This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Indonesia, DAE, Mamoura, Commerzbank Price Bonds

October 9, 2025

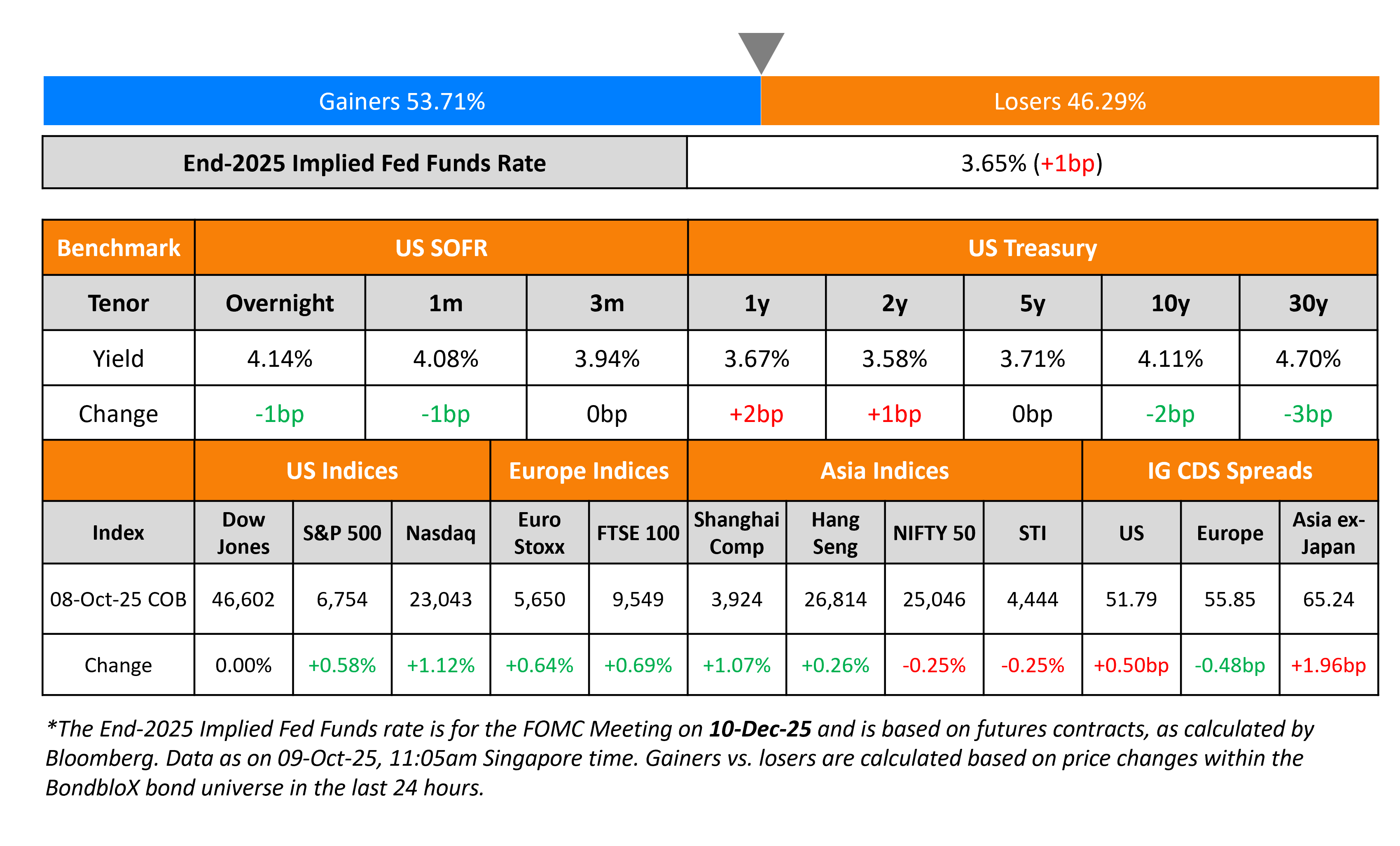

US Treasury yields were broadly stable on Wednesday with a lack of any major data points. The Fed’s September meeting minutes were released, with most officials noting that “it likely would be appropriate to ease policy further over the remainder of this year”. They noted that the downside risks to the jobs market had increased while the upside risks to inflation were still present.

Looking at equity markets, both the S&P and Nasdaq ended higher by 0.6% and 1.1%. The US IG and HY CDS spreads widened by 0.5bp and 2.5bp respectively. European equity indices also closed higher. The iTraxx Main CDS spreads were 0.5bp tighter while the Crossover spreads were flat. Asian equity markets have opened higher today. Asia ex-Japan CDS spreads were 2bp wider.

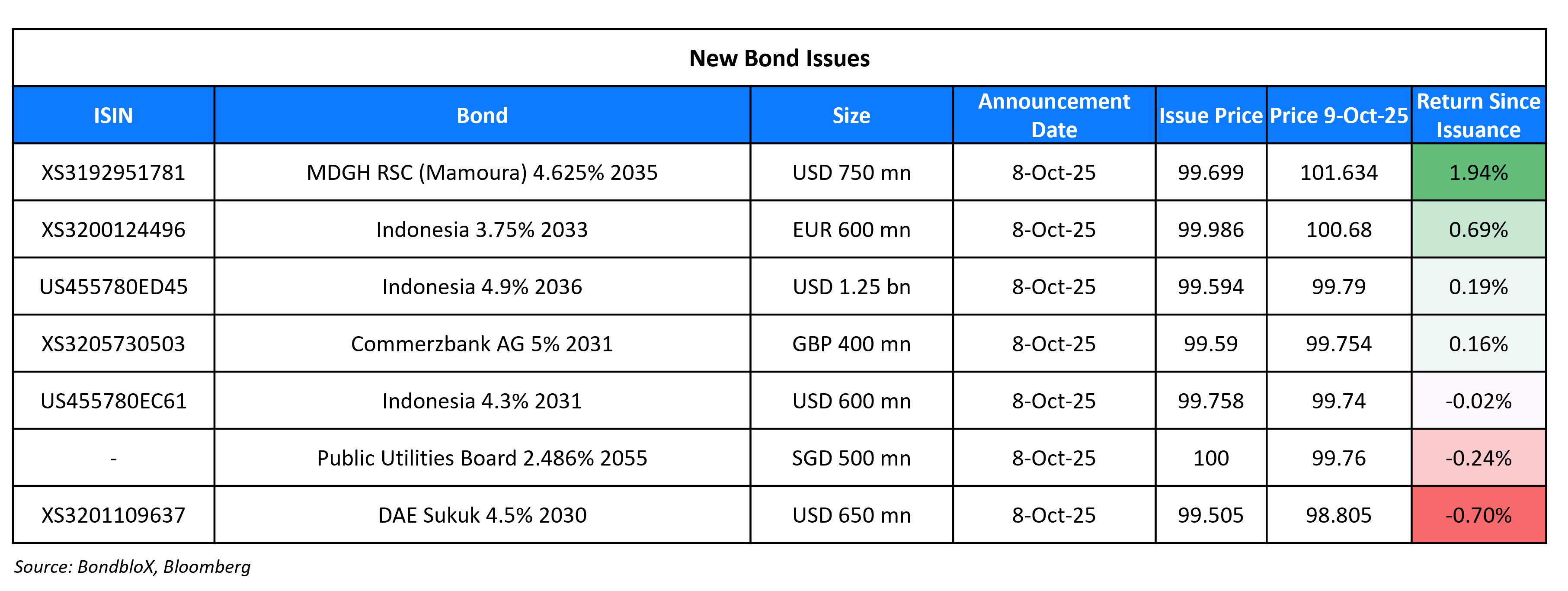

New Bond Issues

Indonesia raised ~$2.54bn via a multi-currency issuance. It raised:

- $600mn via a 5.5Y bond at a yield of 4.35%, 25bp inside initial guidance of 4.6% area. The new bond is priced 6bp tighter to its existing 1.85% 2031s that currently yield 4.41%.

- $1.25bn via a 10.5Y bond at a yield of 4.95%, 25bp inside initial guidance of 5.2% area

- €600mn via an 8Y sustainability bond at a yield of 3.297%, 25bp inside initial guidance of Mid Swap+145bp area.

The senior unsecured notes are rated Baa2/BBB/BBB. Proceeds from the dollar denominated notes will be used for general purposes of the republic. Net proceeds from the SDG issuance will be invested in projects that may qualify as eligible expenditures under its sustainable government securities framework.

Dubai Aerospace Enterprise (DAE Ltd) raised $650mn via a 5Y sukuk at a yield of 4.612%, 35bp inside initial guidance of 4.962% area. The senior unsecured note is rated Baa2/BBB (Moody’s/Fitch) and received orders of over $1.85bn, 2.85x issue size.

Mamoura raised $750mn via a 10Y bond at a yield of 4.663%, 35bp inside initial guidance of 5.013%. The senior unsecured note is rated AA/AA (S&P/Fitch), and received orders of over $4.4bn, 5.9x issue size.

Commerzbank raised £400mn via a 6NC5 bond at a yield of 5.095%, ~12.5bp inside initial guidance of UKT+110/115bp area. The senior non-preferred note is unrated, and received orders of over £1.7bn, 4.3x issue size.

Public Utilities Board raised S$500mn via a 30Y bond at a yield of 2.486%, inline with final guidance. The senior unsecured note is unrated. Proceeds will be used to finance or refinance new or existing eligible green projects under its green framework.

Rating Changes

- Moody’s Ratings upgrades Verisure to Ba1 from B1 following its IPO, concluding the review; outlook stable

- Fitch Upgrades 5 Spanish Government-Related Entities; Outlooks Stable

- Comerica Inc. Ratings Placed On CreditWatch Positive On Announced Acquisition By Fifth Third Bancorp

- Moody’s Ratings reviews Sammaan Capital’s ratings for upgrade on new investment from International Holding Company

New Bonds Pipeline

-

Oman $ Long 7Y Sukuk

- Goldman Sachs Private Credit FI Investor Calls

- Burgan Bank $ 5Y bond

- Avation $300-400mn, up to 5.5NC2 Bond

Term of the Day: Carry Trades

Carry trades are a popular trading strategy where an investor borrows money from a country with low interest rates (and a weaker currency) and invests the money in another country’s asset with a higher interest rate. Historically, a famous example has been the Japanese yen-funded carry trade. This was mainly owing to the zero-to-negative interest rates in Japan for the better part of two decades, and bets that rates there would remain at rock bottom levels. In this case, investors globally and even locally would borrow at low interest rates in Japan and invest the money in overseas equities and bonds like the US stock market. Carry trades typically work well when central bank policy certainty is high and expectations are for low market volatility. With the BOJ recently raising rates for the second time in 17 years in July and hinting at more hikes, the famous yen-funded carry-trade has seen an unwinding with more volatility and doubts over the benefits of a yen carry trade.

Some analysts noted the Yen carry trade might be back after the new Japanese Prime Minister Sanae Takaichi’s appointment.”

Talking Heads

On Buying High-Grade Bonds After M&A Being a Good Trade – BofA Strategists

Buying high-grade bonds from a company that’s funding an acquisition can be a good trade because spreads on the securities often narrow… Companies that are digesting an acquisition often focus on cutting debt over time, which is good for bondholders

On US Treasuries Risk Losing Haven Status – Manroop Jhooty, Canada Pension Investment Board

“We worry that if the fiscal scenario continues for a period of time”… US Treasuries could begin “to lose this diversification effect because it looks more and more like a risky asset and less and less like a risk-free asset”

On Asia Bonds Looking Vulnerable as Fed Rate Cuts Deliver Less Support

SocGen

“One prominent headwind to emerging-market performance relates to the diminished valuations appeal of local assets”

Rajeev De Mello, Gama Asset Management

The “focus is now shifting to domestic fundamentals”… Investors are likely to reward economies with “coherent and credible policy framework”

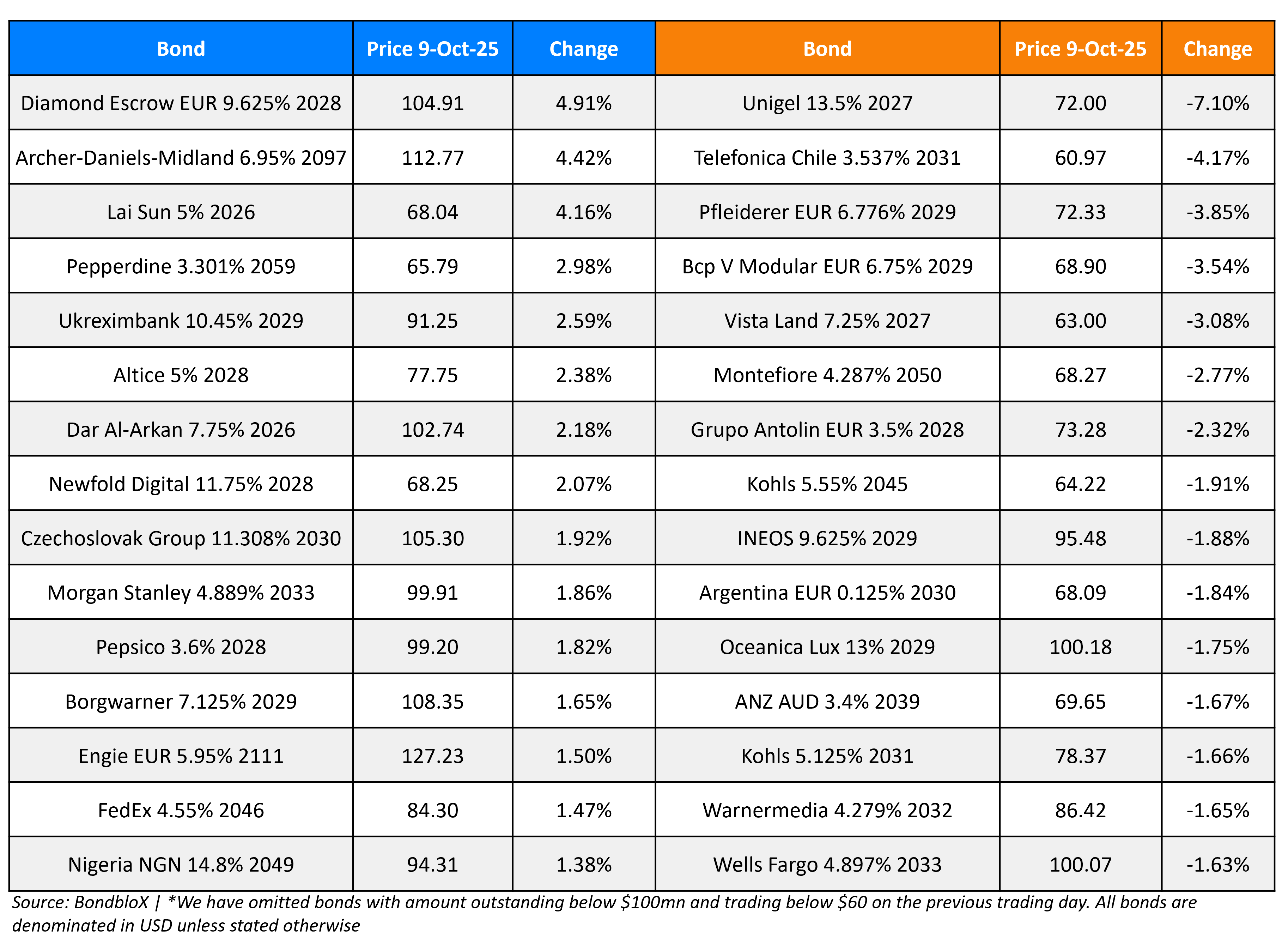

Top Gainers and Losers- 09-Oct-25*

Go back to Latest bond Market News

Related Posts: