This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

ISM Manufacturing Eases Further; Fed Officials Cautious Due to Tariffs Related Risks

April 2, 2025

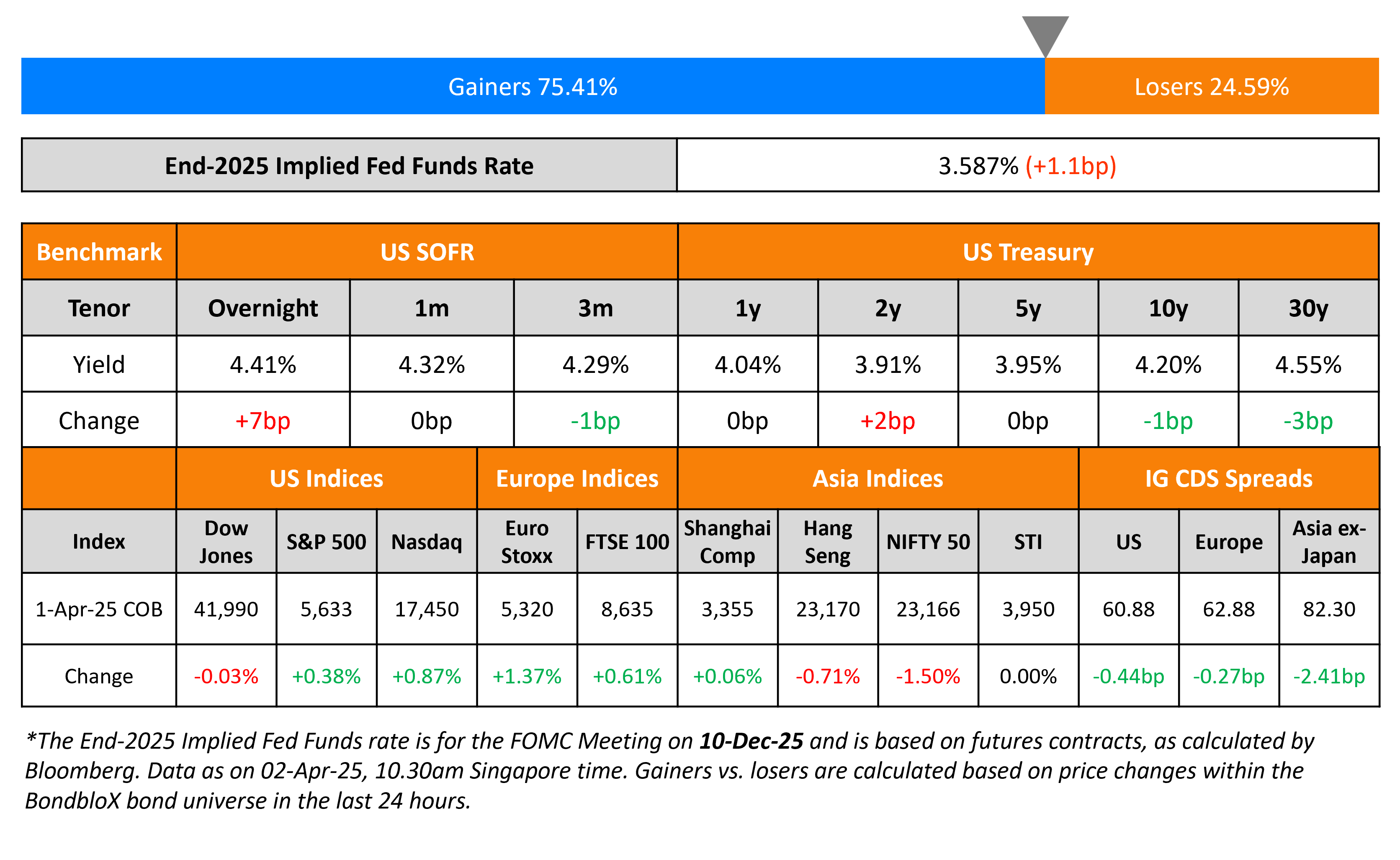

US Treasury yields were stable yesterday with the 2Y at 3.91% and 10Y at 4.2% respectively. The US ISM Manufacturing Index for March came in at 49.0, easing from the prior 50.3 reading, and also lower than expectations of 49.5. This came on the back of a contraction in the New Orders and Employment components. Meanwhile, the inflationary Prices Paid component rose sharply to 69.4, as survey respondents raised concerns about the impact of tariffs. Chicago Fed President Austan Goolsbee said that while the “hard” data indicated a solid US economy and downtrend in inflation from its peak in 2022, the imposition of new tariffs could lead to renewed inflation or an economic slowdown. Richmond Fed President Thomas Barkin said that the timing of any rate cuts will depend on what happens with inflation. He noted that he was worried that tariffs could push up prices and hurt the job market.

US equity markets ended higher, with the S&P and Nasdaq up 0.4% and 0.9% respectively. Looking at credit markets, US IG and HY CDS spreads tightened 0.4bp and 0.9bp respectively. European equity markets ended higher as well. The iTraxx Main and Crossover CDS spreads tightened by 0.3bp and 1.7bp respectively. Asian equity markets have opened broadly higher this morning. Asia ex-Japan CDS spreads were tighter by 2.4bp.

New Bond Issues

Nexa Resources raised $500mn via a 12Y bond at a yield of 6.613%, 5bp inside initial guidance of T+250bp area. The senior unsecured bond is rated BBB-/BBB- (S&P/Fitch). Proceeds will be used to fund the repurchase of its 5.375% 2027 and 6.5% 2028 senior notes pursuant to the tender offer announced and any remaining proceeds to be used for general corporate purposes, including liability management transactions.

NRW Bank raised $1.5bn via a 5Y bond at a yield of 4.106%, 3bp inside initial guidance of SOFR+49bp area. The senior unsecured bond is rated Aa1/AA/AAA. German Federal State of North Rhine-Westphalia is the Guarantor of the bond.

New Bond Pipeline

- EIB hires for € 12Y WNG bond

Rating Changes

-

Fitch Upgrades National Bank of Greece to ‘BBB-‘; Outlook Stable

-

Moody’s Ratings downgrades West China Cement’s ratings to Caa1/Caa2; outlook negative

-

Foot Locker Inc. Downgraded To ‘BB-‘ From ‘BB’ On Operating Performance Challenges; Outlook Stable

-

Fitch Downgrades Ardagh Group to ‘CCC-‘; on Rating Watch Negative; Withdraws Rating

Term of the Day

Fiscal Deficit

Fiscal balance is the difference between a government’s total revenue (total taxes and non-debt capital receipts) and its total expenditure. A fiscal deficit is when the government’s expenditure exceeds its income. Fiscal deficits are typically stated as a percentage of the economy’s GDP. A deficit or gap is generally filled by borrowing from the central bank of the country or by raising money from capital markets through debt instruments. A recurring high fiscal deficit implies that the government is spending beyond its means and could lead to a default in an extreme case.

Talking Heads

On Pimco Favouring Stable Returns From Bonds As Recession Risk Looms

“There is a strong case to diversify away from highly priced US equities into a broader mix of global, high quality bonds. Markets are in the early stages of a multiyear period in which fixed income can outperform equities while offering a more favorable risk-adjusted profile.”

On Treasuries Rallying More on Trump’s Trade War

Thierry Wizman – Macquarie Group

“There is a large group of people in the marketplace that are putting much more emphasis right now on a recession than an inflationary episode without a slowdown. So it’s very difficult to think that bond yields are going to rise.”

On Tariffs Leading to Junk Bond Bargains – UBS

“Tariffs will have more of a sentiment impact on the Asian high-yield market rather than a direct impact on credit fundamentals. Our analysis shows very few Asian high-yield issuers have direct export business to the US. So if it does cause an overshoot in certain high beta high-yield credits, to us it’s a buying opportunity.”

Top Gainers and Losers- 02-April-25*

Go back to Latest bond Market News

Related Posts: