This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Jiangyin Launches € 3Y Bond

November 28, 2025

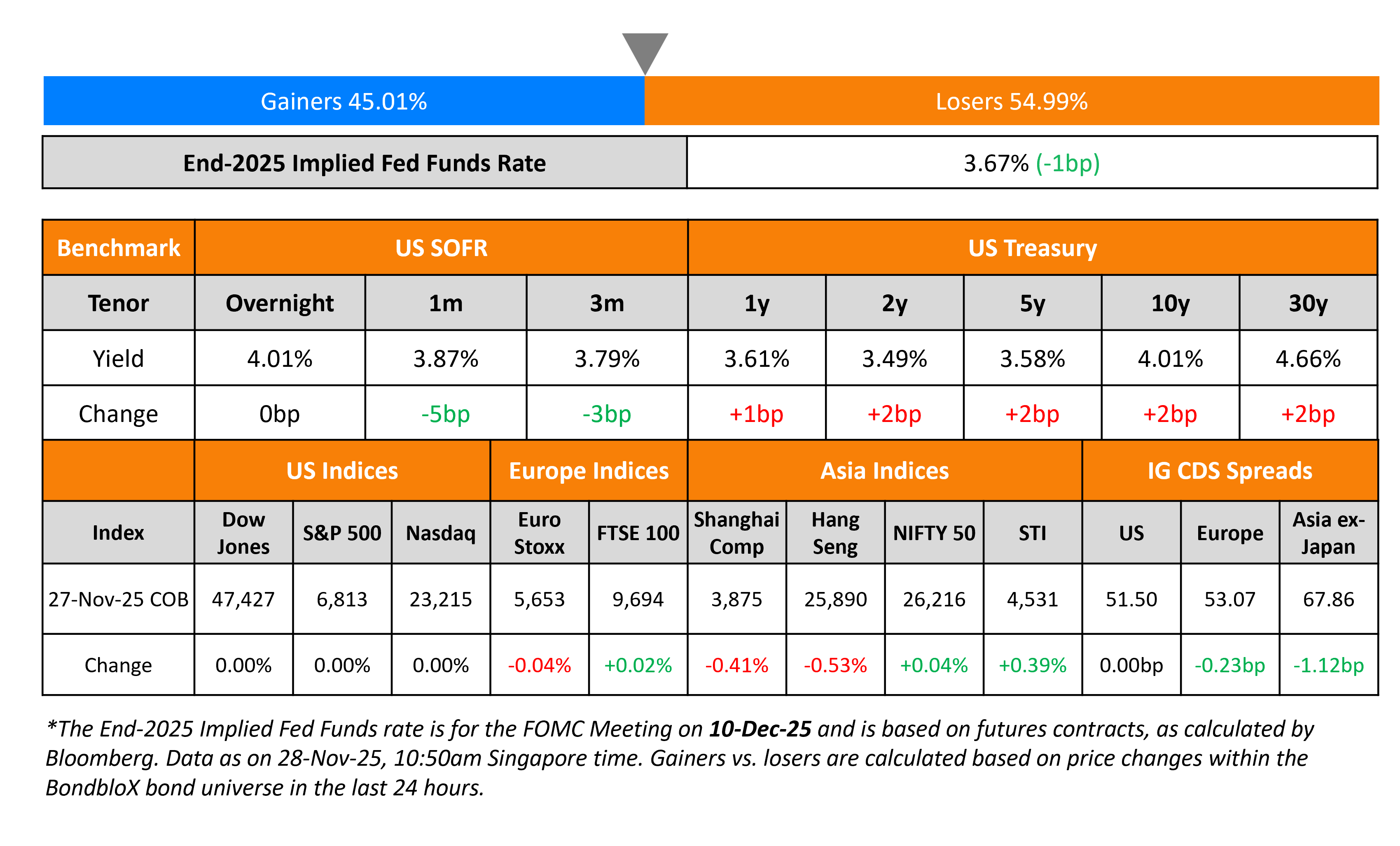

US Treasury yields have ticked higher by 2bp. Due to the Thanksgiving holiday, there were no major macro data points. Besides, US equity and credit markets were also closed. European equity indices were broadly stable. The iTraxx Main CDS and Crossover CDS spreads were 0.2bp and 0.2bp tighter respectively. Asian equity markets have opened mixed this morning. Asia ex-Japan CDS spreads were 1.1bp tighter.

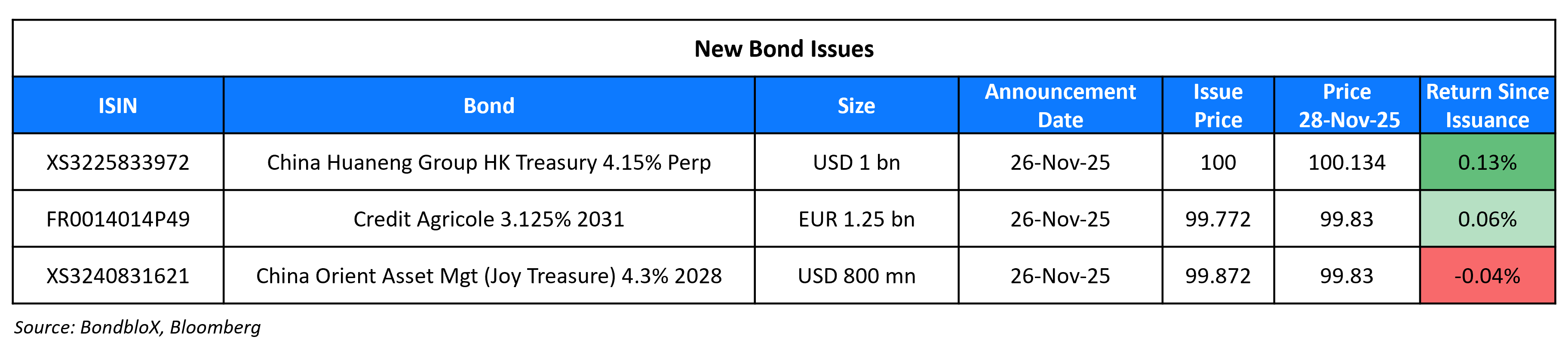

New Bond Issues

- Jiangyin State-owned Assets € 3Y at 3.15% area

Rating Changes

- Fitch Upgrades Salik Company PJSC to ‘A’; Outlook Stable

- Moody’s Ratings downgrades Raízen to Ba1 from Baa3; ratings remain under review for downgrade

- Bahrain-Based Kuwait Finance House B.S.C. (c) Downgraded To ‘BBB’ After Similar Action On Bahrain; Outlook Stable

- Tasmanian Public Finance Corp. Downgraded To ‘AA’ After Similar Action On Australian State; Outlook Stable

- Moody’s Ratings affirms Maldives’ Caa2 rating, changes outlook to stable from negative

- Health And Happiness Outlook Revised To Stable From Negative On Recovering Infant Milk Business; ‘BB’ Ratings Affirmed

Term of the Day: Fallen Angel

A fallen angel is a company or sovereign whose credit rating has been cut from investment grade to junk due to deteriorating financial conditions. The downgrade to junk may have a negative impact on its bond prices as asset managers that are mandated to hold only investment grade debt may be forced to sell off their holdings in the fallen angels.

Talking Heads

On JP Morgan shifting its outlook on Fed rate cut to December

“While the next FOMC meeting remains a close call, we now believe the latest round of Fedspeak tilts the odds toward the Committee deciding to cut rates in two weeks from today… back to looking for a final cut in January”

On Wall Street Maintaining Bullish EM Outlook for 2026

James Lord, Morgan Stanley

“Fed rate cuts will put downward pressure on the dollar. That helps Treasury yields move lower and creates a good backdrop for emerging markets”

BofA strategists

“The BofA baseline envisages a weaker USD; lower rates; low oil prices; and moderately higher equities. History shows that risk premium typically does not stay this low for an extended period”

On Hedge Fund Bond Market Bets Risking Yield Spikes – Pablo Hernandez de Cos, BIS Chief

“This greater presence also increases the likelihood of sharp non-linear sovereign yield spikes through a number of channels… Policymakers should address these challenges by employing a carefully selected mix of tools that spans fiscal, monetary and prudential policy”

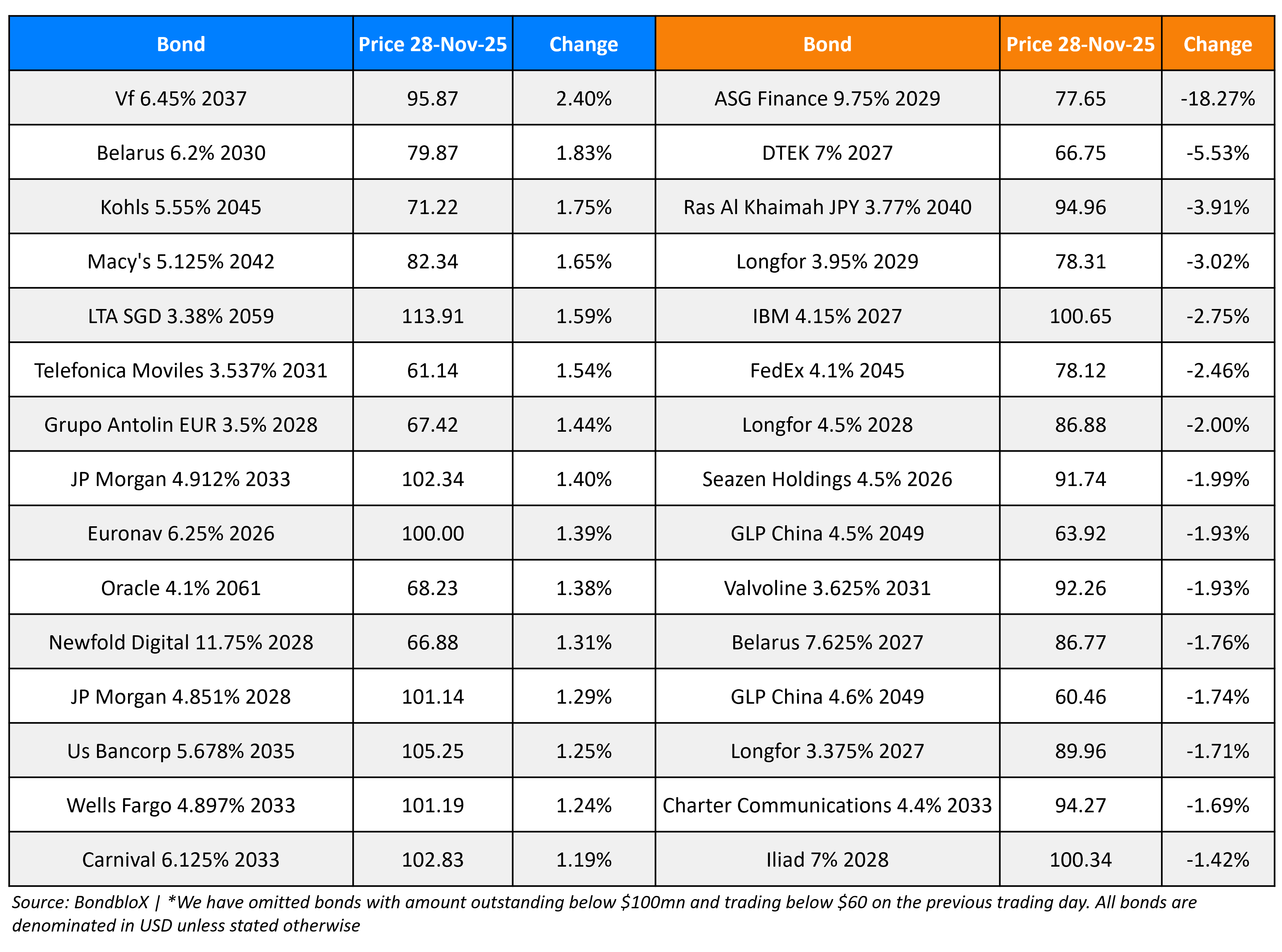

Top Gainers and Losers- 28-Nov-25*

Go back to Latest bond Market News

Related Posts: