This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Kazakhstan, Apollo, Mazoon Price $ Bonds

October 4, 2024

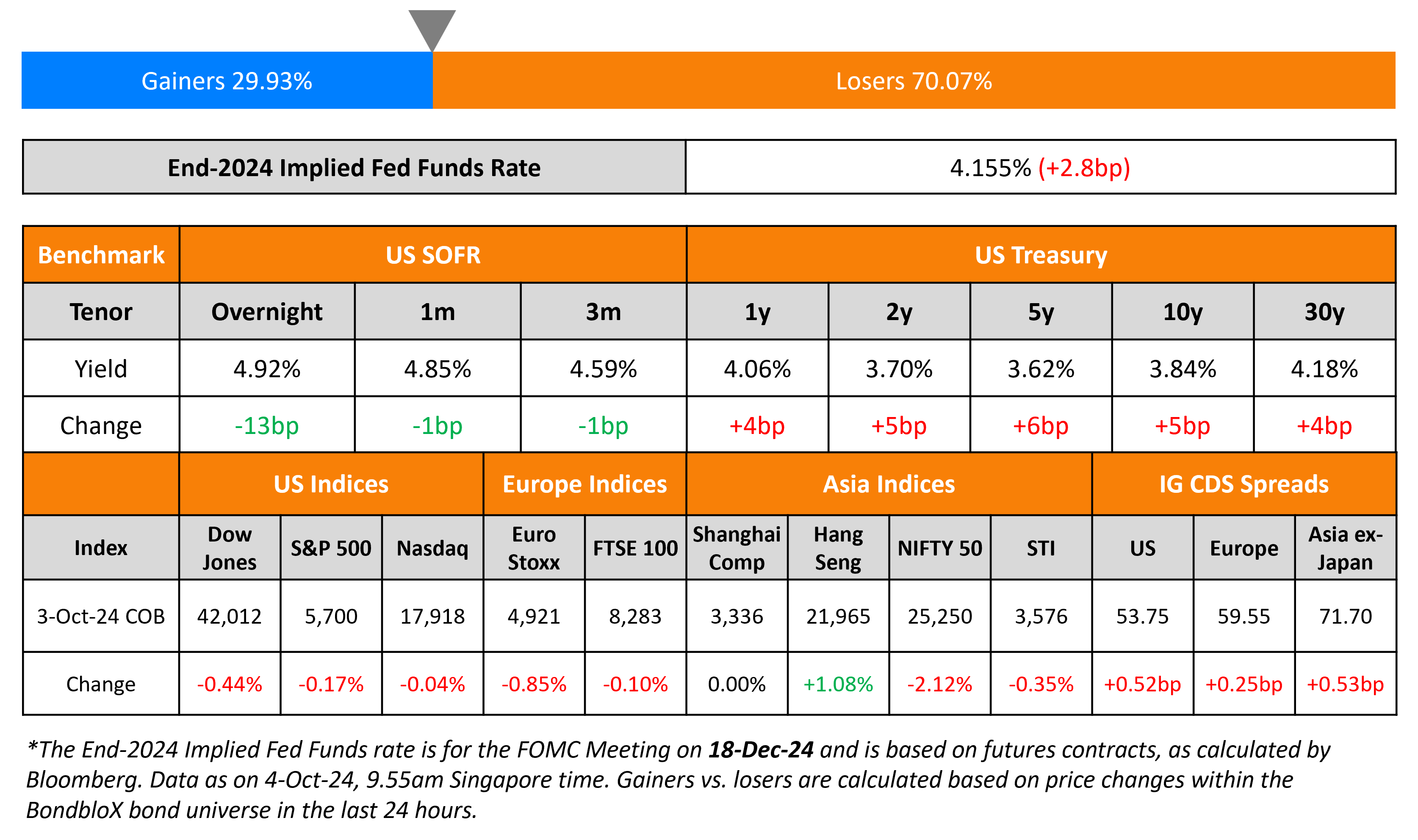

US Treasury yields rose across the board yesterday, by about 4-6bp. This comes on the back of stronger than expected ISM Services data for the month of September. The final print came in at 54.9, beating estimates of 51.7 and the prior month’s 51.5 reading. Additionally, although the initial jobless claims for this week came in worse than initially expected at 225K, analysts still remarked that it was still a level that indicated low layoffs. Markets have slightly revised down the number of rate cuts they expect by end-2024 from 75bp earlier this week, to just over 65bp as seen from the Implied Fed Funds Futures Rate. Following this, markets will be closely watching the change in NFP and Unemployment Rate for the month of September, which will be released later this evening. Separately, Chicago Fed’s Austan Goolsbee remarked that interest rates must come down by “a lot” over the course of the next year. He said that while inflationary pressures have eased, and the job market is where it needs to be, rates need to come down significantly in 2025 to keep it at that level.

US IG and HY CDS widened by 0.5bp and 5bp respectively. Looking at US equity markets, S&P and Nasdaq both closed lower. European equities have followed suit and have closed lower too. In terms of Europe’s CDS spreads, the iTraxx Main and Crossover spreads widened by 0.3bp and 3.2bp respectively. Asian equity indices have opened mixed this morning. Asia ex-Japan CDS spreads widened by 0.5bp.

New Bond Issues

Apollo Global raised $500mn via a 30NC10 bond at a yield of 6%, 50bp inside initial guidance of 6.5% area. The junior subordinated notes are rated A3/BBB+/BBB+. Proceeds will be used for general corporate purposes, including redeeming in full its $300mn AMH 4.95% 2050s, and to pay fees and expenses regarding the offering.

Kazakhstan raised $1.5bn via a long 10Y bond at a yield of 4.714%, 32bp inside initial guidance of T+120bp area. The senior unsecured bonds are rated Baa1/BBB-/BBB. This was Kazakhstan’s first dollar bond offering since 2015 after a legal dispute that raised the threat of asset seizures was resolved earlier this year.

Nama (NEDC) raised $750mn via a 7Y sukuk at a yield of 5.295%, 30bp inside initial guidance of T+195bp area. The senior unsecured notes are rated Ba1/BB+ (Moody’s/Fitch), and received orders of over $2.4bn, 3.2x issue size. Mazoon Assets Co SAOC is the issuer of the notes. Nama’s sukuk offers a 27.5bp yield pick-up over the Oman sovereign’s 6.25% 2031s (rated Ba1/BBB-/BB+) that currently yield 5.02%.

Piramal Capital raised $150mn via a tap of its 7.8% 2028s at a yield of 7.08%, 8.8bp inside initial guidance of 7.166% area. The notes are rated Ba3/BB-. Proceeds will be used in accordance with its sustainable finance framework.

Rating Changes

-

Moody’s Ratings upgrades CEMIG’s rating to Ba1, outlook stable

-

Moody’s Ratings upgrades Plains All American to Baa2 with stable outlook

-

Moody’s Ratings upgrades Açu Petroleo’s rating to Ba1, outlook stable

-

Moody’s Ratings upgrades Lippo Karawaci’s CFR to B3; outlook positive

-

Moody’s Ratings upgrades State Grid Brazil Holding to Baa2, outlook positive

-

Fitch Upgrades Banco BMG S.A.’s IDR to ‘BB-‘ and National Scale Rating to ‘A(bra)’; Outlook Stable

-

Moody’s Ratings downgrades IFS ratings of MBIA’s insurance subsidiaries

Term of the Day

Haircut

Haircut refers to a reduction in value of an asset for the purpose of calculating either margin requirements, level of collateral or salvage value. The haircut is generally stated as a percentage and is the difference between the value of the asset and its reduced value. For example, in a restructuring, if a bond worth $100mn faces a haircut of 20%, then holders would receive only $80mn. In the case of a loan, if the collateral is worth $100mn, a haircut of 30% would imply that a loan of $70mn, giving the lender a cushion in case the market value of the collateral falls.

Talking Heads

On China’s Stock Boom May Turn to Bust as in 2015 – Nomura

“While investors might still be OK to indulge in the boom for now, a more sober assessment is required”… baseline scenario is a bubble that busts “on a smaller scale”

On Markets Can Thwart Any Trump Effort to Sway Fed – JPMorgan

“Another possible check on an attempted removal of a sitting Fed chair is the reaction of financial markets. As president, Trump was very attuned to asset prices as a scorecard on his administration… Ousting a chair as respected as Powell could provoke sharp reaction”

On Dollar Rally Signaling Trader Angst About Global Rate-Cut Path

Kathleen Brooks, XTB

“There is an increased risk of a stronger payrolls report for September, which could trigger larger than usual moves in US stocks and the dollar. High levels of risk aversion combined with a US payrolls report is a volatile mix”

Jayati Bharadwaj, TD Securities

“We have been pointing to how the US dollar was looking cheap and oversold and was bound for a bounce higher”

Top Gainers and Losers- 04-October-24*

Go back to Latest bond Market News

Related Posts: