This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Khazanah, Philippines, Far East Horizon Launch $ Bonds

August 28, 2024

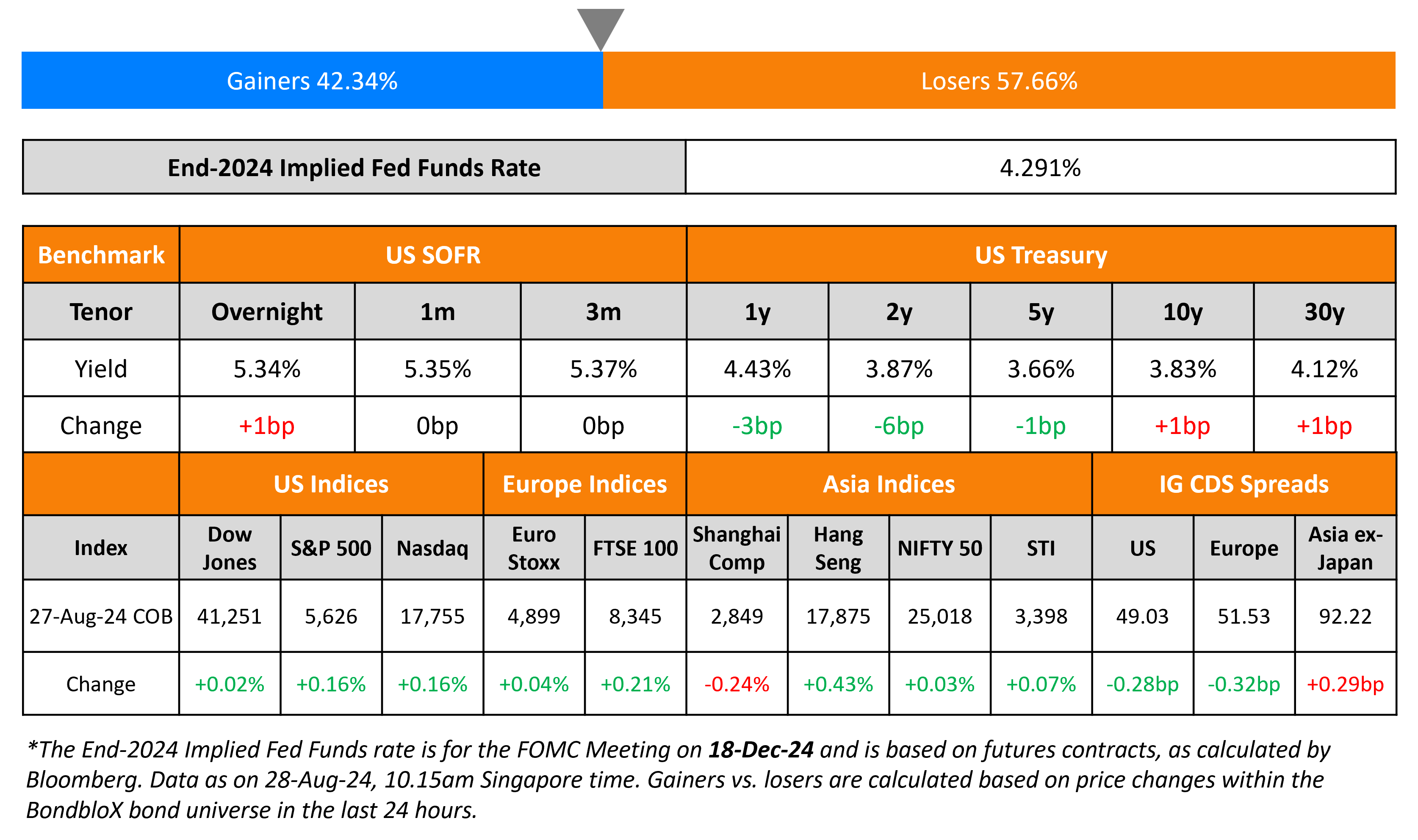

The US Treasury curve bull steepened, with the 2Y yield down 6bp, while yields across longer dated tenors held steady. The 2Y Treasury note auction saw solid demand with a bid-to-cover ratio of 2.68x, with indirect bids at 69%. The US Conference Board Consumer Sentiment Index rose to 103.3 in August vs. expectations of 100.8 and the prior month’s revised 101.9 reading. US IG CDS spreads tightened by 0.3bp and HY CDS spreads tightened by 0.8bp. Looking at US equity indices, the S&P and Nasdaq were up by 0.2% each.

European equity markets inched higher too. Looking at Europe’s CDS spreads, the iTraxx Main spreads tightened 0.3bp and Crossover spreads were tighter by 2bp. Asian equity indices have opened lower this morning. Asia ex-Japan CDS spreads were 0.3bp wider.

New Bond Issues

-

Far East Horizon $ 3.5Y at T+270bp area

-

Khazanah $ 5Y/10Y at T+115/125bp area

-

Philippines $ 5.5Y/10.5Y/25Y at T+110/125bp/5.5% area

BOC Aviation raised $500mn via a 7Y bond at a yield of 4.808%, 35bp inside initial guidance of T+140bp area. The senior unsecured notes are rated A-/A- (S&P/Fitch). Proceeds will be used for new capex, general corporate purposes and/or refinancing of existing borrowings.

Allianz raised $1.25bn via a 30NC10 bond at a yield of 5.6%, 40bp inside initial guidance of 6%. The new Tier 2 notes are rated A1/A+. If not called by 3 September 2034, the coupons will reset to the 5Y CMT plus 277.1bp, including a coupon step-up of 100bp. Proceeds will be used for general corporate purposes, including the potential refinancing of existing debt.

New Bond Pipeline

-

San Miguel Global Power hires for $ bond

Rating Changes

- Moody’s Ratings upgrades Uber’s senior unsecured notes to Baa2; outlook stable

- Manila Electric Co. Upgraded To ‘BBB’ From ‘BBB-‘ On Robust Financials; Outlook Stable

- Blackstone Mortgage Trust Outlook Revised To Negative On Weaker Asset Quality And Rising Leverage; ‘B+’ Ratings Affirmed

- Moody’s Ratings affirms the ratings of The Toronto-Dominion Bank (A1 junior senior unsecured); outlook changed to negative

- Moody’s Ratings affirms AAC Technologies’ Baa3 ratings, revises outlook to stable from negative

Term of the Day

Bid-to-cover

Bid-to-cover is a ratio of the number of bids or orders received for a particular security issuance vs. the amount issued. The bid-to-cover ratio indicates the demand for an issuance – higher the ratio, higher the demand and lower the ratio, lower the demand.

Talking Heads

On Investors Bracing for US Junk Debt’s Last Gasp Before Election

Marc Warm, UBS Group

“A lot of supply that is visible and coming in September and October is M&A that has been signed up in past months. This is the natural time table”

Cade Thompson, KKR & Co.

“The pipeline for M&A is robust. While lately this hasn’t translated into increased transaction volumes, expectations of upcoming rate cuts could catalyze activity”

On Fed Bets Fueling Best Month of 2024 for Latin America Local Debt

Thierry Larose, a money manager at Vontobel Asset

“The end of US exceptionalism, which would translate to a more dovish Fed and a weaker dollar, would be a tailwind for EM local bonds”

Alejo Czerwonko, UBS Global Wealth

“We believe the majority of emerging markets have room to cut interest rates further, to varying degrees… start of a Fed easing cycle this September will support them”

Edwin Gutierrez, Abrdn Plc.

“We have been favoring rates trades in the region (Colombia and Peru)”

On ‘T-Bill and Chill’ a Hard Habit for Investors to Break

Kathy Jones, Charles Schwab & Co.

“Doesn’t make a whole lot of sense for $6 trillion-plus to be sitting in money market funds if the yield is going to go down”

John Queen, Capital Group

“Cash is actually offering some yield and I can understand why people are sort of gravitating to that”

Top Gainers & Losers-28-August-24*

Other News

Moody’s warns of significant ratings impact for Israel from all-out conflict

Go back to Latest bond Market News

Related Posts:

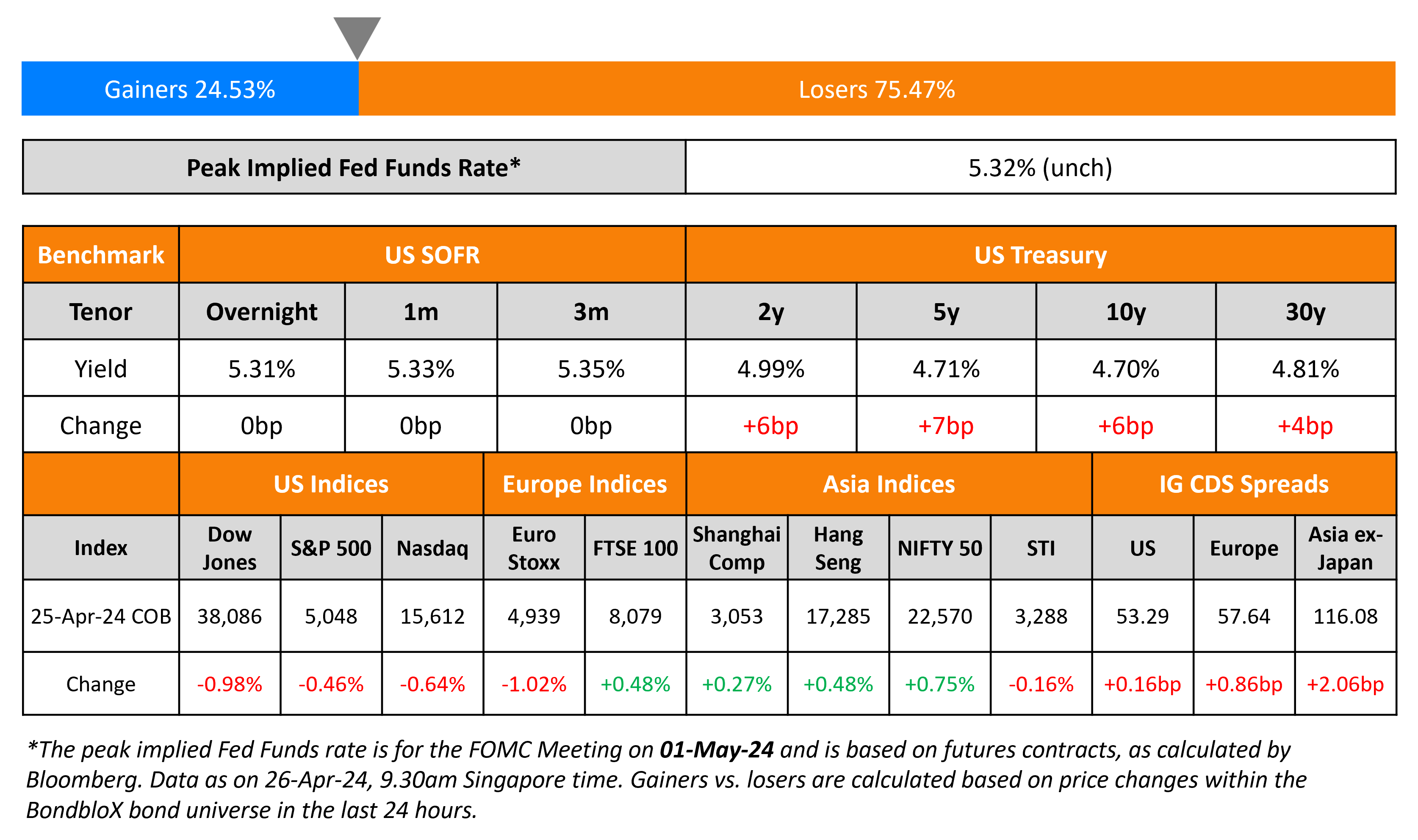

US GDP Softens; KIB Prices $ AT1

April 26, 2024

Turkey, FAB, Astrea Price Bonds; Muthoot Taps 2028s

July 10, 2024