This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Lumen’s Bonds Edge Lower after Kerrisdale Capital Takes Short Position

August 28, 2024

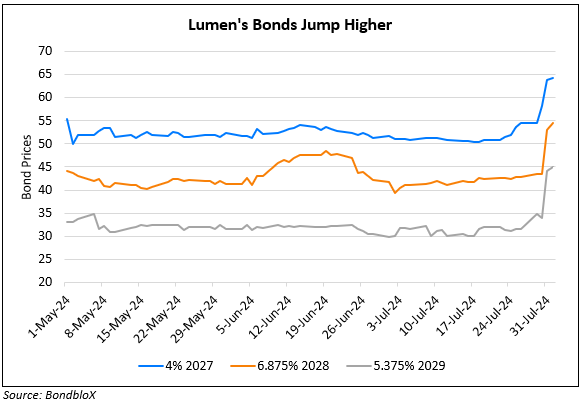

Lumen’s bonds were lower by 1-1.8 points across the curve. Investment management firm Kerrisdale Capital said that it took a short position on Lumen’s stock citing worsening sales and margins. The firm raised doubts about Lumen’s focus on AI to fuel a turnaround its telecom business. It cited the lack of large-scale cloud providers for AI hardware. Besides, Kerrisdale said that while Lumen has identified $7bn in additional “sales opportunities”, its customers in this category are not technology firms but rather companies in healthcare, retail and financial services. Also, with $19bn in debt, Kerrisdale said that Lumen’s recent deals to raise cash do not solve its fundamental growth and balance sheet problems.

Lumen’s bonds have largely been on an uptrend since late July after it secured $5bn in new orders to provide fiber capacity and network management to large customers including Microsoft. They have risen over 50% since then. However, yesterday, its notes moved lower – for instance its 6.875% 2028s were down 1.8 points to 74.3, yielding 17.2%.

For more details, click here

Go back to Latest bond Market News

Related Posts:

Lumen’s Creditor Advisors Propose Debt Extension

September 18, 2023

Lumen’s Creditors Agree to Provide $1.2bn Debt Financing

November 2, 2023

Lumen’s Bonds Continue to Trend Higher

August 1, 2024