This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Kenya’s Bond Buyback May Constitute a Default, says Moody’s

August 3, 2023

Kenya’s dollar bonds ticked lower by ~1 point after Moody’s warned that a planned buyback of half of Kenya’s 6.875% 2024s might constitute a default. Kenya’s President had earlier announced it will buy back half of the $2bn outstanding bonds. However, vice president and senior credit officer at Moody’s David Rogovic has warned that redeeming the bonds at a price below par would constitute a “distressed exchange” and hence constitute a default under Moody’s definition. He pointed to the need for more details about the buyback before a decision is made but believes that the Kenyan government is able to repay the bond. As the country’s hard currency reserves currently stand at only $7.4bn, investors have cast concerns over Kenya’s debt levels, worrying that the country will be forced to restructure their debt like other African nations such as Ghana and Zambia.

Kenya’s 6.875% 2024s have ticked 0.3 points lower and are trading at 95.1 cents on the dollar currently, yielding 12.9%.

For more information, click here

Go back to Latest bond Market News

Related Posts:

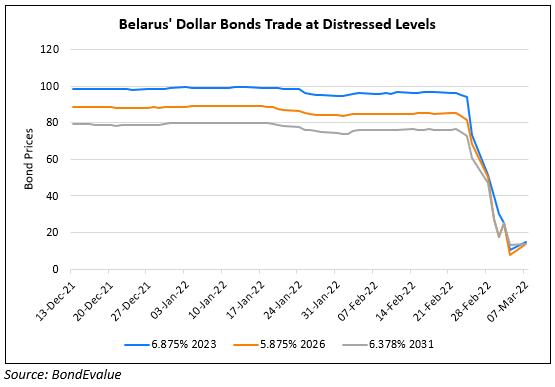

Belarus Downgraded to CCC by S&P

March 7, 2022

IMF Delays $238mn Kenya Loan for Budget Purposes

June 28, 2022

Turkey Downgraded to B from B+ by Fitch

July 12, 2022