This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

ISM Services Weakens to 50.0; Muthoot Launches $ Tap

October 6, 2025

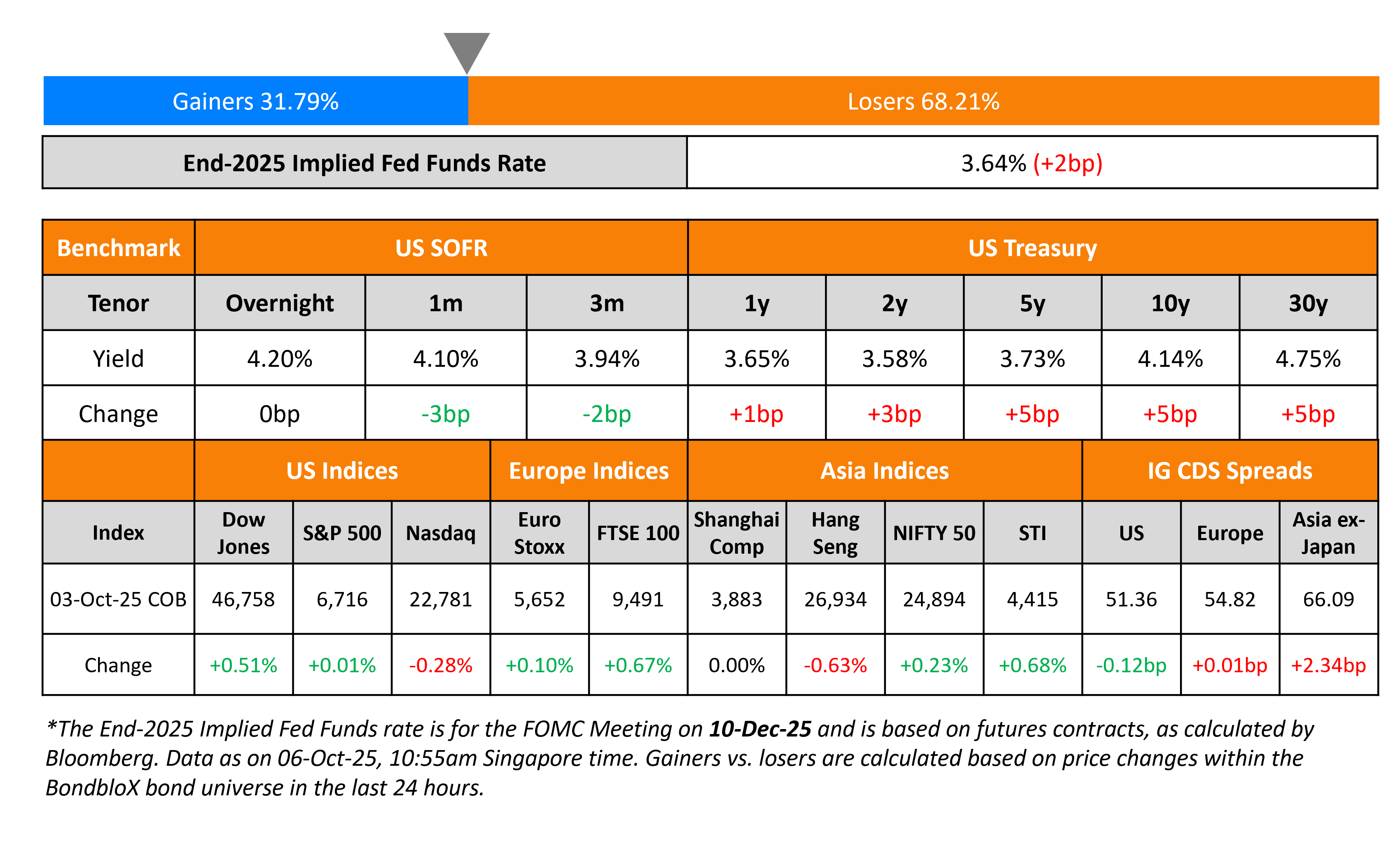

US Treasury yields moved higher by ~3-5bp across the curve. The US ISM Services PMI for September came-in at 50.0, softer than expectations of 51.7. Dallas Fed President Lorie Logan said that the Fed was the “furthest away on the inflation side” of its objectives, adding that the forecast “takes some time to get back to 2%”. She thereby urged caution with regard to rate cuts. Separately, Fed Vice Chair Philip Jefferson cautioned about the risks to inflation and employment objectives, noting that the Fed was juggling between the two.

Looking at equity markets, the S&P ended flat while the Nasdaq ended 0.3% lower. US IG CDS spreads were tighter by 0.1bp while HY CDS spreads were wider by 0.2bp. European equity markets ended higher. The iTraxx Main CDS spreads were stable while Crossover CDS spreads widened by 0.1bp. Asian equity markets have opened broadly higher today – the Nikkei is up 4.5% after Sanae Takaichi became the new Prime Minister. Asia ex-Japan CDS spreads were wider by 2.3bp.

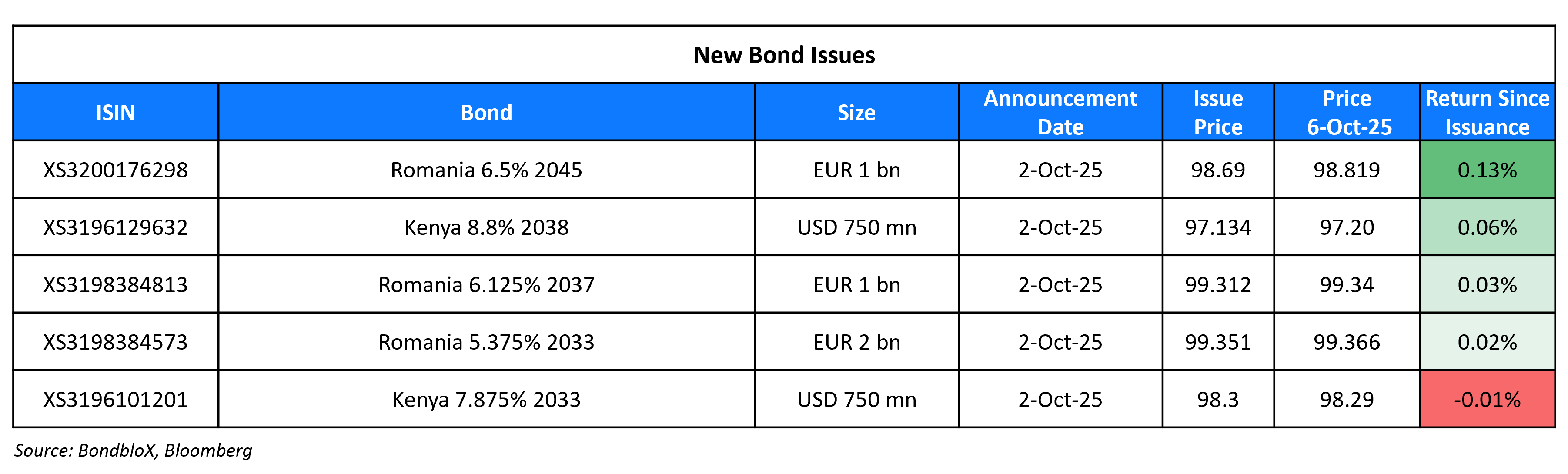

New Bond Issues

- Muthoot Finance $ 6.375% 2030 Tap

Rating Changes

- Moody’s Ratings takes rating action on 15 Spanish banks

- Moody’s Ratings upgrades BBVA Perú’s subordinated debt rating to baa2; outlook remains stable

- Dubai-Based Hotel Operator Five Holdings BVI Upgraded To ‘BB-‘ Following Refinancing; Outlook Stable

- Fitch Upgrades Slovenia to ‘A+’; Outlook Stable

- Stanley Black & Decker Inc. Ratings Lowered To ‘BBB+’ From ‘A-‘; Outlook Negative

- Fitch Downgrades Leonteq AG to ‘BBB-‘; Outlook Stable

- Fitch Downgrades TalkTalk to ‘RD’ on DDE; Upgrades to ‘CCC-‘ on Restructuring Completion

New Bonds Pipeline

- Vakif Katilim $ PerpNC5.5 AT1 Sukuk

Term of the Day: Special Drawing Rights (SDRs)

Special Drawing Rights (SDR) issued by the IMF to its member countries’ central banks are a reserve asset that can be exchanged for hard currencies with another central bank. The value of an SDR is set daily based on a basket of five major international currencies: the USD (43.38%), the EUR (29.31%), the CNY (12.28%), the JPY (7.59%) and the GBP (7.44%). An allocation of SDRs requires approval by IMF members holding 85% of the total votes and US is the biggest holding 16.5% of the votes.

Talking Heads

On Bulls Seen Piling Into EMs as Momentum Returns

Goldman Sachs

EM markets are “thriving, not just surviving”

Jon Harrison, GlobalData

“The outlook for the remainder of the year is positive for equities on improving growth outlook and China stimulus, as well as for local debt as EM central banks continue to cut rates… should be solid inflows into EM assets”

Shamaila Khan, UBS Asset Management

“We’re in the very early stages of the demand continuing to come into emerging market debt”

On Citi Recommending Trade for Reflation, Fed Rate Hikes in 2026-2027

“The risk of a US rebound next year is growing. We think a slight cutting bias priced into this period look excessive”… US government shutdown “will make reading the health of the economy increasingly messy for the next few weeks”

On Treasuries Gain on Week as Shutdown Leaves Market ‘Flying Blind’

Gennadiy Goldberg, TD Securities

“The market’s flying blind at the moment in terms of the data surrounding the shutdown”

Kevin Flanagan, WisdomTree

“There is a sense the Fed is flying blind into a rate cut — that is a fair point, but the bar is high not to cut in October’

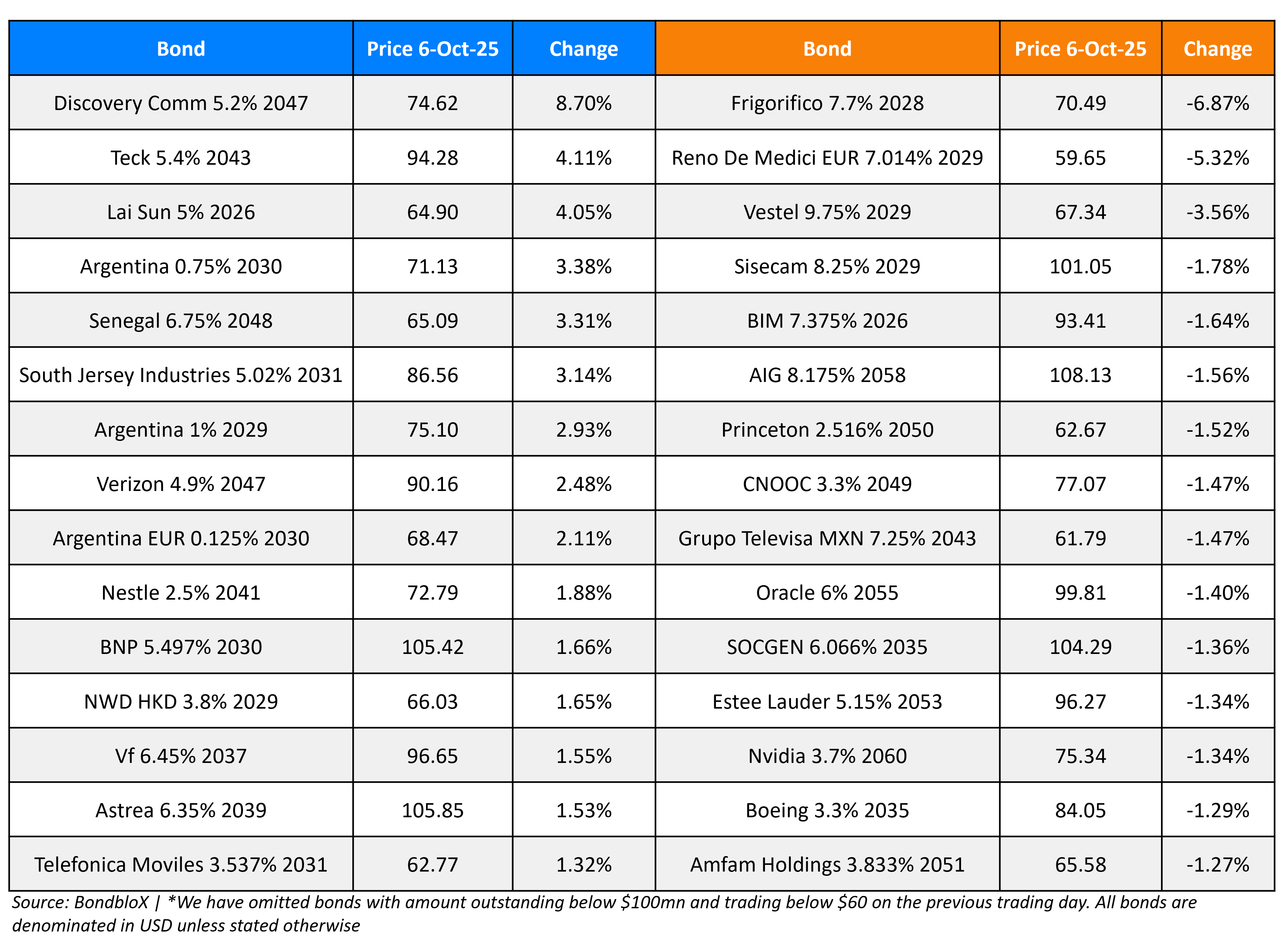

Top Gainers and Losers- 06-Oct-25*

Go back to Latest bond Market News

Related Posts: