This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Link REIT Launches $ 10Y Bond

January 26, 2026

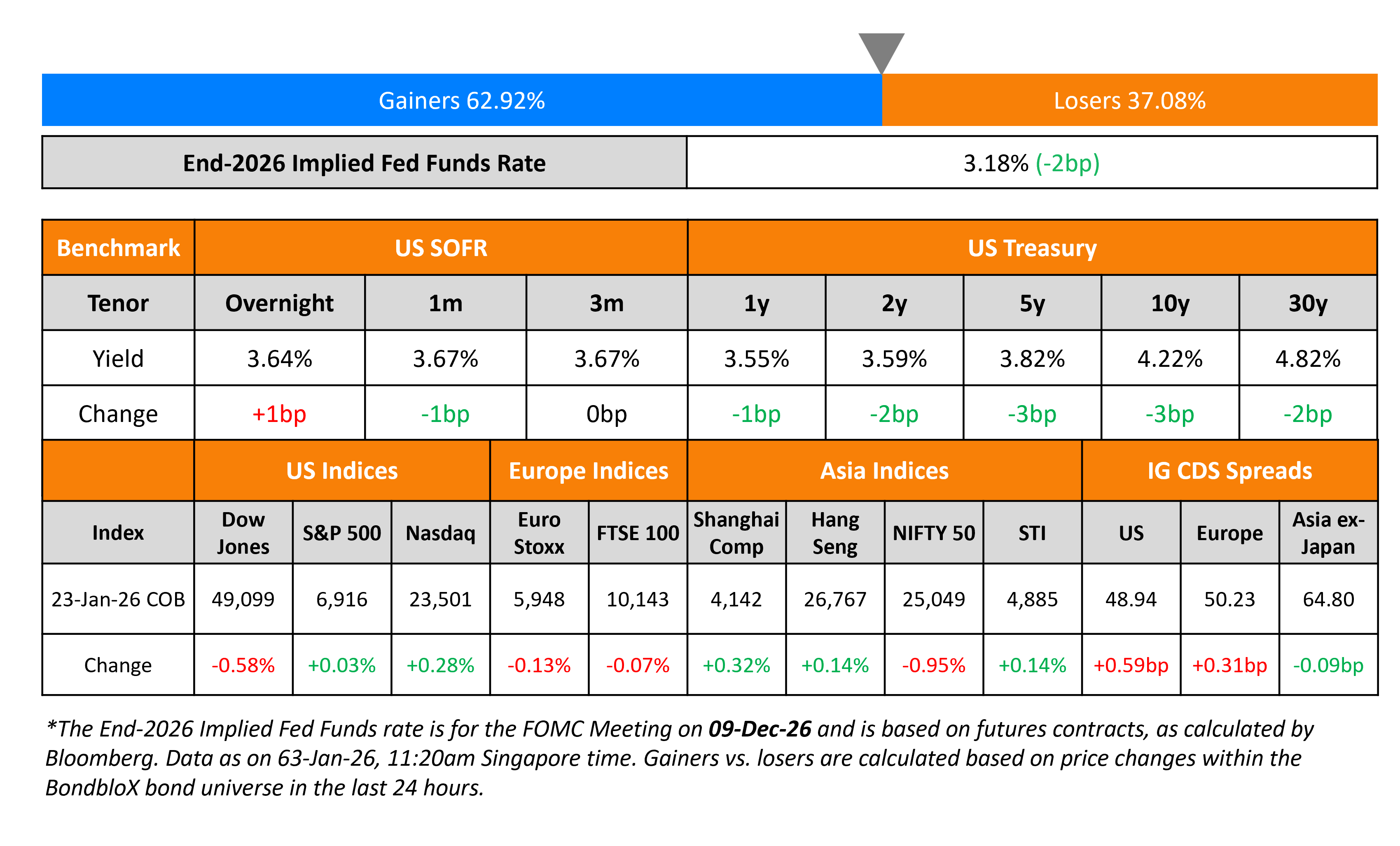

US Treasury yields were lower by 2-3bp across the curve. The preliminary S&P Manufacturing PMI print for January came in at 51.9 vs. expectations of 52.0. The Services PMI came in at 52.5 vs expectations of 52.9. Separately, the Michigan Consumer Sentiment Index for January came in at 56.4 better than the surveyed 54.0.

Looking at US equity markets, the S&P ended almost unchanged while the Nasdaq ended higher by 0.3%. US IG CDS spreads widened by 0.6bp and HY CDS spreads were 3.2bp wider. European equity indices ended lower. The iTraxx Main CDS spreads were 0.3bp wider and the Crossover CDS spreads were 2.2bp wider. Asian equity markets have opened mixed this morning. Asia ex-Japan CDS spreads were tighter by 0.1bp. The Bank of Japan (BOJ) kept its target rate unchanged at 0.75%, inline with expectations. The Japanese Yen fell past the 159-mark against the US Dollar, following which the currency recovered sharply back to 154 amid talks of a potential currency intervention.

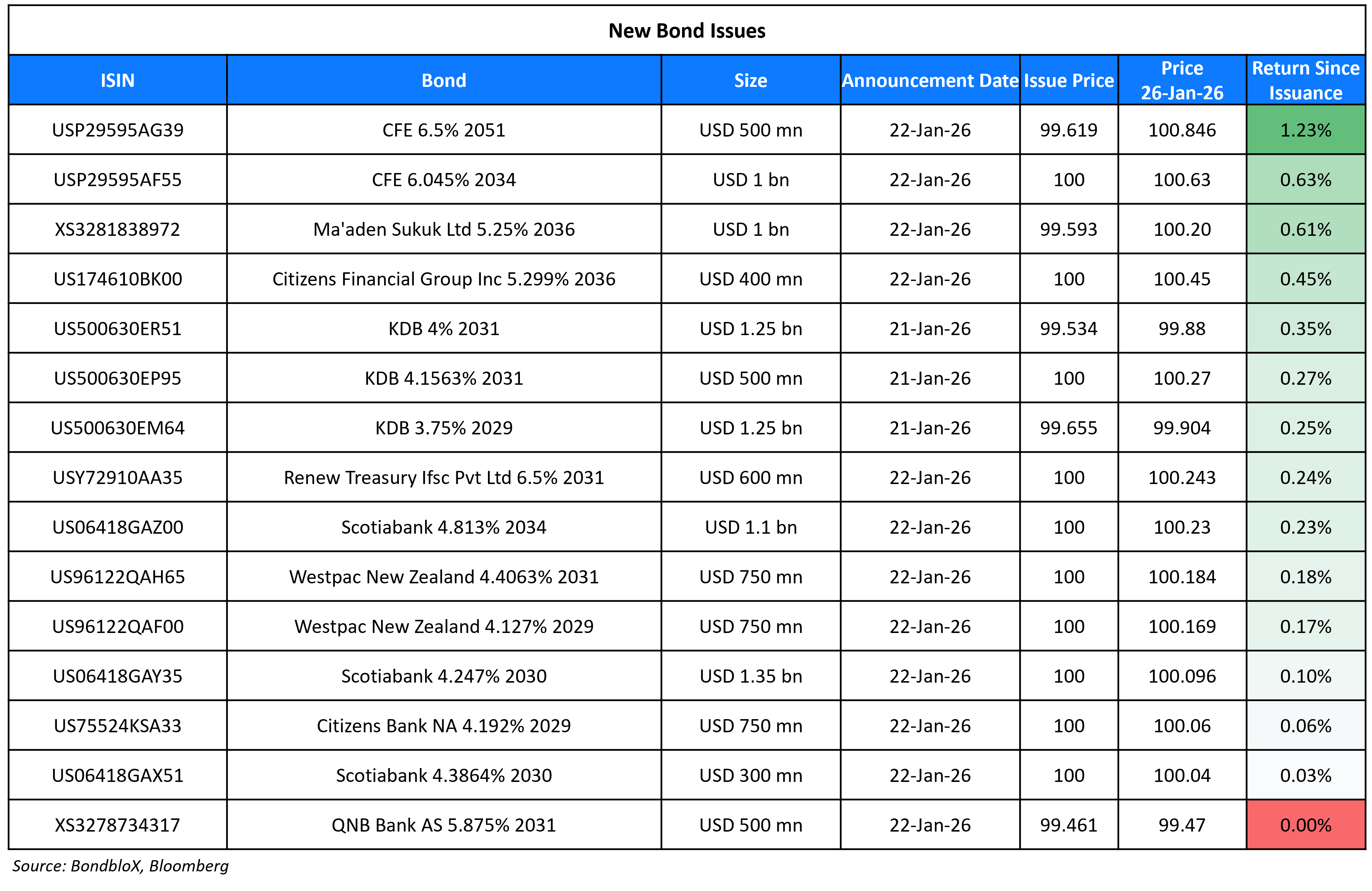

New Bond Issues

- Link REIT $ 10Y at T+105bp area

Saudi Arabian Mining Company raised $1bn via a 10Y sukuk at 5.303%, 30bp inside initial guidance of T+135bp area. The notes are rated Baa1/BBB+ (Moody’s/Fitch), and issued by Ma’aden Sukuk Ltd. Proceeds will be used for general corporate purposes.

New Bonds Pipeline

-

PT Perusahaan Listrik Negara $ 5Y/10Y bonds

-

Watercare Services A$ 5.5Y/10Y bonds

-

Banco BTG Pactual investor calls

Rating Changes

- Edison SpA Upgraded To ‘BBB+’ Following The Same Action On Parent EDF; Outlook Stable

- Fitch Revises Turkiye’s Outlook to Positive; Affirms at ‘BB-‘

- Democratic Republic of Congo Outlook Revised To Positive To Reflect Fiscal And External Progress; Affirmed At ‘B-/B’

- Moody’s Ratings changes Andorra’s outlook to positive, affirms Baa1 ratings

Term of the Day: K-Shaped Economy

A K-shaped economy (recovery) refers to an economic situation where different segments of society or industries recover at very different rates. Here, some segments improve rapidly while others continue to decline or stagnate. The term comes from the shape of the letter “K,” where one line moves upward (representing those who are doing well) and the other moves downward (representing those who are struggling).

The post Covid pandemic recovery, was identified as being K-shaped — Large corporations and digital firms thrived while small businesses and low-wage sectors struggled. Some economists are referring to the US economy as currently undergoing a K-shaped move.

Talking Heads

On The Junkiest Junk Bonds Finding Big Demand This Year

Sean Feeley, Barings

“We believe the outperformance is because of market valuations”

Michael Levitin, MidOcean Partners

“If you don’t invest in any CCCs you are going to get left behind. People want the yield, they need the paper and they have cash”

Corry Short, Barclays

“Because of the degree of dispersion within the CCC segment right now, you have to look through a more narrow lens when trying to identify relative value”

On Sudden Chaos in Japan’s Bond Market Putting Stocks on Notice

Andrew Jackson, Ortus Advisors

“Investors are nervous. Japan’s bull case for the medium term stays intact but for the short term, it isn’t a one-way trade”

Frank Benzimra, Societe Generale

“Investors should consider the limits of this trade”

Richard Kaye, Comgest Asset Management

“I do expect Japanese stocks to do well after the election, and the reason is, I think Takaichi will win.”

On China tech seen as dollar hedge, with focus on earnings, Fed

Mark Haefele, UBS Global Wealth Management

“We like China tech in particular because there’s some success there. There also seems to be government support”

Ulrike Hoffmann-Buchardi, UBS

“We are optimistic, but also cognizant of downside risks, in particular in those countries and areas where capital has gone; (the) U.S. of course has been a big recipient of those inflows”

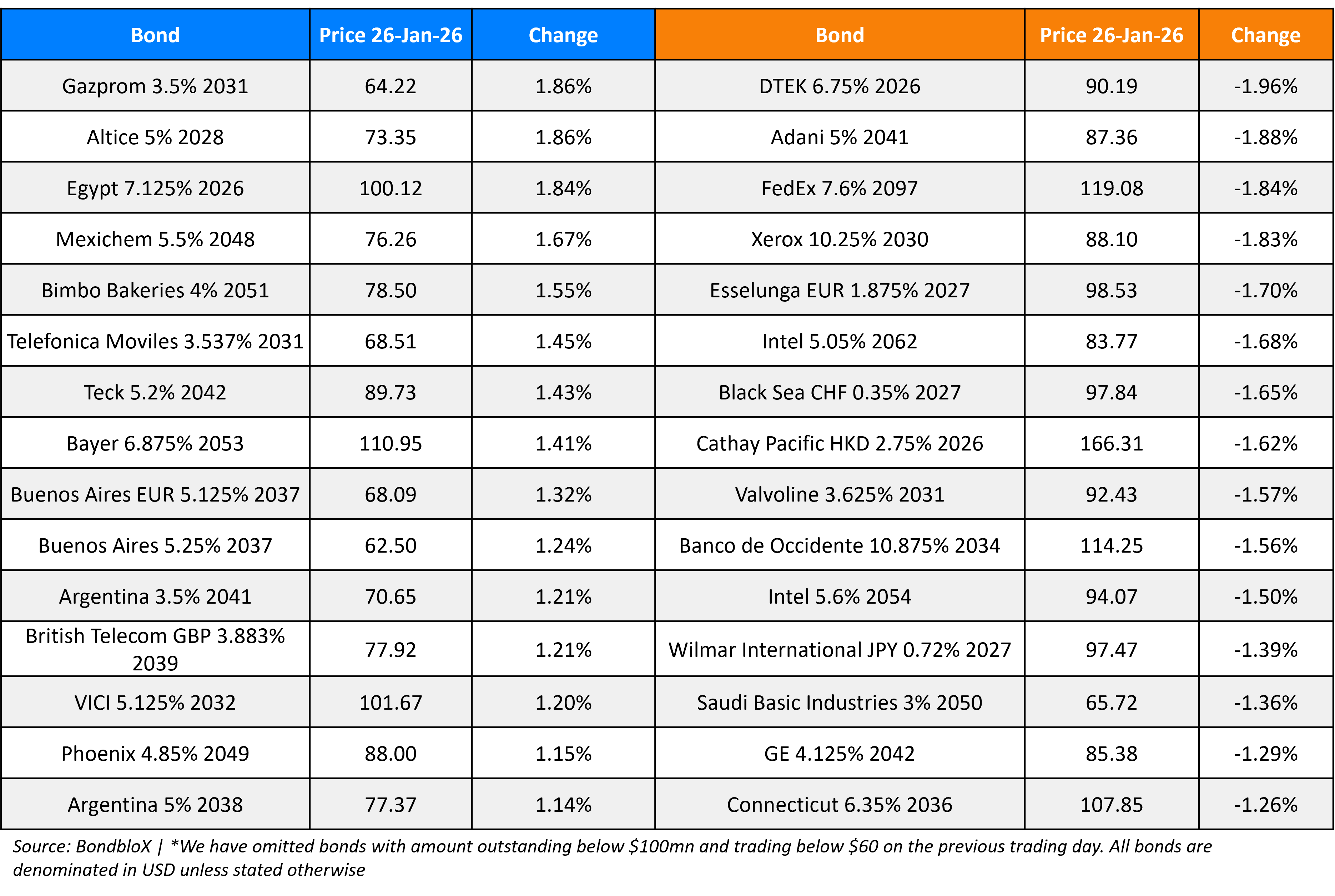

Top Gainers and Losers- 26-Jan-26*

Go back to Latest bond Market News

Related Posts: