This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Indonesia, Bangkok Bank, SMBC Aviation Launch $ Bonds

November 19, 2025

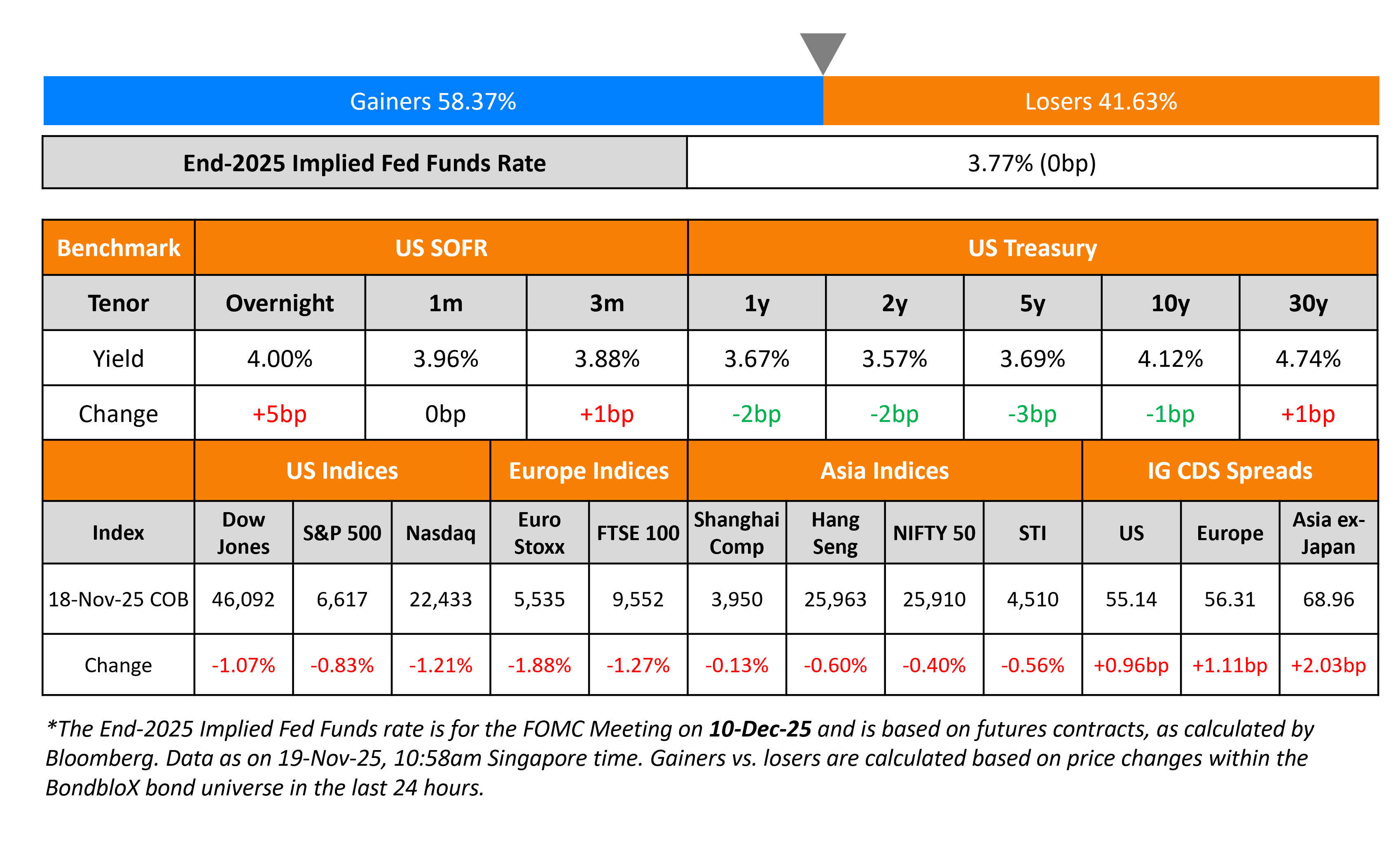

US Treasury yields eased by ~2bp across the curve amid a broad risk-off sentiment in markets. ADP Research revealed that US companies shed 2,500 jobs per week on average in the four weeks ending November 1, indicating a loss of momentum in the labor market. Besides, tech stocks fell again, with markets awaiting Nvidia’s Q3 earnings later today. Separately, Richmond Fed President Thomas Barkin (a non-voting member) sounded positive on inflation, noting that it is unlikely to increase much despite being “somewhat elevated”. However, he said that the labour market might be weaker than the data suggests.

Looking at the equity markets, the S&P and Nasdaq closed lower by 0.8% and 1.2% respectively. US IG and HY CDS spreads were wider by 1bp and 5.4bp respectively. European equity indices ended lower too. The iTraxx Main CDS and Crossover CDS spreads were 1.1bp and 5.8bp wider respectively. Asian equity markets are trading broadly weaker today. Asia ex-Japan CDS spreads were 2bp wider.

New Bond Issues

- Indonesia $ 5Y/10Y sukuk at 4.8%/5.3% areas

-

SMBC Aviation Capital $ 10Y at T+145bp area

- Bangkok Bank $ 5Y/10Y at T+115/130bp areas

- Keppel REIT S$ PerpNC4 at 3.55% area

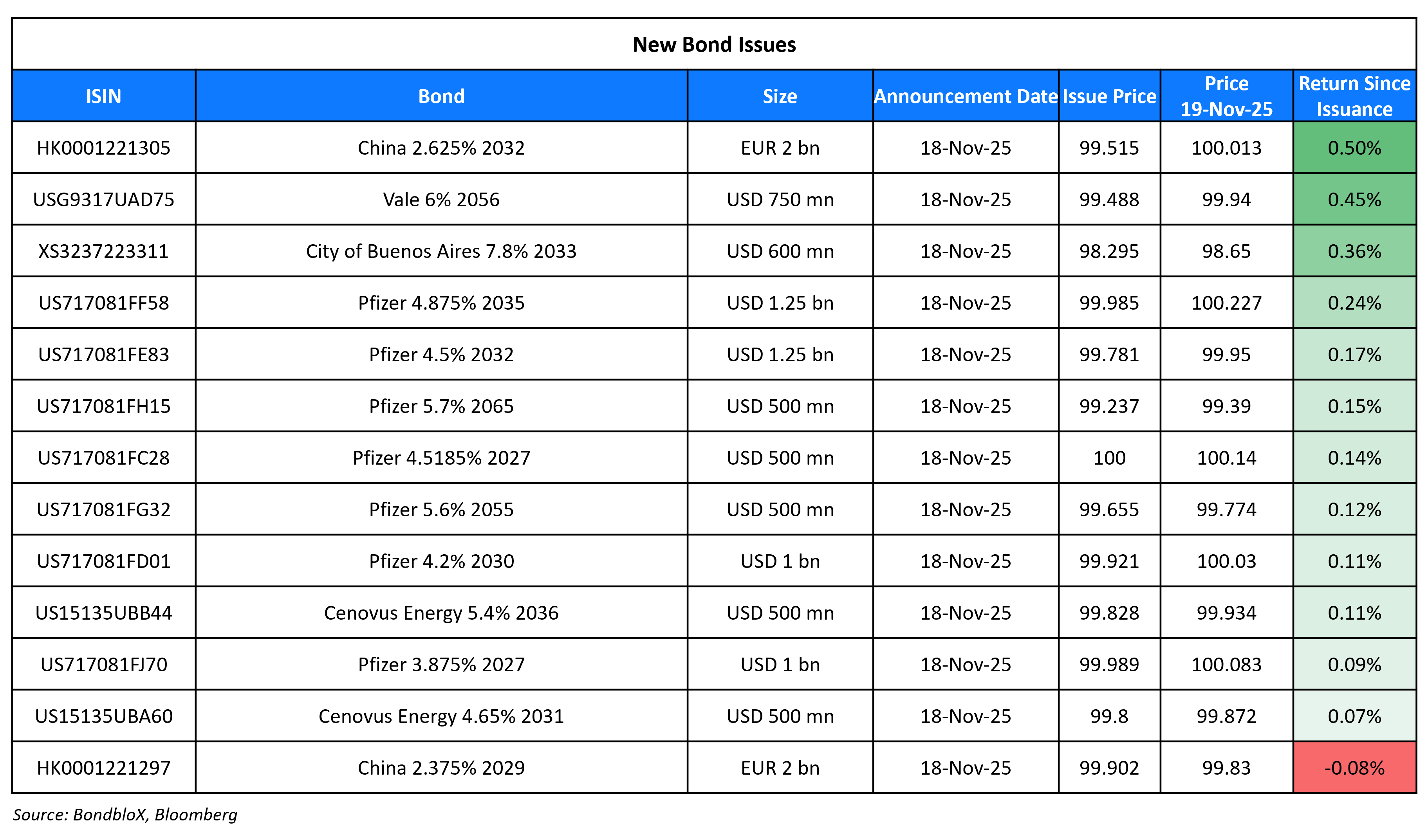

China raised €4bn via a two-part deal. It raised €2bn via a 4Y bond at a yield of 2.401%, 23bp inside initial guidance of MS+28bp area. It also raised €2bn via a 7Y bond at a yield of 2.702%, 25bp inside initial guidance of MS+38bp area. The notes received orders of over €104.5bn, ~26x issue size. This is the highest demand for an EUR-denominated offering by China, as per sources. Net proceeds from the sale of the bonds will be used for general governmental purposes.

Vale raised $750mn via a long 30NC5 bond at a yield of 6.125%, ~37.5bp inside initial guidance of mid-6% area. The senior unsecured note is rated Baa3/BB+/BBB-. Proceeds will be used for general corporate purposes, including replenishing some cash on hand following the purchase of its participating debentures acquired in its optional buyback offer.

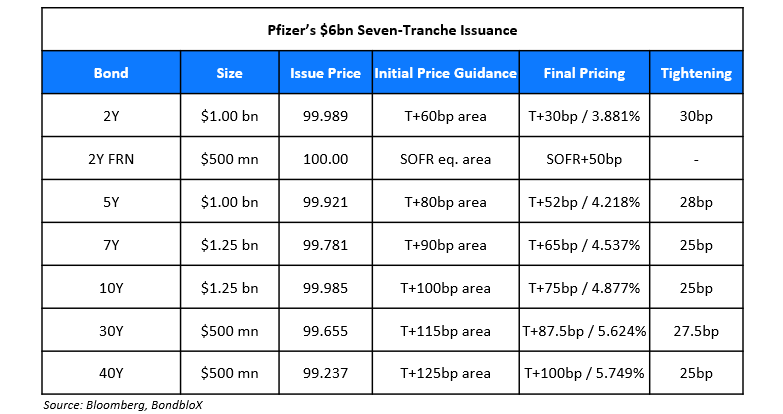

Pfizer raised $6bn via a seven-trancher.

The senior unsecured notes are rated A2/A. Proceeds will be used for general corporate purposes, including the acquisition of Metsera and to refinance existing debt.

City of Buenos Aires raised $600mn via a 7Y bond at a yield of 8.125% inside initial guidance of mid-high 8% area. The senior unsecured notes are rated B2/B-/B-. Proceeds will be used to fund future amortization payments in accordance with its laws.

New Bonds Pipeline

- West China Cement $ bond

-

China Three Gorges € green bond

Rating Changes

- Fitch Upgrades AIG’s Ratings; Outlook Stable

- Fitch Upgrades Ardagh Metal Packaging S.A. to ‘B’; Outlook Stable

- Marubeni Upgraded To ‘A-‘ On Strengthening Business And Capital Bases; Outlook Stable

- Fitch Downgrades Braskem Idesa to ‘CC’

- New Fortress Energy Inc. Downgraded To ‘SD’ On Announced Forbearance Agreement; Affected Note Rating Lowered To ‘D’

- Ecobank Nigeria Ltd. Downgraded To ‘CC’ On Delayed Recapitalization; Ecobank Transnational Outlook Revised To Negative

- Ratings On Eight South African Banks Raised Following Sovereign Upgrade; Outlooks Remain Positive

- GeoPark Ltd. Outlook Revised To Stable From Negative On Close Of Acquisition; ‘B+’ Ratings Affirmed

Term of the Day: Scheme of Arrangement

Scheme of Arrangement (SoA) is a legal mechanism used by a company in financial difficulty to reach a binding agreement with its creditors to pay back all, or part, of its debts over an agreed timeline. Typically, the company draws up scheme proposals for its creditors and sends it to them with notice of a creditors meeting. During the meeting, the company explains the proposals and creditors decide to vote in (or against) favor of the scheme. The scheme is then approved by a High Court, after which debts are written down as per the SoA. SoAs go through a court approval, making it different from consent solicitations.

New Fortress Energy is in talks with creditors to secure a forbearance agreement. The forbearance is said to grant them more time to develop a restructuring plan, potentially utilizing a process like a scheme of arrangement

Talking Heads

On US corporate credit spreads widening as equities market falls

Anonymous Portfolio Manager

“It is a theme everyone is starting to think about… But I don’t see it blowing up in the high-yield or even investment-grade bond market – it’s never going to be big enough to cause pain for people”

On Cash Is Bad as Top South African Investors See EMs in Vogue

Derrick Msibi, Stanlib Asset

“We could be heading toward an era where emerging markets are in vogue… South African equities look relatively cheap but the fact is they’re relatively cheap for a reason”

On Signaling that the BOJ Remains on Rate Hike Path

Kazuo Ueda, BOJ Governor

“The mechanism for inflation and wages to grow together is recovering. Given this, I told the prime minister that we are in the process of making gradual adjustments to the degree of monetary easing”

Kento Minami, Daiwa Securities

“Ueda probably had to send a fresh reminder that the BOJ continues to look at hiking rates given the rapid fall in the yen”

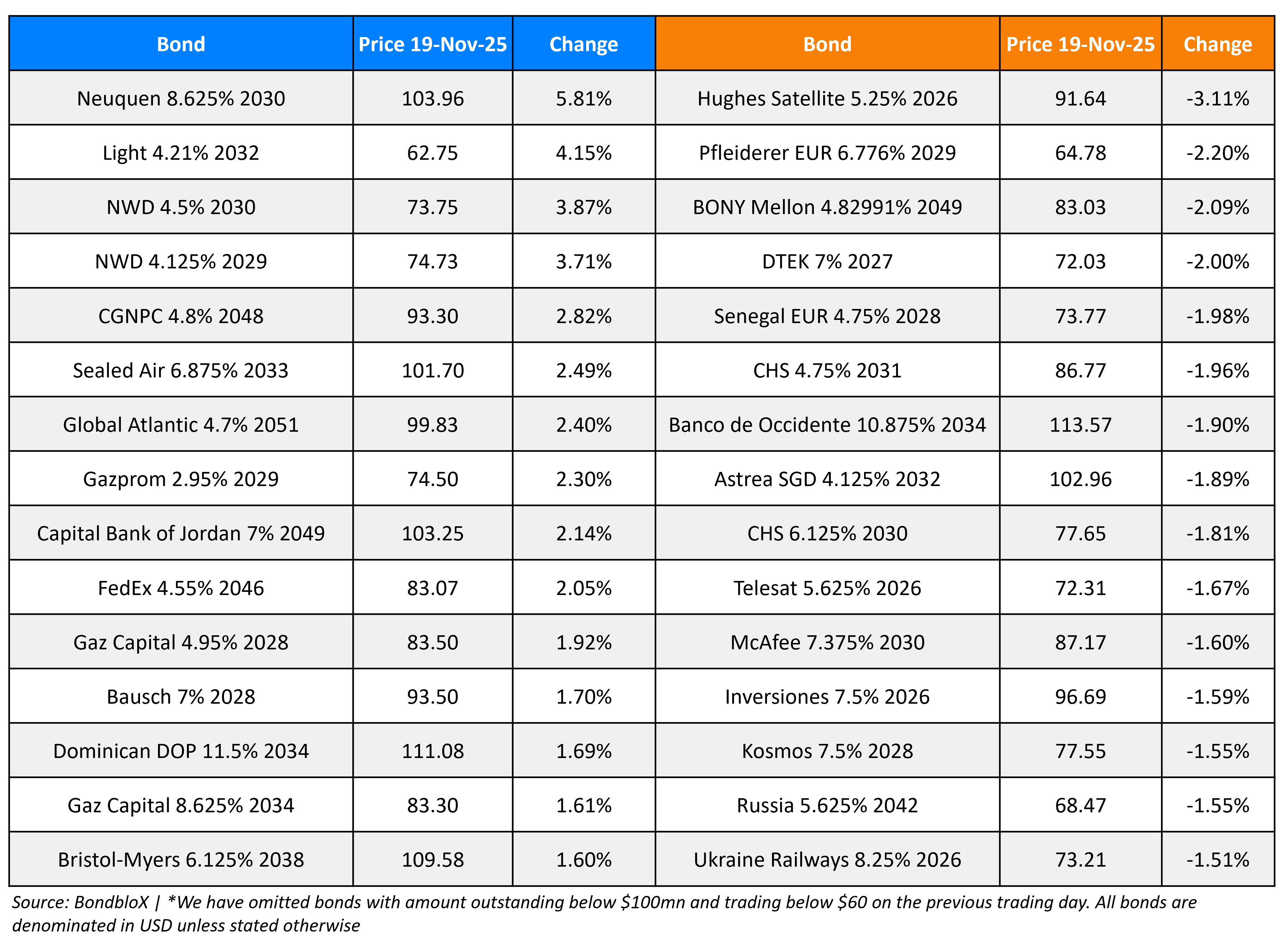

Top Gainers and Losers- 19-Nov-25*

Go back to Latest bond Market News

Related Posts: