This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Li & Fung, Astrea, Arada Launch Bonds; DB, CHS, RBC Price $ Bonds

July 29, 2025

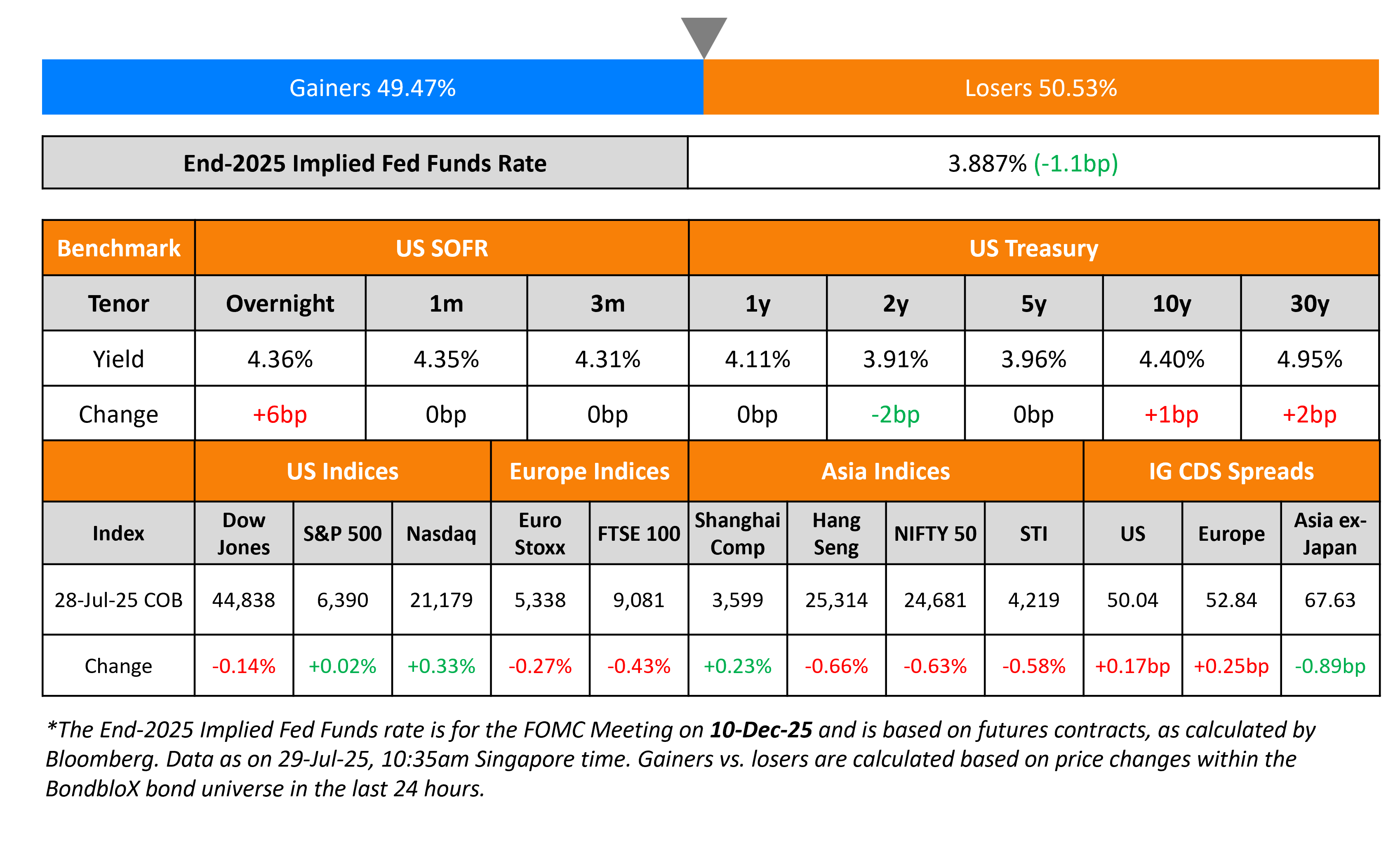

US Treasury yields were almost unchanged on Monday with no major data from the region. U.S. Trade Representative Jamieson Greer said that he is expecting trade talks with China to be more focused on “continued monitoring and checking in on the implementation” of their agreement thus far. He added that they were not expecting any “enormous breakthrough.” US Commerce Secretary Howard Lutnick said that a 90-day extension of the US-China trade truce is a likely outcome.

Looking at US equity markets, the S&P ended flat while the Nasdaq ended higher by 0.3% respectively. US IG CDS spreads were 0.2bp wider and HY CDS spreads widened by 0.9bp. European equity markets ended lower. The iTraxx Main CDS spreads widened by 0.3bp and Crossover CDS spreads widened by 1.4bp. Asian equity markets have opened lower today. Asia ex-Japan CDS spreads were 0.9bp tighter.

New Bond Issues

- Li & Fung $ 3.5NC2 at 9% area

- Astrea 9 Class A-1 S$615mn 15Y at 3.7% area / Class A-2 $200mn 15Y at 6% area

- Arada $450mn 5Y sukuk at 7.625-7.75% area

Deutsche Bank NY raised $2bn via a two-part deal. It raised $1.7bn via a 6NC5 bond at a yield of 4.95%, 32bp inside initial guidance of T+130bp area. It also raised $300mn via a 6NC5 FRN at SOFR+130bp vs. initial guidance of SOFR equivalent area. The senior non-preferred notes are rated Baa1/BBB/A-.

RBC raised $2.75bn via a three-trancher. It raised:

- $1.25bn via a 4NC3 bond at a yield of 4.498%, 22.5bp inside initial guidance of T+85bp area.

- $500mn via a 4NC3 FRN at SOFR+88bp vs initial guidance of SOFR equivalent area

- $1bn via a 6NC5 bond at a yield of 4.696%, 22bp inside initial guidance of T+95bp area

The senior unsecured notes are unrated. Proceeds will be used for general corporate purposes.

Community Health Systems raised $1.79bn via an 8.5NC3 bond at a yield of 9.75%. The senior secured notes are rated Caa1/B-/B. Proceeds, together with cash on hand will be used to refinance a portion of its outstanding 5.625% 2027s via a tender offer. The deal was upsized to $1.79bn from the initially planned $1.5bn raise.

New Bonds Pipeline

- Indonesia hires for A$ 5Y/10Y bond

Rating Changes

-

Moody’s Ratings affirms Oracle’s Baa2 rating; outlook revised to negative

-

PacifiCorp Downgraded To ‘BBB’ From ‘BBB+’ On Weaker Expected Financial Measures, Outlook Negative; Debt Ratings Lowered

-

Brenntag SE Outlook Revised To Negative On Weakening Credit Metrics; ‘BBB+’ Rating Affirmed

-

Moody’s Ratings downgrades Vaco’s CFR to Caa1 from B3; outlook is stable

-

Breitling Downgraded To ‘B-‘ On Ongoing Weaker Operating Performance And Credit Metrics; Outlook Stable

Term of the Day: STRIPS

Separate Trading of Registered Interest and Principal of Securities (aka STRIPS) are a type of Treasury bond that pay no interest or coupon. A typical coupon paying US Treasury is instead stripped/separated wherein, the principal and each interest payment become separate securities. Each separated piece is a zero-coupon bond that matures separately and, has only one payment (the final payment at maturity).

For instance, a 5Y Treasury bond becomes (a) a single principal payment due at maturity, and (b) ten semi-annual interest payments, over the next 5 years. Thus, the 5Y bond has now been separated/stripped into eleven new securities that have unique CUSIPs.

The minimum face value needed to STRIP is $100, and any par amount above that minimum must be a multiple of $100. Treasuries with a fixed-principal, such as notes, bonds, and TIPS are eligible and can be stripped. However, T-Bills and FRNs cannot. Individuals can buy/hold/sell/redeem STRIPS only through a financial institution, a broker, or dealer who handles government securities. Treasury STRIPS are sold at a discount to par (face value) and redeem at the face value.

STRIPS offer several advantages. They are simple to understand with predictable costs and payoffs. There is a wide bracket of maturity dates, where an investor can simply choose the STRIP that best fits the date when they may need cash. This helps investors prepare for specific goals. Besides, they are also backed by the “full faith and credit” of the US government. The BondbloX App allows onboarded users to track and trade STRIPS.

Talking Heads

On Bond Dealers’ Focus on Bills at Bessent’s Treasury

Phoebe White, JPMorgan

“The commentary we’ve heard recently suggested that there isn’t necessarily an urgency right now to start increasing long-end issuance, and that they can meet near-term needs with increased bill issuance,”

Alejandra Vazquez Plata and Jason Williams, Citigroup

If the Treasury continued to refrain from increasing note and bond issuance, the bill share would climb to 27% by 2028 — exceeding its peak in 2020, when sales were ramped up to pay for Covid relief — and to 41% by 2033

On The ‘Most Talked About Bond’ in London Being a Losing Bet

Chris Iggo, chief investment officer for core investments at AXA IM

“Everyone owns the 61s”

Megum Muhic, RBC Capital

“People are still holding onto the position hoping that it will work…It’s quite strange. It’s almost turned into a religion or something.”

Mark Taber, Private fixed income investor

“The idea people are going to quadruple their money on these 2061s is probably a little fanciful”

On Gold Price to Stay Above $3,000/oz as Flight to Safety Endures

David Russell, GoldCore

“The first half of 2025 confirmed what many of us have long believed. Gold is not just a hedge. It is a signal,”

Carsten Menke, Julius Baer

Gold has yet to reclaim April’s record highs, and “the short-term consolidation is set to continue as the market misses an imminent trigger to restart the rally…The multipolar world persists and with it the central banks’ desire to be less dependent on the U.S. dollar as a reserve currency”

Top Gainers and Losers- 29-Jul-25*

Go back to Latest bond Market News

Related Posts: