This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

ISM Manufacturing Stays Below 50-Mark; SoftBank Launches € Bonds; Vakifbank, Carnival Price Bonds

July 2, 2025

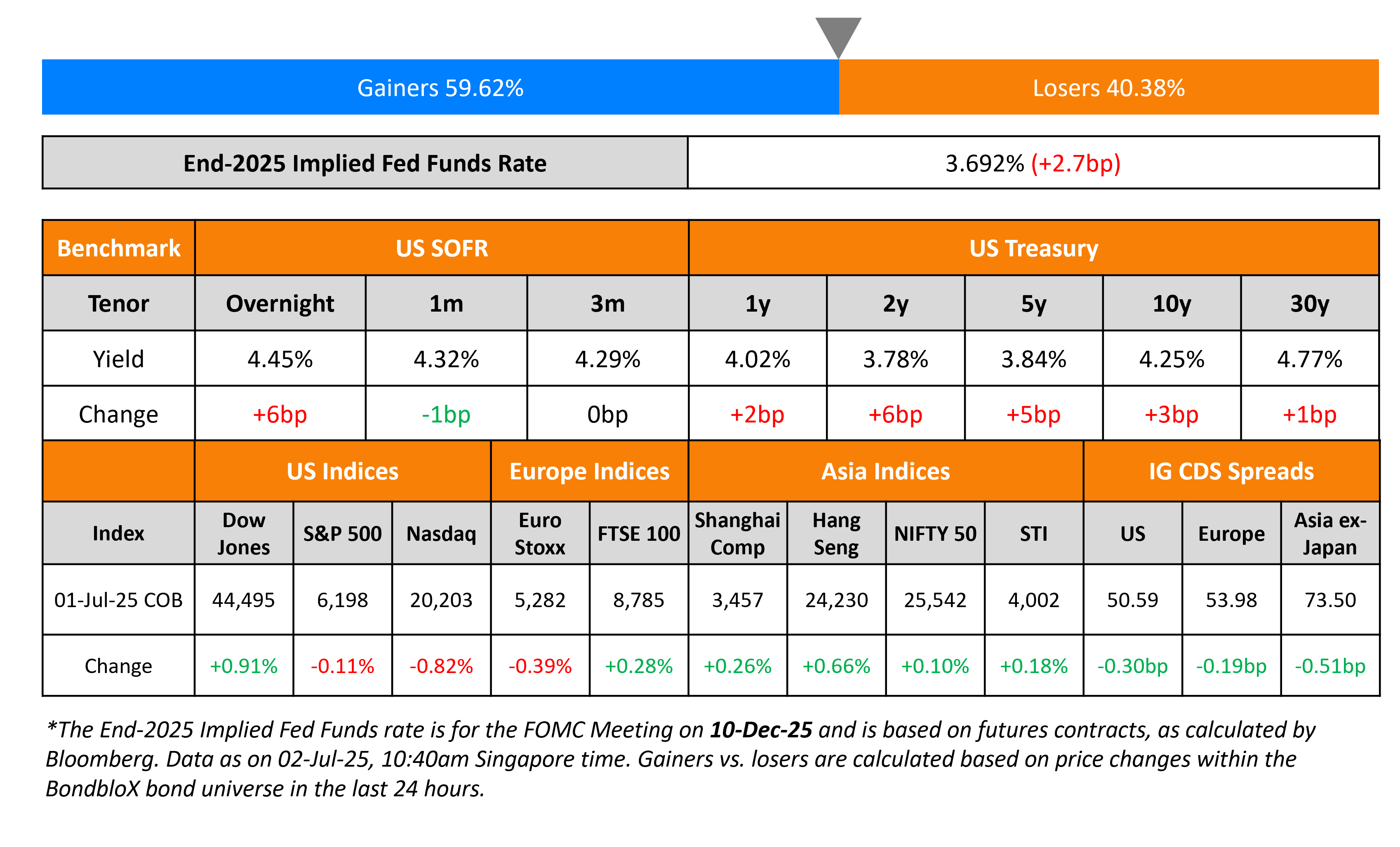

US Treasury yields were higher across the curve, with the curve bear flattening as the 2Y rose 6bp and the 10Y was up by 3bp. The ISM Manufacturing PMI for June came-in slightly better at 49.0 vs. expectations of 48.8 and the prior month’s 48.5 reading. However it stayed in contraction territory underscoring the weakness in the sector. Among its sub-components, the Prices Paid Index continued to expand at 69.7, while both New Orders and Employment indices contracted at 46.4 and 45.0 respectively.

The US Senate passed President Donald Trump’s tax-cut and spending bill with a 51-50 vote. It is now up to the House of Representatives for a possible final approval. In other news, Trump said that he has two or three top choices to replace Jerome Powell as the Federal Reserve chairman. Separately, Jerome Powell said that it would be prudent to wait and learn more about the effects of tariffs on inflation. He added that rate decisions will be data dependent, “going meeting by meeting”.

Looking at equity markets, the S&P and Nasdaq ended lower, down by 0.1% and 0.8% respectively. In credit markets, US IG CDS spreads were tighter by 0.3bp and HY CDS spreads tightened 1.6bp. European equity markets ended mixed. The iTraxx Main CDS spreads tightened by 0.2bp while Crossover CDS spreads widened by 0.4bp. Asian equity markets have opened mixed today. Asia ex-Japan CDS spreads were tighter by 0.5bp.

New Bond Issues

- Softbank € 4.25Y/6Y/8Y at 5.5-5.75/6.23-6.5/6.75-7%

Vakifbank raised $750mn via a 5Y sustainability bond at a yield of 7.375%, 50bp inside initial guidance of 7.875% area. The senior unsecured bond is rated B+ by Fitch. Proceeds will be used to finance or refinance eligible businesses and projects. The new bonds were priced at a new issue premium of 29.5bp over its existing 6.875% 2030s that currently yield 7.08%.

Carnival raised €1bn via a 6Y bond at a yield of 4.125%, ~50bp inside initial guidance of 4.50-4.75% area. The senior unsecured note is rated Ba3/BB+/BB+. The note has a change of control put at 101. Proceeds will be used to fund the full prepayment of the USD TLB (Term Loan B) due 2027 and partial prepayment of the USD TLB due 2028.

New Bonds Pipeline

- Shinhan Bank hires for $ 5Y bond

- Port of Newcastle hires for A$ 8Y/10Y bond

- Qatar Insurance hires for $ PerpNC6, Tier 2 bond

- RAK Bank hires for $ PerpNC6 bond

- NBK hires for $ PerpNC6 AT1 bond

Rating Changes

- Moody’s Ratings upgraded NES Fircroft’s long term CFR to Ba3; stable outlook

- Moody’s Ratings downgrades RSA to Caa3; outlook revised to negative

- Moody’s Ratings downgrades Grupo Energia Bogota’s ratings to Baa3; outlook changed to stable from negative

- Moody’s Ratings affirms Hershey’s A1 senior unsecured rating, changes outlook to negative

Term of the Day: Bolt-on Acquisition

A bolt-on acquisition is a transaction where a larger company acquires a smaller company, to complement and enhance its operations by expanding into new/existing markets and increase market share. They are considered to be an efficient alternative to building capabilities from the scratch or pursuing larger, more complex acquisitions.

Santander’s acquisition of TSB is considered to be an example of a bolt-on acquisition.

Talking Heads

On No Need for Rate Cuts to Stimulate Economy Now – Madis Muller, ECB

“it’s not obvious to me that we need to go into expansionary territory… Growth is weak, but it’s still gradually picking up. So, it’s quite reasonable for now to keep rates where they are and to monitor further developments…Where we are exactly in September is difficult to say today”

On Fed Possibly Lowering Interest Rates by September – US Treasury Chief Scott Bessent

“the criteria is that tariffs were not inflationary. If they’re going to follow that criteria, I think that they could do it sooner than then, but certainly by September”

On Volatile Quarter-End Signalling Funding-Market Dysfunction to Come

Jan Nevruzi, TD Securities

“If (tax bill) is signed into law by Friday then issuance comes right after…For funding markets, I think that implies a more gradual drift higher in repo rates rather than the impact showing up immediately”

John Velis, BNY

“Resolution of the debt ceiling could inject additional stresses into money markets and repo rates will likely be higher and more sensitive in this case”

Top Gainers and Losers- 02-Jul-25*

Go back to Latest bond Market News

Related Posts: