This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Kenya to Decide on New IMF Deal as Current Program Nears End

September 30, 2024

Kenya’s Treasury announced that it will decide on the nature of its next IMF program after the current $3.6bn arrangement expires in April. Chris Kiptoo, the Treasury Principal Secretary of Kenya, stated that a decision has not been made yet but mentioned that discussions for a new program are ongoing. He emphasized the importance of the IMF as a development partner. Kenya may opt for a new funded program or possibly consider alternatives, as it had previously utilized a $1.5bn stand-by credit facility, which went unused by its 2018 expiration. Kenya is in dire state as it awaits a long-delayed $600mn disbursement from the IMF. Kenya’s income targets have also taken a hit after it scaled back the tax reforms as a result of violent protests all over the country. The sovereign was downgraded soon after by Moody’s, S&P and Fitch citing deteriorating fiscal and debt outlook. Last week, the African nation was reported to be in talks with Abu Dhabi for $1.5bn loan financing.

Kenya’s dollar bonds traded broadly stable with its 6.3% 2034s at 82.2, yielding 9.2%.

For more details, click here

Go back to Latest bond Market News

Related Posts:

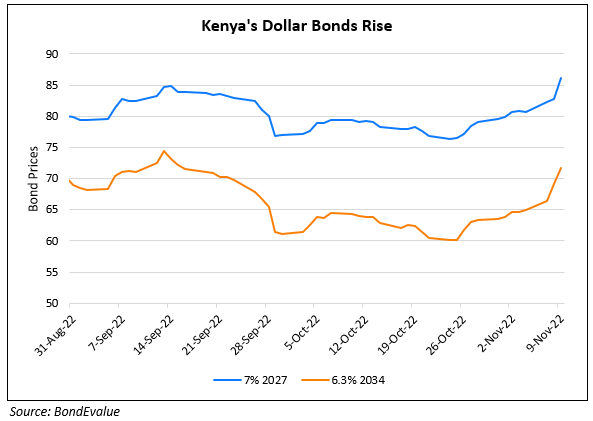

Kenya’s Dollar Bonds Jump Higher on IMF Agreement

November 10, 2022

Kenya to Receive $447mn from IMF to Address Debt and Reforms

December 20, 2022