This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Lai Sun Struggles to Nail Down $446mn Loan Refinancing

July 24, 2025

Lai Sun Development has managed to only secure a partial syndicate backing for a HKD 3.5bn ($446mn) loan. Just 9 out of the 19 original lenders have onboarded for its planned five-year refinancing deal, sources said. Although the existing loan matures on 5 October, Lai Sun could still opt for partial repayment and refinance the remaining amount in case they do not manage to secure the target amount.

Lai Sun’s original loan was backed by its Cheung Sha Wan Plaza office tower, and they had offered about 160bp over the Hong Kong Interbank Offered Rate (HIBOR) for refinancing, said sources. Meanwhile, Lai Sun is also in talks to refinance a separate HKD 3.97bn ($506bn) loan backed by several onshore assets, with maturity coming up in early 2026.

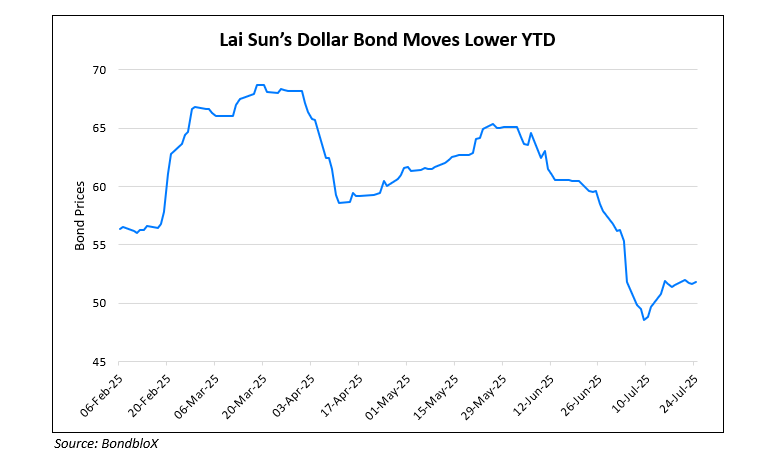

Lai Sun reported about HKD 117.8mn ($15mn) in losses for the first half of 2025, and its property sales fell by a third to HKD 617.2mn ($78.6mn). Lai Sun’s story underscores the serious condition of Hong Kong’s property downturn, where liquidity is scarce and lenders are wary. Lai Sun’s 5% 2026s have trended lower since May, as can be seen in the chart below. They have seen a slight recovery this month, and are currently trading at 51.8 cents to the dollar.

For more details, click here.

Go back to Latest bond Market News

Related Posts:

Dr. Peng Telecom Seeks Extension of its Dollar Bonds

February 2, 2021

Cathay Sells $650mn 5.5Y Bond at 4.875%

May 11, 2021

Cathay’s Granted $1bn Loan Extension

June 9, 2021