This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Indonesia, JPM, Citi Price Bonds; JetBlue, Nike Downgraded

July 17, 2025

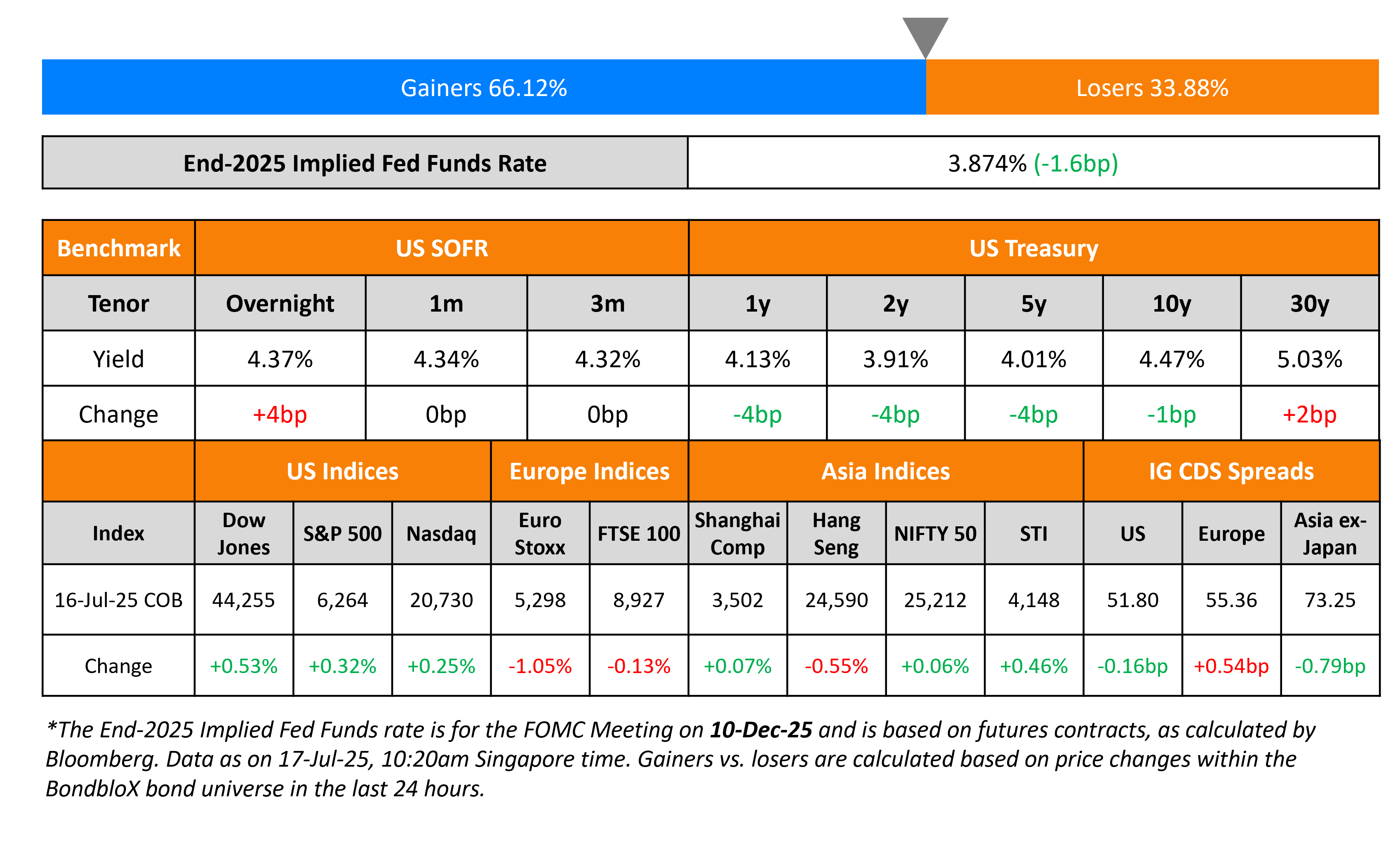

US short-end Treasury yields eased by 4bp while the long-end held steady. US President Donald Trump denied reports that he is planning to remove Fed Chairman Jerome Powell. However, he said that he does not “rule out anything”, noting that it was unlikely to fire him “unless he has to leave for fraud”. On the data front, US PPI YoY for June rose by 2.3% vs. expectations of 2.5% and the prior month’s revised 2.7% reading. The Core PPI rose by 2.6%, vs. expectations of 2.7% and the prior month’s revised reading of 3.2%.

Looking at US equity markets, the S&P and Nasdaq closed ~0.3% higher. US IG and HY CDS spreads tightened by 0.2bp and 0.5bp respectively. European equity markets ended lower. The iTraxx Main CDS spreads widened by 0.5bp while Crossover CDS spreads widened by 6.6bp. Asian equity markets have opened higher today. Asia ex-Japan CDS spreads were tighter by 0.8bp.

New Bond Issues

Indonesia raised $2.2bn via a two-part sukuk issuance. It raised:

- $1.1bn via a 5Y sukuk at a yield of 4.55%, 30bp inside initial guidance of 4.85% area. The notes are priced at a new issue premium of 10bp over its existing 2.85% 2030s that currently yield 4.45%

- $1.1bn via a 10Y green sukuk at a yield of 5.2%, 30bp inside initial guidance of 5.5% area. The notes are priced roughly in-line with its existing 8.5% 2035s that currently yield 5.23%.

The notes are rated Baa2/BBB/BBB. Net proceeds from the 5Y note will be used for general financing requirements, whilst those from the 10Y will be used to finance eligible green expenditures as part of its green framework.

JPMorgan raised $4bn via 11NC10 bond at a yield of 5.576%, 27.5bp inside initial guidance of T+140bp area. The subordinated bank note is unrated. The bond has a make whole call provision applicable from 23 July 2030. Proceeds will be used for general corporate purposes.

Citigroup raised €900mn via a 11NC10 Tier 2 bond at a yield of 4.269%, 35bp inside initial guidance of T+200bp area. The subordinated note is rated Baa2/BBB/BBB+. If not called by 23 July 2035, the coupon will reset to 3m Euribor+165bp.

Citigroup raised $2.7bn via a PerpNC5 preference share issuance at a yield of 6.875%, 25bp inside initial guidance of 7.125% area. The junior subordinated notes are rated Ba1/BB+/BBB-. The SEC registered depositary shares, represent a 1/25th interest in a share of Citi’s fixed-rate reset non-cumulative preferred stock. If not called by 15 August 2030, the coupon will reset to the US 5Y Treasury yield plus 289bp. The bonds have an optional redemption on any dividend payment date as mentioned in the documents. Proceeds will be used for general corporate purposes, which may include the partial or full redemption of outstanding shares of Citigroup preferred stock and related depositary shares.

Rating Changes

- Moody’s Ratings downgrades JetBlue’s CFR to Caa1; outlook stable

- Nike Inc. Downgraded To ‘A+’ From ‘AA-‘ On Reduced Profitability And Ongoing Tariff Risks; Outlook Stable

- Moody’s Ratings downgrades Stonegate’s corporate family rating to Caa1 from B3; outlook changed to stable from negative

- Strathcona Resources Ltd. Upgraded To ‘BB-‘ From ‘B+’ On Improved Credit Measures; Outlook Stable

Term of the Day: Make Whole Call

A Make Whole Call (MWC) is a type of call option on a bond that gives the issuer the right to redeem a bond before its maturity date by compensating (making whole) bondholders for future coupon payments. MWC provisions were introduced in the 1990s and are rarely exercised by issuers. If exercised, the issuer has to pay a lump sum amount to the bondholders that represent the net present value of future foregone coupon payments, typically stated as a formula in the bond prospectus.

MWCs are different from traditional call options in that investors are compensated for foregoing future coupon payments. With traditional call options, the issuer can exercise the call option at the predefined call price without having to pay bondholders for foregoing future coupons. This makes MWCs beneficial to bondholders as compared to traditional call options and are typically expensive for the issuer to exercise.

Talking Heads

On Senegal’s Debt Burden Easing After Data is Rebased

Michael Kafe, Barclays

The emerging oil and gas producer’s 2024 nominal gross domestic product could be lifted by between 15% to 25%…pushing debt-to-GDP back toward or below 100% from 119% currently

Leeuwner Esterhuysen, Oxford Economics

“Until IMF negotiations resume, Senegal will likely keep turning to local markets for funding…Local banks are absorbing most of the new issuance, tightening liquidity and raising the risk of crowding out private sector credit.”

On Battered dollar a boon for U.S. multinational companies

Greg Boutle, BNP Paribas

“Whatever the beat, miss or forward guidance was going to be without the FX effect will obviously be a little bit better with it”

Patrick Kaser, Brandywine Global

“Certainly a lot of companies came into the year assuming a headwind…That’s flipped. That’s a positive for earnings”

David Lefkowitz, UBS

“If the dollar stays at these levels, the boost on a year-over-year basis will get progressively larger”

On Urging Investors to Embrace Risk Assets, Hedge Weaker Dollar – Henry McVey, KKR

“we believe that we have moved from a period of low growth, low inflation… build a portfolio with a focus on hedging against a weaker dollar, higher long-term rates, and more equity volatility”

Top Gainers and Losers- 17-Jul-25*

Go back to Latest bond Market News

Related Posts: