This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

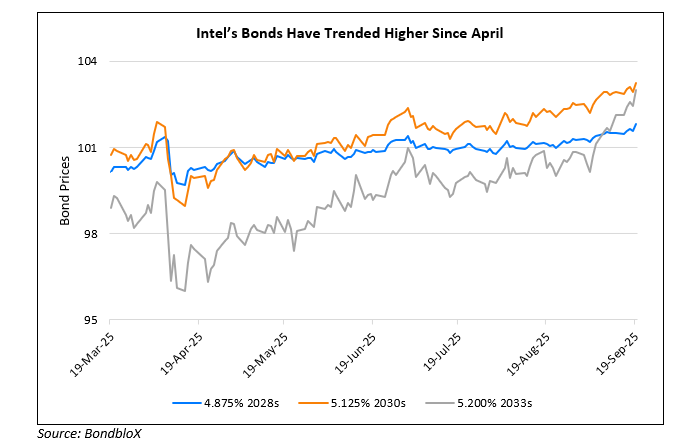

Intel’s Bonds Rally on $5bn NVIDIA Investment

September 19, 2025

Intel’s bonds strengthened after NVIDIA announced a $5bn investment in the chipmaker alongside plans to jointly develop semiconductors. Analysts noted that the deal boosts confidence in Intel’s funding access and long-term competitiveness. The NVIDIA partnership follows the US government’s commitment last month to take a ~10% stake in Intel via the Chips Act and Secure Enclave funding, and SoftBank’s $2bn equity purchase in August. Intel, which had $50.8bn in debt at end-June, will also work with NVIDIA to develop chips for PCs and data centers as it looks to regain ground in the semiconductor race.

Intel’s bonds were trading positive across the curve, with its longer dated bonds (maturing post 2040) rallying by over 1-1.5 points.

For more details, click here.

Go back to Latest bond Market News

Related Posts: