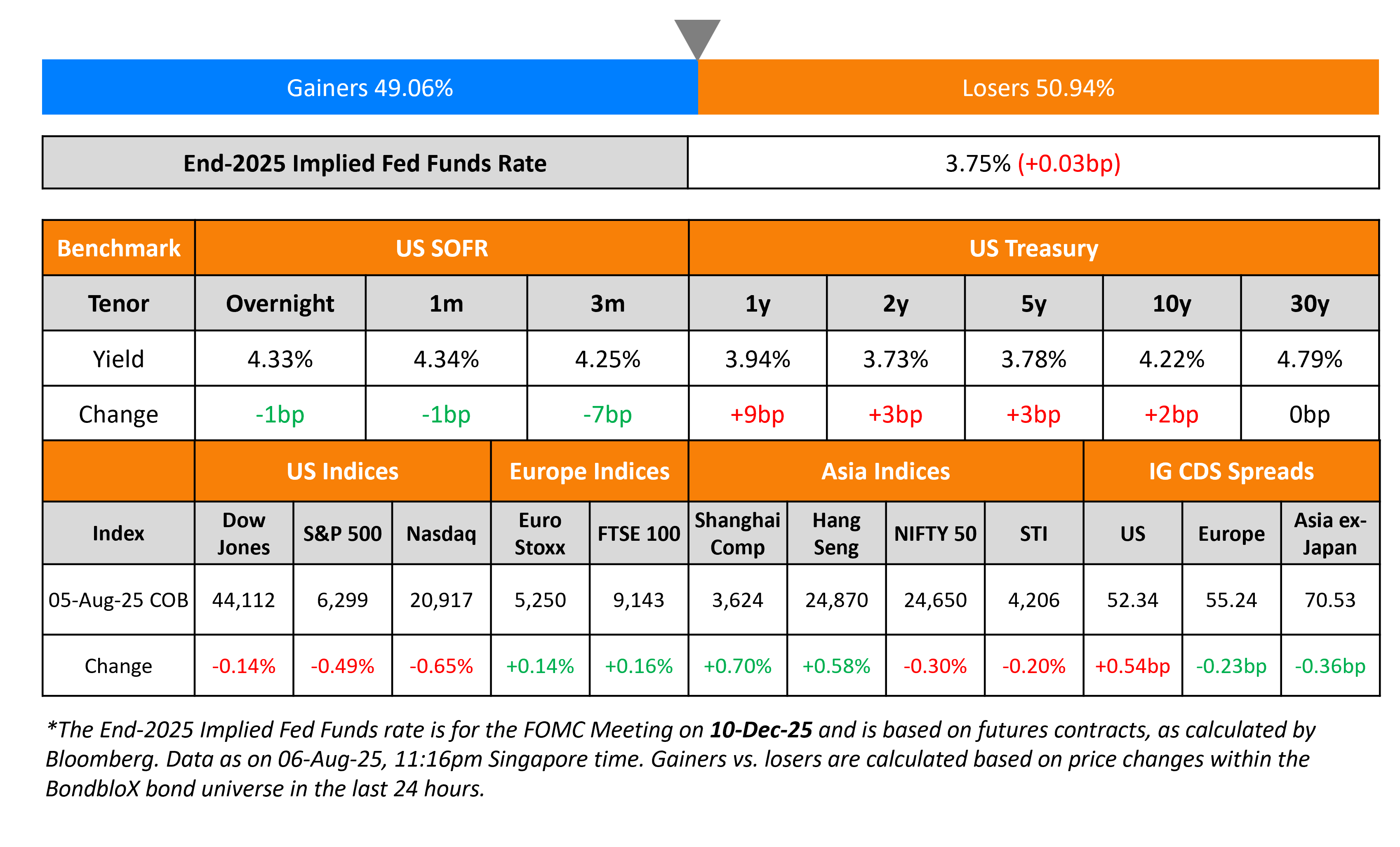

US Treasury yields inched higher by 2-3bp. On the data front, the US ISM Services PMI reading for July came-in at 50.1, just above the 50-mark that indicates a plateau (neither contraction nor expansion). The final print was lower than expectations of 51.5 and the prior month’s 50.8 reading. This came on the back of a fall in the New Orders and Employment sub-components, underscoring the uncertainty over the US administration’s tariff. However, the Prices Paid sub-component saw an unexpected rise. Separately, President Trump mentioned that he was planning to announce a new tariff plan on semiconductors early next week. Also, the US Treasury’s 3Y note auction saw soft demand, tailing by 0.7bp with a bid-to-cover of 2.53x, similar to the prior three auctions’ average.

Looking at US equity markets, the S&P and Nasdaq closed lower by 0.5% and 0.7% respectively. US IG CDS spreads were 0.5bp wider and HY CDS spreads widened by 3.6bp. European equity markets ended higher. The iTraxx Main spreads tightened by 0.2bp while the Crossover CDS spreads widened by 3.1bp. Asian equity markets have opened higher today. Asia ex-Japan CDS spreads were 0.4bp tighter. China’s S&P Services PMI for July expanded to 52.6, much better than expectations of 50.4 and the prior month’s reading of 50.6.

New Bond Issues

- CLAR S$ PerpNC5 green bond at 3.5% Area

Macquarie Bank raised $1bn via a 11NC10 Tier 2 bond at a yield of 5.642%, 25bp inside initial guidance of T+170bp area. The subordinated note is rated A3/BBB+/BBB+. Proceeds will be used for general corporate purposes.

Standard Chartered raised $2bn via a 11NC10 bond at a yield of 5.40%, 25bp inside initial guidance of T+140bp area. The senior unsecured notes are rated A3/BBB+/A. Proceeds will be used for general corporate purposes. The new bond is priced at a new issue premium of ~9bp over its existing 6.228% 2036s currently yielding 5.31%.

UBS raised €2bn via a two-part offering. It raised €750mn via a 6NC5 bond at a yield of 3.162%, 33bp inside initial guidance of MS+120bp area. It also raised €1.25bn via a 11NC10 bond at a yield of 3.757%, 35bp inside initial guidance of MS+150bp area. The senior unsecured notes are rated A2/A-/A. The new bond is priced at a new issue premium of ~14bp over its existing 4.375% 2031s currently yielding 3.02%.

Rating Changes

-

Moody’s Ratings upgrades Hidrovias do Brasil’s ratings to Ba3; stable outlook

-

Gruma S.A.B. de C.V. Upgraded To ‘BBB+’ From ‘BBB’ On Commitment To Strong Credit Metrics; Outlook Stable

- Prime Healthcare Services Inc. Outlook Revised To Positive From Stable; Ratings Affirmed

Term of the Day: Kangaroo Bonds

Kangaroo bonds are bonds issued in Australia by non-Australian issuers denominated in Australian Dollars. These bonds give foreign issuers access to another country’s capital markets and helps them diversify their capital base and could reduce borrowing costs. Although, the currency risk is borne by the issuer.

Indonesia has launched a debut Kangaroo bond deal.

Talking Heads

On Scope for US Dollar to Sink Further – Bill Campbell, DoubleLine Capital

“I’m taking a wait and see approach to that…Excluding the trade deals, I would think that the recycling of global savings back into the US would be slower than what we have seen over the past.”

On Crowded Trade in Big Tech as Fed Nears Rate Cuts

Andrew Greenebaum, Jefferies

“We aren’t trying to argue for a significant downturn, or a massive selloff in tech, but a dovish Fed has tended to provoke regime change whether the overall benchmark is higher or lower…So, if Friday’s payrolls told us anything, it’s that the time to start rotating out of large cap tech may finally be upon us.”

Irene Tunkel, BCA Research

“Time to trim winners after a strong run and protect the downside”

On Bond Market’s Pain Trade Turning Into Payoff After Jobs Shock

Kevin Flanagan, WisdomTree Inc

“There’s nothing like a downward revision of a quarter million people to change the story.”

Mark Dowding, RBC Global

“We still like the steepening view and so are pleased to see the price action”

Priya Misra, JPMorgan

“Greater tension between softer employment and stickier inflation could be a bumpy ride trying to price in the timing and pace of rate cuts.”

Top Gainers and Losers- 6-Aug-25*

Go back to Latest bond Market News

Related Posts: