This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Japan 10Y Yield at Its Highest Since 2008; Macy’s Prices 8NC3 Bond at 7.375%

July 15, 2025

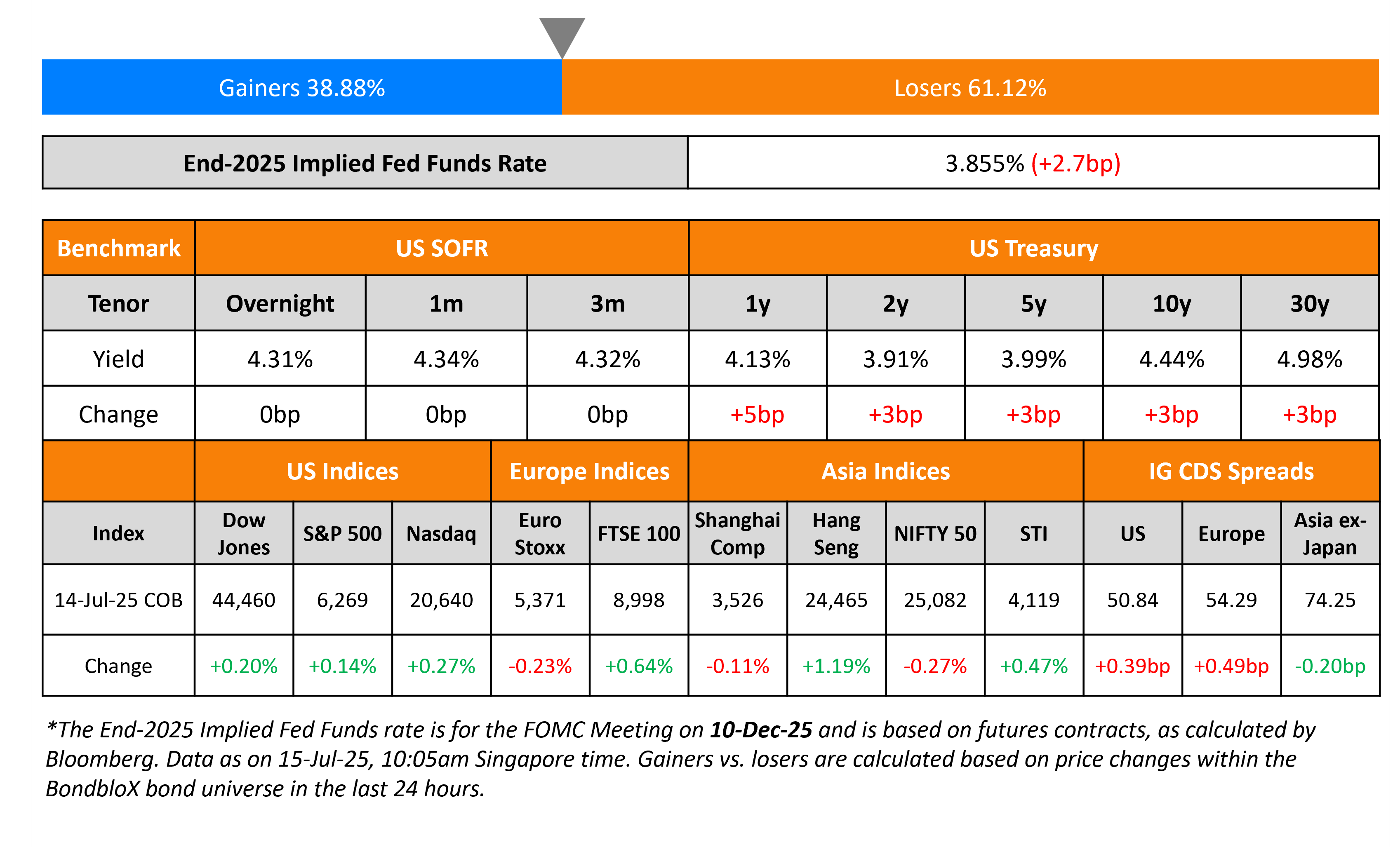

US Treasury yields rose across the curve by ~3bp. US President Donald Trump told reporters that there could be trade talks, including with Europe. Markets await the US inflation data later today with expectations for the Headline and Core CPI at 2.6% and 2.9% YoY respectively.

Looking at US equity markets, the S&P and Nasdaq closed higher by 0.1% and 0.3%, respectively. US IG and HY CDS spreads widened by 0.4bp and 1.9bp respectively. European equity markets ended mixed. The iTraxx Main CDS spreads widened by 0.5bp while Crossover CDS spreads widened by 1.1bp. Asian equity markets have opened broadly higher today. Asia ex-Japan CDS spreads were tighter by 0.2bp. Japan’s 10Y government bond yield touched 1.595%, its highest level since 2008. Analysts note that the move comes amid concerns that government spending is likely to increase ahead of an upper house election on July 20.

New Bond Issues

Macy’s raised $500mn via a 8NC3 bond at a yield of 7.375%, 12.5bp inside initial guidance of 7.50% area. The senior unsecured note is rated Ba2/BB+/BBB-. Proceeds together with cash on hand will be used to fund its concurrent tender offer and to redeem ~$587mn of certain existing outstanding senior notes and debentures.

NongHyup Bank raised $600mn via a two-part social bond offering. It raised $300mn via a 3.5Y FRN at SOFR+68bp, 42bp inside initial guidance of SOFR+110bp area. It also raised $300mn via a 5Y bond at a yield of 4.501%, 40bp inside initial guidance of T+90bp area. The notes are rated Aa3/A+. Net proceeds will be used to finance and/or refinance new and/or existing loans extended for projects that fall within its social finance framework.

Rating Changes

-

Moody’s Ratings upgrades Cirsa to B1 from B2; outlook positive

-

New Fortress Energy Inc. Downgraded To ‘CCC’ On Mounting Refinancing Risk; Outlook Negative

-

Juniper Networks Inc. Outlook Revised To Stable From Negative On HPE Acquisition Close; ‘BBB’ Rating Affirmed

Term of the Day: Consent Solicitation

Consent solicitation is an offer by the issuer to change the terms of the security agreement. These are applicable for changes to bonds or shares issued and can range from distribution payment changes and covenant changes in bonds to changes in the board of directors with regard to equities.

Talking Heads

On US Inflation Expected to Accelerate in June Due to Tariffs

Gregory Daco, EY Parthenon

“You’re still in an environment where businesses used a broad array of strategies to mitigate the effect of duties…But over time that effect is going to increase.”

Scott Anderson, BMO Capital Markets

“Certainly now that the president seems to be throwing a volley of new higher tariff rates at a number of countries, we’re certainly not out of the woods yet on a tariff inflation threat”

On Raising Brent Oil Forecast For Second Half Of 2025 To $66 – Goldman Sachs

“Our unchanged 2026 price forecast reflects an offset between a boost from higher long-dated prices and a hit from a wider 1.7 million barrels per day 2026 surplus…Reduced spare capacity increases our confidence that prices will rebound after 2026…We still recommend buying oil puts (or put spreads) and selling calls”

On Odds of Rate Hike as Soon as October – Hideo Hayakawa, Ex-BOJ Chief Economist

“Inflation is clearly strong…Once a decision is made on tariffs, a rate hike could take place even in October…if the board raises the inflation forecast to 2% for next year, that will likely be taken as a message that a rate hike is coming soon”

Top Gainers and Losers- 15-Jul-25*

Go back to Latest bond Market News

Related Posts: