This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Indonesia Launches $ Bond; Garanti Bank, StarHub, Angola, PIF Price Bonds

October 8, 2025

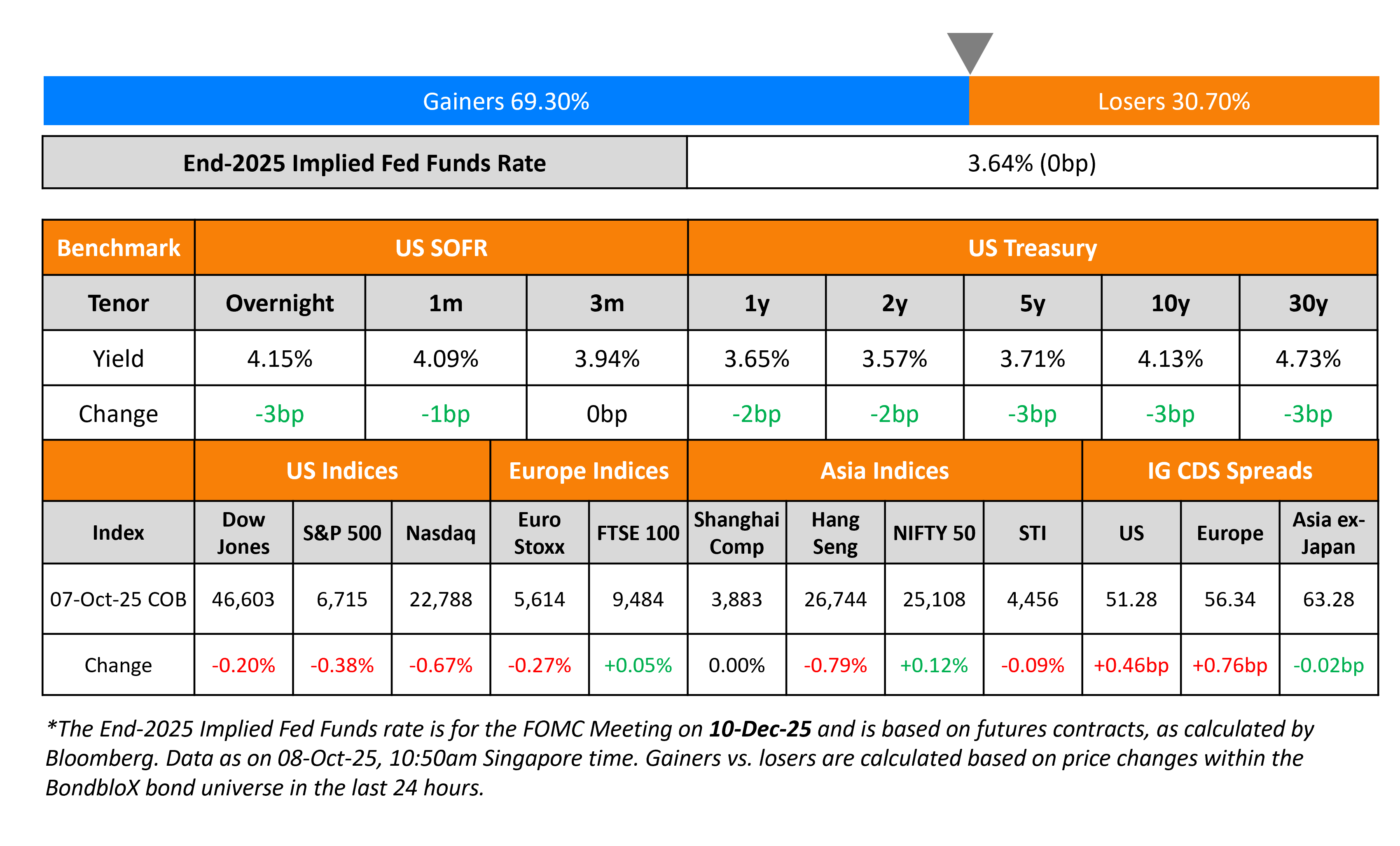

US Treasury yields were ~3bp lower on Tuesday. Again, there were are no macro data points from the US expected this week due to the government shutdown. The Fed’s September meeting minutes are due later todday. Minneapolis Fed President Neel Kashkari warned that any drastic cuts to interest rates would risk stoking inflation. On the other hand, Fed Governor Stephen Miran (appointed by US President Trump), reiterated that the Fed can continue reducing rates due to a slowdown in population growth and his expectations for a limited impact on inflation from tariffs. For context, Miran had dissented in the September FOMC meeting, voting for a 50bp cut. Separately, gold continued to rally to record highs, crossing the $4,000 mark.

Looking at equity markets, both the S&P and Nasdaq ended lower by 0.4% and 0.7%, retracing from record highs. US IG and HY CDS spreads were wider by 0.5bp and 4.1bp respectively. European equity markets ended mixed. The iTraxx Main and Crossover CDS spreads were both wider by 0.8bp and 2.2bp respectively. Asian equity markets have opened mixed today. Asia ex-Japan CDS spreads were flat.

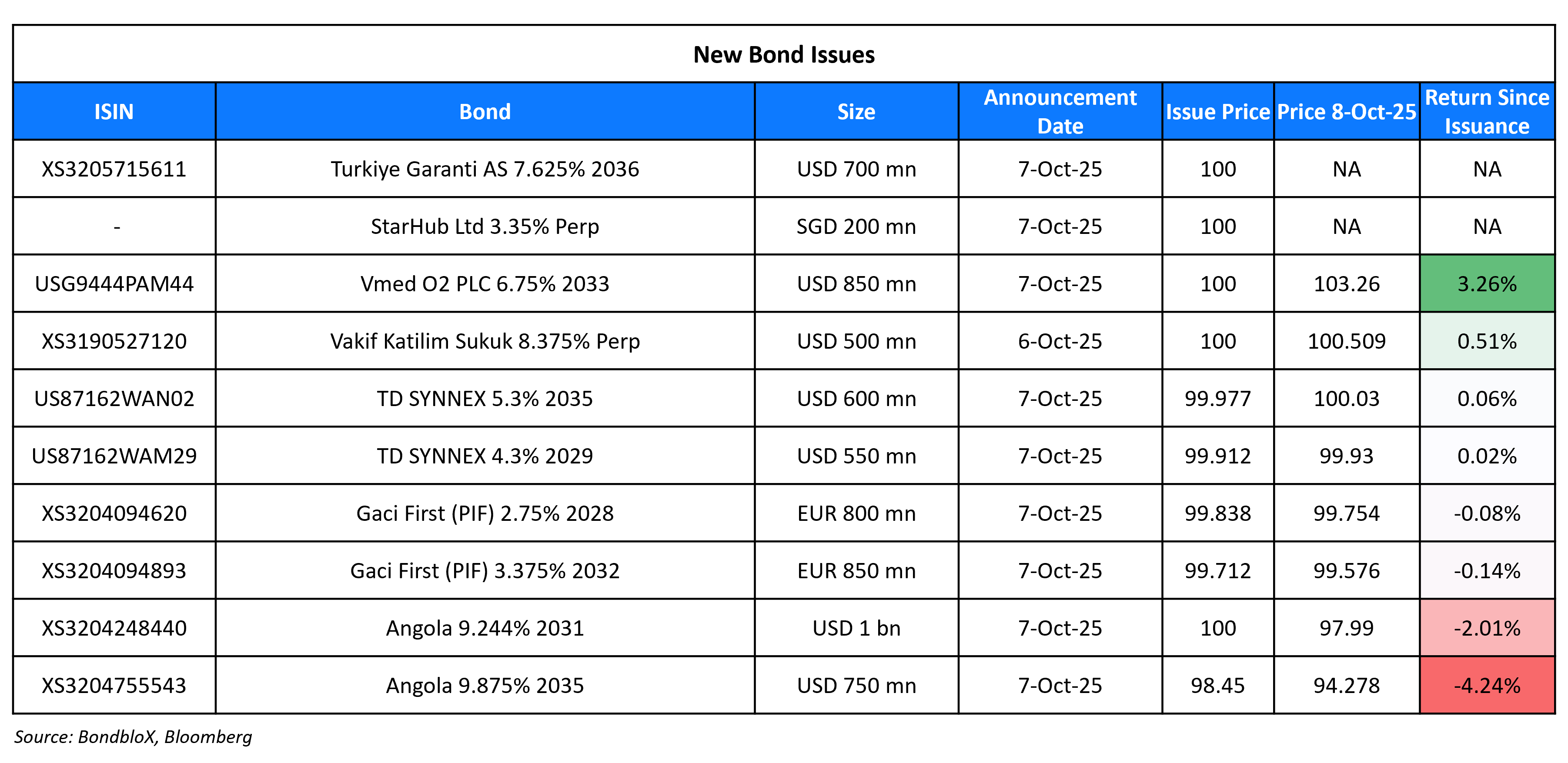

New Bond Issues

Garanti Bank raised $700mn via a 10.5NC5.5 Tier-2 bond at a yield of 7.625%, 37.5bp inside initial guidance of 8% area. The subordinated note is rated B1/B+ (Moody’s/Fitch), and received orders of over $1.3bn, 1.9x issue size. Proceeds will be used for general corporate purposes.

StarHub raised S$200mn via a PerpNC7 bond at a yield of 3.35%, 40bp inside initial guidance of 3.75% area. The subordinated note is unrated. If not called by 14 October 2032, the coupon will reset to the SGD 7Y SORA-OIS plus 171.5bp in addition to a coupon step-up of another 100bp. The note also has a dividend pushes and a dividend stopper. Private banks received a 20-cent rebate. Net proceeds will be used for financing general corporate funding requirements/investments, working capital, capital expenditure and other general funding requirements

Angola raised $1.75bn via a two-part deal. It raised $1bn via a 5Y bond at a yield of 9.25%, 50bp inside initial guidance of 9.75% area. It also raised $750mn via a 10Y bond at a yield of 10.125%, 25bp inside initial guidance of 10.5% area. The senior unsecured notes are rated B3/B-/B- (Moody’s/S&P/Fitch). Proceeds will be used for general budgetary purposes.

PIF raised €1.6bn via a two-part deal. It raised €800mn via a 3Y bond at a yield of 2.807%, ~34.5bp inside initial guidance of MS+90/95bp area. It also raised €850mn via a 7Y bond at a yield of 3.422%, 30bp inside initial guidance of MS+125bp area. The senior non-preferred bond is rated Aa3/A+. Gaci First Investment Co. is the issuer of the notes. Net proceeds will be used to finance or refinance, in whole or in part, assets under its green framework.

TD Synnex raised $1.15bn via a two-trancher. It raised $550mn via a 3Y bond at a yield of 4.331%, 25bp inside initial guidance of 4.581% area. It also raised $600mn via a 10Y bond at a yield of 5.303%, 27bp inside initial guidance of 5.573% area. The senior unsecured notes are rated Baa3/BBB-/BBB- (Moody’s/S&P/Fitch). Proceeds will be used to (a) repay all or a portion of the $581.3mn senior unsecured term loan, (b) repay/redeem the outstanding $700mn 1.75% 2026s prior to maturity (c) for general corporate purposes.

Rating Changes

- Fitch Upgrades BBVA to ‘A-‘; Outlook Stable

- Fitch Upgrades TPG’s IDRs to ‘A-‘; Outlook Stable

- Elanco Animal Health Inc. Upgraded To ‘BB’ From ‘BB-‘ On Lower Leverage; Outlook Positive

- Chevron Phillips Chemical Co. LLC Downgraded To ‘BBB+’ On Lower Expected Demand And Earnings, Outlook Negative

- Fitch Revises CaixaBank’s Outlook to Positive; Upgrades Short-Term IDR to ‘F1’

New Bonds Pipeline

- Goldman Sachs Private Credit FI Investor Calls

- NAB 3Y FRN/3Y and/or 10Y AUD

- Dubai Aerospace Enterprise $ 5Y Sukuk investor calls

- Burgan Bank $ 5Y bond

- Avation $300-400mn, up to 5.5NC2 Bond

Term of the Day: Dividend Stopper

Dividend stopper is a common covenant seen in perpetual bond structures that requires the bond issuer to not pay a dividend, if it decides to stop coupon payments on the perpetual bonds. Some contingent convertible (CoCo) perpetual bonds have a clause that allows the issuer to skip a coupon payment at their discretion, if the financial situation of the issuer is stressed. In such cases, a dividend stopper covenant is beneficial to the CoCo bondholders as it restricts the issuer from paying dividends on its equity in times when it has not paid coupon to its CoCo bondholders. This is why the presence (or absence) of a dividend stopper covenant is seen as the determining factor on whether the CoCo perpetual bonds are not (or are) subordinated to its equity.

Talking Heads

On EM Bond Bonanza Narrows Yield Gap Over Treasuries to 7-Year Low

Anders Faergemann, head of EM sovereigns at PineBridge Investments

“We are obviously aware of how tight spreads are on a historic basis… justified by the improvement we have seen in a number of indicators

Fady Gendy, Arqaam Capital

“The region is not rich versus similar-rated Asia credit or lower-rated and more volatile EM credit… On a yield basis, all-in yields are still decent for a highly-rated space”

On Goldman and Citi Split Over French Election Risks for Bonds

Goldman strategists

Near-term election risks “have largely been pre-empted” by current pricing after a bond selloff following Monday’s unexpected resignation of the prime minister

Citigroup

Election risks are “only starting” to be reflected in bond spreads

Kevin Thozet, Carmignac

“If we were holding snap elections tomorrow, potentially the stalemate would remain”

On Europe Among ‘Most Compelling’ Credit Bets

James Turner, BlackRock

“Companies still look in quite good shape overall. There’s not many opportunities to find relatively safe yield at the moment… stretching for yield in fragile areas cannot match finding resilient companies with strong balance sheets… Each time we get what the market thinks is a potential catalyst, it might push spreads a little bit wider”

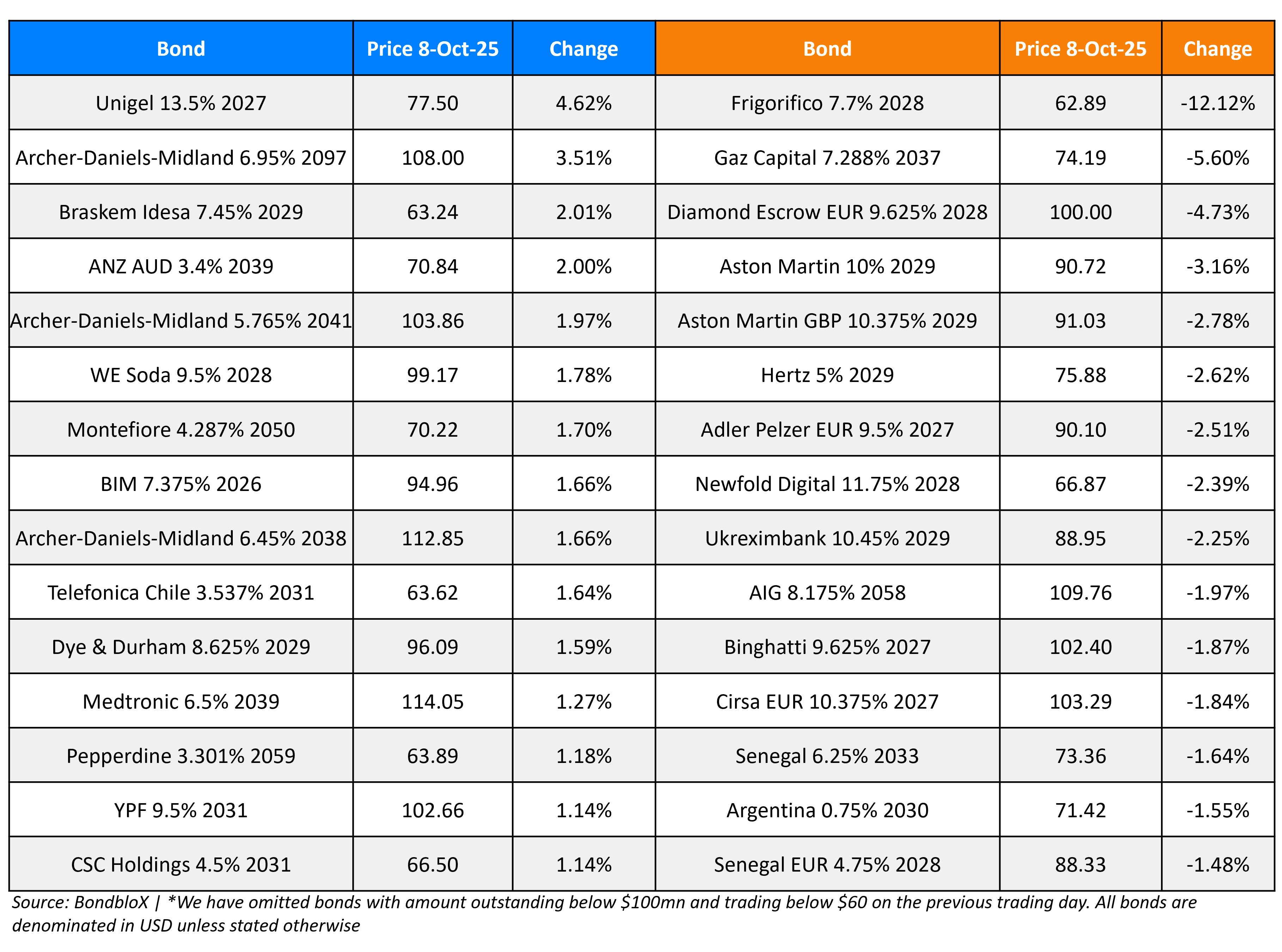

Top Gainers and Losers- 08-Oct-25*

Go back to Latest bond Market News

Related Posts: