This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Isbank, CLP HK, BNP, UniCredit Price Bonds

January 10, 2025

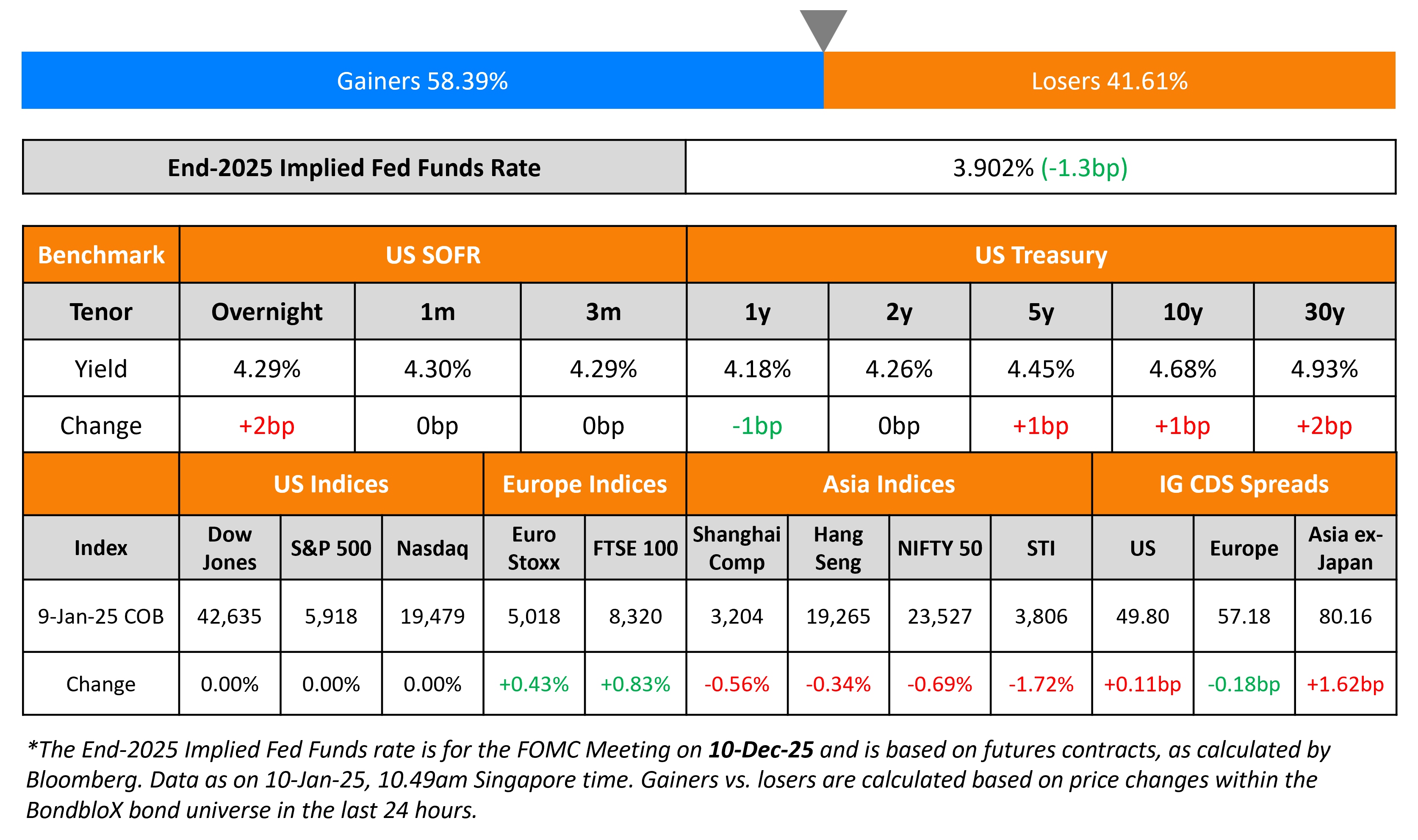

US Treasury yields were steady in a shortened trading session due a national day holiday on account of the mourning of former president Jimmy Carter. Fed Governor Michelle Bowman said that her assessment of the progress in inflation stalled last year, noting that she does not see policy being restrictive enough. Along similar lines, Boston Fed President Susan Collins said that she expected fewer rate cuts in 2025 than her earlier expectations due to resilient employment and inflation concerns. Richmond Fed President Tom Barkin said that the recent rise in long-term treasury yields may be reflecting a higher term premium as opposed to inflation concerns.

US IG and HY CDS spreads widened by 0.1bp and 2.4bp respectively. US equity markets were closed. European equities ended higher. In terms of Europe’s CDS spreads, the iTraxx Main and Crossover spreads tightened by 0.2bp and 0.7bp respectively. Asian equities have opened broadly lower this morning. Asia ex-Japan CDS spreads were 1.6bp wider. Issuance volumes eased across regions, nearing the end of the week and ahead of the US jobs report.

New Bond Issues

Turkey’s İşbank raised $500mn via a PerpNC5.5 AT1 bond at a yield of 9.125%, 37.5bp inside initial guidance of 9.50% area. The subordinated notes are rated B- (Fitch), and received orders of over $1.45bn, 2.9x issue size. If not called by 15 July 2030, the coupon resets to the 5Y UST plus 463.3bp. Proceeds will be used for general corporate purposes.

CLP Power Hong Kong raised $500mn via a PerpNC5.25 bond at a yield of 5.452%, 42.3bp inside initial guidance of 5.875% area. The subordinated notes are rated A3/A-. If not called before the first reset date, the coupon resets to the 5Y UST plus 100.5bp and with an additional 25bp coupon step-up. If not called between then and the 20th year, there is an additional 75bp coupon step-up. Proceeds will be used to redeem its 3.55% Perp.

BNP Paribas raised €1bn via a 10.5NC5.5 Tier 2 bond at a yield of 4.203%, 25bp inside initial guidance of MS+205bp. The subordinated notes are rated Baa2/BBB+/A-, and received orders of over €2.6bn, 2.6x issue size.

UniCredit raised €2bn via a two-tranche deal. It raised €1bn via a 4.5NC3.5 bond at a yield of 3.342%, 32bp inside initial guidance of MS+130bp area. It also raised €1bn via a 8NC7 bond at a yield of 3.848%, 30bp inside initial guidance of MS+170bp area. The senior non-preferred notes are rated Baa3/BBB-/BBB.

New Bonds Pipeline

- Tata Capital hires for $ 3.5Y bond

- Hyundai Capital Services hires for $ 3Y/3Y FRN bonds

Rating Changes

-

Fitch Upgrades Bank of Ceylon’s IDRs and VR to ‘CCC+’ and ‘ccc+’

-

Advanced Micro Devices Inc. Upgraded To ‘A’ On Strong Growth Prospects And Share Gains; Outlook Stable

-

Sempra Outlook Revised To Negative, Ratings Affirmed; Southern California Gas Downgraded, Outlook Stable

-

Moody’s Ratings places Hidrovias do Brasil ratings under review for downgrade

Term of the Day: Term Premium

The term premium is the yield premium that investors expect to receive in order to be compensated for lending for longer periods as compared to shorter periods. The term structure of interest rates in a normal scenario is upward sloping, with longer term yields higher than short term yields. However, research by the BIS and other institutions note that the term premium can also be affected by other factors, thereby reducing the yield compensation – for example flight to quality towards long-end treasuries, liquidity considerations etc.

Talking Heads

On Hong Kong Housing Analysts Predicting a Market Bottom This Year

Patrick Wong, Bloomberg Intelligence

“The property market is going to be better in 2025”. Home prices could gradually rebound as lower mortgage rates help.

Jeff Yau, DBS Group

“A potential positive carry — rental yield exceeding borrowing costs — will also entice investors to purchase homes”

On US Bond Yield Surge Prompting Some Companies to Delay Debt Sales

Noel Hebert, Bloomberg Intelligence

“Companies may wait on a better entry point… you probably have more downside than upside to yields,”

Nicholas Elfner, Breckinridge Capital

“If it’s really rate volatility, that is more challenging for underwriters to bring corporate-bond deals rather than just movement up or movement down in yields”

Stephen Searl, Conning

“At these kind of yields, I think it forces some needed discipline on corporate treasurers”

Top Gainers and Losers- 10-January-25*

Go back to Latest bond Market News

Related Posts: