This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Macau Gaming Revenues at Post-Covid High of $2.5bn in May

June 3, 2024

Gross gaming revenues (GGR) from Macau gaming companies touched a post-pandemic high of MOP 20.2bn ($2.5bn) in May, up 8.9% MoM. Given the Labor Day holiday period (a five-day public holiday in Mainland China), Macau received approximately 605,000 tourists during this period. However, gaming revenues still came in 22.2% below May 2019’s revenue of MOP 25.95bn ($3.23bn). As per data by the local regulator, the first five months of this year has seen a combined GGR of MOP 96.06bn ($11.9bn), up 47.9% YoY.

In related coverage, Bloomberg Intelligence (BI) notes that Wynn Macau’s dollar bonds could tighten relative to its US parent, Wynn Resorts. They note that Wynn Macau has a stronger balance sheet, improving credit metrics and liquidity, as well as improving Macau earnings. BI adds that Wynn Macau’s short-dated bonds trade 80bp wider to Wynn Las Vegas and the gap between its long-dated bonds and Wynn Resorts Finance is about 110 bps. Further, BI mentioned that the Macau subsidiary’s net debt has reduced by $1.1bn and Ebitda growth has been strong, thus improving its credit profile.

Go back to Latest bond Market News

Related Posts:

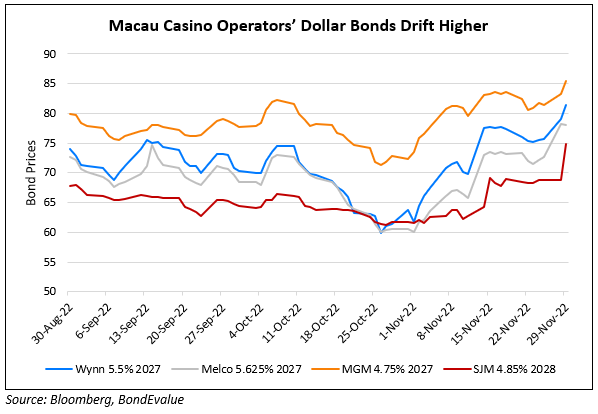

Wynn Macau Bonds Inch Up Post Gaming Law Reform

January 18, 2022

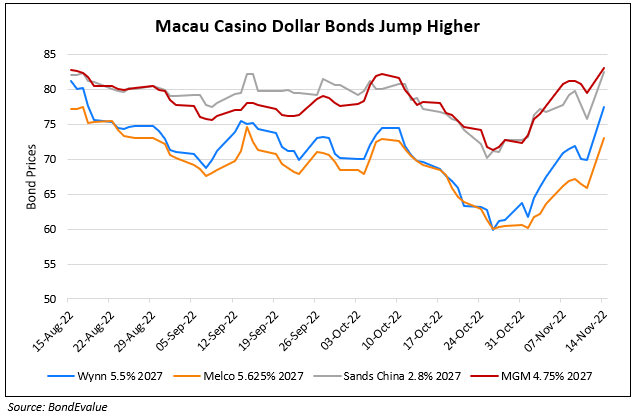

Macau Casino Bonds Jump by Over 5%

November 29, 2022