This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

JPM, Citi, MAF Price Bonds

October 16, 2025

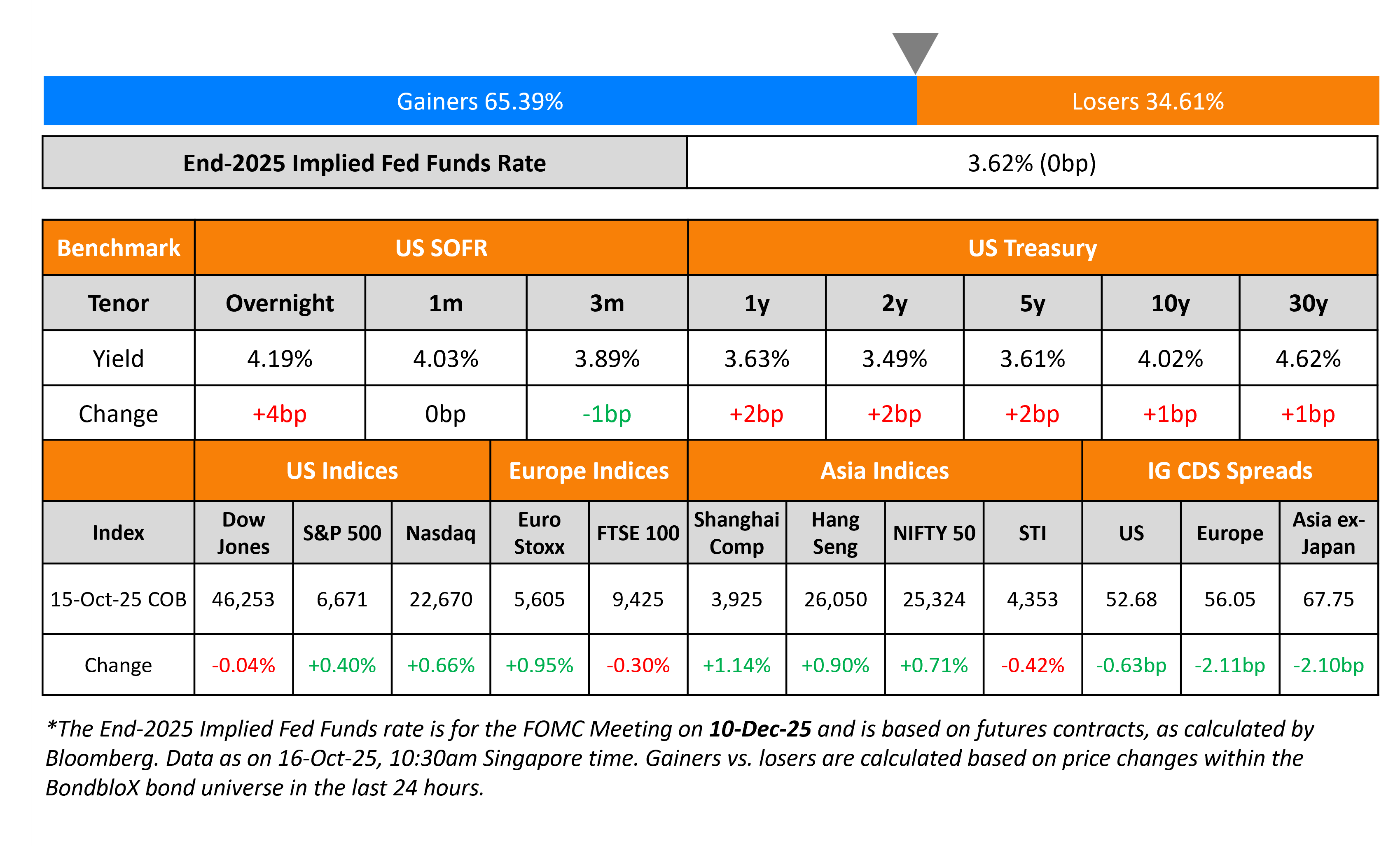

US Treasury yields were broadly stable across the curve yesterday. US sold around $95bn of 6-week T-bills in an auction yesterday. According to Chicago Fed estimates, the retail sales excluding autos and parts saw a 0.5% increase last month after advancing 0.7% in August. Fed Reserve governor Stephen Miran said that the US-China trade tensions pose a “material” downside risk to the economic outlook, and urged to quickly get to a more neutral policy by cutting benchmark rates. Separately, Boston Fed Susan Collins said that the US central bank should continue lowering interest rates this year to support the labor market. She added that the mildly restrictive monetary policy is appropriate for ensuring that inflation resumes its decline once tariff effects filter through the economy.

Looking at equity markets, both the S&P and Nasdaq ended higher by 0.4% and 0.7% respectively. The US IG and HY CDS spreads tightened by 0.6bp and 4.5bp respectively. European equity indices ended mixed. The iTraxx Main CDS spreads were 2.1bp tighter while the Crossover spreads were 6.1bp tighter. Asian equity markets have opened broadly higher today. Asia ex-Japan CDS spreads were 2.1bp tighter.

New Bond Issues

- Terawulf $3.2bn 5NC2 at 8% area

- Stockland Trust A$ 10Y at ASW + 150bp area

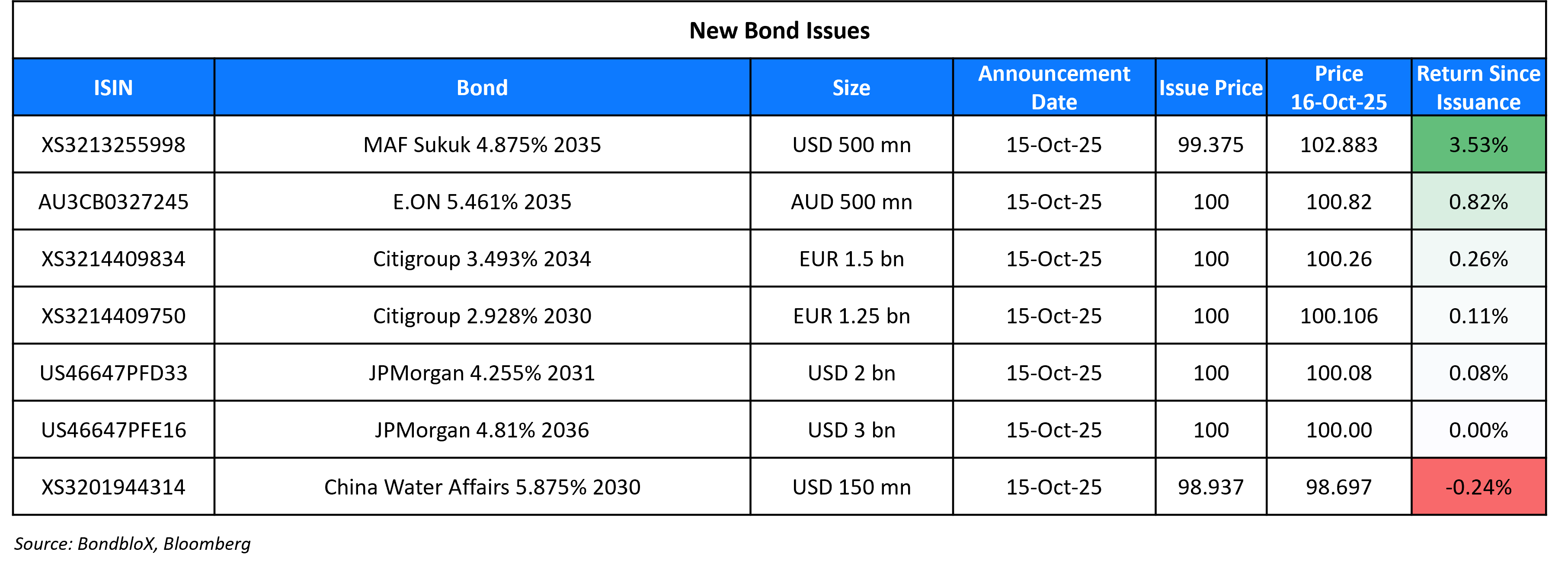

JP Morgan raised $5bn in two tranches. It raised:

- $2bn via a 6NC5 bond at a yield of 4.255%, 30bp inside initial guidance of T+90-95 area

- $3bn via a 11NC10 bond at a yield of 4.81%, 28bp inside initial guidance of T+105 area

The bonds have an optional call redemption at par, one year prior to maturity. Proceeds will be used for general corporate purposes.

Citigroup raised €2.75bn in two tranches. It raised:

- €1.25bn via a 5NC4 bond at a yield of 2.928%, 32bp inside initial guidance of MS+105 area

- €1.5bn via a 9NC8 bond at a yield of 3.493%, 32bp inside initial guidance of MS+135 area

The senior unsecured notes are rated A3/BBB+/A (Moody’s/S&P/Fitch).

Majid Al Futtaim (MAF) raised $500mn via a 10Y sukuk at a yield of 4.955%, 30bp inside initial guidance of T+125bp area. The senior unsecured sukuk is rated BBB/BBB (S&P/Fitch). MAF Sukuk Ltd is the issuer of the notes while Majid Al Futtaim Properties LLC is the obligor. Proceeds will be used for general corporate purposes.

China Water Affairs raised $150mn via a 5NC3 guaranteed bond at a yield of 6.125%, 25bp inside initial guidance of 6.375% area. The senior blue bond is rated Ba1/BB+ (Moody’s/S&P). The bond is callable in the 3rd year and 4th year at 102.938% and 101.469% respectively. Proceeds will be used to repay certain offshore indebtedness and to finance or refinance, in whole or in part, eligible green projects, particularly water supply projects, in accordance with the Green & Blue Finance Framework.

E.ON raised A$500mn via a 10Y Green bond at a yield of 5.461%, 12bp inside initial guidance of ASW+150bp area. The senior unsecured bond is rated Baa2/BBB+/BBB+. Net proceeds will be used to finance and/or refinance Eligible Green Projects as defined by E.ON’s Green Bond Framework dated December 2021.

New Bonds Pipeline

- Avation $300-400mn, up to 5.5NC2 Bond

-

Republic of Korea $ 5Y bond

- GS Caltex $ 5Y bond

Rating Changes

- Seagate Technology Holdings PLC Upgraded To ‘BB+’ From ‘BB’ On Strong Recovery; Outlook Stable

- Moody’s Ratings upgrades Intralot’s ratings to B2 with a stable outlook

- IAMGOLD Corp. Upgraded To ‘BB-‘ From ‘B’ On Improving Cash Flow, Planned Debt Reduction; Outlook Stable

- Fitch Downgrades Mediobanca to ‘BBB-‘ on MPS’s Takeover; Outlook Stable

- Anadolu Efes Biracilik ve Malt Sanayii AS Downgraded To ‘BB’ On Weak Cash Flow Generation In Turkiye; Outlook Negative

- Coca-Cola Icecek A.S. ‘BB+’ Ratings Affirmed On Forecasted Credit Metric Improvement; Outlook Revised To Stable

- Kilroy Realty Corp. Outlook Revised To Negative On Pressured Operating Performance; ‘BBB-‘ Ratings Affirmed

Term of the Day

Green Bonds

Green bonds are bonds whose proceeds are used towards financing projects that have a positive environmental impact such as renewable energy. The first green bond was issued by the European Investment Bank in 2007. Since then, the bond markets have seen green bond issues from supranationals such as The World Bank, sovereigns and corporates.

Talking Heads

On US Data Darkness Spreading Globally

Kazuo Ueda, BOJ Governor

“It’s a serious problem. We hope this gets fixed soon.”

Robert Kahn, Eurasia Group

“Certainly, there is still a great deal of information out there, and policymakers are dedicating substantial effort to gather micro data and anecdotal evidence. But how best to put it together, and importantly how markets will react to such news, are critical unknowns. As time goes on, the risk of error rises as uncertainties compound.”

On Thai Banks Facing Revenue Hit – Fitch

Thailand’s post-pandemic recovery has been weaker than that of regional peers, and economic prospects in 2025 and 2026 are likely to remain weak amid global uncertainties, adding pressure on banks. Household debt puts pressure on the ability of clients to repay loans, reducing banks’ appetite for lending.”

On BOJ Moving With Slower Rate Hikes

Nada Choueiri, IMF

“Going forward, gradualism is very important because of the degree of uncertainty. It’s important to be gradual, very gradual, and look at all the data that is coming through. We have not seen worrisome signs of overheating in terms of consumption and underlying inflation. I would disagree that they are behind the curve.”

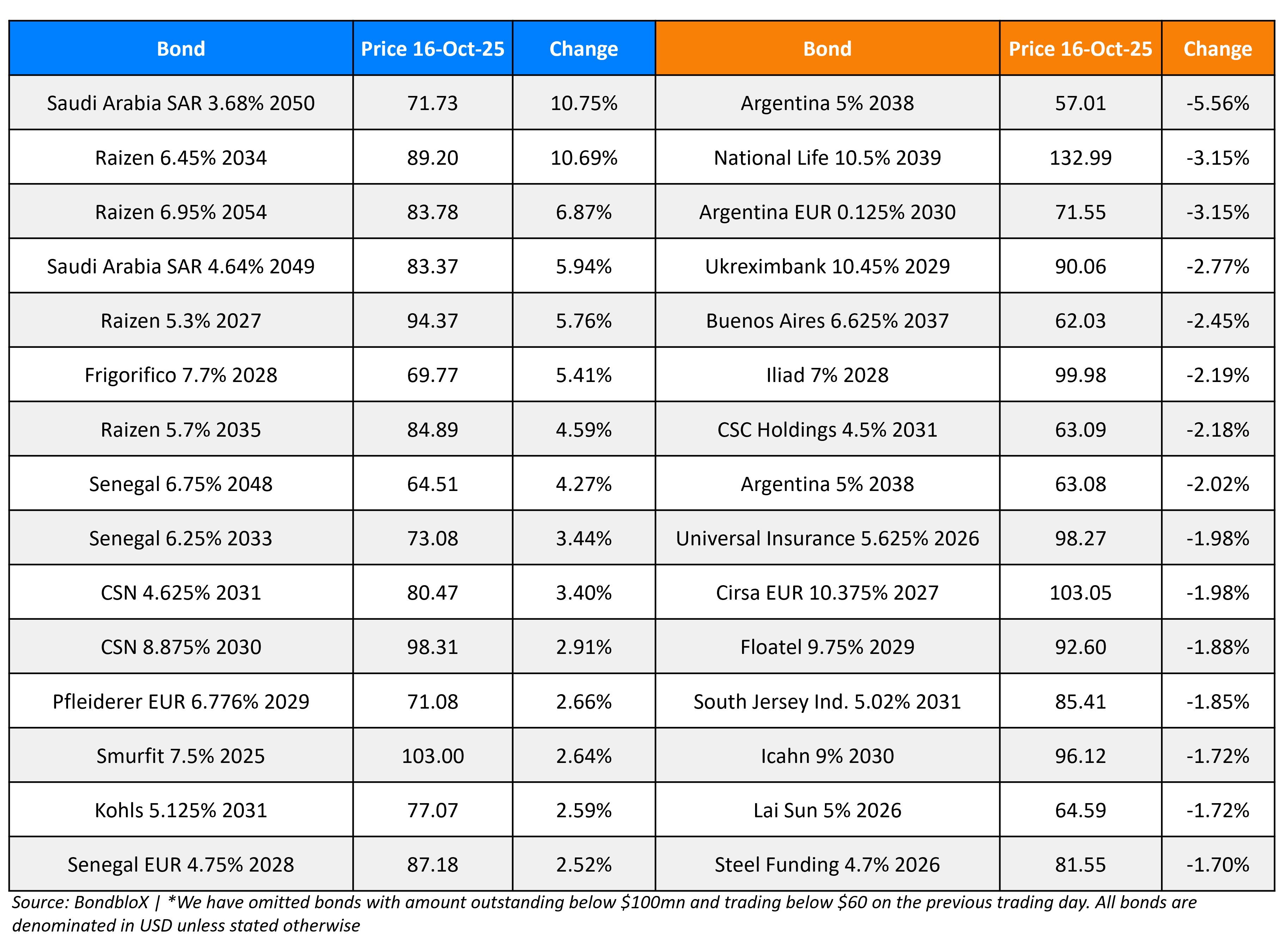

Top Gainers and Losers- 16-Oct-25*

Go back to Latest bond Market News

Related Posts: