This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Job Openings For April Higher at 7.391mn; AIA, Macquarie Launch Bonds; NAB Raises $2.25bn; Ukraine Downgraded to ‘D’

June 4, 2025

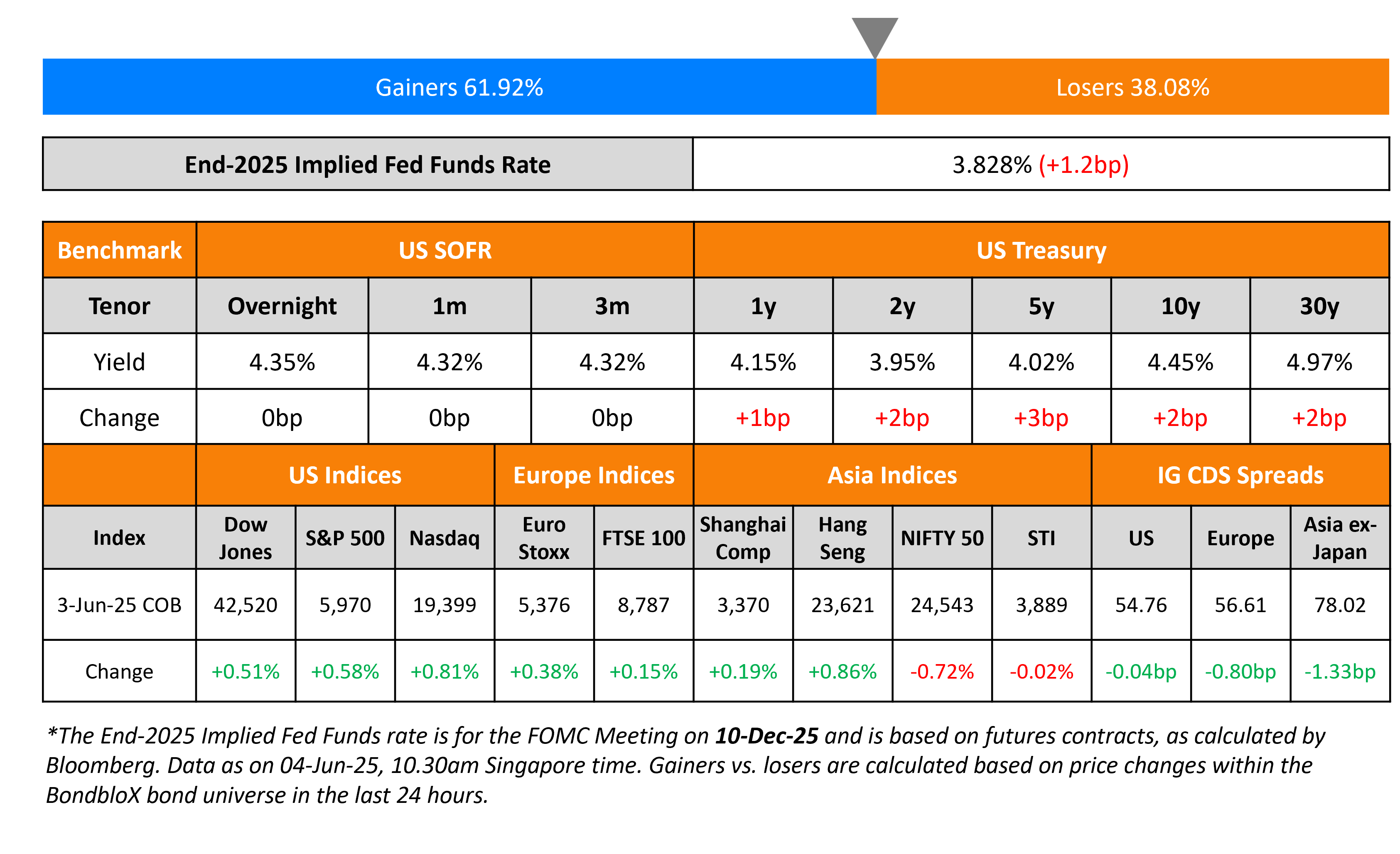

US Treasury yields moved higher by 2-3bp on Tuesday. US JOLTS Job Openings for April came-in higher at 7.391mn, vs. expectations of 7.11mn. Atlanta Fed President Raphael Bostic commented that the best approach for monetary policy was to be patient and that he would like to see a lot more progress on inflation before moving interest rates. Separately, US President Donald Trump signed an order doubling tariffs on steel and aluminium imports from 25% to 50%. This is the second hike in import taxes on metals since March.

Looking at US equity markets, S&P and Nasdaq were higher by 0.6% and 0.8% respectively. Looking at credit markets, US IG spreads remained flat whereas HY CDS spreads tightened by 2.2bp. European indices ended in green yesterday. Looking at credit markets, the iTraxx Main and Crossover CDS spreads tightened by 0.8bp and 4.4bp respectively. Asian equity markets have opened higher today. Asia ex-Japan IG CDS spreads tightened by 1.3bp.

New Bond Issues

- AIA S$ 10Y Tier-2 at 4% area

- Macquarie Bank $ 3Y at T+75bp area

NAB raised $2.25bn via a three-tranche deal. It raised:

- $750mn via a 3Y bond at a yield of 4.308%, 25bp inside initial guidance of T+65bp area. The new bond was priced roughly in line with its existing 4.9% 2028s that currently yields 4.28%

- $750mn via a 5Y FRN at SOFR+65bp, vs initial guidance of SOFR equivalent area

- $750mn via a 5Y bond at a yield of 4.534%, ~25bp inside initial guidance of T+75/80bp area. The new bond was priced at a new issue premium of ~8bp over its existing 4.9% 2030s that currently yields 4.45%

These senior bank notes are rated Aa2/AA-. Proceeds will be used for general corporate purposes.

Wing Tai raised S$200mn via a 7Y bond at a yield of 3.83%, 22bp inside initial guidance of 4.05% area. The senior unsecured note is unrated. Proceeds will be used for working capital, for Wing Tai’s and its subsidiaries’ investments and to refinance existing borrowings. Private banks received a 25 cent concession.

Hotel Properties raised S$220mn via a 5Y bond at a yield of 4.4%, 25bp inside initial guidance of 4.65% area. These unsecured bonds are unrated.

Hong Kong raised ~$2.14bn via a multicurrency green two-trancher. It raised $1bn via a 5Y green bond at a yield of 4.151%, 38bp inside initial guidance of T+50bp area. It also raised €1bn ($1.14bn) via an 8Y bond at a yield of 3.155%, 25bp inside initial guidance of MS+100bp area. Proceeds will be used to finance and/or refinance projects that fall under one or more of eligible categories under its green bond framework.

Qatar Islamic Bank (QIB) raised $750mn via a 5Y sukuk at a yield of 4.803%, ~37.5bp inside initial guidance of T+115/120bp area. The senior unsecured sukuk is rated A, and received orders of over $1.5bn, 2x issue size. The new bond was priced at a new issue premium of ~20bp over its existing 4.485% sukuk due 2029 that currently yields 4.60%.

BNY Mellon raised $2bn via a three-tranche deal. It raised:

- $750mn via a 3NC2 bond at a yield of 4.441%, 27bp inside initial guidance of T+75bp area. The new bond was priced at a new issue premium of ~3bp over its existing 4.543% 2029s that currently yields 4.41%.

- $500mn via a 3NC2 FRN at SOFR+68bp, vs initial guidance of SOFR equivalent area

- $750mn via a 11NC10 bond at a yield of 5.316%, 25bp inside initial guidance of T+25bp area

These senior unsecured notes are rated Aa3/A/AA-/AA -. Proceeds will be used for general corporate purposes.

Rating Changes

- Moody’s Ratings upgrades Seplat’s CFR to B2 from Caa1; Outlook changed to stable from positive

- Moody’s Ratings upgrades the long-term deposit ratings of Nigerian banks to B3 from Caa1, changes the outlook to stable from positive

- Ukraine Issue Rating Lowered To ‘D’; ‘SD’ FC Ratings And ‘CCC+/C’ LC Ratings Affirmed; LC Outlook Stable

- Fitch Revises Tereos’s Outlook to Stable; Affirms IDR at ‘BB’

- Arab Bank (Bahrain) Outlook Revised To Negative Following Same Action On Sovereign; Affirmed At ‘B+/B’

Term of the Day: Revolving Credit

Revolving credit is a form of borrowing where the credit line has a maximum limit but the borrower can access it in any quantum based on their funding needs. In a normal borrowing, once the loan has been repaid, the borrower must take a new loan to borrow more. In revolving debt, the borrower can re-access any funds that have been paid back too. Revolving debt generally comes with a higher interest rate and does not necessarily have a fixed coupon.

Talking Heads

On Monthly Inflation Number Just One Data Point – Petra Tschudin, SNB

“We’re focused on the medium term…periods of sub-zero inflation typically have coincided with an appreciation of the franc…The uncertainty in connection to the trade-policy situation is very great”

On Importance of Price Stability – Lisa Cook, Federal Reserve Governor

“I will carefully consider how to balance our dual mandate, and I will take into account the fact that price stability is essential for achieving long periods of strong labor market conditions…appear to be increasing the likelihood of both higher inflation and labor-market cooling…I see higher inflation and slower activity as a result of these tariffs…high inflation could make firms more willing to raise prices and consumers more likely to expect high inflation to persist”

Go back to Latest bond Market News

Related Posts: