This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

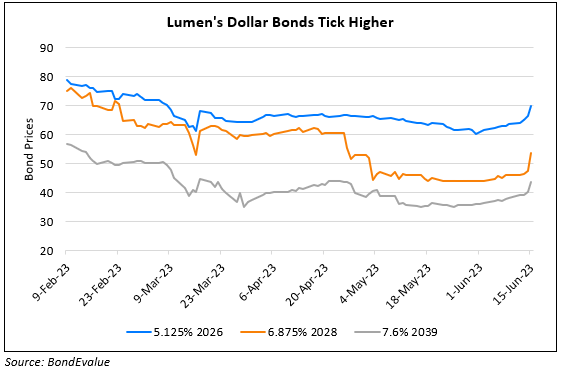

Lumen’s Bonds Dip After Almost $9bn Net Loss

August 2, 2023

Lumen Technologies’ dollar bonds dropped after it reported a net loss of $8.74bn. The company was hit by an impairment charge of $8.8bn in Q2 due to a sustained decline in their share price and variance in the market valuation in the April-June period. Revenues during the second quarter were at $3.66bn, slightly below estimates of $3.67bn. Its long-term debt at end-June stood at $19.9bn. The telecommunications company’s dollar bonds have been under pressure since February where it gave a soft earnings forecast. Decline in its traditional internet services has hurt its revenues and Lumen is undergoing a digital transformation process to sift through its operations.

Its 5.125% 2026s dropped 6 points to 52 cents on the dollar, yielding 28%.

For more details, click here

Go back to Latest bond Market News

Related Posts: