This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Indonesia, Bangkok Bank Price $ Bonds

November 20, 2025

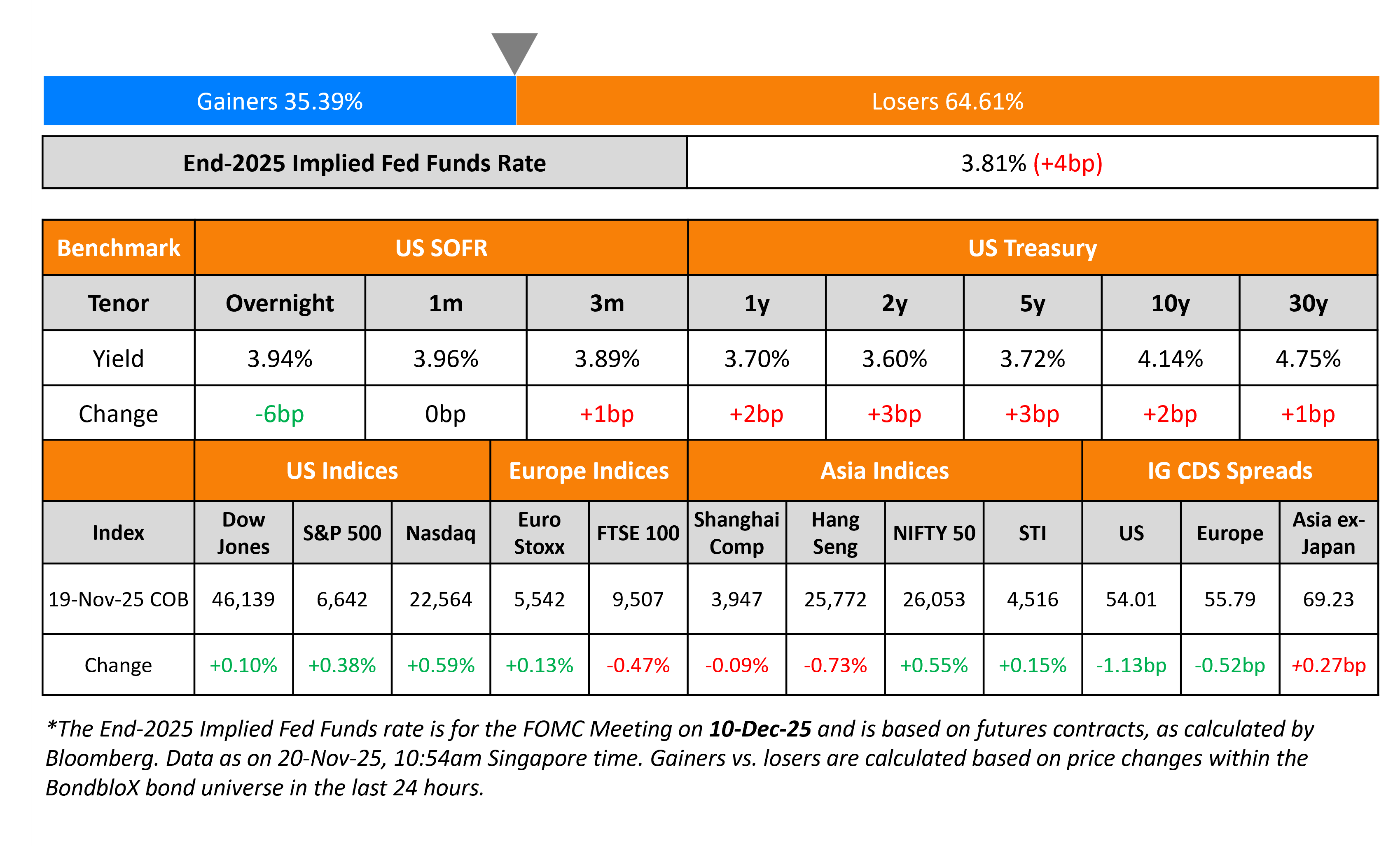

US Treasury yields rose by 2-3bp across the curve. The Fed’s October meeting minutes noted that “many participants” thought it would be appropriate to keep the target range unchanged for the rest of the year. However it also noted that “several participants” said another cut “could well be appropriate in December if the economy evolved about as they expected”. Separately, the BLS said that it will not be releasing its complete jobs report for October, due to inability to collect certain data. However it will provide some of the October data along with the full November jobs report on December 16. Thus, the October and November jobs data will not be available in time for the FOMC’s December meeting. Markets are now pricing-in only a 27% chance of a 25bp rate cut in the next FOMC meeting vs. nearly 45% a day prior.

Looking at the equity markets, the S&P and Nasdaq closed higher by 0.4% and 0.6% respectively, with Nvidia’s much awaited earnings report beating estimates and quelling concerns about AI-based overvaluation. US IG and HY CDS spreads were tighter by 1.1bp and 6.9bp respectively. European equity indices ended mixed. The iTraxx Main CDS and Crossover CDS spreads were 0.5bp and 5.1bp tighter respectively. Asian equity markets are trading in the green today. Asia ex-Japan CDS spreads were 0.3bp wider.

New Bond Issues

-

China Three Gorges € 5Y green MS+90bp area

-

AgBank of China (Singapore branch) $ 3Y FRN at SOFR+100bp area

Indonesia raised $2bn via a two-part sukuk deal. It raised $1.1bn via a 5Y sukuk at a yield of 4.50%, 30bp inside initial guidance of 4.80% area. It also raised $900mn via a 10Y sukuk at a yield of 5.00%, 30bp inside initial guidance of 5.30% area. The senior unsecured notes are rated Baa2/BBB/BBB (Moody’s/S&P/Fitch). Proceeds will be used for general financing requirements. The new 5Y sukuk is priced at a new issue premium of 12bp over its existing 4.55% sukuk due 2030 that currently yields 4.38%. The new 10Y sukuk is priced at a new issue premium of 16bp over its existing 5.6% bond due 2035 that currently yields 4.84%.

Bangkok Bank raised $1.1bn via a two-part deal. It raised $500mn via a 5Y bond at a yield of 4.501%, 33bp inside initial guidance of T+115bp area. It also raised $600mn via a 10Y bond at a yield of 5.082%, 33bp inside initial guidance of T+130bp area. The senior unsecured notes are rated Baa1/BBB+ (Moody’s/S&P). Proceeds will be used for general corporate purposes.

SMBC Aviation Capital raised $750mn via a 10Y bond at a yield of 5.263%, 30bp inside initial guidance of T+145bp area. The senior unsecured note is rated A-/BBB+ (S&P/Fitch).

Goldman Sachs Private Credit raised $500mn via a long 5Y bond at a yield of 6.155%, 17.5bp inside initial guidance of T+262.5bp area. The senior unsecured note is rated Baa3/BBB-/BBB-. Proceeds will be used to repay a portion of its outstanding debt under its credit facilities, and for general corporate purposes.

New Bonds Pipeline

- West China Cement $ bond

Rating Changes

- Fitch Upgrades Axtel’s IDRs to ‘BB’; Outlook Stable

- Fitch Upgrades Deer Investment to ‘B-‘; Outlook Stable

- Fitch Downgrades Braskem Idesa to ‘C’

- Canacol Energy Ltd. Downgraded To ‘D’ From ‘CCC+’ Following Creditor Protection Filing For Organized Debt Restructuring

- BRB – Banco de Brasilia S.A. Downgraded To ‘B-‘ And Placed On CreditWatch Negative On Fraud Investigation

- Ineos Group Holdings And Ineos Quattro Holdings Outlooks Revised To Negative; Affirmed At ‘BB-‘ On Weaker Earnings

- Fitch Revises Brightstar’s Outlook to Negative; Affirms Ratings at ‘BB+

Term of the Day: Chapter 15

Chapter 15 is a legal bankruptcy filing where a foreign debtor files for bankruptcy in US courts. In general Chapter 15 bankruptcy is an ancillary case to a primary proceeding brought in another country, typically the debtor’s home country. As an alternative, the debtor may commence a complete Chapter 7 or Chapter 11 bankruptcy case in the US provided its assets in the US are sufficiently complex to warrant a full-blown domestic bankruptcy case. Bloomberg notes that non-US based companies that are in financial jeopardy tend to file for Chapter 15 bankruptcy to ensure that they will not be sued by creditors in the US or have assets seized there. Chapter 15 gives foreign creditors the right to participate in US bankruptcy cases and prohibits discrimination against foreign creditors.

Canacol Energy has sought Chapter 15 protection in New York

Talking Heads

On Bond Market Wagers on Fed Rate Cut Falling on Void Jobs Data

Michael Gapen, Morgan Stanley

“This lowers the chances of a December rate cut. An easing labor market is the key argument for a December rate cut”

Leah Traub, Lord Abbett & Co

“We already knew that there wouldn’t be an October unemployment rate but the news that the November data will not get published until after the Fed meeting should be a disappointment”

On Bond Dealers Rebuffing NY Fed Tool as Strains in Repo Market Build

John Williams, New York Fed President

“It is best thought of as a way of making sure that the overall market has adequate liquidity consistent with the FOMC’s desired level of interest rates… expect that the SRF will continue to be actively used in this way and contain upward pressures on money market rates”

Blake Gwinn, RBC Capital Markets

“Part of the original sin is the SRF is never what it should be. It was framed as a bank alternative to reserves, but it should’ve been a repo operation to begin with.”

On Private Credit Becoming Core as JPMorgan Rethinks 60/40 Model

David Kelly, JPMorgan Asset Management

“A key reason for having bonds in a portfolio is that they are supposed to zag when stocks zig. But if stocks zig and bonds zig too, then you lose the diversification benefit from diversification into bonds… Investors can fund a 10% position or a 20% position or a 30% position in alternatives proportionately from the 60% stocks, 40% bonds and just make each of those slices smaller”

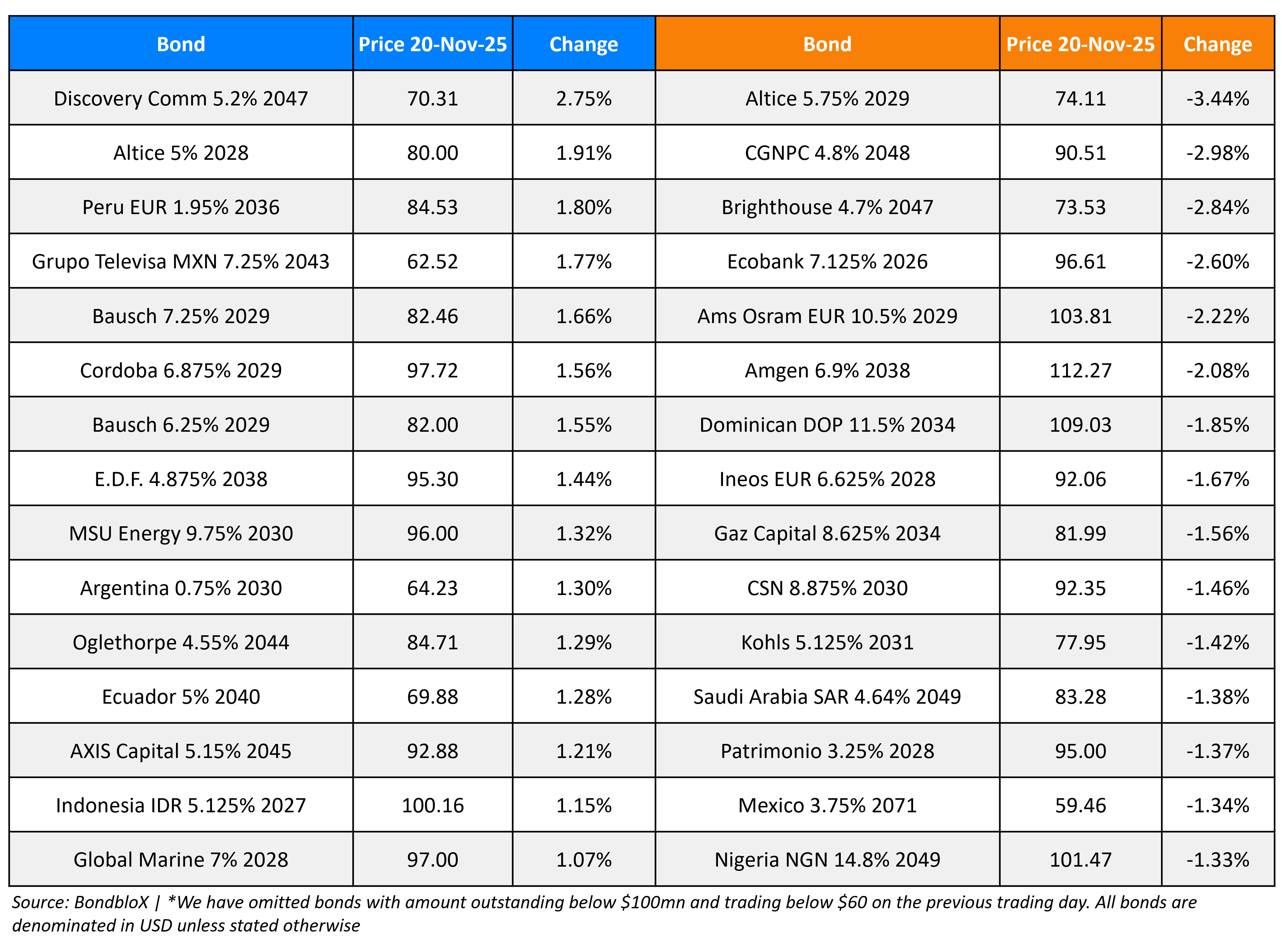

Top Gainers and Losers- 20-Nov-25*

Go back to Latest bond Market News

Related Posts: