This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Lumen Launches Debt Tender Exchange Offer; Downgraded to CC by S&P; Bonds Rally

September 5, 2024

Lumen Technologies has launched a debt tender exchange offer for its 5.125% 2026s, 4% 2027s, 6.875% 2028s and 4.5% 2029s. The company is looking to exchange these notes for newly issued super-priority senior secured notes. The exchange offer is set to expire on 1 October 2024 and its early expiration deadline is on 16 September 2024. The notes have decreasing order of acceptance priority with their increasing maturity date. The maximum acceptance amount for all the tendered notes is set at $500mn with the sub cap of $100mn for the 2029s. The company will pay $1,000, $975, $895, $700 per $1000 principal for 2026s, 2027s, 2028s and 2029s respectively if tendered before 16 September 2024. If tendered after the early expiration deadline, it will pay $900, $875, $795, $600 respectively.

Lumen’s subsidiary Level 3 Financing has also commenced a debt tender exchange offer for its 3.4% 2027s, 4.625% 2027s and 4.25% 2028s, in decreasing order of acceptance priority respectively. The company is looking to exchange these notes for newly issued Level 3 notes. Its exchange offer also has similar deadlines with maximum acceptance amount set at $350mn.

As a result of the launch of the exchange offer, S&P downgraded Lumen Technologies to CC from CCC+. S&P also lowered the ratings on the bonds to C. S&P views the proposed transaction as distressed and it tantamount to default because lenders will not receive adequate compensation to offset the maturity extension and in some cases, will receive a discount to par value.

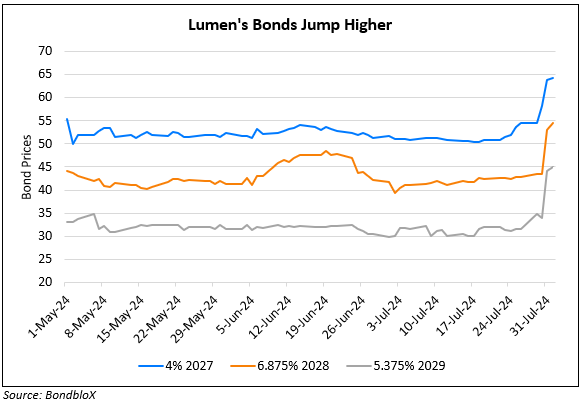

Lumen’s 4% 2027s were among the top gainers with bonds rising by 10.1 points to trade at 89.2, yielding 9.03%

For more details, click here

Go back to Latest bond Market News

Related Posts:

Lumen’s Creditor Advisors Propose Debt Extension

September 18, 2023

Lumen’s Creditors Agree to Provide $1.2bn Debt Financing

November 2, 2023

Lumen’s Bonds Continue to Trend Higher

August 1, 2024