This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Lumen to Raise $1.25bn via Bond Issuance; Launches Buyback Offer for Notes

December 10, 2025

Lumen Technologies announced that its wholly-owned subsidiary, Level 3 Financing Inc., plans to raise $1.25bn via an 8.5% bond due 2036. The planned issue size was increased by $500mn from the previously announced offering size. The company plans to use the net proceeds from the offering, along with cash on hand/other available liquidity if necessary, to repurchase its existing second lien notes via a tender offer. Besides, the funds will also be used to cover related fees and expenses, and any remaining proceeds will be used for general corporate purposes.

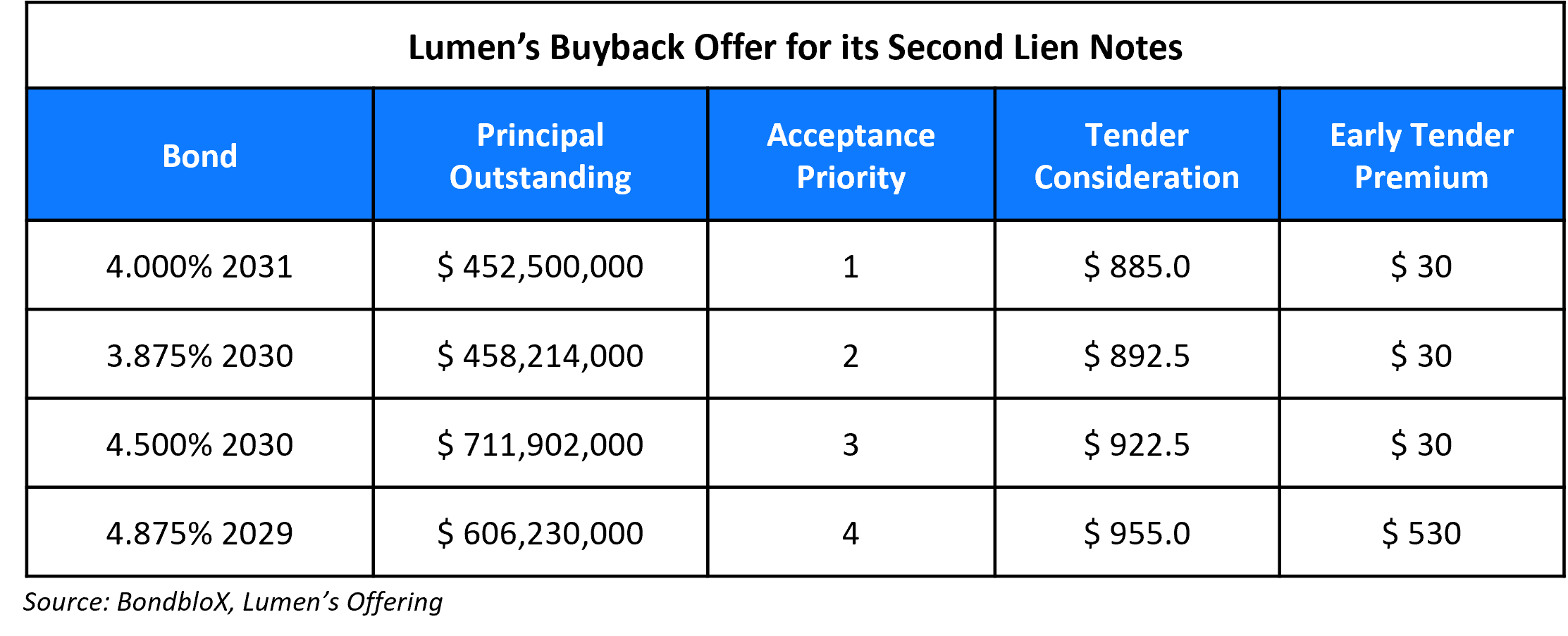

Level 3 Financing is also conducting a cash tender offer to buy back back up to $1.5bn across four of its second lien notes (excluding accrued and unpaid interest) as shown in the table below. The early tender date is December 19 and the offer will expire on December 23.

Go back to Latest bond Market News

Related Posts: