This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

KoGas, Mitsubishi Launch $ Bonds; Macro; Rating Changes; Gainers and Losers

June 27, 2023

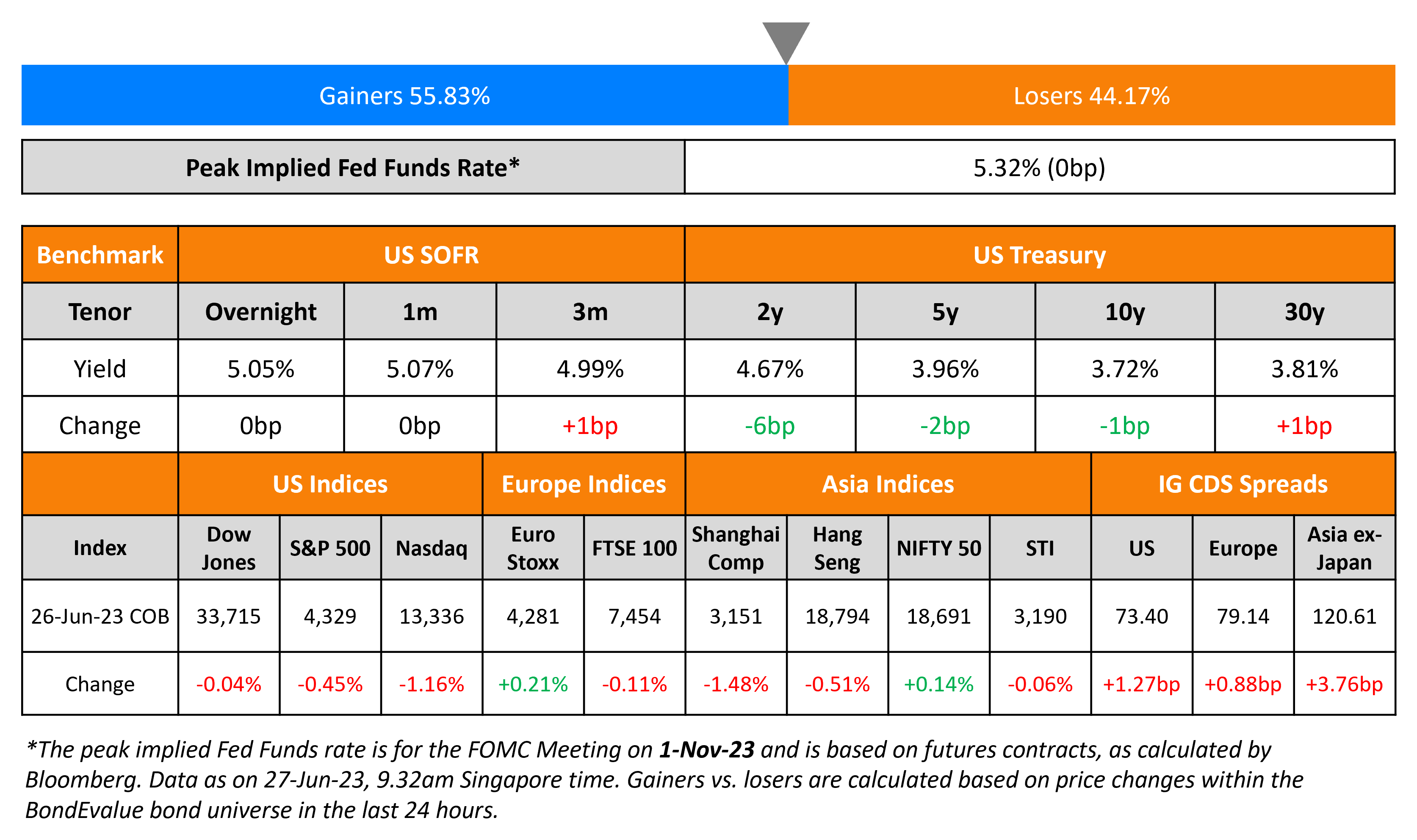

US Treasury yields have broadly steadied after having fallen 5-6bp earlier yesterday following the uncertainty out of Russia over the weekend. Markets continue to price in a 25bp hike in July with a 77% probability and expect them to stay at that level till the end of the year, as per CME probabilities. The peak Fed Funds rate was unchanged at 5.32%. US equity indices ended in the red again, with the S&P and Nasdaq down 0.5% and 1.2% lower respectively. Credit spreads continued to widen with the US IG and HY CDS spreads wider by 1.3bp and 7.9bp respectively.

European equity indices closed broadly flat, with European main and Crossover CDS spreads wider by 10.9bp and 6.4bp. Asia ex-Japan CDS spreads widened by 3.8bp. Asian equity markets have opened broadly higher this morning to begin the week. Pakistan unexpectedly hiked its policy rate by 100 basis points to 22% in an emergency meeting ahead of its last attempt to be able to revive its IMF loan program.

New Bond Issues

- KoGas $ 5Y at T+120bp area

- Mitsubishi $ 5Y at T+130bp area

Petrobras Global Finance raised $1.25bn via a 10Y bond at a yield of 6.625%, ~37.5bp inside initial guidance of low 7%s area. The senior unsecured bonds have expected ratings of Ba1/BB-/BB-. Proceeds will be used for general corporate purposes, which may include the repayment of outstanding indebtedness. This is Petrobras’ first dollar bond issuance since June 2021 when it raised $2.25bn via a 5.5% bond due 2051

ANZ raised $1.5bn via a two-tranche deal. It raised $1bn via a 2Y bond at a yield of 5.375%, 25bp inside initial guidance of T+90bp area, out of its New York branch. It also raised $500mn via a 2Y FRN at a yield of SOFR+75bp, 75bp wider than initial guidance of SOFR (Term of the Day, explained below) equivalent. The new 2Y fixed rate bonds are priced at a new issue premium of ~19bp to its existing 3.7% 2025s and 5.088% 2025s that yield 5.18% and 5.19% respectively. The senior unsecured notes have expected ratings of Aa3/AA-/A+. Proceeds will be used for general corporate purposes. The issuer may redeem the notes in whole but not in part for certain tax reasons.

Korean lender Nonghyup Bank raised $600mn via a 5Y social bond at a yield of 4.95%, 37bp inside initial guidance of T+135bp area. The senior unsecured notes have expected ratings of A1/A+, and received orders over $3.5bn, 5.8x issue size. Asset and fund managers took 49%, banks 34%, insurers and central banks 13% and private banks and others 4%. Regionally, APAC bought 74%, the US 17% and EMEA 9%. Proceeds will be used to (re)finance new and/or existing loans extended for projects that fall within the “access to essential services” category of eligible social assets that provide financial support to farmers and the agricultural sector.

Royal Bank of Canada raised €750mn via a 5Y bond at a yield of 4.212%, 20bp inside initial guidance of MS+125bp area. The senior unsecured bonds have expected ratings of A1/A/AA-, and received orders over €1.24bn, 1.7x issue size. Proceeds will be used for bail-in and general corporate purposes.

Rating Changes

- Fitch Downgrades Sino-Ocean to ‘CCC+’; Withdraws Ratings

- Fitch Downgrades Azure Power Restricted Groups to ‘B’; Maintains Rating Watch Negative

- Moody’s changes CICT’s outlook to stable; affirms A3 ratings

- Moody’s changes Minerva’s outlook to stable from positive; affirms Ba3 rating

Term of the Day

SOFR

Secured Overnight Financing Rate (SOFR) is a broad measure of the cost of borrowing cash overnight collateralized by Treasury securities. SOFR is calculated as a volume-weighted median of three rates – tri-party repo data collected from BNY Mellon, General Collateral Financing (GCF) Repo transaction data and data on bilateral Treasury repo transactions cleared through FICC’s DVP service, which are obtained from DTCC Solutions LLC. SOFR was selected as the representative rate for use in USD derivatives, and was suggested as an alternative to LIBOR.

Talking Heads

On Inflation and Monetary Policy – IMF deputy managing director Gita Gopinath

“Inflation is taking too long to get back to target…While headline inflation has eased significantly, inflation in services has stayed high, and the date by when it is expected to return to target could slip further…Financial stresses could generate tensions between central banks’ price and financial stability objectives…While central banks must never lose sight of their commitment to price stability, they could tolerate a somewhat slower return to the inflation target to avert systemic stress… Monetary policy should continue to tighten and then remain in restrictive territory until core inflation is on a clear downward path.”

On Policy Implementation to Counter Inflation

Agustin Carstens, general manager at the Bank for International Settlements (BIS)

“The time to obsessively pursue short term growth is past. Monetary policy must now restore price stability. Fiscal policy must consolidate…Unrealistic expectations that have emerged since the (GFC) and COVID-19 pandemic about the degree and persistence of monetary and fiscal support need to be corrected.”

Claudio Borio, head of monetary and economics unit at BIS

“I think central banks will get inflation under control. That is their job – to restore price stability…The question is what will the cost be…The easy gains have now been reaped and the last mile (to bring inflation back to safe levels) is going to be more difficult…I wouldn’t be surprised if there were more surprises.”

On an Expected Surge in Treasury Bills Supply Over the Next Few Months

Anshul Pradhan – head of US rates strategy at Barclays

“A worsening fiscal profile, amid fairly modest spending cuts, suggests that the upcoming supply deluge will not be limited to T-bills…The Treasury will soon need to increase auction sizes meaningfully across the curve. We believe the rates market is too complacent.”

Jay Barry, head of US government-bond strategy at JPMorgan

“(Waning demand from US banks and foreign accounts) will likely force the Treasury to rely on more price-sensitive buyers like hedge funds and asset managers. That could mean a higher term premium, narrower swap spreads and a steeper yield curve.”

Meghan Swiber, rates strategist at Bank of America

“(The combination of added Treasury bills supply and positive US growth) creates more question marks around who is the buyer base, especially if there is no recession…The largest threat to this coupon supply being absorbed smoothly is a soft landing for the economy or the Fed adding more rate hikes.”

Jim Cielinski, global head of fixed income at Janus Henderson

“…the interest rate bill is going to be much higher in the next three years. And excess global savings are dropping as the supply of debt goes up.”

On PBOC Fixing Its Daily Reference Rate for the Yuan

Christopher Wong, FX strategist at OCBC

“The fixing is a strong signal that PBOC does not like the recent excessive, one-side move especially from 7.20 to 7.25 so quickly…Any intervention probably only slows pace of yuan depreciation, and 7.25 probably will be seen as first line in the sand for now.”

Kiyong Seong, strategist at SocGen

“We believe the main interest of the PBOC is to maintain low interest environment in the onshore market, which is not compatible with a stronger yuan…The PBOC is likely to set the fixing stronger than the consensus on a sporadic basis. I don’t believe it will be a game changer though.”

Top Gainers & Losers – 27-June-23*

Other News

Credit Suisse Sent Thousands of Trades Late to Trace – Finra

Go back to Latest bond Market News

Related Posts: