This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

January 2025: Positive Start to the Year As 69% of Dollar Bonds End Higher

February 3, 2025

January 2025 was a positive month for bond investors with 69% of dollar bonds ending higher (price returns ex-coupons). Both, Investment Grade (IG) bonds and High Yield dollar bonds performed equally well with 69% and 71% of the bonds respectively ending in the green. This came on the back of the move higher in Treasuries thanks to signs of softer inflation and a delay in tariffs at the time, after an initial sell-off led by a strong labor market. However, a range of tariffs have now been implemented – US President Donald Trump imposed a 25% tariff on imports from Canada and Mexico, with an exception of a 10% tariff on Canadian energy. Besides, a 10% additional duty on Chinese products was also imposed, effective February 4.

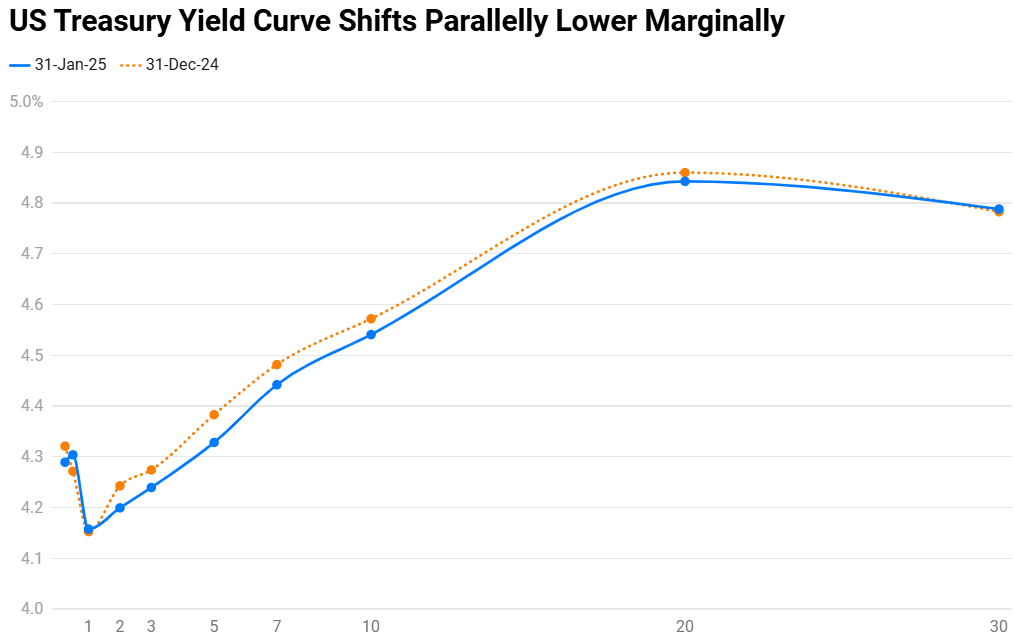

January saw the Treasury yield curve shift parallelly lower, albeit only marginally falling by ~3-5bp across tenors. Treasury yields surged higher following the strong Non Farm Payrolls (NFP) print, but then eased through the month as inflation concerns eased and Trump delayed the imposition of tariffs. US NFP for December saw job additions of 256k much higher than expectations of 165k, AHE YoY eased slightly by 3.9% from 4.0%. Looking at inflation, US CPI YoY rose 2.9%, in-line with expectations. However, Core CPI YoY eased to 3.2% from 3.3%, marking its first stepdown in four months. Meanwhile, manufacturing activity continued to contract, albeit with an improvement. The US ISM Manufacturing Index reading for December improved to a nine-month high of 49.3, with the Services PMI stayed upbeat at 54.1.

Most IG dollar bonds traded higher albeit with no standout gainers. Among the losers, Nan Fung's 5% Perp fell by 7%, impacted by the broad sell-off in the real estate sector.

Under the HY segment, the biggest gainers were dollar bonds of China Vanke that rallied over 12% up to even 25%. The move comes after the initial sell-off during the month due to reports of a potential bond extension, CEO detention and more. However, such news was quashed and followed by reports of a potential takeover by the government and that the developer would redeem its RMB 1bn ($137.68mn) onshore notes due 2027 early in March. Also, US Steel's bonds rallied despite Nippon Steel's proposed acquisition being blocked, concluding with Cleveland-Cliffs reportedly preparing an all-cash bid for them. Among the biggest losers were dollar bonds of NWD that fell by 20-30% after several negative updates including rumors of a debt restructuring and offering prized properties worth $15bn as collateral for loan refinancing. With the impact of the property market taking its toll, dollar bonds of Road King and Lai Sun also dropped 11-15%.

Issuance Volumes

Global corporate dollar bond issuances stood at $407bn in January, 3x that of December. As compared to January 2024, issuance volumes were up 3% YoY. 87% of the issuance volumes came from IG issuers with HY comprising 12% and unrated issuers taking the remaining 1%.

Asia ex-Japan & Middle East G3 issuance stood at $56bn, up 6x MoM, while being up 15% YoY. 87% of the issuance volumes came from IG issuers with HY comprising 11% and unrated issuers taking the remaining 2%.

Largest Deals

Some of the largest deals globally were led by the big banks - BofA’s $10bn five-part offering led the tables, followed by ABN Amro’s €8bn two-tranche issuance, Goldman Sachs’ $8.5bn four-part offering, JPMorgan and Morgan Stanley’s $8bn four-tranchers each and Wells Fargo’s $6bn three-trancher.

In the APAC and Middle East, Saudi Arabia’s $12bn three-trancher led the tables, followed by AAHK’s $4.15bn three-trancher, Saudi PIF’s $4bn two-trancher, Philippines’ $3.29bn multicurrency three-trancher, and KDB’s $3bn three-part deal.

Top Gainers & Losers

Go back to Latest bond Market News

Related Posts:

Bond Yields – Explained

December 26, 2024

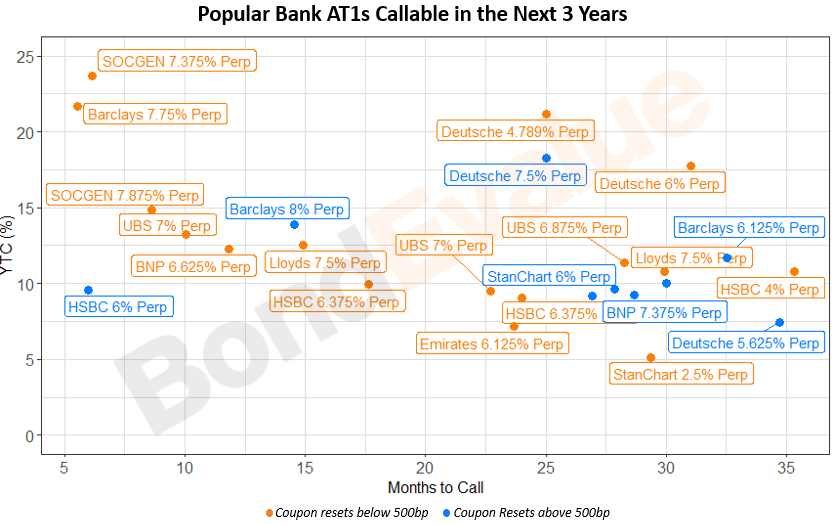

Finding Value in Popular Bank AT1 & Tier 2 Bonds

April 5, 2023