This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Istanbul Upgraded to Ba3 Following Turkiye’s Upgrade

July 30, 2025

Metropolitan Municipality of Istanbul has been upgraded to Ba3 from B1 by Moody’s. This mirrors Türkiye’s rating upgrade from earlier this week as Istanbul contributes to about 30% of Türkiye’s GDP. Istanbul’s upgrade follows improved national discipline with tight monetary policy. This has tamed inflation to 35% YoY in June 2025 from 72% last year. The rating upgrade incorporates Istanbul’s capacity to consistently maintain operating performance and adequate liquidity despite elevated inflation levels. Moody’s forecasts Istanbul’s primary operating balance to surpass 40% of operating revenue. Moody’s expects Istanbul to retain its debt burden, with net direct and indirect debt (NDID) accounting for 79% of operating revenue at end-2024 vs. 100% in 2023.

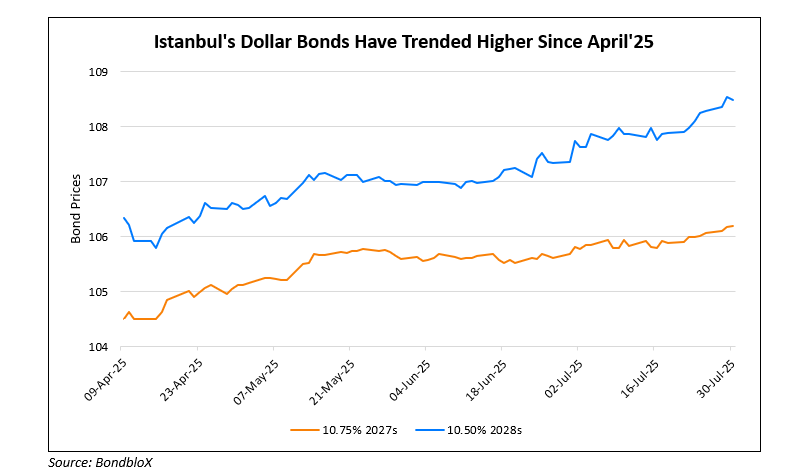

Istanbul’s dollar bonds have been trended higher since April, as seen in the chart below. Istanbul’s 10.5% 2028s are trading stable at 108.48, yielding 7.39%.

For more details, click here.

Go back to Latest bond Market News

Related Posts: