This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Indonesia, Great Wall, Sumitomo Launch $ Bonds

June 25, 2024

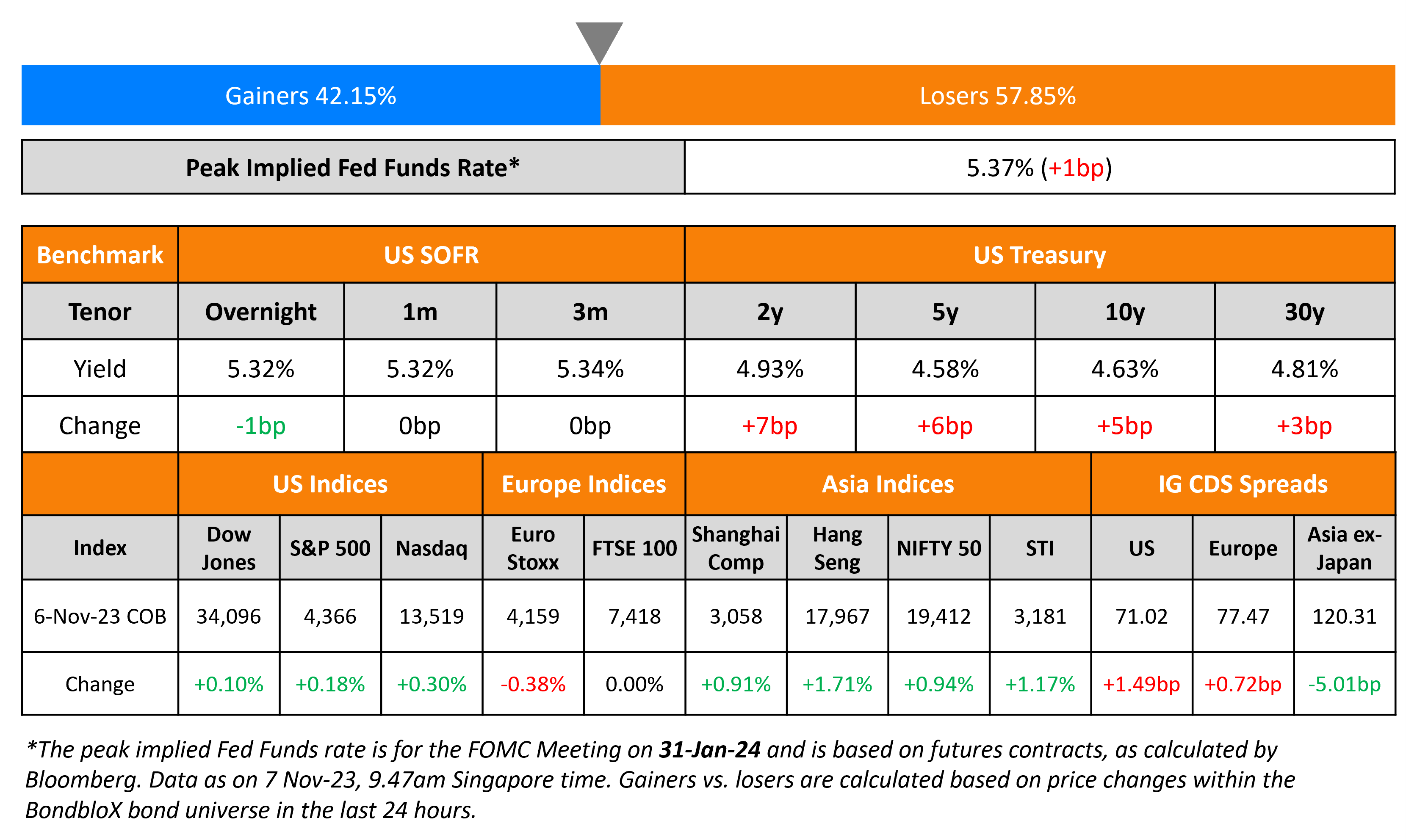

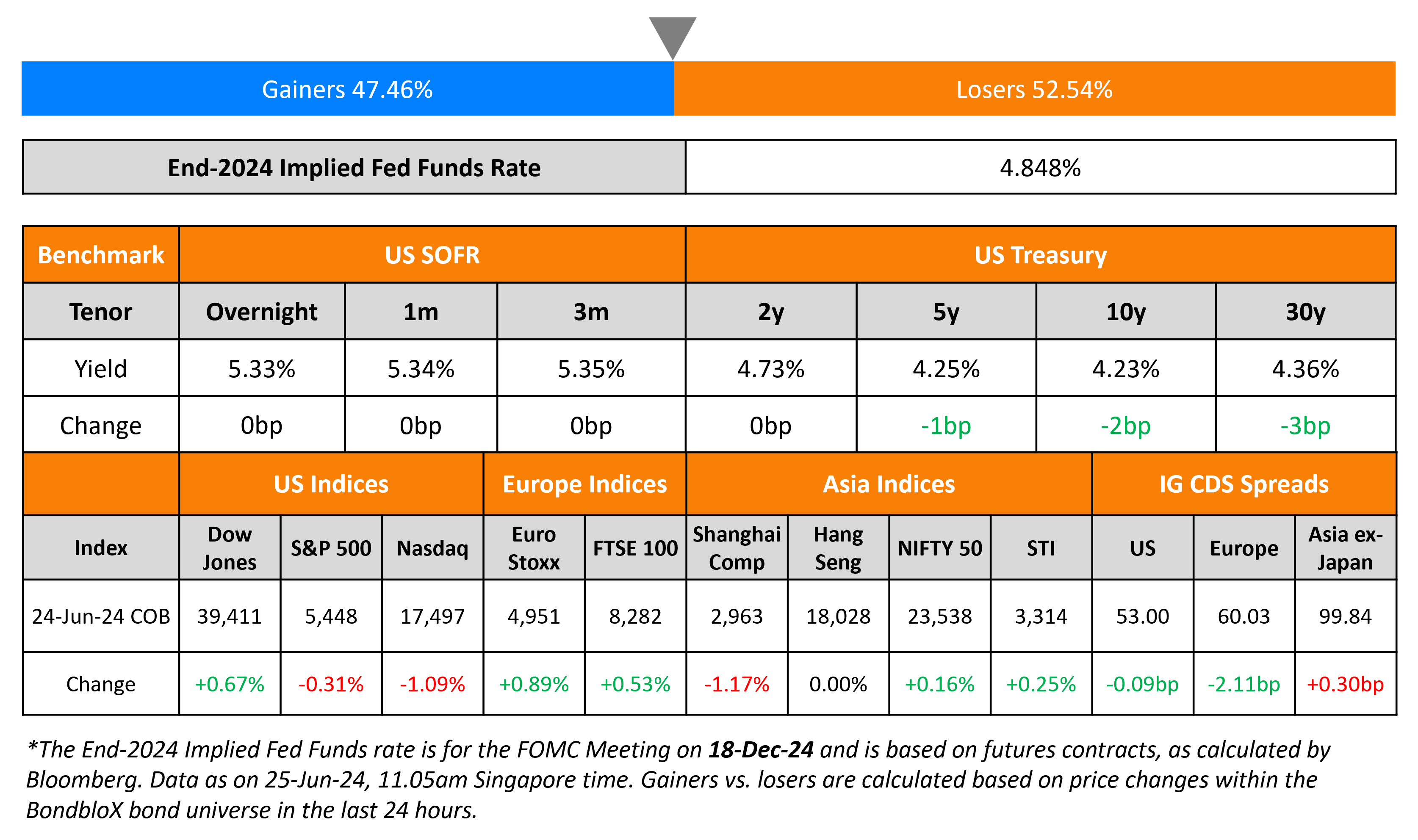

Treasuries traded stable across the curve. The Dallas Fed Manufacturing Index continued to stay in contraction territory for June, at -15.1 vs. expectations of -15 and the prior -19.4 print. Separately, Chicago Fed President Austan Goolsbee said that he was looking for inflation to cool further, while not mentioning anything about the timing of rate cuts. Looking at equity markets, S&P and Nasdaq were down 0.3% and 1.1%, respectively. US IG spreads were 0.1bp tighter while HY CDS spreads widened by 1bp.

European equity indices ended higher across the board. In credit markets, the iTraxx Main and Crossover spreads were tighter by 2.1bp and 6.6bp respectively. Asian equity indices have opened broadly higher this morning. Asia ex-Japan CDS spreads were 0.3bp wider.

.png)

New Bond Issues

- Sumitomo Corp $ 5Y/10Y at T+105/125bp area

- Indonesia $ 5Y/10Y/30Y Green at 5.4/5.5/5.8% area

- China Great Wall $ 3.5Y/PerpNC3 at T+240bp/7.7% area

LG Energy raised $2bn via a three-part offering. It raised:

- $700mn via a 3Y bond at a yield of 5.474%, 30bp inside initial guidance of T+130bp area

- $800mn via a 5Y green bond at a yield of 5.383%, 30bp inside initial guidance of T+140bp area

- $500mn via a 10Y green bond at a yield of 5.611%, 30bp inside initial guidance of T+165bp area

The senior unsecured notes are rated Baa1/BBB+. Proceeds from the 3Y bond will be used for general corporate purposes. Proceeds from the green notes will be used to finance or refinance, in whole/part, new or existing projects related to (a) low carbon transportation and (a) energy efficiency as per LGES’ green financing framework dated February 2023.

Enbridge raised $1.2bn via a two-trancher. It raised $500mn via a 30.75NC5.5 bond at a yield of 7.375%, 37.5bp inside initial guidance of 7.75% area. It also raised $500mn via a 30NC9.75 bond at a yield of 7.2%, 55bp inside initial guidance of 7.75% area. The junior subordinated notes are rated Baa3/BBB-/BBB- (Moody’s / S&P/ Fitch).

New Bonds Pipeline

- Bangkok Bank hires for $ 10Y bond

- DSM-Firmenich hires for $ 10Y bond

- Cathay Life hires for $ 10Y bond

- Sharjah Islamic Bank hires for $ 5Y bond

- EDO hires for $ 7Y bond

Rating Changes

- Moody’s Ratings upgrades AerCap’s long-term issuer rating to Baa1 from Baa2; outlook is stable

-

Intrum Downgraded To ‘CCC’ On Increased Likelihood Of A Distressed Exchange After Capital Structure Update

- Teva Pharmaceutical Industries Ltd. Outlook Revised To Positive On Expected Deleveraging And Improved Growth Prospects

- Adler Group Downgraded To ‘SD’ On Approved Debt Recapitalization Plan

- British Airways PLC Outlook Revised To Positive Following The Same Action On The Parent; ‘BBB-‘ Rating Affirmed

Term of the Day

Steering Committee

A steering committee is an advisory committee that helps monitor and provide a direction and guidance on key matters concerning a specific constituency during the course of the bankruptcy proceeding. For example, in certain high value chapter 11 cases, a large group of lending syndicates tend to take guidance from a smaller bank steering committee.

Talking Heads

On BOJ debating the need for timely rate hike, with chance of July action

Ryutaro Kono, chief Japan economist at BNP Paribas

“BOJ must continue to closely monitor data leading up to the next policy meeting. If deemed appropriate, the BOJ should raise its policy rate without too much delay”

On India’s Long-Dated Bonds Are ‘Clarion Call’ for Investors

Lakshmi Iyer, CEO of Kotak Investment Advisors

“Duration is our clarion call. Incrementally adding duration to your portfolio and adding bonds beyond the 10-year paper, in the 15-30 year segment, seems to be the best value “

Prashant Singh, PM at Neuberger Berman

“If we were to zoom in on one point of the curve, I would say probably seven to 10 years… liquidity perspective as well as the shape of the curve perspective”

On Warning of Labor Market Risks, Nearing Inflection Point – Fed’s Mary Daly

“So far, the labor market has adjusted slowly, and the unemployment rate has only edged up. But we are getting nearer to a point where that benign outcome could be less likely”

Top Gainers & Losers- 25-June-24*

Go back to Latest bond Market News

Related Posts: